by Frank Holmes, CEO, CIO, U.S. Global Investors

The U.S. is adding new renewable energy capacity at a record clip, but that doesn’t mean it’s ready to quit fossil fuels just yet. The country just became the world’s biggest exporter of liquefied natural gas (LNG) for the first time ever, with last year’s shipments hitting an unprecedented 91.2 million metric tons, exceeding top suppliers Australia and Qatar.

The surge in LNG exports, primarily driven by Freeport LNG’s return to full service and robust global demand, particularly from Europe, signifies America’s pivotal role in the global energy market.

The U.S. also remains the world’s largest oil producer. In October, the energy powerhouse generated a staggering 13.25 million barrels per day, marking only the fourth month on record that the country met or surpassed 13 million barrels per day on average.

Updated Period Table of Commodities Returns

It’s against this backdrop that we share with you our always-popular, interactive Periodic Table of Commodities Returns, updated to reflect 2023 data.

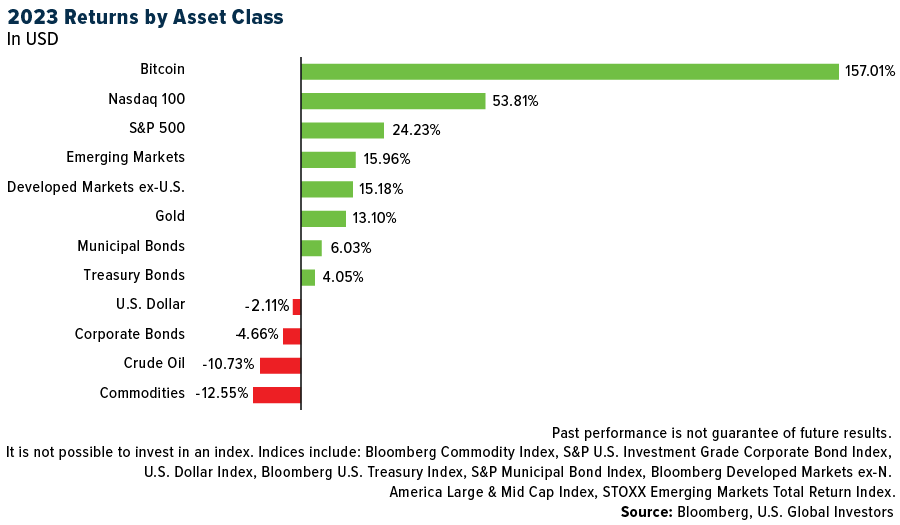

Commodities as a whole had a challenging year, with the group finishing down 12.55% due to a number of factors, including rising rates, recession fears and China’s disappointing pandemic reopening.

Excess supply contributed to the drawdown. Despite strong global demand, the price of natural gas plunged nearly 44%, its worst year in at least a decade, largely as a result of record-high production.

According to the Energy Information Administration (EIA), the U.S. produced an astonishing 104.9 billion cubic feet per (Bcf/d), a new monthly high.

After topping the list of commodities in the previous two years, lithium prices cratered for very much the same reason in 2023. This, combined with news that Americans’ appetite for electric vehicles (EVs) may be waning, drove the battery metal down to prices last seen in summer 2021.

I believe these lower prices set up an attractive buying opportunity. Commodities are the building blocks of everything we use and enjoy on a daily basis, and as the global population expands, so too does demand for these materials. The Minerals Education Coalition (MEC) estimates that every American born in 2023 will require over 3 million pounds of metals, minerals and fuels over the course of their lifetime. Last year alone, over 40,000 pounds of raw materials, from cement to sand to aluminum, were needed for every person in the U.S.

Gold Took the Crown

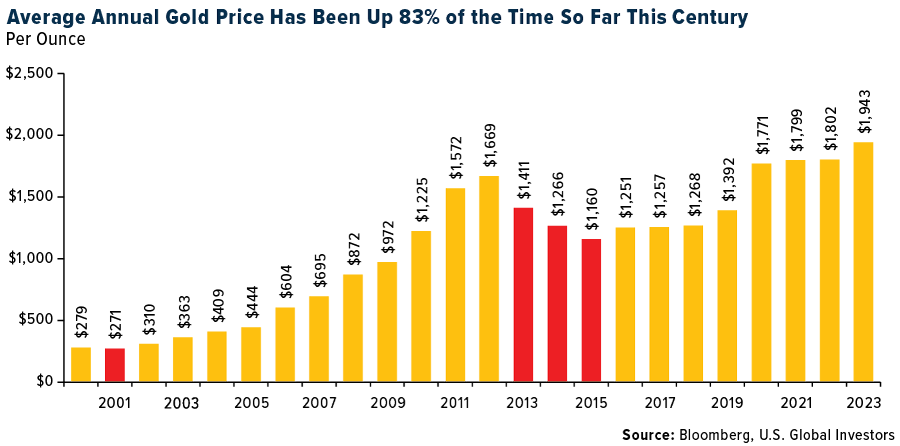

Gold was the number one commodity and only one of two that finished the year in the black, copper being the other commodity (just barely). The precious metal rose 13.10% to close the year above $2,000 per ounce for the very first time, and with an average 2023 price of $1,943, it managed to notch its eighth straight annual gain. Gold has now advanced in 20 of the past 24 years, or 83% of the time.

