by Tom Halverson, Russell Investments

Executive summary:

- Many advisors are finding their clients show little interest these days in how the markets are doing

- Regional Director Tim Halverson thinks many investors have succumbed to either complacency, denial or stress

- He provides some suggestions on how advisors can re-engage clients

Lately, many advisors have been asking me how top advisors are handling the issue of investor apathy.

It’s quite surprising this question comes up given the significant events of the past three years. We’ve had to deal with the challenges brought on by Covid, followed by the recovery phase, and we’ve also navigated through market selloffs and surges. It’s been quite a rollercoaster ride, yet it appears that many investors aren’t as concerned as one might expect.

I remember a specific meeting from late last year when I tried to explain to an advisor and a key client the unprecedented rise in interest rates. The advisor questioned why, with all of my experience, I hadn’t predicted this situation. I clarified that we diversify our approach precisely because we cannot foresee everything. Unfortunately, he wasn’t satisfied with my response, and I haven’t heard from him since. Even though the advisor was dissatisfied, at least he was engaged. It seems that many investors, including this one, are simply not engaged at all.

If you have clients who were upset about the markets last year and have no real concerns this year, welcome to the club.

I think a lot of investors are currently displaying behaviors characterized by what I call the “CDS mode.” To be clear: I’m not referring to Certificates of Deposit (CDs), even though there is currently a substantial amount of money invested in these cash-like instruments or money market funds. That’s a separate topic altogether.

When I refer to the “CDS mode” I’m actually talking about the mindset characterized by Complacency, Denial and Stress. From what I have seen, many investors currently demonstrate one of these characteristics. Allow me to elaborate:

COMPLACENCY

Currently, many investors seem hesitant to take any action. Their investments are performing well, and their checking accounts may be reflecting positive balances, leading them to feel content with the status quo. Additionally, a significant number of people have been on vacation recently, diverting attention away from their financial matters. If you have travelled this summer, you likely noticed how many people were on the move. Personally, I managed to cross something off my bucket list and it seems like many others had similar plans. The one crucial lesson from the COVID-19 pandemic is the reminder that tomorrow is uncertain so enjoy today.

The most concerning thing for me is not the lack of contact from my clients – I understand that we’re all busy and still enjoying what’s left of the summer. My worry lies in the fact that many investors may have become accustomed to the market continuously going up – or quickly recovering from any downturn. They might have forgotten that the market consists of more than just a handful of stocks, and their confidence may be bolstered by the healthy three-year returns displayed on their statements. Our quarterly Economic and Market Review for the end of June 2023 shows the returns of various indexes, but also shows how those returns have been driven by just a handful of names. Historically, such a concentration hasn’t been sustainable: high flying stocks haven't maintained their momentum indefinitely.

Additionally, some investors may be banking on a “soft landing” for the economy based on expectations the U.S. Federal Reserve is getting monetary policy right. Similar to many other asset manager firms, we are forecasting the possibility of a recession – maybe mild, maybe not – in the next 12 to 18 months. Just like preparing for a flood is best done in sunny weather, it may be wise to discuss rebalancing with clients now or, at the very least, ensure their risk tolerance aligns with their portfolios. I know of an advisor who recently sent risk questionnaires to all of his clients to ensure they are still positioned in the right portfolio for their financial goals and comfort levels.

DENIAL

My advisors have also encountered clients in denial about how much they are going to actually need in retirement. A couple of my coworkers just wrote about the downfall of owning too much cash. Yet cash holdings remain high.

Yes, 5% yields are great, but if you do the math, earning 5% pretax might not be enough to build a healthy nest egg – especially considering the impact of inflation. Take my generation, for example. I am a Gen Xer. On average, individuals in my age group have saved a mere $40,000 for retirement.1 That is not a misprint… $40,000. We’re aware this amount won’t suffice, especially considering the average life expectancy for people my age is 85. It’s clear that many of us are in denial about our retirement needs. We all have our moments of denial about various aspects of life: I, for one, still hold hope that my hair will grow back, despite my son humorously referring to my bald spot as “the stadium.” It has grown from the size of the Kane Cougars stadium (capacity 7,400) to something closer to Soldier Field (capacity 61,500). It is what it is.

Sometimes advisors and other financial professionals need to have tough conversations and now may be one of those times. Once effective way to prompt clients to contemplate their future is by using a “future face” app. Surprisingly, seeing a potential future self can be quite eye-opening for some clients, leading them to consider the lifestyle they’d like to maintain and its associated costs.

