by Brian Levitt, Global Market Strategist, Invesco

Key takeaways

Market historyMarkets, over more than 120 years, have experienced a long-term advance despite war, recession, oil shocks, political assassinations, and much more. |

Military conflictMilitary conflicts test investors’ resolve to stick to their investment plan, but history suggests these events have not derailed the long-term growth of markets. |

Differences from 1973The market fall after the Yom Kippur War in 1973 may be concerning to investors given the parallels to today’s conflict, but there are very significant differences. |

History is comprised of challenging times. As a global market strategist, it’s my job to talk about these historic events in the context of the markets, and to offer some perspective for investors. Unfortunately, it’s time to do so once again.

Markets, over more than 120 years, have experienced a long-term advance despite war, recession, oil shocks, political assassinations, and much more. While military conflicts test investors’ resolve to stick to their investment plan, history suggests these events have not derailed the long-term growth of financial markets. I implore investors to maintain a long-term perspective.

Stock market returns following geopolitical conflicts

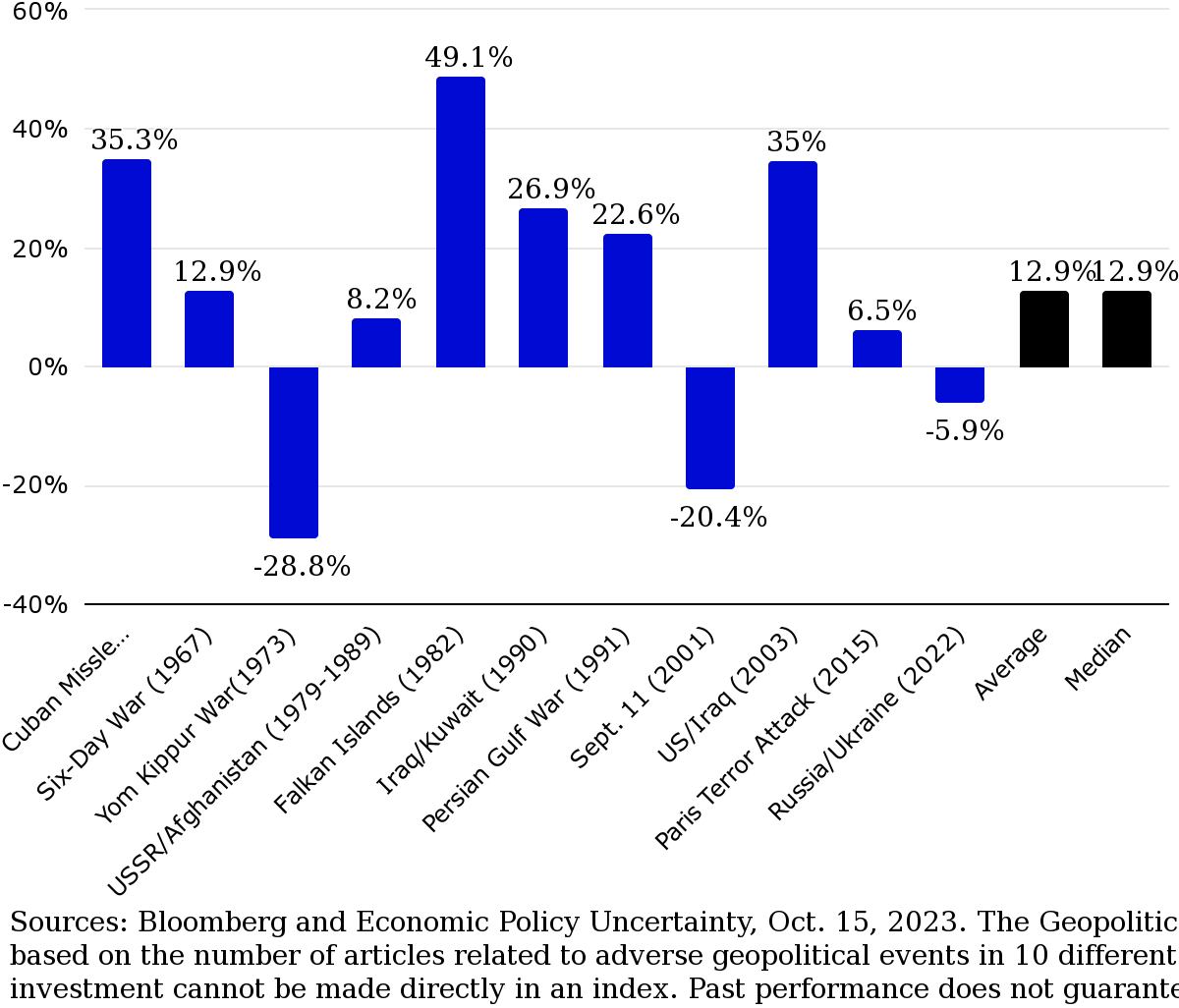

If there’s a factor that impacts market performance, there’s an index to measure it. Geopolitical risk is no exception. The chart below illustrates 11 points in history where we experienced a peak in the Geopolitical Risk Index, and it shows the return of the S&P 500 Index 12 months after that peak. In most cases, the stock market rose significantly in the year following peak geopolitical risk.

Stocks have made significant returns in the 12 months following peak geopolitical risk

S&P 500 Index returns 12 months after a peak in the Geopolitical Risk Index

A closer look at the Yom Kippur War

The biggest outlier in the above chart is the Yom Kippur War in 1973, which was followed by a severe recession and a sharp decline in markets. This may be concerning to investors given the parallels to today’s conflict, but there are very significant differences:

- The 1970s recession was fueled by the Arab oil embargo against the United States. But today, the US is significantly more energy independent than it was back then.

- In the 1970s, inflation was beginning to rise. But in the current instance, inflation peaked well over a year ago — the US Consumer Price Index hit 9.1% in June 2022, falling to 3.7% in September 2023.1

- The Federal Reserve appears to not be suffering from a credibility gap as it was in the 1970s. Inflation expectations are very well anchored in the US.

Footnotes

1 Source: US Bureau of Labor Statistics, as of Oct. 12, 2023

Copyright © Invesco