Looking ahead to the end of 2024, I believe we’ll see a fresh boost in gold’s investment case once the Federal Reserve begins trimming rates. Support should also come from central banks, which bought a record amount of gold in the first nine months of the year. Financial institutions purchased a net 800 metric tons from January to September 2023, a 14% increase from the same period in 2022, according to the World Gold Council (WGC).

China easily led all other countries, accumulating 181 tons of gold in the first nine months, as it seeks to prop up its currency and diversify away from the U.S. dollar. The WGC estimates that gold now represents just 4.3% of the country’s total foreign reserves, compared to nearly 70% for the U.S. If China were to get to America’s level, it would need to buy an additional 33,810 metric tons, which is 10 times more gold than the entire world produced in 2022.

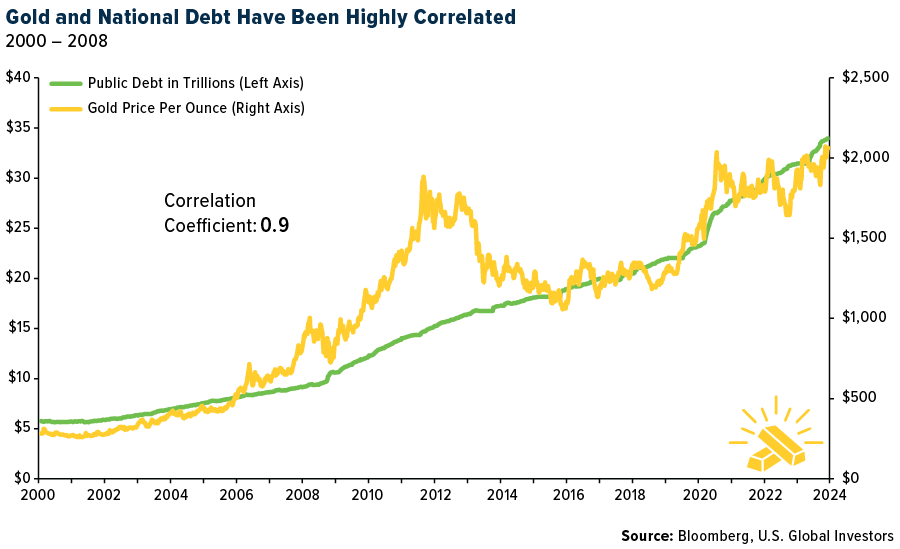

Before moving on, I’d like to point out that U.S. national debt just crossed above $34 trillion for the first time, the equivalent of $101,000 per U.S. citizen, or $264,000 per taxpayer. I believe this is a good place to look if you want to know where gold may be headed in the coming months and years. Since the start of this century, national debt and gold have shared a strong positive correlation coefficient of 0.9. In simple terms, this means that both have tended to make similar moves day-to-day. If you think debt is headed higher, it may make sense to consider an investment in physical gold and gold mining stocks.

Solar Market’s Unprecedented Growth in 2023

On the energy side, the renewable energy market saw significant strides in 2023, with over 440 gigawatts of added capacity. Notably, both the U.S. and Europe set new benchmarks for solar installations, while China’s contributions dwarfed everyone else’s, adding between 180 and 230 gigawatts (GW).

Wood Mackenzie, however, forecasts a slowdown in the growth rate of annual solar installations this year. Despite this, the global solar market remains substantially larger than it was a few years ago, following a typical S-curve pattern of rapid growth followed by gradual maturation. This build-out is expected to benefit silver in particular, a key mineral found in photovoltaic (PV) panels.

A Word on the Election

On a final note, 2024 is an election year, and it appears more and more likely that we’ll have a second rematch between incumbent president Joe Biden and Donald Trump. I expect to see heightened vitriol and animus this year compared to past cycles, given that both men are deeply unpopular and facing either criminal charges or an impeachment inquiry.

As unpleasant as this election is shaping up to be, I don’t predict substantial effects on the market. Believe it or not, the S&P 500 has never declined in a presidential re-election year, and historical data doesn’t support the notion that election outcomes profoundly influence U.S. stock market returns over the long term. Other factors are more crucial in driving stock market trends.

