by Antonio (Tony) DeSpirito, Managing Director, Global Chief Investment, Fundamental Equities, BlackRock

Key takeaways

Q4 for the win? 2023 has offered ample fodder for bears and bulls alike, with each quarter nudging toward the latter. Which will prevail in the year’s final months? As Q4 begins, we see:

- A slim output gap arguing for continued prudence

- Wider gaps in profitability and valuation favoring selectivity

- Artificial intelligence (AI) fueling dispersion, disruption and opportunity

Equity market overview and outlook

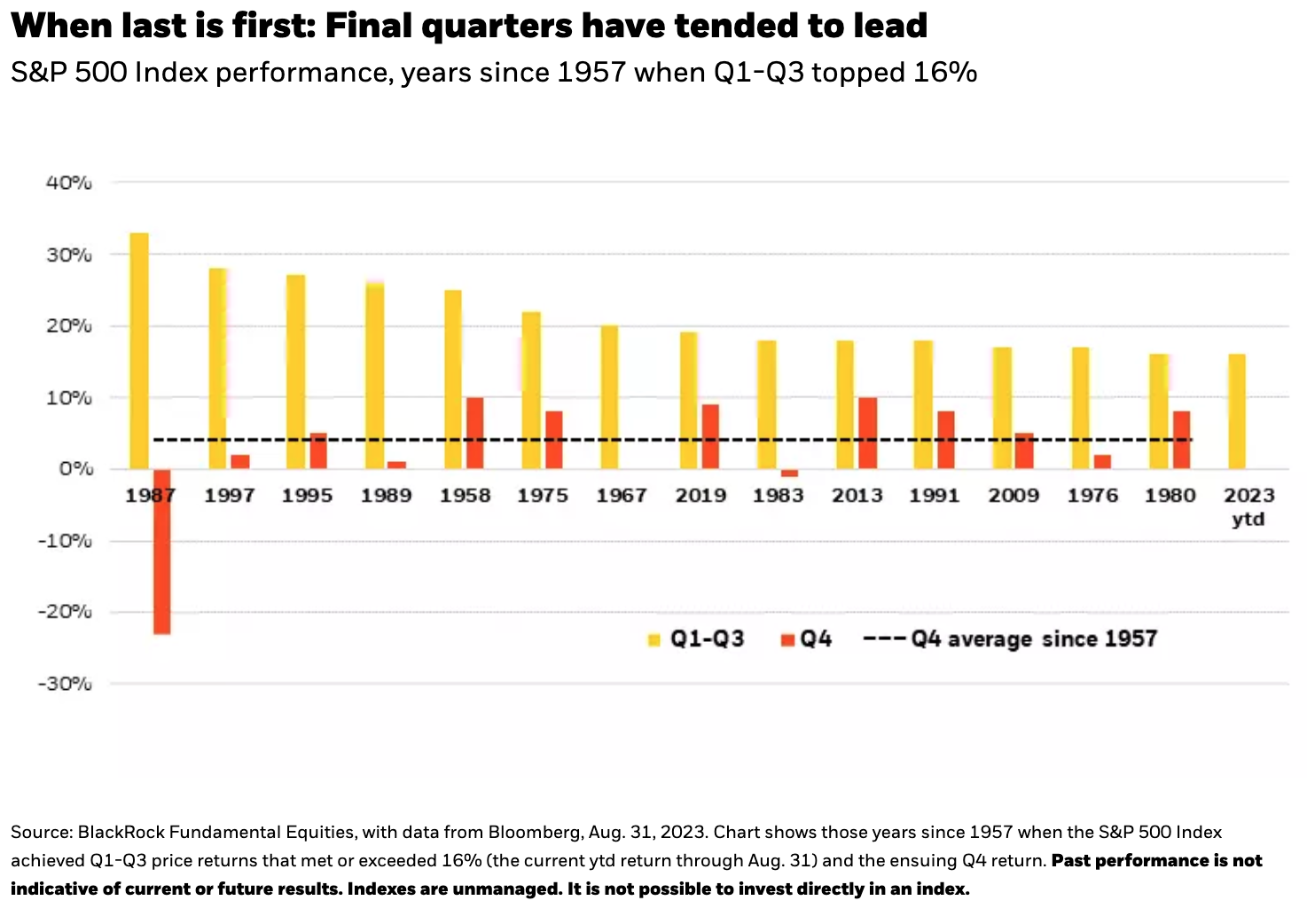

U.S. stocks typically post their best returns in the final quarter of the year. Our review of S&P 500 performance since the index’s inception in 1957 found an average Q4 uptick of 4%. (Q1 was next best at an average 2%.) In years when performance in the first three quarters came in at or above where we sit year-to-date, index moves in the final quarter were positive in all but three instances, with the October 1987 stock market crash making that year an outlier. See chart below.

We are cautiously optimistic for Q4 2023. The market has already defied expectations and the economy is operating on a slim output gap ― meaning all resources are running near full potential. This argues for a continued focus on resilience in equity allocations. Still, because much of the market’s return this year has been driven by a handful of mega-cap stocks in the “tech-plus” sectors, we believe there is opportunity to uncover those next-level stocks that have yet to be fully rewarded for their fundamentals.

Mind the (output) gap

Mind the (output) gap

Stock markets turned decidedly more upbeat in July as many strategists adjusted their projections away from recession and toward a “soft landing” scenario for the U.S. economy. While we do not foresee a deep recession, we maintain our view that this is still a late-cycle investing environment and, as a result, a focus on resilience is still warranted in equity portfolios.