Furthermore, offering more personalized financial products for clients may be beneficial. Clients appreciate customization, much like the extensive drink options available at Starbucks. Did you know there are around 87,000 drink combinations? That’s right, 87,000! That means nearly every person can have their caffeinated beverage EXACTLY the way they want it. This is something that Starbucks has introduced to coffee culture and this trend has come to financial services. I’ve observed that the more tailored solutions you can provide for to clients, the more likely they are to engage in thoughtful discussions about their investment journey. At Russell Investments we can help guide that conversation.

STRESS

I think the last few years have really taken a toll on people’s emotions. All clients ever hear or read is bad news. Their stress over those issues does not allow them to make the best decisions. I get it. I get quite stressed when the Bears lose to the Packers, but I can’t allow that to affect my investing decisions.

What concerns me most is that some clients seem to be disregarding how much their stress can affect their returns. Our 2023 Value of an Advisor study revealed that the value advisors provided to their clients has never been higher, with the advisor’s role as a behavioral coach being the most significant contributor to this value. This is even before next year’s election. We’re all familiar with how politics tends to influence people’s perceptions of the market’s direction, even though reality does not bear it out.

I think people are growing weary of the considerable uncertainty in the markets, and when you’re fatigued, your decision-making may not be at is best. Advisors, how many times have you heard clients say something like this, “I don’t want to invest because_____”?

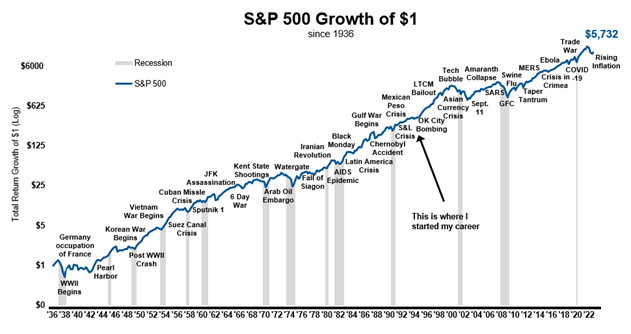

Look at all of the reasons not to invest since I began my career in 1997, and even before I entered the financial services industry...

Click image to enlarge

Source: St. Louis Fred & Morningstar Direct. S&P 500 index as of 12/31/2022. Log: Lognormal scale. Total Return: Includes dividend reinvestments

I’ve come across a term that describes how most successful investors approach their investments: “Worried but fully invested.” That is how I would describe my own investing style. Are there things to be worried about? Sure, but since 1920, the market has ended the year higher 73% of the time.2 Anytime I need a pick-me-up about the future I just talk to my kids. That being said, a lot of clients are consuming a lot of social media and news and I am not sure that is a good thing.

My top advisors have a strategy that works wonders: they avoid getting entangled in political discussions and instead remain focused on their investment plans. A crucial motto to remember is “don’t confuse your politics with your plan”. If you need help with creating that plan, please ask about our Discovery Cards.

I always suggest investors should watch home hunters or a decorating show rather than anything political. I reiterate to them that we – the financial services professionals – get paid to worry, so they don’t have to.

Who thought the market bottom during the Great Financial Crisis would be March 9, 2009, or the market bottom of the Covid pandemic would be March 13, 2020? My guess is that very few of us anticipated those dates. Those were scary times to be sure. But as the chart above shows, markets are resilient, and their long-term trend is up.

At Russell Investments, we have a lot of material that can help you deal with investor behavior. Many clients may not inquire about your fees if they sense your genuine concern and see that you maintain regular communication with them. By preparing your clients for what lies ahead, not only can you retain their trust, but you may also gain some referrals.

The bottom line

Nick Murray – the author of Simple Wealth, Inevitable Wealth – says ”the biggest detriment to a client’s return is not their investments, it is their own behavior.” The market has been great so far in 2023 and that might continue, but if it starts to get wobbly, some investors may decide to move out of equities and begin asking for more CDs. Before you buy that CD for a client take a second to think about what their motivation really is.

We at Russell Investments are here to help you with the conversations you have with your clients today, and tomorrow. Advisors do not always need more products, but they could always use a good partner. Please reach out.

1 Source: https://www.forbes.com/sites/dandoonan/2023/07/26/generation-x-on-the-brink-the-stark-reality-of-their-grim-retirement-outlook/

2 Source: Russell Investments. Represented by the S&P 500 Index from 1926-2022.