by Curt LaChappelle, Locorr Funds

Key Takeaways

|

|

Correlation dynamics have shifted over time, impacting the effectiveness of traditional diversification approaches. Rebalancing to include low-correlating assets can help reinforce portfolio diversification, offering resilience when stocks and bonds move in tandem. | Implementing a low-correlating “sleeve” strategy emerges as a dynamic solution. Combining multiple low-correlating strategies that move differently from equities and fixed income—and from each other—can help bolster diversification to create an “all-weather portfolio.” |

In the ever-changing landscape of financial markets, one principle has stood the test of time: Diversification. Often hailed as the cornerstone of Modern Portfolio Theory, diversification has been a guiding principle for investors seeking to navigate the uncertainties of investing. At the heart of this principle lies the work of Harry Markowitz, a name synonymous with the pioneering concept that has shaped the way we approach portfolio construction.

“To reduce risk, it is necessary to avoid a portfolio whose securities are all highly correlated with each other. One hundred securities whose returns rise and fall in near unison afford little protection than the uncertain return of a single security.” – Harry Markowitz

Markowitz introduced diversification as a means to reduce portfolio risk. His work laid the foundation for Modern Portfolio Theory (“MPT”), demonstrating how spreading investments across various assets with low or even negative correlations can effectively mitigate risk. At its core, diversification seeks to minimize the impact of losses arising from an overreliance on a single asset, providing investors with a buffer against market turbulence. The key to MPT is to identify and incorporate assets exhibiting either low correlation or, even better, negative correlation (i.e., move in opposite directions) to each other. Doing so helps investors achieve a balanced mix of investments that seeks to cushion the portfolio against significant downturns while still providing opportunities for growth and creating an all-weather portfolio.

Stating the Obvious: The Hazard of Singular Investments

The inherent risk associated with relying solely on one type of investment becomes easily evident when considering the performance of a long-only stock portfolio. It goes without saying that stock prices can be volatile and influenced by various factors. If all investments are concentrated in long-only equities and the stock market experiences a downturn, the portfolio may likely move in lockstep. In other words, the potential for significant losses is magnified when investments lack diversity.

Enter the 60/40 portfolio, a blend of stocks and bonds that seeks to balance growth, driven primarily by stocks, with the perceived safety of bonds. Notably, fixed income commands a sizable allocation in a 60/40 portfolio for a key reason: diversification. This allocation makes sense, given that the historically low correlation between stocks and bonds has positioned bonds as a protective buffer during equity market declines.

