by John Lynch, Deborah Koplik, Matthew Anderson, Comerica Wealth Management

Executive Summary

The good news is that the S&P 500® exceeded our fair value (4,400) estimate in 2023.

The bad news is that the Index has already exceeded our fair value (4,750) estimate for 2024.

Key Takeaways:

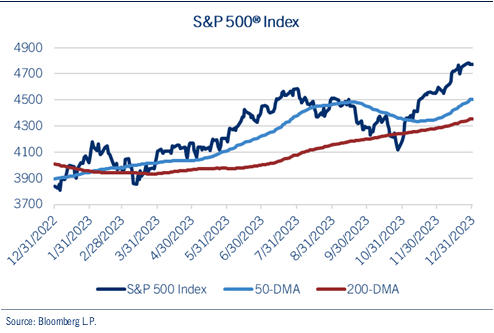

- The equity markets surged during the last two months of the year, as optimism about potential Fed rate cuts proliferated on the improved inflation outlook.

- The gains for investors were not isolated in the stock market, as an “everything rally” boosted bonds and gold, too.

- Yet we get paid to worry, and for all the undeniable technical momentum supporting the financial markets, “everything” is not supposed to “rally” simultaneously.

- We struggle to reconcile market expectations for six rate cuts with the combination of consensus projections for growth in GDP, sales and corporate profits. Three cuts seem more likely to us.

- Fortunately, we view the decline in inflation-adjusted, or “real” yields as more impactful to the equity markets, given their correlation to expanding P/E multiples.

Consequently, we now look for slightly higher market multiples to support equity prices in the year ahead. Applying a TTM P/E multiple of ~22x our below consensus profit forecast of $237.50 suggests the S&P 500® Index would be fairly valued in the range of 5,200 by year end.

Good News and Bad News

The good news is that the S&P 500® exceeded our fair value estimate in 2023.

The bad news is that the Index has already exceeded our fair value estimate for 2024.

Indeed, the equity markets surged during the last two months of the year, as optimism about potential Fed rate cuts proliferated on the improved inflation outlook.

Moreover, market interest rates plunged and net liquidity surged as the Treasury Department issued record debt with shorter-term maturities.

The result was that a good year for equity markets quickly turned into a great year for equity markets. See chart: S&P 500® Index.

And the gains for investors were not isolated in the stock market, as an “everything rally” boosted bonds and gold, too.

Yet we get paid to worry, and for all the undeniable technical momentum supporting the financial markets, “everything” is not supposed to “rally” simultaneously. Some asset classes zig when others zag.

Of course, a variety of challenges remain, including monetary policy, the presidential election, wars on two continents and ships are struggling to navigate the Red Sea.

Our 2024 Market Outlook calls for moderation in GDP, inflation and employment. Market interest rates may nudge lower as the Fed cuts rates three times and corporate profits climb by approximately 8.0%. Given the large expansion in P/E multiples in 2023, we look for market growth to approximate EPS growth this year.

The big question for investors is how much of this was priced into the markets in the waning weeks of 2023?

The answer likely lies at the Federal Reserve’s doorstep.

Monetary policymakers recently indicated plans to reduce its target for the federal funds rate by ~75 basis points in 2024, yet investors interpreted that dovish forecast as ~150 basis points, instead.

Economic growth is moderating, with consensus expectations for real GDP growth of ~1.5% in 2024. FactSet reports that companies in the S&P 500® are expected to increase sales by ~5.0% with corporate profits climbing by ~12.0%, according to consensus expectations.

We struggle to reconcile market expectations for six rate cuts with this combination of GDP, sales and profits.

Typically, when the Fed cuts rates, it’s because they have to cut rates.

Nevertheless, two of Wall Street’s great adages are: 1) Don’t fight the Fed and 2) Don’t fight the trend. In the current environment, both are formidable forces.

While the drop in nominal yields has garnered headlines, we view the decline in inflation-adjusted, or “real” yields as more impactful to the equity markets, given their correlation to P/E multiples. See chart: U.S. Treasury 10-Year Real Yield.

Consequently, we now look for slightly higher market multiples to support equity prices in the year ahead.

While we maintain our 2024 profit forecast of $237.50, we suspect a trailing twelve-month (TTM) P/E multiple of ~22X can now support the S&P 500® being fairly valued in the 5,200 range by year end. Looking at a preliminary profit forecast of $260.00 for the Index in 2025, this would correlate to a forward twelve-month (FTM) P/E of ~20X, also supporting our new year end fair value projection for the Index.

Be well and stay safe!

Contributors

John Lynch

Chief Investment Officer

Comerica Wealth Management

Deborah Koplik

Director Portfolio Management

Comerica Wealth Management

Matthew Anderson

Senior Analyst

Comerica Wealth Management