by Will Smith, CFA, Director, US High Yield & Robert Schwartz, Portfolio Manager—High Yield, AllianceBernstein

With yield curves still inverted, a short-dated high-yield strategy continues to make sense for return-seeking investors with a defensive mindset.

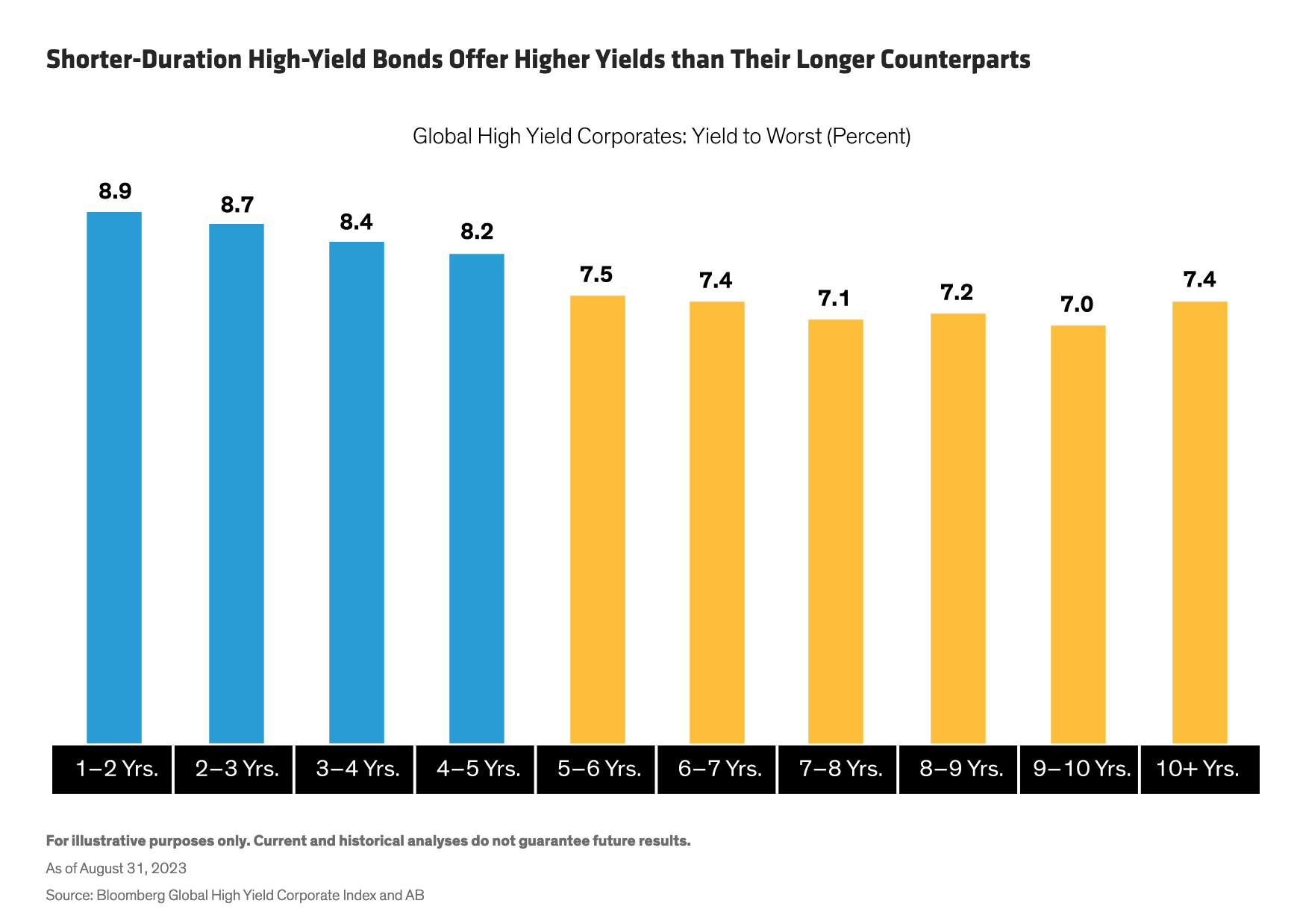

The US and some European yield curves have been inverted for some time now. Of course, that can’t last forever. Ultimately, inflation should fall enough to allow central banks to lower short-term rates. In the meantime, continued yield-curve inversion translates to continued investing opportunities at the short end of the high-yield market, in our view (Display).

Short-Dated High-Yield Valuations Still Look Attractive

US and euro high-yield spreads have tightened this year (by about 93 bps and 19 bps respectively), driving bond prices higher. Even so, for return-seeking investors, shorter-dated high-yield bonds still look attractive, with yields at their highest levels in a decade and starting prices still very low by historical standards (Display).

That’s because years of low interest rates allowed companies to issue bonds with rock-bottom coupons, and these securities now trade at big discounts to par because of subsequent rate hikes.

As a result, we think potential credit-market scenarios are the most favorable they’ve been in a long time. Deep discounts to par help cushion returns on the downside and provide greater upside if the issuer experiences a positive credit event. And as starting yields have proved to be reliable indicators of future returns over the next three to five years, we think short-duration high-yield bonds may currently offer worthwhile prospective returns at current prices.

Higher-Quality Shorter-Dated Bonds Can Help Mitigate Downside Risks

Focusing on high-quality, short-duration bonds helps mitigate two big risks: sensitivity to interest rates, and the impact of defaults that result from an economic slowdown. Higher-quality issuers have stronger fundamentals and so are more resilient to economic setbacks, including rate rises. Bonds with short lives leave less time for defaults to strike. They also benefit from the “the pull to par” as prices rise toward par at maturity, which will likely create capital appreciation irrespective of fluctuations in interest rates or the economy.

