by Brian Levitt, Global Market Strategist, Invesco

Key takeaways

Investing during conflictHistorically, investors have been better served adding to their equity portfolios at the start of conflicts rather than reducing exposure or simply staying the course. |

Investing after tighteningHow has the US stock market historically performed in the one year after the Fed ended its tightening cycle? We crunch the numbers. |

Reinvestment riskIt may not feel like it now, but this could become a concern if an economic slowdown results in the US Federal Reserve lowering interest rates. |

“First, don’t ever call me at this time again! Question one: Does it change the trajectory of the US economy? Question two: Does it change how the US Federal Reserve will approach policy? If not, then go back to grieving.”

I’m afraid that the renewed violence in the Middle East will have us grieving for the foreseeable future. At the risk of sounding unsympathetic (which I could never be) I believe that the answers to my mentor’s timeless questions regarding yet another regional conflict are “no and no.” That is, unless there is a meaningful expansion of the war, resulting in a sustained rise in energy prices.

A ’keep it simple’ strategy

We start with three simple questions.

1. Where are we in the cycle?

It feels late in the cycle, but the economy is remarkably resilient. I believe an economic downturn in the near term is unlikely.

2. What’s the market telling us about the direction of the US economy?

These markets have been anticipating above-trend US growth. Interest rates are meaningfully higher since the beginning of the summer.1 Stocks have been outperforming bonds in the second half of the year.2 The market expects the economic resilience to persist.

3. What will be the monetary policy response?

I think the US Federal Reserve (Fed) is done hiking. I hope they’re done. Are they done? Regardless, the end of tightening is either here or near.

Sound growth and improving policy clarity would likely provide a risk-on environment between now and the end of the year, if not beyond.

