by Kristina Hooper, Chief Global Market Strategist, Invesco

Key takeaways

Geopolitical riskGlobal stocks didn’t experience the big sell-off many feared would occur last week, despite the rise in geopolitical risk since Hamas’ attack of Israel. |

Monetary policyThere is still uncertainty about the path of monetary policy, with the focus on when US Federal Reserve rate cuts will begin and how many we will get in 2024. |

Chinese economyThe Chinese economy continues to show mixed results, with weakness in parts such as the property sector but resilience in other parts. |

1. Markets are becoming somewhat desensitized to geopolitical risk

Global stocks didn’t experience the big sell-off many feared would occur last week,1 despite the rise in geopolitical risk since Hamas’ attack of Israel. Just as markets have become desensitized to US government shutdowns, they have become somewhat desensitized to geopolitical conflicts.

That’s not to say that geopolitical risks have no impact on markets. There has been an increased preference for perceived “safe haven” asset classes as concerns persist that the Israel-Hamas war will not remain contained and that other countries will get involved.

Demand for US Treasuries caused prices to rise and yields to fall, with the yield on the 10-year US Treasury dropping to 4.629% over the course of last week.2 In addition, the price of gold has risen by nearly $100 since the attack.2

And it goes without saying that geopolitical risks are exacerbated by the lack of a Speaker in the US House of Representatives. Kevin McCarthy was removed from that position on Oct. 3 — the first time in history that the House has voted to remove a Speaker — and the debate over his replacement continues.

2. Central banks are still driving markets

Central banks, especially the US Federal Reserve (Fed), have been driving markets for years — and that still continues today. Perhaps that’s a good thing right now since it means we’re unlikely to see market destabilization caused by geopolitical risk. But we also have to hope that central banks won’t destabilize markets themselves with words and dot plots…

The good news is that “Fedspeak” in the past week has been more dovish. More Federal Open Market Committee (FOMC) members have echoed the words of San Francisco Fed President Mary Daly, who said that tightening financial conditions are doing much of the Fed’s work for it (meaning further rate hikes shouldn’t be necessary to control inflation).

However, there is still uncertainty about the path of monetary policy — with the focus on when Fed rate cuts will begin and how many we will get in 2024. That’s because the minutes from the September FOMC meeting have made it clear that the Fed remains very data dependent: "All participants agreed that the Committee was in a position to proceed carefully and that policy decisions at every meeting would continue to be based on the totality of incoming information and its implications for the economic outlook as well as the balance of risks.”3

Stocks and bonds are likely to continue trading in a range — albeit rather wide — until we get clarity on Fed policy going forward.

3. The US economy continues to show resilience

The International Monetary Fund (IMF) upgraded its forecast for US economic growth to 2.1% in 2023 and 1.5% in 2024 (a substantial upward revision from the 1% it forecasted in July).4

But perhaps because of the resilience of the US economy, fears of inflation resurgence are still alive and well. The US Consumer Price Index (CPI) reading for September5 was slightly higher than expected. Headline CPI rose 0.4% month over month and 3.7% year over year. Core CPI, which excludes food and energy prices, rose 0.3% month over month and 4.1% year over year.

As I have cautioned before, not every inflation-related data point will be perfect. However, in my opinion, the trend is clear: Inflation readings are improving, and the disinflationary process continues. Some areas of inflation will be stickier than others. However, concerns over the September inflation print drove US dollar strength later in the week. For example, inflation hawks are focused on the stickiness of “supercore” inflation, which excludes housing prices as well as prices for food and energy. I think these inflation hawks may be missing the forest for the trees. In taking a step back, I see a US economy that is on solid footing but slowing and bringing inflation along with it.

4. The economy remains a mixed bag in China

The Chinese economy continues to show mixed results, with weakness in parts such as the property sector but resilience in other parts.

For September, Chinese monthly exports and total social financing flows beat expectations, but consumer prices were flat from a year ago while producer prices dropped 2.5% year over year, suggesting weakened demand.6 And there continue to be significant concerns about the property sector given missed debt payments by real estate developers.

Market sentiment could start to improve as policymakers continue to offer targeted policies to stabilize the markets, such as the recent China state wealth fund purchase of shares in four major banks and the potential rollout of a Stabilization Fund. Last week, the IMF downwardly revised its forecasts for Chinese economic growth — but it is still at a solid 5% for 2023 (and 4.2% in 2024).7

5. An interesting dynamic emerges with oil prices

Both elevated valuations and uncertainty about the global economy are likely to prevent energy prices from rising much more in the short term. In addition, signs emerged weeks ago that higher oil prices have led to some reduction in demand:

"Supply fears gave way to deteriorating macroeconomic indicators and signs of demand destruction in the United States, where gasoline deliveries plunged to two-decade lows. Demand destruction has hurt emerging markets even harder, as currency effects and the removal of subsidies have amplified the rise in fuel prices.”8

I assume these pressures will result in some volatility around a relatively elevated price level; the key takeaway is that there is likely to be a ceiling on oil prices.

6. US earnings season is off to a solid start

S&P 500 blended earnings growth (actual earnings and estimated earnings for those companies that have not yet reported) for the third quarter has improved slightly since the end of September thanks to a good start to earnings season. At the end of September, the estimated earnings growth rate for the S&P 500 for the third quarter was -0.3%.9 As of last Friday, the blended earnings growth rate had improved to 0.4%.9

It's important to keep in mind that only 6% of companies have actually reported earnings thus far, but 84% of those have reported better-than-expected earnings (largely from the financials sector).9 We will get a better sense of third quarter earnings this week, as there are more than 50 S&P 500 companies expected to report including more companies from the financials sector, some major airlines, and Tesla, Schlumberger, and Netflix.