Therefore, I advise that investors concentrate on underlying economic conditions. In an election year, the most effective investment strategy, in my view, is to maintain a diversified portfolio instead of pursuing short-term, tactical bets.

Visit the updated Periodic Table of Commodities Returns, updated for 2023, by clicking here!

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 0.59%. The S&P 500 Stock Index fell 1.64%, while the Nasdaq Composite fell 3.25%. The Russell 2000 small capitalization index lost 3.65% this week.

- The Hang Seng Composite lost 2.81% this week; while Taiwan was down 2.30% and the KOSPI fell 3.44%.

- The 10-year Treasury bond yield rose 16 basis points to 4.043%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Turkish Air, up 4.6%. According to Bank of America, in the latest week, system net sales rose 16.2% year-over-year, compared to +6.5% for the week before. The holiday shift allowed volumes to remain strong. Domestic and international sales each accelerated versus recent weeks, with domestic sales continuing to see strength over international, at +19.1% and +14.1%, respectively. International volumes outperformed at +32.3% compared to domestic at +22.9%

- The Shanghai Containerized Freight Index surged 40% week-over-week during the last week, bringing the monthly gains to 75%, led by the Asia-Europe and Asia-Mediterranean route (+217% and 177% each during the past month).

- Alaska Airlines will be raising prices for checked bags to $35 for the first checked bag (from $30 prior) and $45 for the second checked bag (from $40 prior). Baggage fees are included in Alaska’s ancillary revenue which contributes 5% of total revenue, which means a 15% increase in fees (on average) is not insignificant.

Weaknesses

- The worst performing airline stock for the week was Azul, down 12.4%. According to Bank of America, U.S. airlines’ trailing seven-day average daily website visits were 28% lower for the week compared to the prior week. Visits to most websites decelerated, except for Hawaiian which accelerated.

- Another Maersk ship was hit by a missile in the Red Sea. The incident comes a day after the Danish government decided to send a frigate to the area as part of a U.S.-led coalition to secure passage after repeated attacks on ships from the Houthi movement, which is fighting Israel’s war against Hamas in Gaza. It also comes just after Maersk started sending its container ships through the waters again, which lead up to the crucial trade artery of the Suez Canal. Following the incident, Maersk will stop all voyages through the strait for the time being.

- Flight attendants at Air Transat have overwhelmingly rejected a new tentative contract, with more than 98% of votes against it. This rejection poses a challenge for the airline, especially as it aims to benefit from the current surge in air travel demand. The tentative agreement, reached last month with the Canadian Union of Public Employees (CUPE), represents around 2,000 Transat workers, and proposed pay increases of about 18% over five years.

Opportunities

- UBS forecasts air passenger yields of Pan-Asian airlines, under UBS coverage, to remain 15-22% above the 2019 level in 2024. On the demand side, appetite for leisure travel remains strong, based on Skyscanner’s survey of 18,000 travelers in 15 countries that indicates more travelers would increase travel budgets and frequency than those who would reduce them in 2024. For business demand, most travel managers expect to increase business travel budgets in 2024 versus 2023, based on UBS Evidence Lab’s Global Travel Manager Business Survey.

- According to JPMorgan, the Suez Canal represents a strategic trade route, constituting 30% of global container volumes, 12% of global tanker ships and 6% of global bulk trade. Putting this into context, there were over 24,000 transits through the Suez Canal in 2023, with containerships (43%) accounting for the largest share of tonnage transiting, followed by oil tankers (23%) and bulk carriers (19%). For container shipping, Asia-Europe (48%) and Asia-Mediterranean (23%) had the highest share of containership capacity on the Suez route.

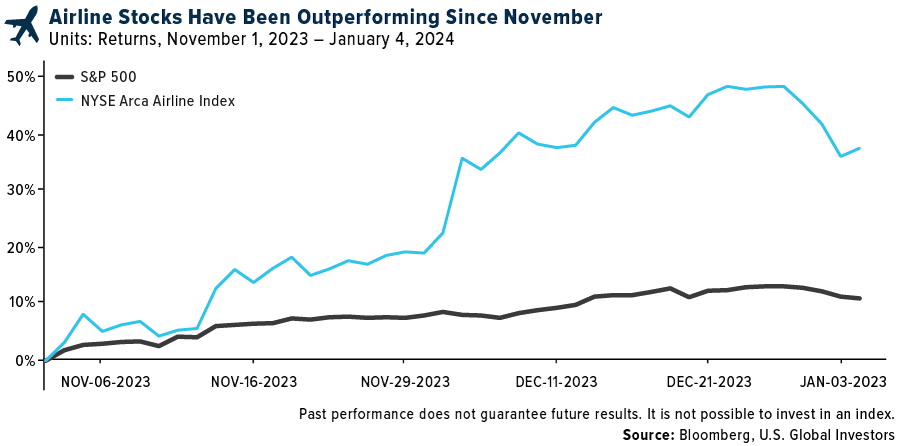

- According to Bank of America, airline stocks returned 9% in December compared to the S&P 500’s 4% in the second consecutive month of outperformance. Strong holiday travel demand continued to drive investor optimism through December after weak returns through much of the fall as shoulder-season oversupply pressured pricing.