Statistics can prove anything

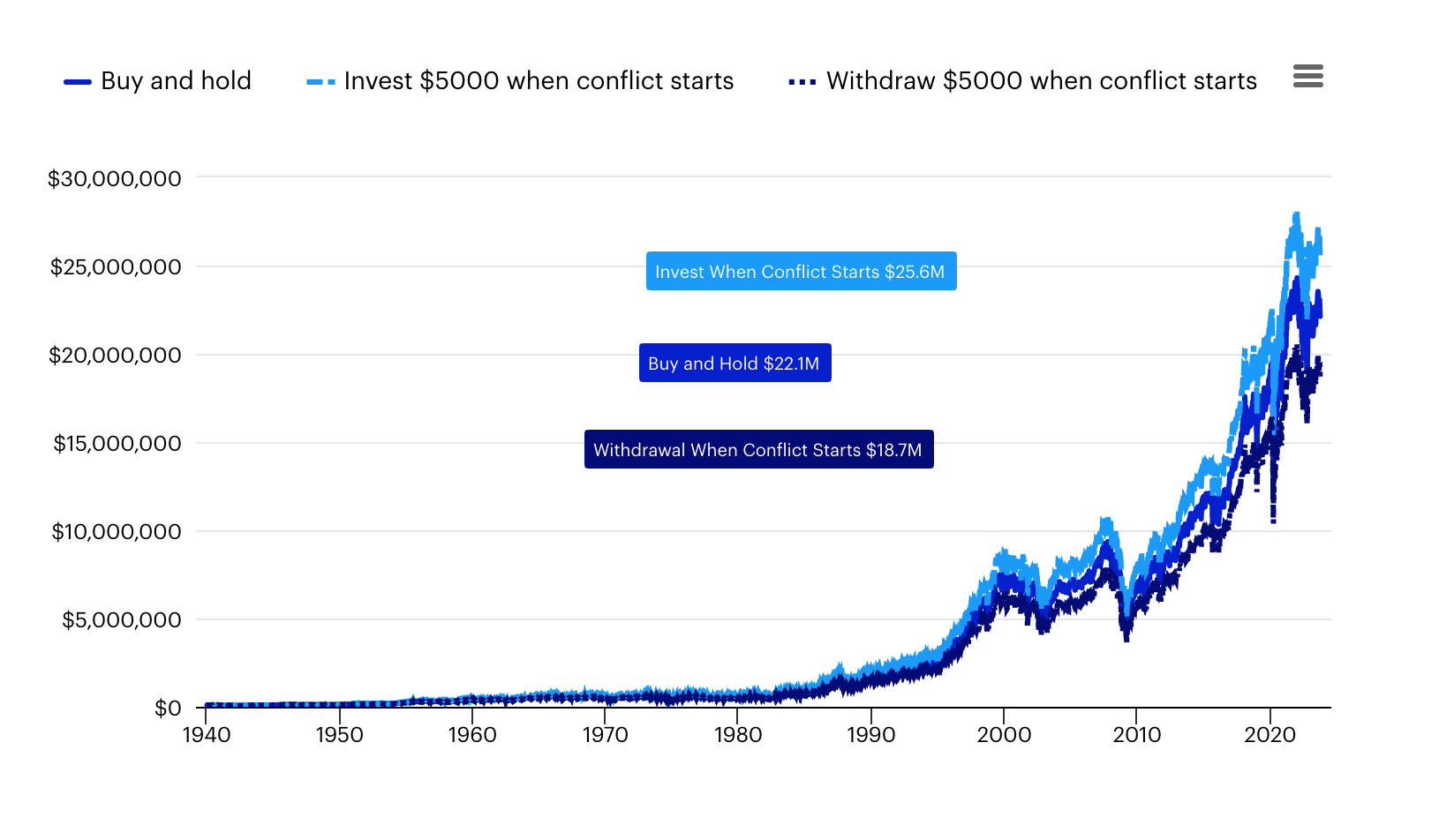

One more point about investing in a time of conflict. It turns out that historically investors have been better served adding to their equity portfolios at the start of conflicts rather than reducing exposure or simply staying the course. Why? It’s cliché but time in the market tends to be the most important factor in long-term investing returns.

Learn more: Military conflicts haven’t derailed the long-term growth of stocks

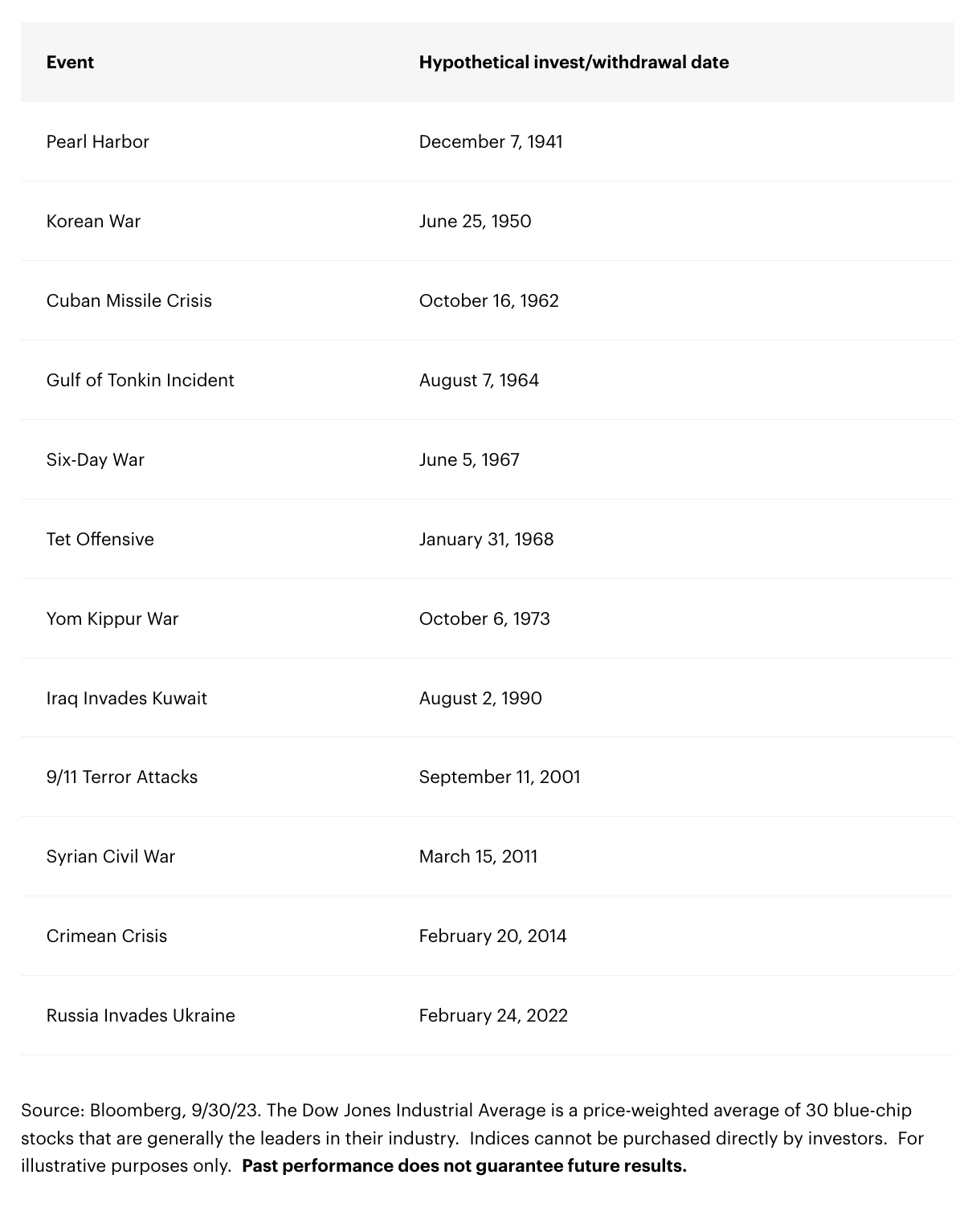

Historically, investors have not been well served by withdrawing investments when conflicts begin

