by Russ Koesterich, JD, CFA, Portfolio Manager, BlackRock

In this article, Russ Koesterich discusses why equity performance in 2024 may be more muted and warrant more focused positioning across segments of the market.

Key takeaways

- Just as 2023 market returns proved to align with seasonal patterns, there was another underlying factor that impacted performance, the political cycle.

- Since 1926, year three of the election cycle has proven to be the strongest – with a median return that is double the average of the other three years.

- With 2024 being an election year, these patterns are worth consideration. While one small part of the broader outlook, history suggests more muted equity performance.

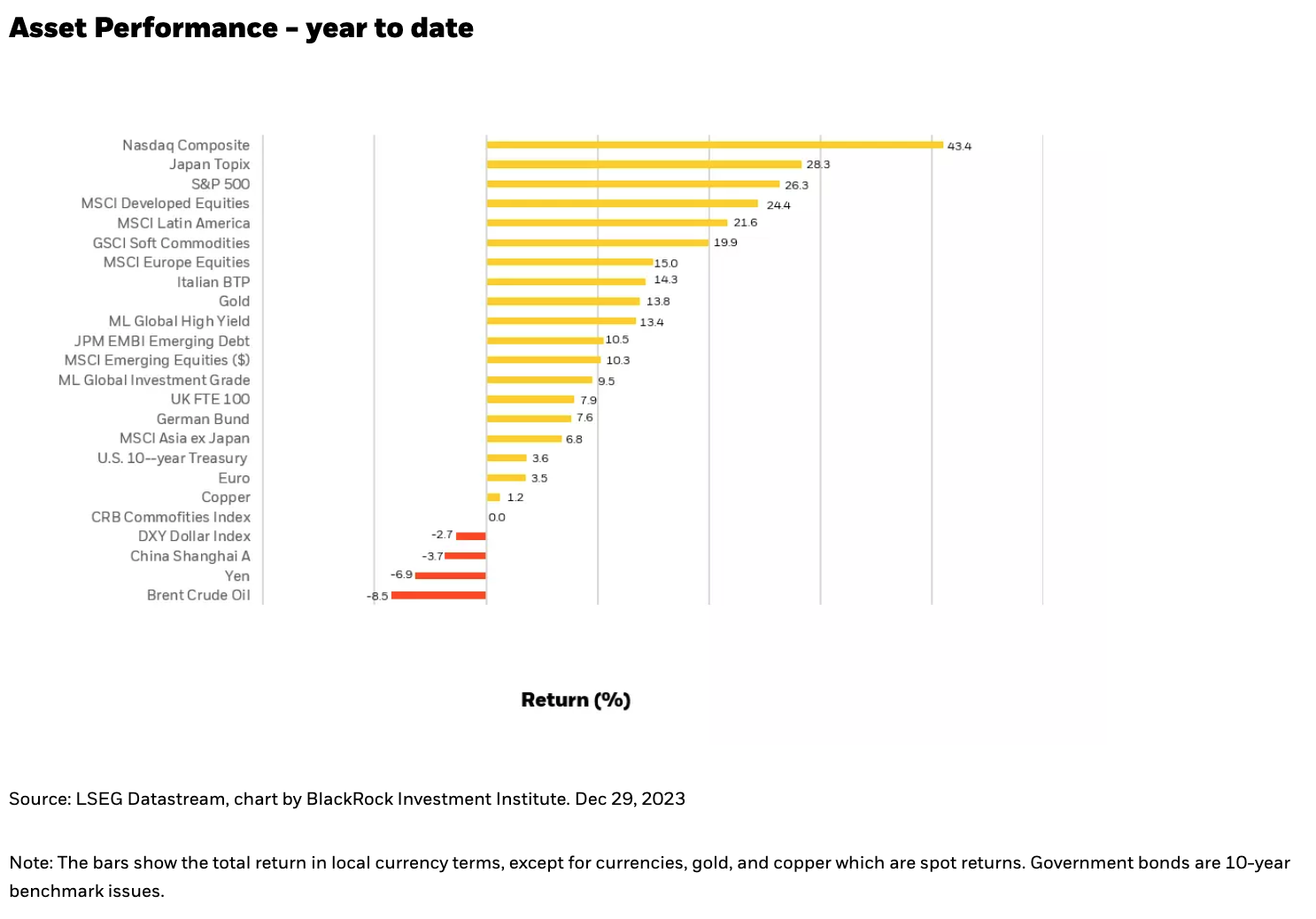

Last January, I authored a piece that discussed the tendency for market performance following a down year (2022), to be either very good or very bad, but rarely average, with the biggest source of variation being inflation. Performance in 2023 has conformed to historical trends with the S&P 500 up over +25% through year-end and the tech-heavy NASDAQ Composite +43%. In addition, while seasonal effects on stock markets can be often overstated, 2023 reminded investors why it’s worth paying some attention to the calendar. Stocks rallied in January, corrected in late summer, before rallying strongly in November. 2023 returns have mostly confirmed both historical tendencies and seasonal patterns.

There is another, longer-cycle that investors also watch: the election cycle. As with seasonality, the impact can be exaggerated. But while rarely the biggest factor in driving returns, with an election year approaching it is worth revisiting how stock returns correlate with the political cycle.

3rd Year a Charm

Despite the frequent reversals and shifts in the investment narrative throughout 2023, equities had a stellar year. U.S. large caps have returned 26%, while the Nasdaq is up by more than 43% (see Chart 1). Just as last year’s trading has generally conformed to seasonal trends, a strong 3rd year of the election cycle is also consistent with historical patterns.

Using the Dow Industrials - admittedly not the broadest index but the one with a suitably long track record - suggests a few patterns. The most pronounced of which is equity market strength in the third year of the cycle. Since 1926, the average price return in year three has been 12.50%, with a median return of more than 15%. This is double the average of the other three years. The higher average reflects the fact that third years rarely produce negative returns.

While it is not clear what drives the cycle, one theory has been tied to the economy. Re-election, either for the sitting President or their party, is more likely with strong growth. This suggests a tailwind from any fiscal stimulus, often delivered a year or more before the next election.

Across the GA Selects Model Offering, positioning is shaped by macro regime identification that informs top-down allocation and considers a variety of factors. While the past is not always prologue, things like policy and the election cycle does merit consideration when making measured bets in your asset allocation. For most of 2023, our model offerings have had “risk on” bias across risk profiles, which has served investors well.

A more muted 2024?

It's not obvious that this aggressive risk taking will continue into next year. Since bottoming in late October, equity markets surged more than 16% through year-end. The rally has been led by higher beta, lower quality names. This is consistent with seasonal patterns, but perhaps more importantly with a rapid easing in financial conditions. Investors have responded to a plunge in real, or inflation adjusted bond yields.

It's not obvious that this aggressive risk taking will continue into next years. Assuming a soft-landing, further declines in bond yields may be harder to come by. This does not suggest another correction, merely that the recent risk-led rally probably comes with an expiration date.

And while the election cycle is only one small part of the broader outlook, history also suggests more muted market moves. Returns in the last year of an election cycle are typically modest. Returns average a little over 4%, with the median around 7%. More muted returns are also reflected in less volatility and a lower standard deviation of returns. In other words, the election cycle suggests less drama after two years of more extreme performance. This suggests staying long stocks but pulling back a bit on the riskiest bets for 2024.