by William H. Gross | October 4, 2023

Professional stock investors know little about bonds and vice versa I suppose. Yours truly has to be included in that mix but that doesn’t stop me from trying. Here’s the topic for today’s Investment Outlook: How has the significant rise in U.S. (and global) interest rates affected the value of the stock market?

I’ll start by suggesting that stock analysts almost always cite the rise in yields as a precursor to slower economic growth and a lowering of EPS (earnings per share) estimates over the near term. I’ll go with that although most experts have been shocked by the continuing surge in GDP growth after a near historic rise in short and long maturity yields beginning nearly 2 years ago. It may seem different this time but fiscal deficits between 1 and 3 trillion during the same period are different and that to me at least is the reason why the economy and stock prices have held up so well.

But EPS levels and forward assumptions are only part of the story and as it turns out, a less significant influence on stock prices than the change in interest rates which tend to dominate longer term values. The fact is that over the last 2 years, nominal and real yields have risen by 400 and 350 basis points respectively in 10 year Treasury space and such an increase over such a short time period might even cause an equity analyst to wonder why stocks aren’t in a bear as opposed to a bull market. I have an explanation.

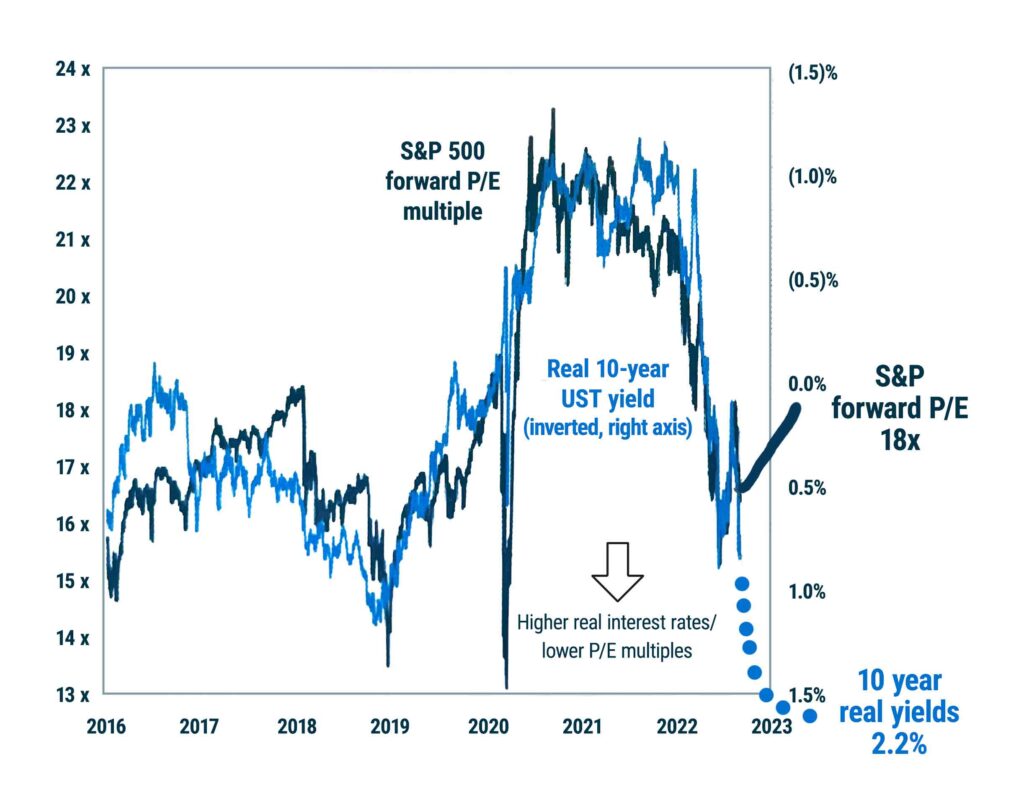

As the updated Goldman Sachs chart shown below might suggest, S&P 500 forward P/E multiples have for the last 5 years been correlated to real 10 year Treasury yields with the exception of the last 12 months or so. There is a long-term logic for this. A P/E ratio turned upside down to E/P is really an earnings yield. One might commonsensically assume that if bond yields go up by 350 basis points that (everything else being equal) earnings yields (E/P) should follow somewhat. They did until the Fall of 2022 as the chart will show but not since. A plethora of explanations abound. The aforementioned strong economy, the bond market’s assumption that the Fed will lower yields quickly in 2024, and hopes for positive influences on productivity and earnings growth from AI are decent explanations. Everything else has not been equal during the 350 basis point rise in real 10 year Treasuries. Once the Fed stops and then lowers short-term rates, we’ve got a bull market optimists claim. Well not so fast.

Although models such as the Gordon dividend discount and my own Goldman Sacks chart from 2016-2021 would infer, if all else was equal, a rise of 350 basis points in 10 year real rates accompanied by a 350 basis point in E/P earnings yields would lower the market’s P/E ratio to 12X instead of the current 18X. That’s a huge difference!

Most analysts and hopefully you readers would agree with this mathematical logic but not its conclusion for now. I am with them and you. But still, a new bull market? Can AI and $2 trillion fiscal deficits going forward validate that “it’s different this time”? I’m suspicious. Unless Chair Powell and company can significantly lower real 10 year Treasury rates from 2.25%, investors may eventually realize that bonds are a better deal than clearly overvalued stocks headed into an economic slowdown/recession. Personally, I don’t believe Powell will be willing or able to lower short rates significantly in the face of a 3% inflation future. I’d pass on stocks and bonds in terms of future total returns. Best bets are arbitrage situations such as ATVI (Activision) and CPRI (Capri) that yield annualized returns of 10-20%. (ATVI should close in 2 weeks or so). Pipeline MLPs are still a favorite of mine due to their favorable partnerships tax benefits but pricewise are a little toppy due to oil prices that seem vulnerable to the downside.

In any case, keep your eye on real (and nominal) 10 year Treasury rates. They need to come down a lot to validate existing forward P/E ratios. They may not.