by Jeremy Schwartz, CFA, Global Chief Investment Officer & Brian Manby, CFA, Associate, Investment Strategy, WisdomTree

Markets have been fascinated by equity risk premiums recently.

Not long ago, interest rates were near 0%, Treasury yields offered less than 1%, inflation was benign and there was little discussion about whether the earnings yield on equities offered appropriate compensation for their inherent risks. Risk premiums simply did not matter in a yield-scarce environment when the TINA (“there is no alternative”) narrative dominated markets. And TINA existed for good reason, as equities offered very attractive compensation relative to bonds of all durations.

But just a few years later, market conditions have reversed. Both interest rates and Treasury yields ratcheted upward with pernicious inflation, prompting renewed discussion about equity risk premiums in a new environment with abundant opportunity for yield. More importantly, investors wonder what current risk premiums portend for equity markets.

Nominal Equity Risk Premium at it Lowest Level since 2004

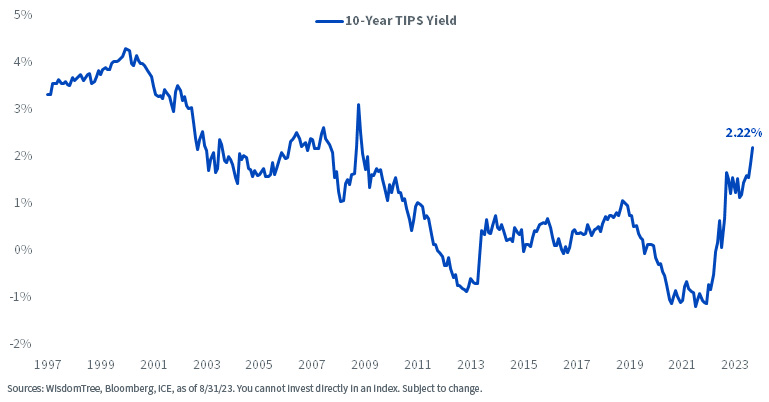

Newly Positive Real Yields at Post-GFC Highs

There is no doubt that prevailing equity market valuations are lofty, with the nominal equity risk premium below its historical average and at its lowest since 2004. Meanwhile, real yields on Treasury bonds have not been this high since the global financial crisis (GFC).

So, if investors can receive roughly 2% real yields risk-free in the bond market, does that mean equities are overvalued and poised for downside?

Are Today’s Yields Sustainable?

We don’t deny that bonds look more attractive than they have in a long time. But just because something looks appealing relative to its own history doesn’t preclude ownership of other assets.

At a steady, 2% real yield, it would take 36 years to double an investment while maintaining purchasing power, according to the infamous Rule of 72 theory. Even if such a time horizon is acceptable for an investor, we question whether a 2% real yield will be a reliable, real return for the next four decades.

Since Treasury Inflation-Protected Securities (TIPS) were introduced in 1997, long-term real rates in the U.S. remained in a structural decline. Several determinants have contributed to their secular downtrend with most derived from demographic and economic forces rather than solely monetary influences. Professor Jeremy Siegel does an excellent job outlining these effects in chapter eight of the sixth edition of Stocks for the Long Run, so I will not reiterate them here, but the historical path of real rates appears capped by these forces.

Real yields peaked over 4% during the tech bubble and slid for two decades thereafter, even breaching negative territory. Although there were a few, brief periods of rising rate respite, real yields resumed their downtrend shortly after these catalysts faded.

Given the structural headwinds supporting declining rates, we question whether real yields of 2% (or more) are sustainable for long-term investment.

Think Stocks… for the Long Run!

Earlier this year, we urged investors to reconsider nominal gauges of equity risk premiums in an effort to discourage rejecting stocks merely because of a narrowing spread between their earnings yield and that of the nominal 10-Year U.S. Treasury yield.

Stocks are real assets, whose returns have exceeded inflation over the long term, and whose risk premiums should therefore be judged against real risk-free yields rather than nominal ones. In inflationary environments, companies pass along higher input costs to consumers via higher prices, and the long-term evidence indicates that dividends and earnings have outpaced inflation over the long run.

Today’s equity risk premium using real yields is still below its long-term average but provides nearly 1.4% of additional compensation over TIPS and 2.2% over the nominal gauge.

Real Equity Premiums Provide Better Risk Compensation

The S&P 500 is currently priced at 19 times next year’s earnings, resulting in a 5.1% forward earnings yield. Using the Rule of 72 with that forward yield, an investment would double and maintain purchasing power in about 14 years, over two decades earlier than the 36-year horizon using today’s real bond yields.

The current 3% equity risk premium is also consistent with the long-term 3% average premium of equities over bonds from over 200 years of data in Professor Siegel’s Stocks for the Long Run. Though both bonds and stocks are expensive according to their 200-year history, their long-term equity risk premiums are preserved because their implied forward returns are reduced by similar magnitudes.

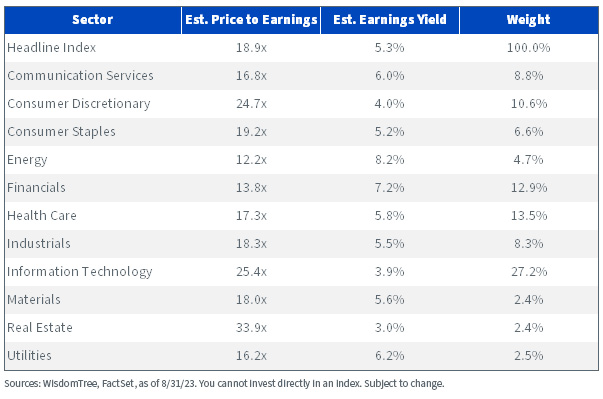

We don’t believe the real equity risk premium is prohibitive, especially when you consider the concentration of 2023’s equity sector leadership. Stretched technology and consumer discretionary valuations continue to support the S&P 500 while lowering the forward earnings yield for the headline index. Meanwhile, eight of the 11 sectors feature earnings yields either in line with or higher than the headline number, representing nearly 60% of the index.

S&P 500 Index

Conclusion

As long-term investments in real assets, equities deserve comparison to real risk premiums. By these measures, we’re not convinced that U.S. equities are overbought to the extent that they prohibit ownership or exhibit insufficient risk compensation.

We agree that bonds and real interest rates are attractive relative to their own history and may warrant renewed attention for a portfolio, but support for them does not, and should not, create opposition for equities.

Copyright © WisdomTree