Threats

- According to UBS, regarding supply, passenger capacity growth could be tempered by the slow delivery rate of new aircraft and disruption related to Pratt & Whitney’s GTF engines, which could pressure fleet availability. In 2023, the number of aircraft in APAC grew only 2% versus the 2011-2019 average of 7%, while around 680 aircraft in Asia (8% of passenger aircraft) are powered by GTF engines and may be grounded for inspection.

- According to Bank of America, Red Sea supply chain disruptions have worsened in late December. Containers are seeing the highest disruptions, and the bank sees risks skewed to the upside to container rates in January 2024. The group’s base case, however, is that supply chains and container rates normalize in February-March 2024, helped by weaker exports during the post-Chinese New Year low season and the possibility that peak disruption has already passed with some liners returning to the Red Sea in response to Operation Prosperity Guardian.

- According to Goldman, regarding the impact of the closure of runway “C” at the Haneda Airport, the company said that this will result in a reduction of 60-70 JAL flights per day. By multiplying the per-day reduction in flights by the key assumptions (passenger yield of ¥15,700 (as of 1H3/24), per-aircraft seat capacity of 250, and load factor of 75% (as of 1H3/24)), Goldman estimates the impact on revenue per day at around ¥0.18-0.20 bn, equating to slightly over 10% of revenue per day (around ¥1.5 bn) in JAL’s domestic passenger business.

Luxury Goods and International Markets

Strengths

- The Eurozone Manufacturing purchasing managers index (PMI) rose slightly to a seven-month high of 44.4 in December, according to a report released on Tuesday. The figure remained below the 50.0 threshold that separates growth from contraction for the eighteenth month in a row, although it has been slowly improving since July of last year.

- The combined net worth of the 500 richest people surged by $1.5 trillion in 2023, fully rebounding from the $1.4 trillion lost the prior year, according to the Bloomberg Billionaires Index. Elon Musk regained the title of the richest person in the world from French luxury owner Bernard Arnault. Musk’s net worth stands at $232 billion, more than $50 billion above Arnault’s net worth of $179 billion.

- MGM China Holdings, a Macau hotel/casino operator, was the best performing S&P Global Luxury stock, gaining 5.4% in the past five days. Macau’s hotel and casino operators gained in the first week of 2024 trading after China reported that cross-border travel returned to the pandemic level during the New Year holiday. There were 5.18 million border crossings across mainland China from December 30 to January 1, nearly a five-fold increase from a year ago and around the same level seen in 2019.

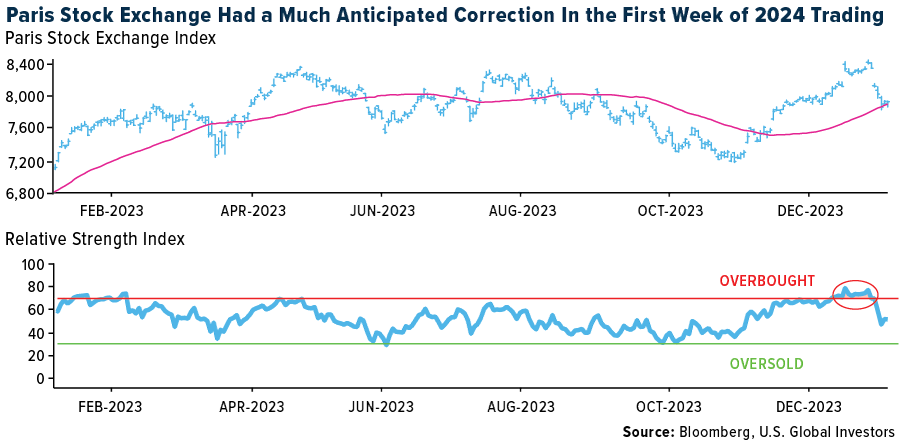

Weaknesses

- The Paris Stock Exchange, where many luxury companies are listed, experienced a weaker start to 2024. At the end of 2023, equities trading on the exchange resigned into overbought territory (per the below RSI indicator), and a correction was expected. During the first week of trading in the new year, France underperformed in Europe, equities lost 2.6%. The shares of Hermes declined 6% and LVMH 7%.