The output gap of the U.S. economy, which represents the difference between the economy’s actual versus maximum potential output, is very narrow. The economy is making very efficient use of its existing resources to power the flow of goods and services, with little room to do more and take off running. A key variable is the labor picture, which is quite tight. The unemployment rate stood at just 3.8% as of August. Absent a burst of productivity, the U.S. lacks sufficient additional workers to increase the economy’s output beyond current levels without risking inflation.

GDP figures have held in, inflation readings are coming down and the economy has so far managed to avoid a recession. Yet we still see potential for waning excess consumer savings and the lagged effects of the Fed’s rate-hiking campaign to pinch economic growth and make it harder for companies to grow earnings in the near term.

Late-cycle playbook

Against this backdrop, we believe it is prudent to stick with the late-cycle playbook in equities, as the economy has yet to embark on a new cycle of post-recessionary growth. This implies diversifying risk exposures and focusing on companies with solid balance sheets and durable business models. The key, and the complication after the market’s strong run year-to-date, is to find them at attractive valuations.

The good news is that the very narrow market that had prevailed in the first half, with the seven largest stocks dominating S&P 500 return, has started to broaden ― a healthy sign for the market and a good environment for stock picking. Year-to-date, some of the weakest performers with the most compressed valuations have been low-volatility, low-beta stocks.