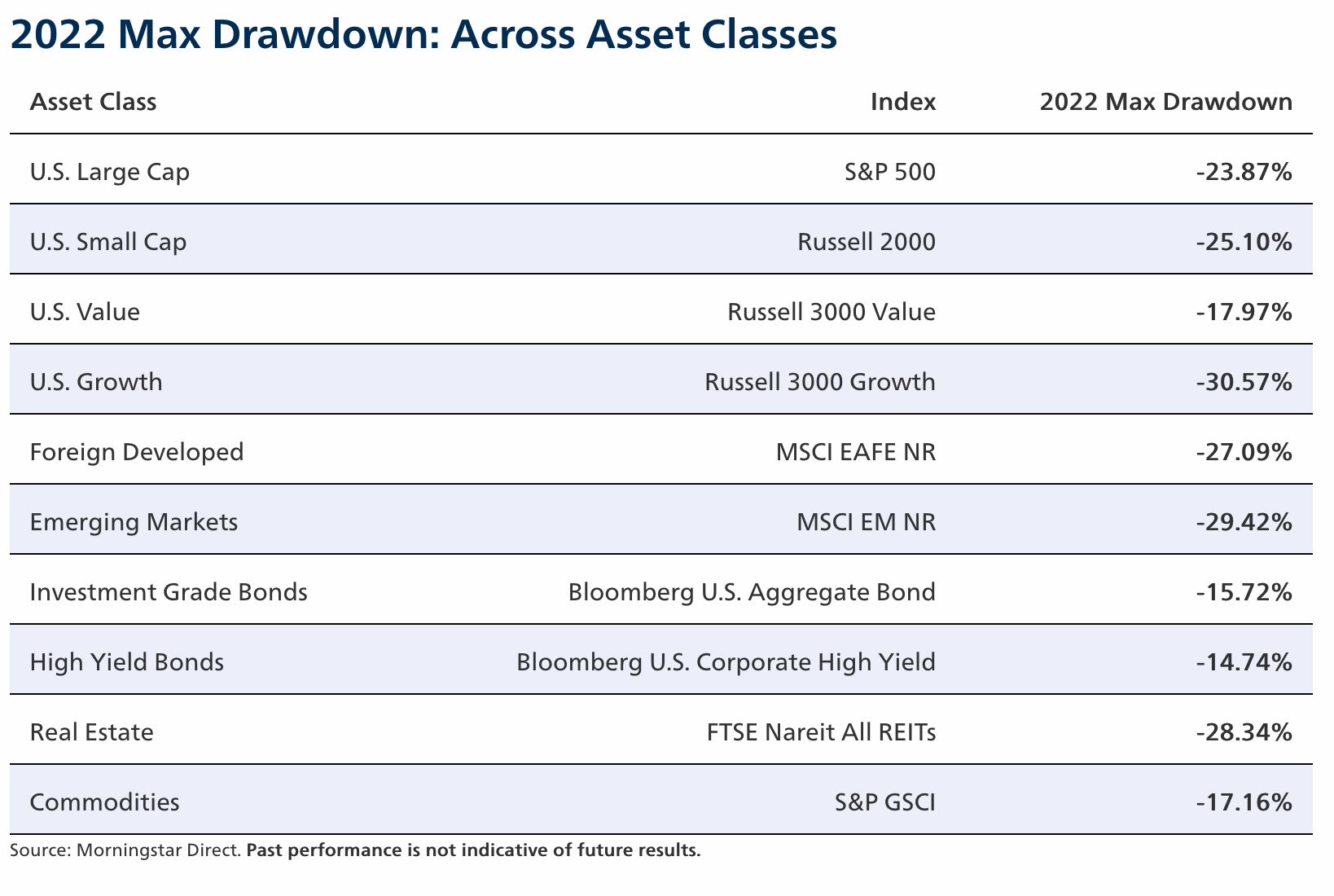

However, as Markowitz suggested, even this traditional 60/40 mix can fall short if these assets move in lockstep, negating any diversification benefit. This correlation conundrum emerged most recently in 2022, when all major asset classes, including bonds, moved in tandem, wreaking havoc on investor portfolios.

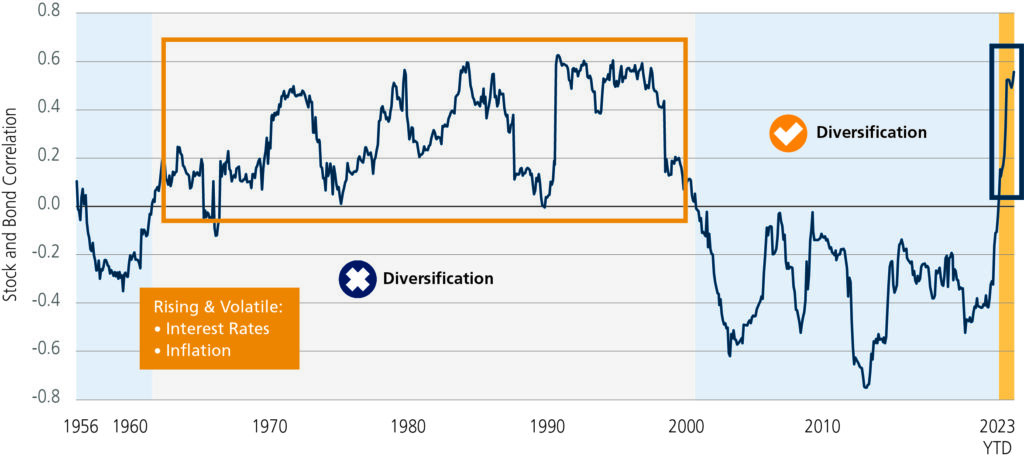

Unfortunately, it wasn’t just in 2022 that traditional paths to diversification failed. The landscape of correlations and diversification has witnessed dramatic shifts over time and these positive correlation scenarios have disrupted the traditional approach to diversification, challenging the effectiveness of the once-reliable 60/40 portfolio.

Unfortunately, it wasn’t just in 2022 that traditional paths to diversification failed. The landscape of correlations and diversification has witnessed dramatic shifts over time and these positive correlation scenarios have disrupted the traditional approach to diversification, challenging the effectiveness of the once-reliable 60/40 portfolio.

Rule #1

The reliance on fixed income as a diversifier has broken down as the once-negative correlation to equities has eroded.

The Balance of Perception and Reality

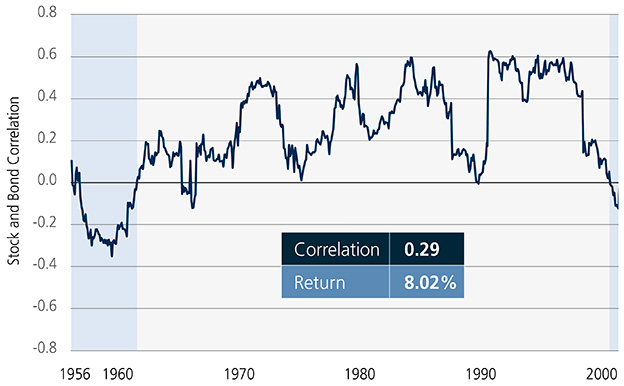

A closer look at these historical market patterns reveals an interesting interplay between investor perception and reality. Despite bonds and stocks moving in tandem from 1961 to 2000, investors failed to notice any portfolio vulnerabilities, likely due to positive net returns. The “reliable” 60/40 blend proved fruitful but hardly diversified.

