by Jordan Michaels, Sector Portfolio Manager, Fidelity Investments (US)

Key takeaways

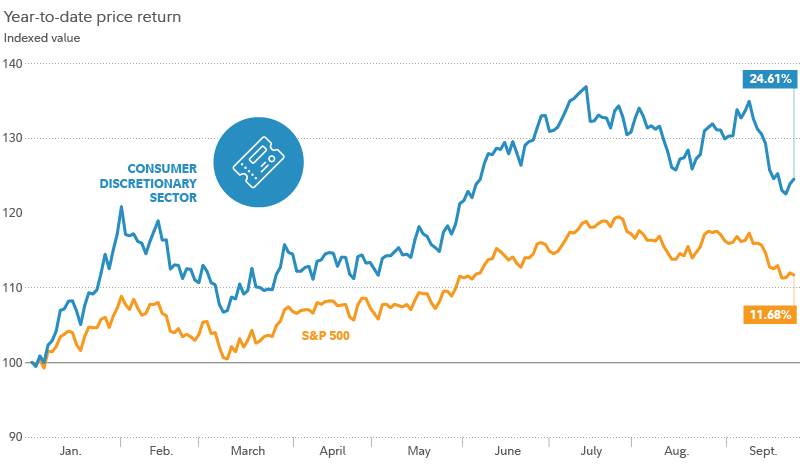

- The consumer discretionary sector has posted roughly twice the gains of the S&P 500® so far this year, as the economy has bucked expectations by continuing to grow.

- That’s unusual leadership for this phase of the business cycle, when it’s more common for discretionary stocks to lag.

- Some retailers have relatively defensive business models, and have also recently traded at attractively low valuations—contributing to a positive potential outlook.

The consumer discretionary sector is perhaps one of the best examples of what an odd year 2023 has been so far for the stock market.

As its name suggests, the sector encompasses companies that sell nonessential goods and services to consumers—think “wants,” not “needs,”—like clothes, new cars, and cruise trips. Because these are precisely the types of goods and services that customers tend to cut back on first in a pinch, the sector typically lags when the economy slows and recession risk rises (Fidelity researchers believe that the US economy is in the late cycle, not recession, but that recession risk has increased).

Yet instead of lagging, the sector has surged, gaining about twice as much as the S&P 500 year to date through late September (though remember that past performance is no guarantee of future results).

In part, that’s been due to the same macro themes that have driven the stock market higher this year (in spite of the sense of pessimism in the air). The economy has continued to expand this year, inflation has slowed, the Fed may be nearing the end of its interest-rate-hiking cycle, and the chances of a soft landing may have improved—all of which are generally good for consumers.

And in part it’s been due to unique issues impacting some of the largest companies in the sector. The 2 largest constituents in the sector, by a wide margin, are Amazon and Tesla both of which have experienced extremely strong gains so far this year as mega-cap, tech-related stocks have surged. Both companies have also been seen as potential investing plays on artificial intelligence, and both have reported some strong results during the year.

A mixed near-term outlook

Looking ahead, one key question that may impact the sector is whether this economic cycle may shift to look more like a “typical cycle.” If the economy were to slow further or enter recession, the sector could lag. On the other hand, that could set the sector up for outperformance during an eventual recovery, as consumer discretionary stocks have historically tended to lead the market when the economy shows the first signs of improvement, known as the early-cycle phase. And it’s also possible that this unusual market cycle will continue to buck expectations and historical patterns.

On a more fundamental level, these companies do face some near-term challenges. Consumers remain pressured by persistent inflation and high interest rates. And companies’ pricing power has softened as the supply-chain disruptions of the past few years have eased.

Potential opportunity among some retailers

That said, these setbacks are already priced into the stocks in many cases, and reflected in low price-earnings ratios, particularly among retailers across a variety of segments. And some of these companies have defensive aspects to their business models, which could be an advantage if the economic outlook worsens.

Consider, for example, the operating model of The TJX Companies, whose businesses include TJ Maxx, Marshalls, and HomeGoods. While excess inventories may be a negative for traditional retailers, it can be an advantage for the business model of TJX, which buys up excess inventory from name-brand retailers, to then sell at its low-cost stores. And because low price points are already built into the company’s business model, it may have a degree of insulation against further economic slowing (which can lead consumers to trade down, from higher-priced stores to lower-priced stores).

Fund top holdings1

Top-10 holdings of the Fidelity® Select Consumer Discretionary Portfolio as of August 31, 2023:

- 25.3% – Amazon.com Inc.

- 13.9% – Tesla Inc.

- 4.9% – Home Depot Inc.

- 4.8% – Lowes Cos. Inc.

- 4.4% – TJX Companies Inc.

- 3.0% – Nike Inc.

- 2.8% – Hilton Worldwide Holdings Inc.

- 2.4% – The Booking Holdings Inc.

- 2.3% – McDonald's Corp.

- 2.2% – Aptiv PLC

Another example has been Lowe’s the home-improvement retailer. While there has been some softening of consumer spending on do-it-yourself projects (after surging during the pandemic), there are positive long-term factors that could help support this segment. Low housing availability and high interest rates may have many consumers looking to stay put—and turn their attentions to improving the homes they already own—rather than moving. And an aging housing stock and aging population could help drive longer-term demand for home repairs, maintenance, and upgrades.

An emphasis on the long-term outlook

As of early October, there are reasons for near-term caution on the economic and consumer backdrop. However, as sector portfolio manager, my focus remains on the longer term. Fortunately, the consumer discretionary sector continues to offer pockets of attractively valued stocks, where Fidelity's research insights can help us uncover those companies with strong risk-reward profiles and long-term growth potential.

Copyright © Fidelity.com