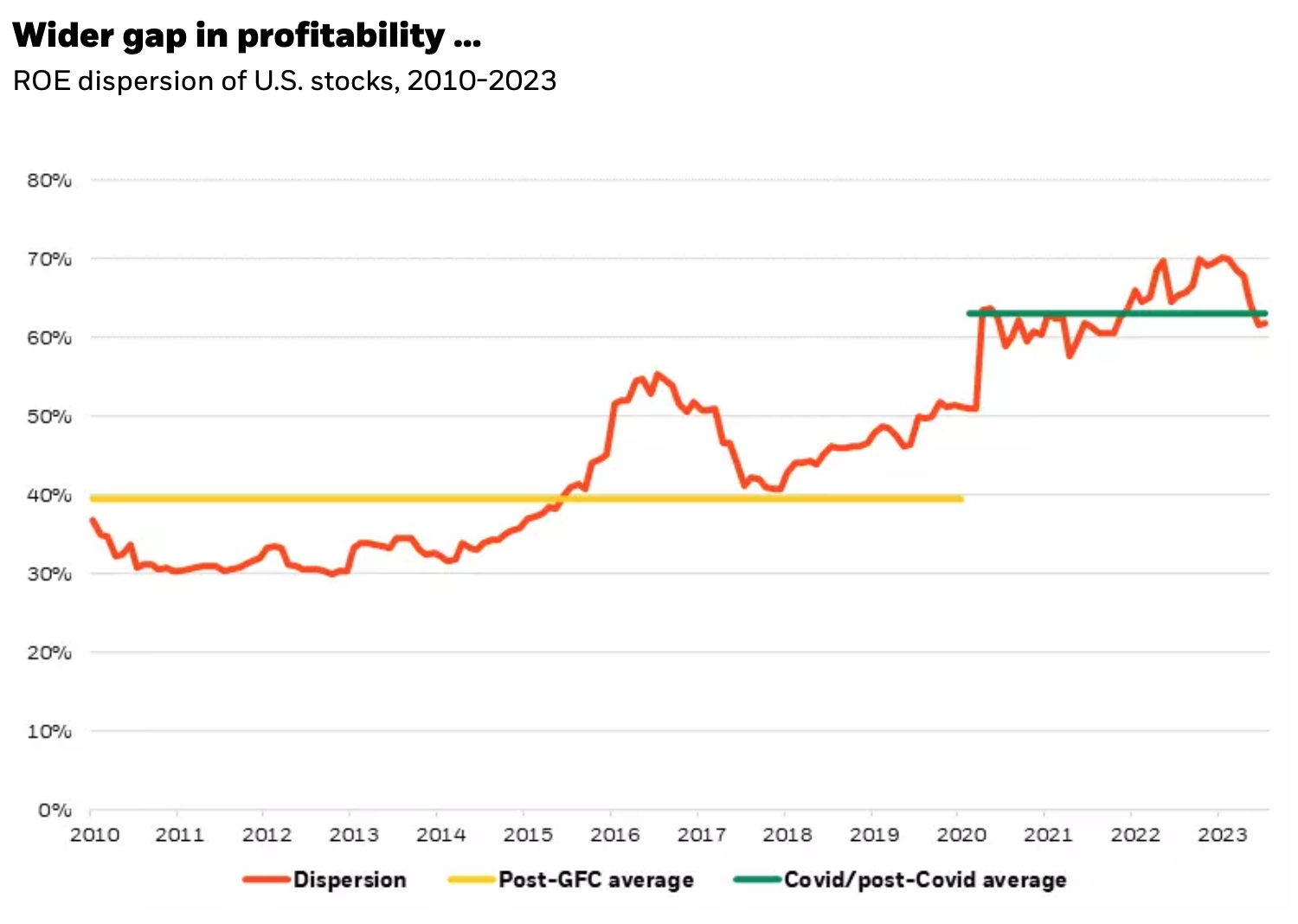

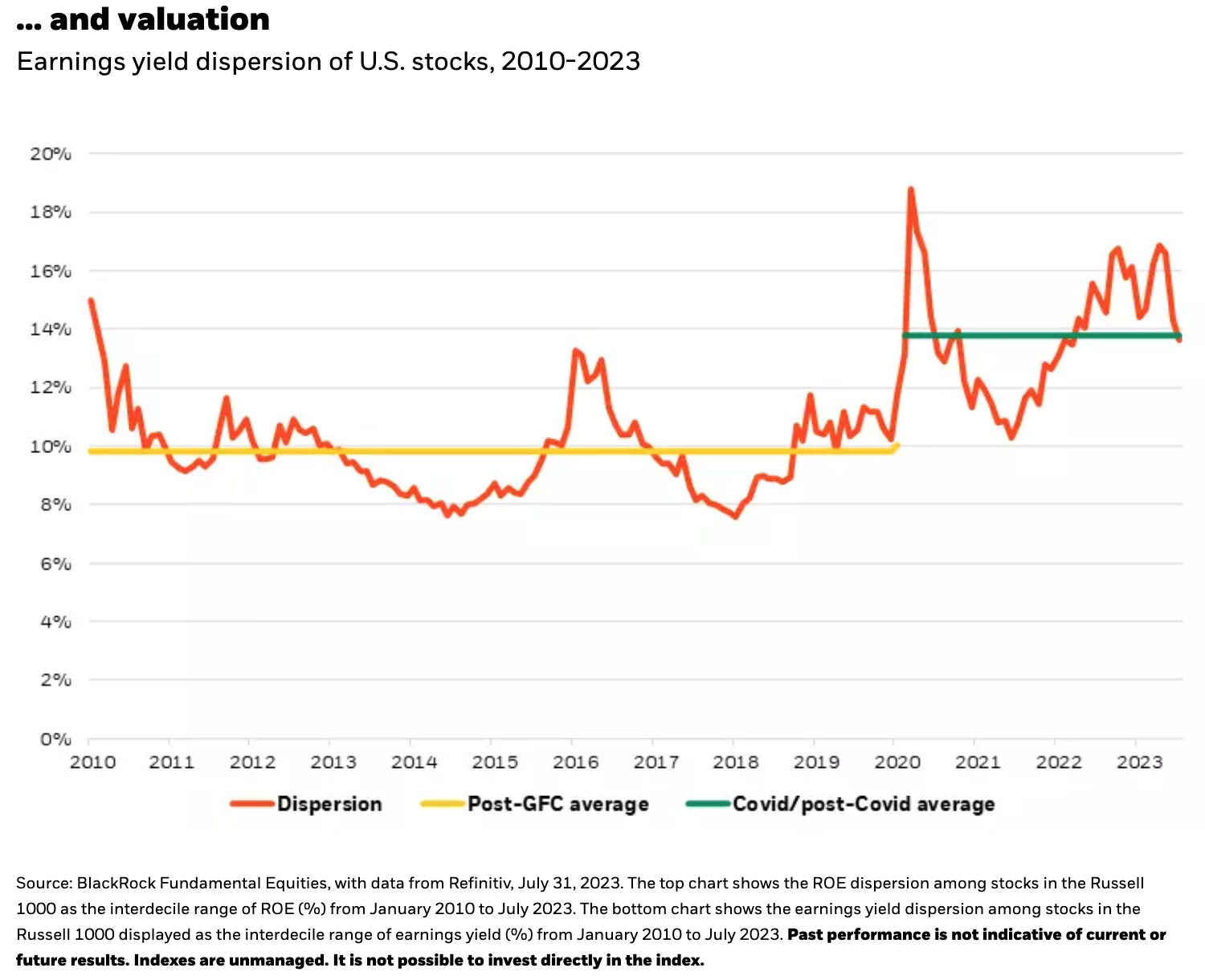

“We see smaller reward in making bold calls on the big picture and much greater potential from making good calls on individual stocks.”

As noted in Equity investing for a new era: The return of alpha, we also observe a trend toward increased market dispersion. This is evident in returns ― a larger gap between top and bottom performers ― but even more so in the return on equity (ROE) and valuations across individual stocks, a phenomenon not isolated to the U.S. The charts below show the uptick in dispersion since the period of moderation (low rates, inflation and volatility) after the Global Financial Crisis (GFC) and the new investment regime in formation since the Covid crisis. Skilled stock pickers can capitalize on these growing gaps in seeking to identify and populate portfolios with shares of companies that demonstrate the fundamental wherewithal to deliver growing earnings across time.

Critical observations on generative AI

With anticipation around generative artificial intelligence (genAI) helping to power year-to-date stock market gains, this quarter we explore AI’s role in shaping tomorrow’s opportunity set. We offer a 3-by-3 analysis of reasons for excitement and awareness in our full Q4 commentary

The bottom line: We see generative AI on an improvement curve with prospects to transform businesses around the world, much like the internet has over the last quarter of a century. Yet it is precisely because genAI is new, exciting and evolving that we cannot take a static approach to the investment thesis.

Constant monitoring is required to assess whether expectations are aligned to the financial and fundamental realities. As fundamental-based stock pickers, we are continually fact-checking the investment case as the cycle around generative AI advances from peak expectations to enlightenment and productivity. The genAI story has only just begun and, we expect, will be written for many years to come.