by Melda Mergen, CFA, CAIA, Global Head of Equities, Columbia Threadneedle Investments

There are plenty of macro drivers that will create equity volatility in 2024. To succeed, investors will need to focus on company fundamentals.

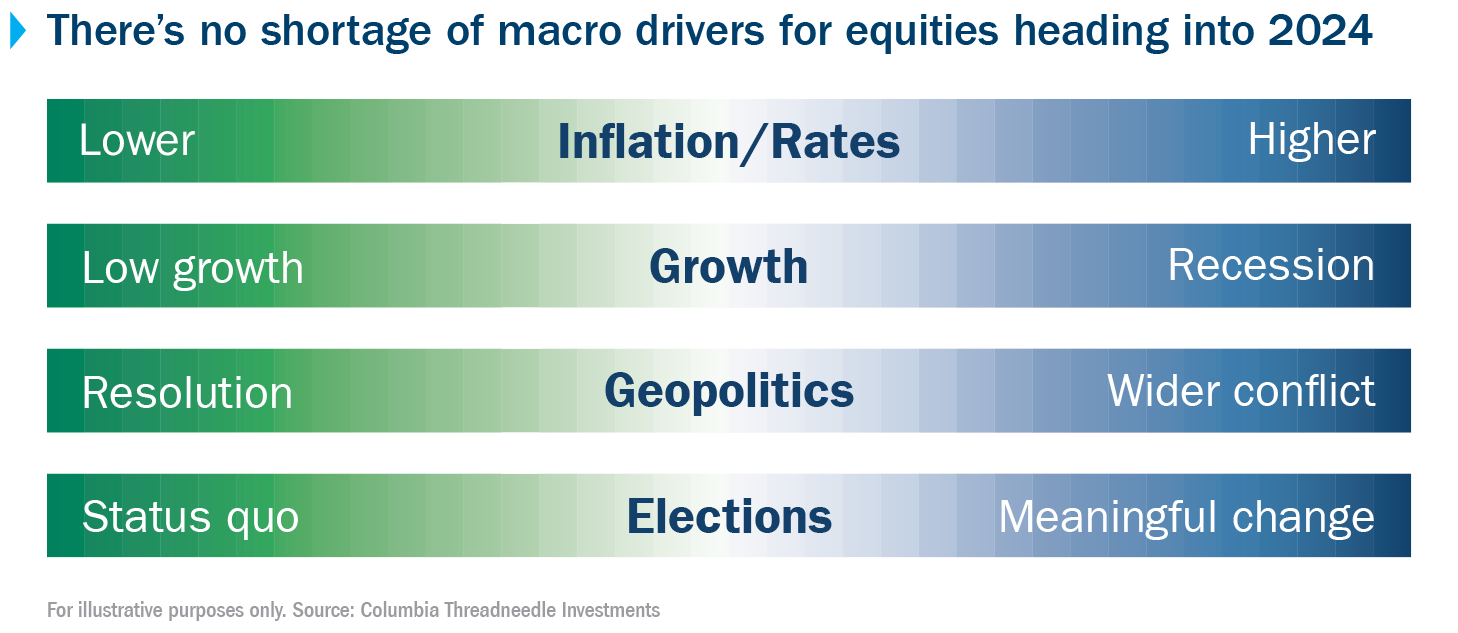

Heading into 2024, inflation, recession, elections and geopolitical risk are all potential drivers of dislocations in the equity market. Rather than approaching this environment by making calls on growth versus value or large cap versus small, we think that managing a portfolio with the potential to deliver alpha despite these macro challenges is the path to success for 2024. Here’s why we’re focused on fundamentals:

Rates that are higher for longer will create clearer winners and losers

It looks like we’ve finally reached a plateau in Fed rate hikes, but with inflation sticky and employment and growth relatively strong, the Fed may pause for longer than expected. The continued effort to keep inflation in check has a direct impact on companies.

First, there‘s a significant impact on demand as consumers who have worked through their savings feel the pinch of higher credit costs. This will have impacts beyond just consumer discretionary companies. Second, the cost of doing business will stay at elevated levels. Higher borrowing costs may be particularly challenging for smaller companies that rely on short-term financing to support operations. And third, pricing power, which has kept profits aloft for many companies, is likely to weaken as companies find it more difficult to pass higher costs of doing business on to consumers.

We think the biggest risk for the markets is that investors are underestimating the potential magnitude of an economic slowdown. Against these pressures, the key to separating the winners from the losers will be finding companies that have resilient balance sheets and demonstrate multiple drivers for growth — not just cutting costs.

Market performance may broaden outside top tier tech

A handful of tech high fliers have driven most of the S&P returns in 2023, fueled by AI optimism. We do believe that AI has the potential to be a transformational force for growth across the wider economy, not just in tech. But we also think the market’s timeline is unrealistic. In our view, we are more likely three to five years away than the one to two years that we saw priced into a narrow group of companies this year.

The concentration in performance in 2023 has created opportunity for research-based investors, as the pool of companies likely overlooked by the market (within tech and other sectors) is larger. Over 2024, we think the market will be less monolithic, with opportunities spread out more widely.

There may be attractive opportunities to improve diversification with small caps and outside the U.S.

Ahead of a potential slowdown, we see an opportunity to add to strategic allocations in small caps and international stocks, particularly emerging markets — areas where we think many investors are underallocated. Small caps are cheap now for a good reason — in a recession they would be the first ones affected. But we think there are good stock selection opportunities in both small-cap growth and value. On a price-to-earnings basis, valuations in Europe are more attractive versus the U.S., but stocks there may be even more sensitive to macro factors and rates. So careful stock selection, again, will be critical.

When investors allocate away from cash, they should consider dividend growers

Yields on cash, money markets and CDs are at 15-year highs, and investors have flocked to these instruments. In a world where inflation is likely to be structurally higher, investors will need capital appreciation along with income to meet long-term goals. Cash may be offering a compelling yield now, but it will fall when the Fed eventually cuts rates. Dividend stocks, on the other hand, can offer the potential for income and capital appreciation. All dividend-paying stocks are not the same, however. Finding dividend growers with balance sheets that can sustain dividend payments through more volatility can help investors pursue their income goals.

The bottom line

Next year may be a bumpy road for investors, but we view equities as long-term, strategic holdings. If executed successfully, active, research-based decisions to over and underweight companies provide potential for outperformance. Even if investors don’t feel like they should add to their equity allocation next year, they also shouldn’t make sell decisions based only on short-term volatility. If markets do come down, investors focused on companies with strong fundamentals will have opportunities to add to their long-term strategic positions at attractive prices.

Download this article as a PDF

Copyright © Columbia Threadneedle Investments