- Both China and the United States experienced a decline in their manufacturing activities. In December, China’s Manufacturing PMI fell from 49.4 to 49.0. However, the Caixin Manufacturing PMI, which focuses on production among smaller, privately owned firms, saw a slight increase from 50.7 to 50.8 during the same period. In the United States, the S&P Global U.S. Manufacturing PMI decreased from 48.2 in the previous month to 47.9 in December.

- Faraday Future Intelligence, an electric vehicle (EV) maker, was the worst performing S&P Global Luxury stock, losing 31.1% in the past five days. This troubled manufacturer of EVs may be delisted from the NASDAQ because of its low price after losing 99% of its value last year. The company was given a deadline of June 24, 2024, to meet the minimum $1 share price. It closed at 16 cents on Friday.

Opportunities

- Hong Kong’s luxury retail market is likely to regain some lost ground in 2024 as high-end brands slowly find their way back to the city after an exodus sparked by 2019’s street protests and three years of pandemic restrictions, according to South China Morning Post. Hong Kong attracts customers from the mainland due to lower taxes and for years has had a reputation as a prime international destination for luxury goods spending.

- This year, Paris will host the Summer Olympics. LVMH will sponsor the Olympic Games in Paris with top fashion brands Louis Vuitton and Dior, Moet Hennessy champagne and spirits labels, and jeweler Chaumet, designing medals for the event. Sephora, LVMH’s beauty retailer, is sponsoring the iconic Olympic torch. The Summer Olympics will take place between July 26 and August 11.

- Peloton Interactive, an exercise equipment maker, will partner with TikTok to develop fitness content and improve its brand’s promotion. The partnership marks the first time that Peloton will produce custom social content for use outside its own network. China’s TikTok has more than 1 billion active users around the globe, with thousands of communities devoted to fitness activities, according to the companies.

Threats

- The recently released minutes of the FOMC meeting have presented a conflicting narrative compared to the United States press conference held a few weeks ago. It has come as a surprise to observers that the anticipated rate cuts, originally expected to occur early this year, may now be taking place later in the year or even in 2025. Last year’s shift in expectations toward rate cuts had a positive impact on the market, effectively creating a potential reversal of sentiment following the recent release of the FOMC minutes.

- Back in September, Barclay’s downgraded the luxury sector to neutral from positive and this week analysts at Barclay’s cut their earnings estimates for luxury stocks ahead of the fourth quarter earnings season. The Broker expects the organic growth in the industry to be up mid-single-digit and mostly driven by the return of Chinese tourists.

- Barclays’ primary scenario forecasts a 5% growth rate for the luxury sector, principally using the assumption of a 50% increase in Chinese offshore spending. However, if Chinese tourism growth remains limited to 20%, brokers predict a more modest sector growth rate of 3%. The performance of the luxury sector this year may depend on the prospect of Chinese tourists returning to Europe.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was natural gas, rising 14.56%, as weather forecasts showed intense cold moving into the Midwest and East this weekend, despite storage levels for natural gas being at a five-year high. The U.S. has become the world’s biggest exporter of liquefied natural gas (LNG) for the first time, with 2023 shipments overtaking leading suppliers Australia and Qatar. The U.S. exported 91.2 million metric tons of LNG in 2023, a record for the country, according to data through December 31 compiled by Bloomberg. The expanded output was due to last year’s restart of Freeport LNG in Texas, which had been shuttered for months following a June 2022 fire and explosion. Qatar, the top LNG supplier in 2022, saw its volumes shrink for the first time since at least 2016, with a 1.9% decline dropping the nation into the third spot for shipments of the super-chilled fuel.

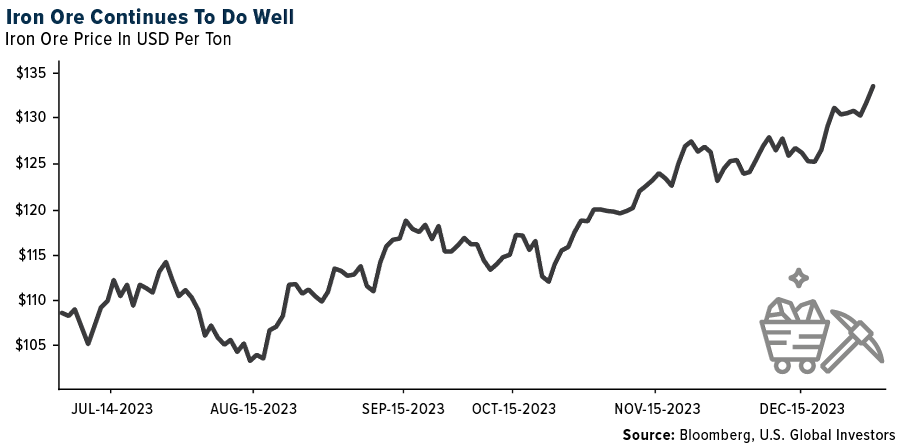

- Iron ore climbed for a third day on expectations that China’s government will bolster economic stimulus, as pre-Lunar New Year holiday restocking commences. The steelmaking material rose as much as 1.2%, putting it on track for its highest close since June 2022. It has been supported in recent weeks by signals from Beijing authorities that more stimuluses could be on the way for the economy, and particularly the struggling property sector.