Dow Jones Industrial Average: Growth of $100,000 with $5,000 investments/withdrawals at start of select conflicts

It may be confirmation bias, but …

… an inverted yield curve has historically been the time to extend the maturity and duration of bond portfolios rather than remain in cash. That may seem paradoxical to investors. Why lend money to the US government for 10 years at 5.0% (for example) when you can get 5.4% from a money market or certificate of deposit?3 The bird in the hand, right?

The answer, historically, has been reinvestment risk. Reinvestment risk is the probability that an investor won’t be able to reinvest cash flows, such as coupon payments, at a rate equal to their current return. It may not feel like it this month, but could occur, for example, if an economic slowdown results in the US Federal Reserve lowering interest rates.

Consider two of the past times that the yield curve was inverted, May 2000 and June 2006. In both examples, investing in intermediate to long US Treasury bonds and “locking in” the yield was a better approach than taking advantage of the elevated short-term yield and reinvesting at lower rates when short-term yields inevitably declined.4 In short, if you’re happy with a 5% yield for 30 days, then you would likely be happier by “locking in” close to a 5% yield for 10 years.

Since you asked (Part 1)

Q: When does good news for the US economy stop being bad news for the stock market?

A: Good US economic data or data that runs above trend (as it has recently) won’t be bad for markets when US inflation is closer to 2.5%. With inflation above 3%5, above-trend growth has led to higher 10-year Treasury rates and has biased the Fed towards tightening financial conditions.

The good news is that inflation does appear to be heading lower. The Federal Reserve Bank of New York Underlying Inflation Gauge (which captures sustained movement in inflation from information contained in a broad set of price, real activity, and financial data) fell to 2.87% in September.6 Historically, it has tended to lead the core Consumer Price Index lower.

I guess what I’m saying is that bit of good news may mean that good news becomes good news again.

Since you asked (Part 2)

Q: How has the US stock market historically performed in the one year after the Fed ended its tightening cycle?

A: I’m pleased to see investors looking ahead to the next monetary policy cycle.

- There have been nine tightening cycles since the mid-1970s.7

- The S&P 500 Index posted positive returns in seven of the nine years following the end of tightening. The two negative experiences occurred following the April 1981 (-7.4%) and April 2000 (-13.0%) rate cuts.8

- The average one-year return is 13.2%. The median is 14.7%.9

It was said

“Given the uncertainties and risks, and how far we have come, the Committee is proceeding carefully. We will make decisions about the extent of additional policy firming and how long policy will remain restrictive based on the totality of the incoming data, the evolving outlook, and the balance of risks.” – Fed Chair Jerome Powell

No surprises here. I do believe that the Federal Open Market Committee is uncertain how to proceed from here. Either way, when the tightening is over, the Fed Chair will not ring a bell and announce it. There would be no incentive to ease financial conditions. For what it’s worth, the market still thinks that the Fed Funds Rate has peaked and will be at 4.75% by this time next year.10

Automate my job?

Each month I pose a question to ChatGPT — the artificial intelligence-driven chatbot — and assess the response.

Q: How can investors seek to protect themselves during periods of global conflict and war?

A: (Response edited for brevity’s sake) Here are some approaches investors may consider:

- Alternative investments: Consider alternative assets like commodities, which may have lower correlation to traditional financial markets.

- Have a cash reserve: Keeping a portion of your portfolio in cash provides liquidity and flexibility. It allows you to take advantage of opportunities that may arise during times of market uncertainty.

- Maintain a long-term perspective: While it’s important to be vigilant, making impulsive decisions based on short-term events can lead to suboptimal outcomes. Sticking to a well-thought-out long-term investment strategy is crucial.

Well done ChatGPT. I agree, particularly about that last point.

On the road again

My travels this month took me to the beautiful city of Annapolis, Maryland. It’s never a bad day when you’re walking cobblestone streets, dodging the jogging midshipmen, and taking in the views of the water and the 18th century architecture. Highlights of my day included drinking a beer at a bar that had been frequented by Ben Franklin and George Washington. The dinner event was at a bistro that hires people with employment barriers and gives them an opportunity to develop a resume and earn a living wage. The experience provided a much-needed lift in spirit in what has been a troubling month.

I’m not ready for winter.