by Ryan James Boyle, Senior Economist, Northern Trust

The secular forces that held down rates for forty years have not entirely changed.

This week’s shopping list included candy and gourmet popcorn to leave in the kids’ shoes as a surprise on the morning of St. Nicholas Day. They’re likely old enough to discern that a mythical old man isn’t working his way around the world offering treats. But even though St. Nick is unobservable, he is an important part of the season for them.

In economics, we reckon with a number of unobservable concepts and forces. The one we’re wrestling with most at the moment is the neutral rate of interest. Divining what the rate is and how it affects the economy is much more difficult than trying to deduce how shoes get filled with sweets at the beginning of each December.

The neutral rate, or r* (pronounced r-star) is the level of nominal interest rates that is at equilibrium: it balances the aggregate supply of saving with the demand for financing. When rates are at their neutral level, they are neither inflationary nor restrictive, neither encouraging excesses of debt nor holding business back with high costs of financing.

Deriving r* is not a simple calculation. We can only judge whether r* is achieved by the actual economic outcomes that surround it. The rate is a moving target, with circumstances pushing it higher or lower. Over time and across regions, r* will vary.

Difficult as the estimation may be, policymakers need some notion of r* in order to make decisions. Fed Chair Jerome Powell has made regular use of the analogy of navigating by the stars—most recently, “under a cloudy sky” in his Jackson Hole speech.

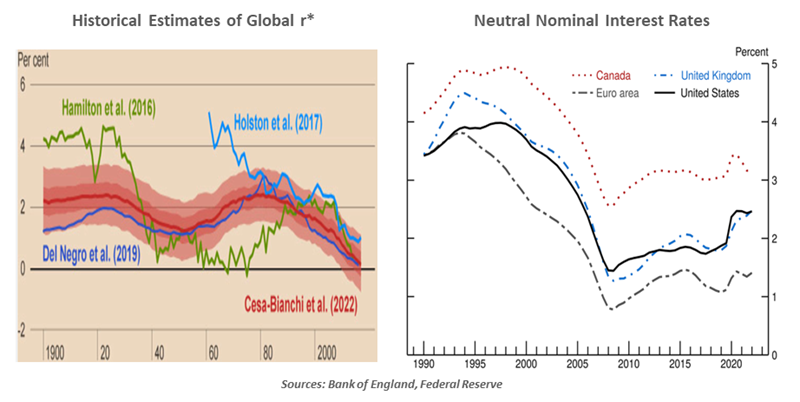

While we cannot pinpoint a precise level, there is little doubt that in the near term, r* is increasing. Over the past two years, central banks across markets have raised rates significantly and given more stringent forward guidance, but recession has not emerged. In the pre-COVID cycle, the Fed cautiously raised rates by about two percentage points, then retreated; the European Central Bank (ECB), among others, could not rise out of negative policy rates for fear of tipping into recession. Today, all markets have taken these aggressive rate hikes in stride.

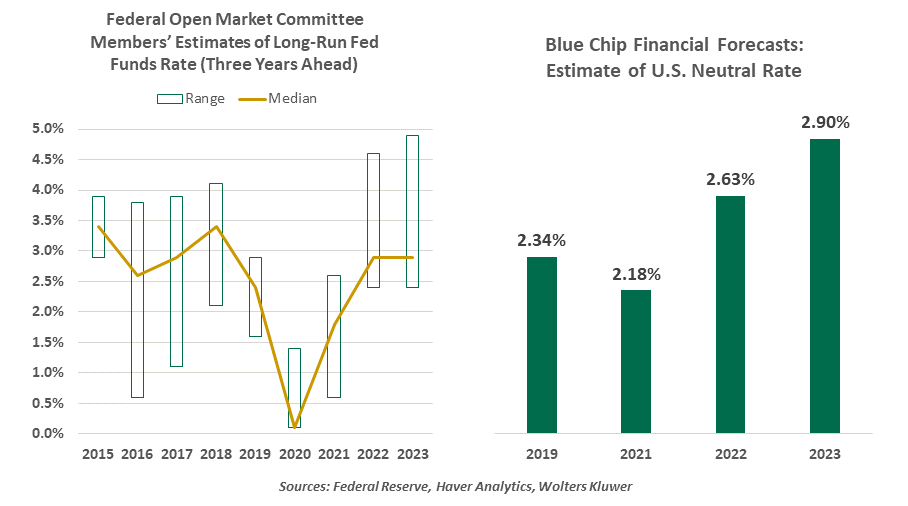

Estimates of r* are moving accordingly. Federal Open Market Committee members have raised their forecasts by almost three percentage points from a crisis low; the median estimate in September was above the top of the range of dots in 2019. Estimates of U.S. r* among the interest rate forecasters in the monthly Blue Chip Financial Forecasts are also on the rise. The restrictive forces pushing up r* are global, with policymakers among the ECB, Bank of England, Bank of Canada and Reserve Bank of Australia all recently alluding to higher rate expectations.

The drivers of the push upward make good sense. Aside from the immediate lack of a recession, there are cyclical forces that will keep r* elevated:

- Debt: Governments already carried a high stock of debt coming into the pandemic, then borrowed extensively to manage through the crisis. With government debt levels poised only to rise, the added demand for financing will push up the neutral rate. Much of this new debt was absorbed by central banks, which are now reducing their balance sheets as those instruments reach maturity; this acts as a reduction in the supply of saving.

- Productivity: Slower productivity gains were one factor contributing to the gradual decline of interest rates. Low productivity lowers potential output and returns on business investments, which diminishes the demand for capital. Real output per hour has shown encouraging gains in the U.S. in 2023, which we hope will become a widespread trend as labor markets remain tight worldwide. The promise of developments such as the latest generation of artificial intelligence are increasing demand for capital, which pushes r* higher.

However, upward revisions to r* have been modest. The secular forces that weighed on rates for forty years until 2020 have not entirely changed. After the pandemic disruptions are well and truly behind us, we will look to the following factors to determine the appropriate range of policy:

- Demographics: People are living longer, healthier lives. While a welcome outcome, this requires more retirement savings and social support for elderly populations. Meanwhile, lower birth rates mean less household formation and the credit that comes with it. Together, these forces lead to an oversupply of savings and lower demand for loans, keeping rates low. A smaller labor force also means weaker consumer demand, leading to firms investing less.

- Liquidity: Former Fed Chair Ben Bernanke famously observed a “global saving glut” that increased capital flows into the U.S., pushing down borrowing costs and fueling some of the asset price appreciation that precipitated the Global Financial Crisis. The glut was borne of corporations reducing their investments, preferring to grow financial assets. That same liquidity preference is returning. The Fed now expects banks to operate with “ample reserves.” More liquidity seeking a home will keep borrowing costs low.

On net, we think r* is somewhat higher than it has been in the past. This will be beneficial for central banks; a higher steady-state rate will allow them to respond to future economic stress with rate cuts, which are not possible when rates are already at or below the zero lower bound.

Central bank governors have the unenviable job of trying to consolidate all these forces, and more, into a policy rate strategy. In the near term, higher rates are appropriate to continue the fight against inflation. Once prices are on track to containment, the hard work begins of setting a path to a long-run rate. Estimates of neutral will help establish the destination, leaving the challenge of determining how quickly to navigate the course.

I was hoping that St. Nick would leave a note in my shoe revealing the true level of neutral interest rates. Alas, I was disappointed to find my shoe rack undisturbed on December 6. The search for r-star continues.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions. © 2023 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/terms-and-conditions.

Copyright © Northern Trust