- According to Morgan Stanley, after a long period of softness, the alumina price has come back to life, driven by fears of bauxite mining disruptions in Guinea and tightening bauxite and alumina supplies in China. The China alumina price has risen by 24% since early December and the Australia price is up 7% over the same period, dragging aluminum higher too.

Weaknesses

- The worst performing commodity for the week was aluminum, dropping 4.73%, after rising 10% in December following the UK’s move to put sanctions on Russian aluminum imports. On Friday, Core Lithium Ltd. announced it is suspending mining operations to reduce cash costs amid a “significant decline” in prices. The company will continue to process stockpiled ores, but that is not a long-term plan, as a rebound in spodumene prices would be needed to rescue the company.

- According to Morgan Stanley, China’s apparent oil demand fell for the second consecutive month, dropping 570 kb/d month-over-month to reach 15.5 mb/d. This was only 0.6 mb/d higher year-over-year (4%), narrowing the annual growth rate to the lowest since February of 2022. The monthly fall was driven by a further cut to refinery throughputs and crude imports to slow inventory builds.

- Supply is back in the driver’s seat for global oil markets. At issue is rising crude production from non-OPEC+ nations including the U.S., which could outstrip global demand that is still growing but at a slower pace. The oil cartel’s response has been to pledge deeper output cuts, but traders are skeptical they will be sufficiently implemented to fully eliminate a surplus.

Opportunities

- The price of Australian Carbon Credit Units climbed to a six-month high as corporate emitters planned their 2024 carbon budgets, a trend likely to further lift prices early this year. Spot prices of ACCUs rose 0.8% to A$33.75 a ton ($22.79) on Wednesday, a 12% growth since the start of November and the highest level since June, according to Jarden Partners Ltd.

- According to UBS, refining margins are expected to remain above mid-cycle in 2024. On paper the market looks more balanced, but the industry has not been able to operate at 95% utilization on a consistent basis. Global capacity additions will take a lot longer to supply product to international markets. The Dangote refinery in Nigeria is a single train 650mb/d capacity unit, which will not be easy to ramp nor to operate for that matter. In 2025, the closure of both Lyondell’s Houston refinery and the 150mb/d Grangemouth refinery in Scotland will help refining margins.

- Apache agreed to acquire shale explorer Callon Petroleum Co. for $4.5 billion including debt, the latest in a wave of buyouts reshaping the U.S. oil landscape. The all-stock transaction equates to $38.31 per share for Callon and has been unanimously approved by both boards of directors, the companies said in a statement on Thursday. It is expected to close during the second quarter.

Threats

- Air Liquide, one of world’s largest companies that specialize in industrial gas manufacturing is pressing Mexico to explain why the government ordered a temporary occupation of Air Liquid’s hydrogen plant at the Miguel Hidalgo refinery in the town of Tula on December 29. Pemex has taken over the plant and is said to be responsible for paying compensation to the Paris-based company. President Andres Mauel Lopez Obrador (AMLO) has had a string of conflicts with private and public companies as the nationalist leader tries to cement state power before the end of his term this year.

- Libya’s largest oil field halted production after protesters entered the facility, according to a person with direct knowledge of the operations. The country’s National Oil Corp. had warned earlier that a full stoppage and a force majeure were likely if the north African country was unable to meet the demands of protesters at the Sharara field, according to a letter from the company signed by an NOC board member and obtained by Bloomberg.

- Nickel fell for a fifth straight session as rising inventories pointed to lackluster demand. A hawkish readout from Federal Reserve policymakers also hit wider sentiment. The metal is down about 2% so far in 2024, following a 45% slump last year that made it the worst performer among the six base metals on the London Metal Exchange. The market has been flooded with a wave of new material from top producer Indonesia at a time when demand growth has faded.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Internet Computer, rising 38.43%.

- Monthly cryptocurrency exchange trading volume surpassed $1 trillion in December, a threshold that exchanges had failed to surpass in over a year. December was a big month for crypto trading, with exchange volume totaling $1.1 trillion, writes Bloomberg.

- Social media influencer Logan Paul has announced to his millions of followers his commitment to personally repay victims of the failed NFT project CryptoZpp, which he launched and endorsed, reports Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Bonk, down 30.45%.