Positive Returns for the 60/40 May Have Shrouded the Lack of Diversification

Source: LoCorr Fund Management and Morningstar Direct. Monthly data as of September 30, 2023. Returns from a hypothetical 60/40 portfolio of S&P 500 Index and 10-year Treasury Constant Maturity Bond Index, rebalanced monthly. Average 3-yr rolling correlation between S&P 500 PR Index and 10-Year Treasury Constant Maturity Bond Index. Returns shown are annualized. Past performance is not indicative of future results.

As the chart below illustrates, the 2000s brought a reversal, with positive correlations between stocks and bonds turning negative—thus satisfying investor expectations for returns and diversification. It wasn’t until 2022, amid inflation and rising interest rates (much like the period from 1961-2000), that positive correlation between the two returned—negating any diversification benefits and leaving investors with what was, at times, essentially a long-only portfolio. This time, returns were down across the board, and investors took notice.

Correlation Regimes Have Fluctuated Over the Years, Leaving Portfolios Vulnerable

Source: LoCorr Fund Management and Morningstar Direct. Time period 4/30/56-9/30/23. Average 3-yr rolling correlation between S&P 500 PR Index and 10-Year Treasury Constant Maturity Bond Index.

A Historical Connection Between Inflation and Correlation

As markets continue to evolve, predicting positive correlation regimes remains challenging. Inflation, a key driver of market dynamics, has historically induced a positive correlation between stocks and bonds. In fact, in the past, when inflation has been above 4%, the correlation was positive 100% of the time. Even when inflation tempered to between 2-4%, historical correlation remained positive 65% of the time—suggesting positive correlation may persist despite cooling inflation.

“Since 1956, stock and bond correlation has been positive 59% of the time.”

Source: Morningstar Direct. April 1956-September 2023, a period of 810 months: 476 positive/334 negative.

Improving Diversification: The Role of Low-Correlating Strategies

In the face of positive correlation regimes, the importance of strategies and assets that are directionally agnostic becomes evident. By integrating low-correlating assets into portfolios exhibiting low or negative correlation with stocks and bonds, investors can significantly enhance diversification and risk management during both positive and negative regimes.

Rule #2:

Advisors should strategically incorporate assets with a low correlation to equities and fixed income to ensure portfolio diversification across various market environments.

There’s No Single Solution: Effective Diversification through “Sleeve” Strategies

Reflecting on Markowitz’s principles, just as you wouldn’t confine your equity allocation to a single stock, similarly, a low-correlation allocation shouldn’t rely solely on a single low-correlating asset. Instead, we believe combining two or more of these low-correlating strategies within a portfolio, referred to as a “sleeve,” is a more effective method for achieving diversification.

A sleeve strategy involves the creation of a separate allocation within the portfolio dedicated specifically to low-correlating assets. This approach can potentially mitigate risks associated with traditional asset classes and periods of positive correlation, ultimately reinforcing diversification. Additionally, blending low-correlating strategies within the sleeve structure empowers advisors to target a spectrum of outcomes. This adaptability enables advisors to tailor investor portfolios precisely to distinct risk appetites and investment objectives, whether seeking a hedge against inflation or harnessing additional sources of returns, for example.

This strategic (versus tactical) approach helps balance the risk and reward dynamics, potentially providing a more stable foundation for long-term investment success.

Rule #3:

There is no silver bullet; advisors should create a “sleeve” of low-correlating strategies that move differently from stocks and bonds and move differently from each other.

Conclusion: The Path Forward

As the financial landscape constantly shifts, one principle remains steadfast: diversification. Harry Markowitz’s pioneering work has ingrained this concept into Modern Portfolio Theory, offering a beacon for investors hoping to mitigate portfolio risk. Yet, beneath the surface, the impact of correlation on “diversified” portfolios remains a hidden challenge.

The cornerstone of diversification is the strategic allocation of investments to counterbalance losses and dampen volatility. However, the devil lies in the correlation details—how assets move together. 2022 starkly revealed this as perceived diverse assets (i.e., stocks and bonds) moved in lockstep—downward—questioning the essence of traditional portfolio construction.

Because predicting positive correlation regimes is no easy feat, low-correlating strategies have emerged as diversification heroes. These directionally agnostic approaches add value regardless of market direction, potentially offering a buffer against correlated movements of traditional investments.

As we move through investment uncertainty, understanding the subtleties of correlation is paramount. Perception often deviates from reality, meaning advisors must remain vigilant and ever-cautious about how assets interplay. Embracing the correlation challenge, while daunting, has ushered in innovation and a new set of rules by incorporating low-correlating assets. Diversification’s true power shines only when correlation intricacies are recognized and fully accounted for in the portfolio construction process.

Copyright © Locorr Funds