Dates to watch

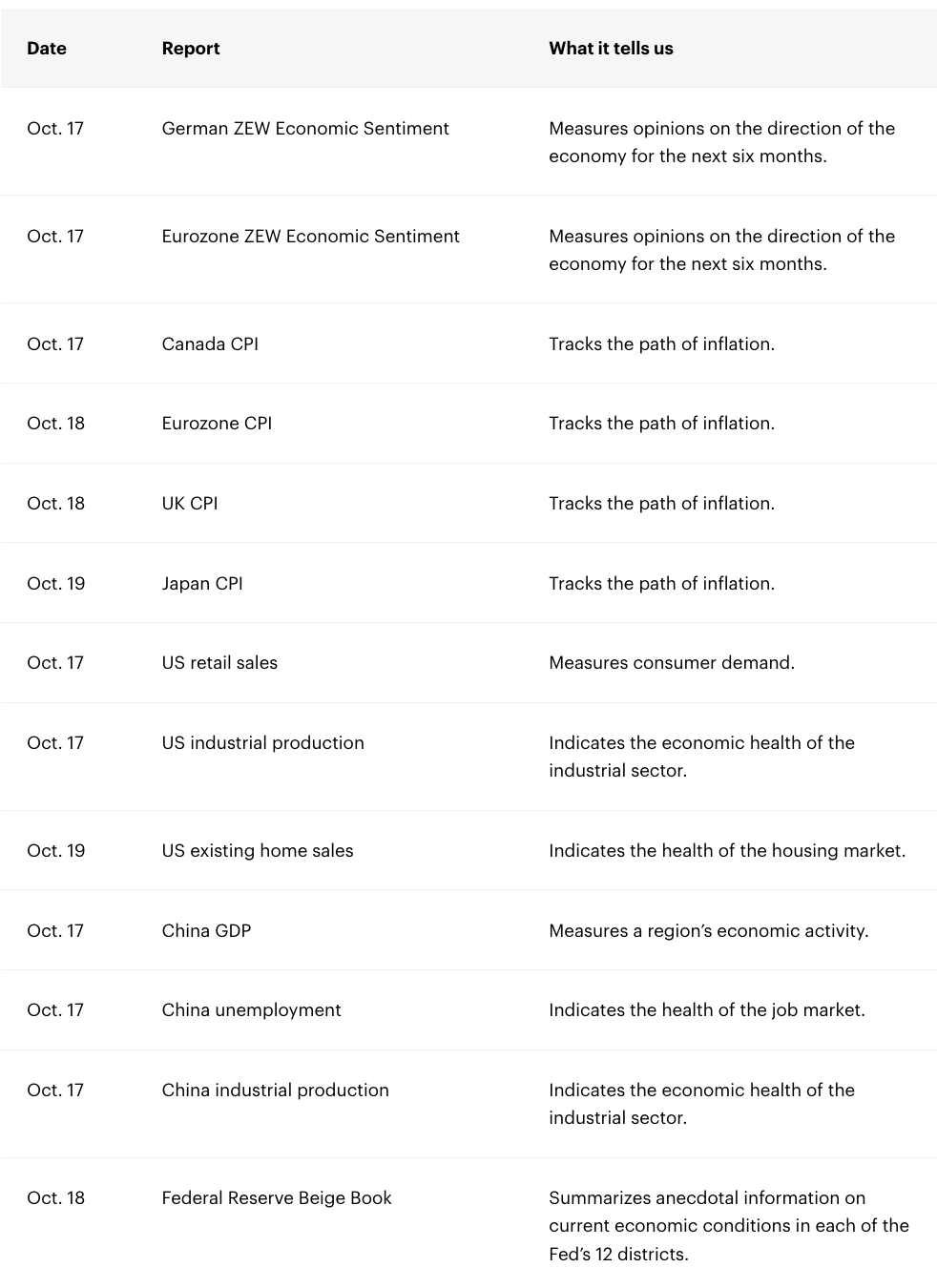

Looking ahead, I will be focused on ZEW Economic Sentiment indexes for Germany and the Eurozone. Inflation readings from Canada, the eurozone, the UK, and Japan will be very important for their monetary policy implications. In the US, I will be paying attention to retail sales, industrial production, and existing home sales. It’s a big week for China, with gross domestic product (GDP), unemployment, and industrial production to be released. I will also be very interested in the anecdotal information provided in the Federal Reserve Beige Book — I can often glean important insights from this publication.

With contributions from David Chao and Andras Vig

Footnotes

- 1 Source: Refinitiv Datastream and the Invesco Global Market Strategy Office

- 2 Source: Bloomberg, as of Oct. 13, 2023

- 3 Source: September FOMC Meeting minutes

- 4 Source: International Monetary Fund World Economic Outlook, October 10, 2023

- 5 Source: US Bureau of Labor Statistics, as of October 12, 2023

- 6 Source: China National Bureau of Statistics, October 13, 2023

- 7 Source: International Monetary Fund World Economic Outlook, October 10, 2023

- 8 Source: International Energy Agency monthly report

- 9 Source: Factset Earnings Insight, October 13, 2023

Copyright © Invesco