- The Bitcoin spot market still has deficiencies, including price discrepancy across exchanges and platform risks, according to Simeon Hyman, a global investment strategist at ProShares. On Bloomberg TV, Hyman said there are multiple prices for Bitcoin, while futures in the cryptocurrency rely on a combination of prices for settlement everyday, writes Bloomberg.

- Michael Saylor is selling almost $216 million worth of shares in MicroStrategy, the software company he co-founded and turned into the largest publicly traded holder of Bitcoin, writes Bloomberg.

Opportunities

- Crypto asset manager Grayscale Investments is in talks with firms, including JPMorgan and Goldman Sachs, to potentially play a key role in its proposed Bitcoin exchange-traded fund. Both are being considered to be authorized participants, writes Bloomberg.

- Cowen analyst Stephen Glagola raised the target on Coinbase Global Inc. to $75 from $39 and maintains an underperform rating, according to Bloomberg.

- In a Bitcoin production and mining operation update published yesterday, Marathon Digital Holdings announced that it produced a company record 1,853 Bitcoin ($81.2 million at current prices) last month, according to Bloomberg.

Threats

- In a significant development, Chinese official media has highlighted the growing concern over corrupt officials using cryptocurrency cold storage to illicitly transfer and transact funds internationally. Exports at the meeting emphasized the urgent need for both legislative and technological advancements to effectively combat these emerging forms of corruption, writes Bloomberg.

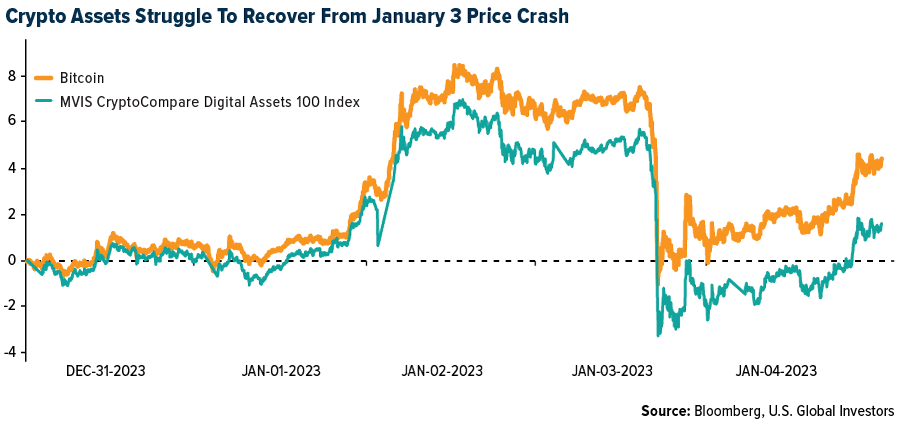

- Bitcoin struggled to rebound from a precipitous drop which sent the largest cryptocurrency falling as much as 9.22% earlier in the week. The token was little changed on Thursday morning London time, trading at around $43,056 and marking a partial recovery from Wednesday’s low but still 6.2% from the year’s high, according to Bloomberg.

- South Korean police have arrested a man they suspect of stealing cash as part of a bogus over-the-counter (OTC) crypto exchange. Officers said that the man “lured” a victim into believing the deal was a bone fide crypto transaction, according to CryptoNews.

Gold Market

This week gold futures closed at $2,051.50, down $20.30 per ounce, or 0.98%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 4.44%. The S&P/TSX Venture Index came in off 0.28%. The U.S. Trade-Weighted Dollar rose 1.13%.

Strengths

- The best performing precious metal for the week was gold, but still down 0.98%. Gold is set for its first weekly drop in a month, largely fueled by resilient labor market numbers reported this week which have quelled investors’ expectations of a rate cut as soon as March.

- Investors flocked to gold in record numbers in 2023 as global economic turbulence triggered a flight to safety, according to the Royal Mint. The number of people buying gold bars and coins jumped by 7% year-on-year, surpassing the highs of the 2020 lockdown investing boom. The British coin maker said this was due to a jump in small-scale retail investors buying “safe haven” assets. At the same time, The Royal Mint’s total payouts to customers selling back their bullion surged by nearly half after gold prices hit an all-time high last year.

- Gold rose as Federal Reserve policymakers pushed back against expectations for aggressive monetary easing early this year. Minutes from the central bank’s December meeting released Wednesday showed that policymakers agreed that it would be appropriate to maintain a restrictive stance “for some time,” while acknowledging they were probably at the peak rate and would begin cutting in 2024.

Weaknesses

- The worst performing precious metal for the week was palladium, down 6.83%. Platinum was also down 3.54%. Palladium has been weakened by substitution with the cheaper option, platinum. However, both metals continue to suffer from the poor outlook on future demand with the increased adoption of electric vehicles.

