These 5 investing moves can help you get the most out of your portfolio.

As 2024 dawns, it’s hard to deny the sense of uncertainty in the air. But despite the potential risks, there are still plenty of smart moves for investors to consider.

Here are 5 of our Fidelity pros' top investing ideas. And be sure to check out our full 2024 investing outlook for more timely strategies to potentially grow and protect your money in the new year and beyond.

1. Don't miss these income opportunities

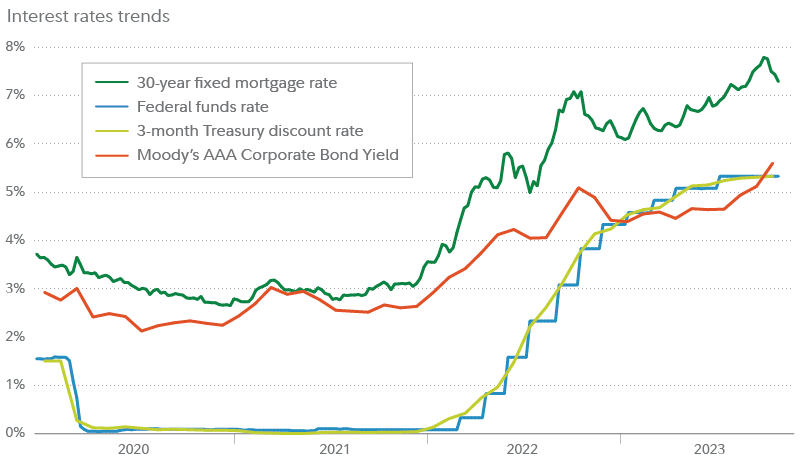

Thanks to higher interest rates, bonds, CDs, and money market funds look more attractive for income seekers than they have since before the 2008 financial crisis. But in 2024, the Fed could start cutting rates, bringing short-term yields down too. So now could be a good time to consider locking in higher long-term rates while they last.

For more details, read Viewpoints: The biggest risk you may not know about.

Source: Federal Reserve Bank of St. Louis, as of November 28, 2023

2. Play offense and defense with stocks

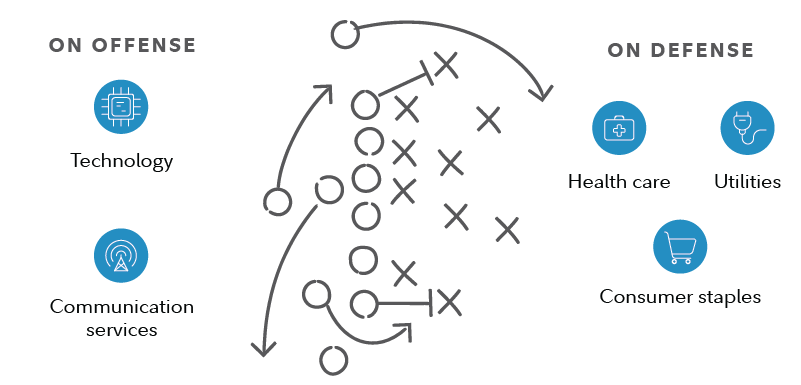

If the economy remains strong in 2024, mega-cap growth stocks could continue to lead—particularly companies that offer a play on artificial intelligence, such as those found in the technology and communication services sectors. But if the economy slows, defensive sectors like health care, utilities, and consumer staples could outperform. Since the economic outlook remains uncertain, consider building some offense and defense into your portfolio.

For a deep dive on all 11 sectors from Fidelity leaders, read our 2024 Sector Outlook.

Source: Fidelity Investments

3. Strive for balance in your portfolio

Stocks of large US companies have been big winners over the past decade, but small companies and international stocks may be worth a look in the year ahead. Many emerging-market economies are expected to grow faster than the US in the future, and their stocks may be attractively priced in the present. And small caps are one of Fidelity strategist Denise Chisholm’s highest-conviction picks for the year ahead, due to their low valuations and the possibility that they could come into favor in a soft-landing scenario.

Consider making sure you have broad exposure to a variety of markets, company sizes, and investing styles in your portfolio.

4. Focus on fees and taxes

You can't control what the market does in 2024, so focus on what you can control, like fees and taxes. Check out the fees you're paying for investments, like expense ratios on mutual funds and ETFs, or mark-ups on bonds. Take a look at your portfolio's asset location—meaning what assets you hold in what types of accounts—which can impact your after-tax returns.

And if 2024 brings a return of market volatility, remember that bumpy markets can offer a potential opportunity for tax-loss harvesting.

5. Remember that not all news drives markets

Many sources of global conflict, uncertainty, and instability from the past year may continue into 2024. And in the US, a presidential election will undoubtedly bring some surprising headlines. But remember that markets often shrug off headline news—and are instead moved by economic fundamentals like corporate earnings, interest rates, and developments on inflation and economic growth. So keep a steady hand on your portfolio, and stick to your plan or get one. That way if or when 2024 tests your nerves, you'll be in the driver's seat.

Navigate 2024 with confidence

Inevitably, 2024 will bring its own curveballs, none of which we can fully anticipate now. But staying diversified, being both opportunistic and defensive, and focusing on what you can control should help investors navigate whatever lies ahead.

Copyright © Fidelity Investments