Of course, with global economies slowing, credit fundamentals are sure to weaken from current levels, and defaults and downgrades are likely to pick up. But we think that’s mostly priced into markets for those industries and credits that are on weak footing. For the better-placed issuers, credit fundamentals are starting from a position of strength.

The result is a larger margin of safety to cushion investors from the impact of high rates or prospectively lower growth. A high-quality, short-duration high-yield credit strategy should provide even better downside mitigation if prospects for economies darken further.

Higher-Quality Short-Dated Bonds May Improve Risk/Return Balance

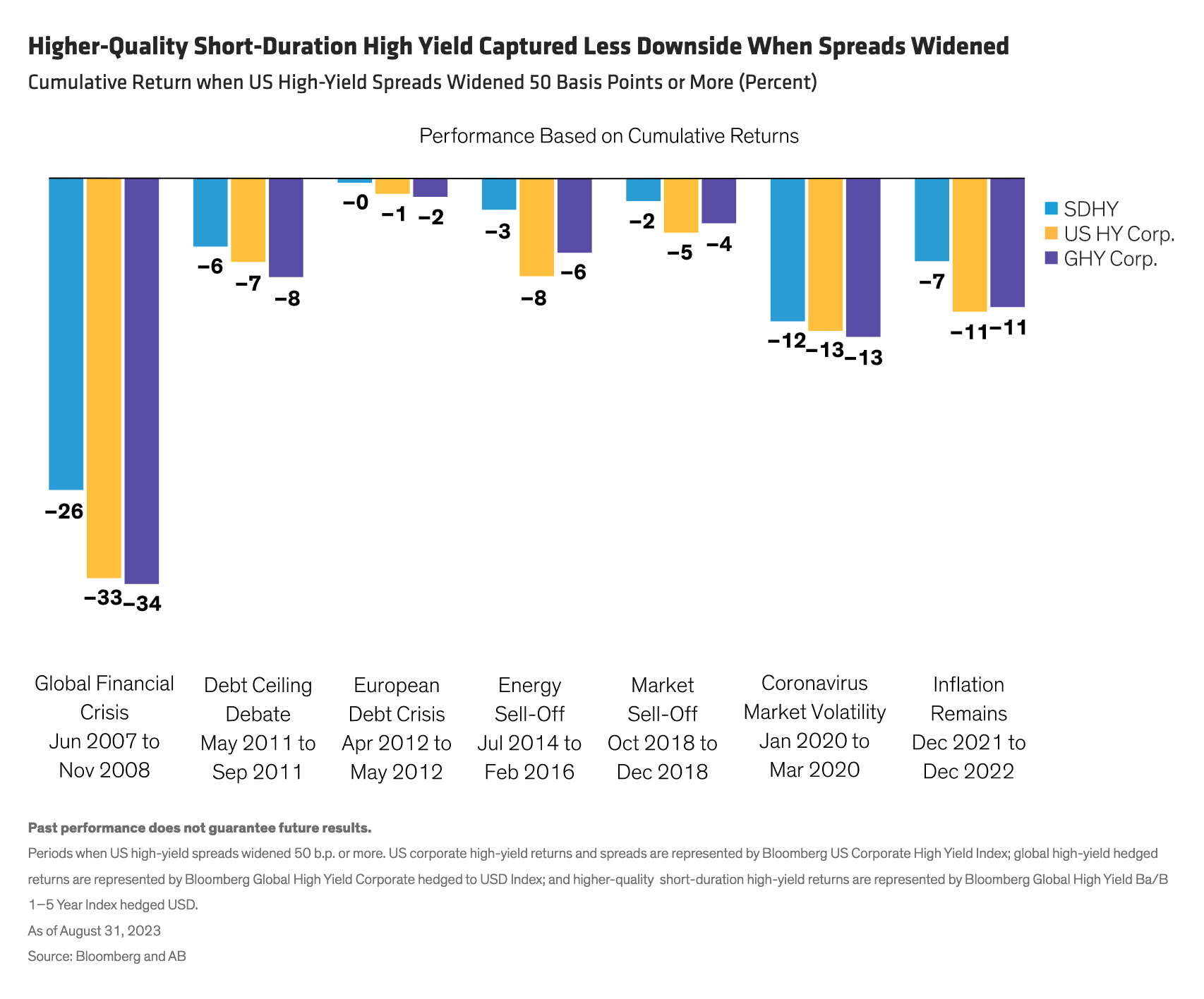

For defensively minded bond investors, we find there’s a yet another advantage over time. Opting for a higher credit-quality, short-duration high-yield strategy can materially reduce volatility compared with the broader high-yield market, in exchange for only a modest reduction in yield (Display).

In fact, over the 20 years ending August 31, 2023, BB- and B-rated high-yield bonds between one and five years to maturity captured more than 88% of the broader high-yield market return, while experiencing approximately 63% of the average monthly drawdown. Consequently, they have provided better risk-adjusted returns than their longer-dated (five- to 10-year) high-yield counterparts.

But they have really come into their own during periods of extreme market stress. At these times, higher-quality, short-duration high yield has exhibited much lower downside capture than both the global and US high-yield markets (Display).

While the near- to medium-term future seems uncertain and is likely to be volatile, we think credit investors could be handsomely rewarded, particularly in short-duration high-yield corporate bonds. Investors who sit on the sidelines may be disappointed if they don’t lock in today’s elevated yields.