- OreCorp published a supplementary bidder’s statement for Silvercorp’s proposed acquisition of the company and its Nyanzaga Gold Project in Tanzania. The Tanzanian Fair Competition Commission (FCC) has now informed Silvercorp and OreCorp that it considers a new merger approval may be required.

- Gold Fields Ltd. suspended work at the South Deep mine, which sits on the third-biggest known body of gold-bearing ore, after a worker was killed at the operation in South Africa. “An employee was fatally injured underground in an incident involving trackless mining equipment,” the Johannesburg-based company said in a statement Thursday.

Opportunities

- Gold historically sees a January rally, based on its performance over the last decade. The precious metal typically posts a 3.5% increase during this month. Gold has already started 2024 on a strong note, building on 2023’s 13% gain. Investors are now pricing in an 80% probability of a Federal Reserve interest-rate cut in March.

- According to BMO, FireFox Gold is exploring at its Kolho, Jeesiö, Mustajärvi, Seuru, Ylöjärvi, and Riikonkoski projects, all in Finland (in which Agnico’s Kittila mine is located). Agnico Eagle has acquired 19.01M units (each is 1 share and 1 warrant), representing 10.9% of shares for $1.4M. An earn-in agreement also gives Agnico Eagle the right to earn a 51% interest in the Kolho properties in Northern Finland; upon earning 51%, Agnico Eagle will be the operator of the project and will have the right to acquire an additional 24% interest.

- Barrick Gold Corp. has spoken with some of First Quantum Minerals Ltd.’s major investors to gauge their support for a potential takeover, after the sudden closure of its flagship mine left the Canadian copper producer reeling and wiped out more than half its market value. Barrick CEO Mark Bristow approached some of First Quantum’s largest investors late last year, according to people familiar with the situation, who asked not to be identified as the talks were private. It was not immediately clear if Barrick has made a fresh approach to First Quantum, and there is no guarantee it will make a formal offer.

Threats

- Endeavor announced the termination of CEO Sébastien de Montessus, whose dismissal follows from an investigation into two separate incidents including irregular payment instructions relating to asset disposals totaling $5.9 million, as well as personal misconduct due to a reported incident in October 2023. The CEO transition at Endeavor comes as the Sabodala-Massawa Phase 2 Expansion (Senegal) and Lafigue (Cote d’Ivoire) projects are scheduled for first gold in the second and third quarter 2024 production, respectively, potentially putting these timelines at risk.

- Gold Road’s share price slumped as much as 8% after reporting a 16% quarterly decline in production, reports Bloomberg. RBC analyst Alex Barkley noted that the weak operating quarter has the potential to see carry-over issues extending into 2024. Production shortfalls could reduce revenue in the future.

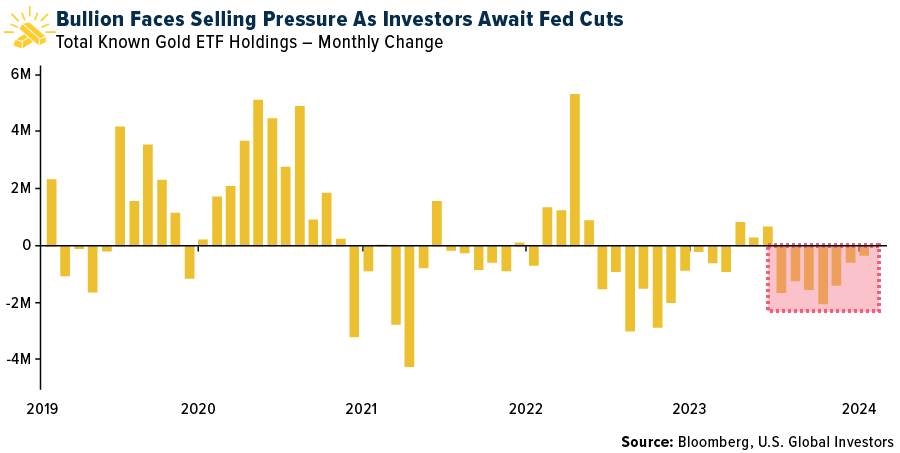

- Investors of bullion-backed exchange-traded funds (ETFs) are on edge, with December marking the seventh straight month of outflows despite gold’s positive performance last year. The trend may not reverse until the market is convinced that the Fed is firmly on a path of looser monetary policy, which tends to help the non-interest-bearing metal, as reported by Bloomberg. Expectations that the central bank was poised to cut interest rates sooner than expected helped propel the precious metal to a record last month. But that euphoria has since tempered with swaps markets now seeing an almost 70% chance of a cut by March — lower than the 85% odds seen in late December.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Copyright © U.S. Global Investors