by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Market Ethos

September 18, 2023

Investing isn’t easy. The markets rarely behave the way most think they should and seem to often behave in a way that makes most people wrong. The financial media is filled with stories of ‘fat tails’ – things that went exceptionally well or extremely poorly. Pulling on those emotional strings to participate or capitulate, even when most investors’ experience is squarely in the more boring middle. And when profits are made by putting your hard-earned dollars in harm’s way, the government tends to show up to share in the party.

It’s no wonder Canadian investors lean pretty heavily on dividends or the dividend factor. They’re historically less volatile, with good returns and some preferential tax treatment for Canadian qualified dividends. And while the previous paragraph may sound a bit down, don’t forget the eighth wonder of the world – compounding. As Albert Einstein famously said, ‘compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.’

Wise words. Steady returns and smaller drawdowns can create a lot of wealth over time.

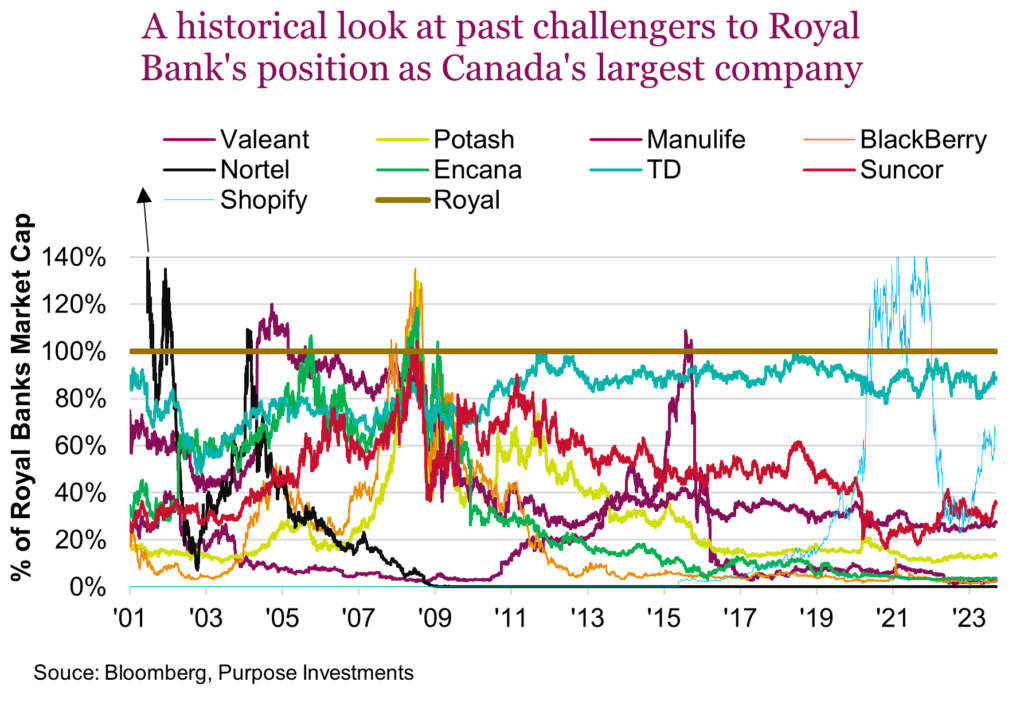

There is one more reason to explain Canadians’ admiration for dividends, an often-painful experience when deviating elsewhere in Canada. The chart below is kind of fun, and we do apologize if we missed a company along the way. This is a historical look at all the companies that, at one time or another, had a larger market capitalization than Royal Bank. Not implying Royal is a proxy for dividends, but it’s still a fun chart. There are many tough experiences among the names on this list, and you can add other groups, too, like gold, marijuana, etc. These all proved to be lessons that tended to keep investors focused on dividends.

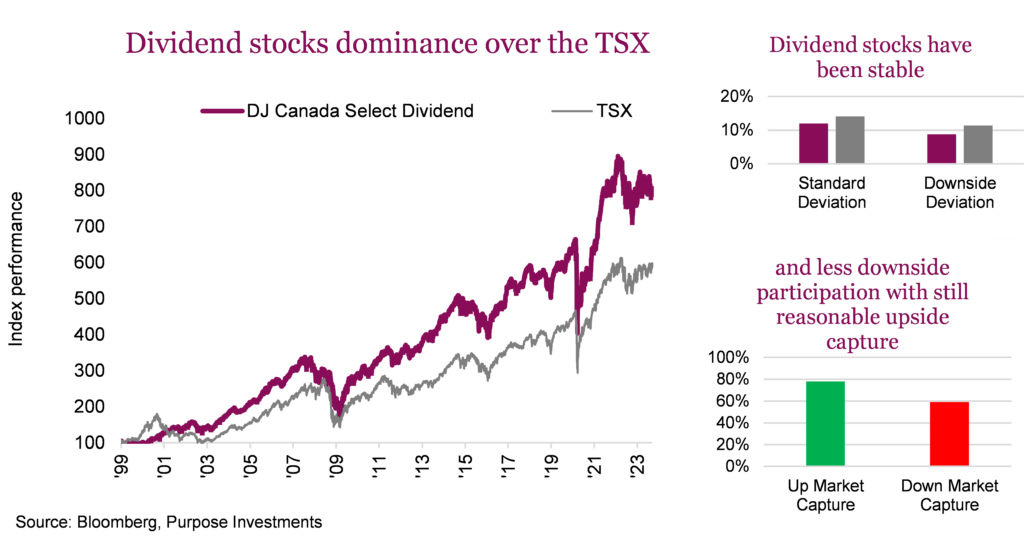

Of course, the good news is dividends have worked really well over the past 20+ years. Using the DJ Canada Select Dividend index as a proxy, dividends have outperformed the TSX handily over the years. And done so with less volatility, a happy combination.

We would never suggest investors ignore the past, but it appears changes are afoot, perhaps the biggest being yields. One of the positive impulses for the dividend factor over the past 20+ years has been the long grind lower in bond yields. As yields fell, investors looked elsewhere for a nice income stream, resulting in a steady inflow for dividend payers. It also encouraged more and more companies to adopt an investor-friendly dividend policy.

There’s no denying rising yields over the past two years have changed this tailwind to a headwind. The simple fact is if you can receive a 3.7% yield on a government bond compared to a paltry 1.5% a few years back, the yield on a dividend-paying stock must also move higher. It is not a 1:1 comparison because of different credit risks between governments and corporations, different taxation of income vs. dividends, coupons are guaranteed while dividends are not but often increase with time, etc. Still, higher yielding on competing asset classes is a headwind for dividend-paying companies, just as it was a tailwind when yields were falling.

To complicate things a little more, it isn’t as simple as looking at today’s yields but also where the market thinks yields are going. For instance, the broader TSX and the DJ Canadian Dividend index were roughly neck and neck in 2023 until a couple of months ago. So, what happened? Well, the consensus started coming around to stronger overall economic growth and recession talk slowed. This increased the likelihood that yields will remain higher for longer, and guess what that means? The yield on dividend companies must be higher as well. The dividend yield goes up as the price of the stock goes down.

Today, about 20% of the TSX constituents carry a yield of over 5%, up from 8% two years ago. To put it bluntly, higher bond yields have resulted in price declines for many dividend payers, which has helped lift dividend yields.

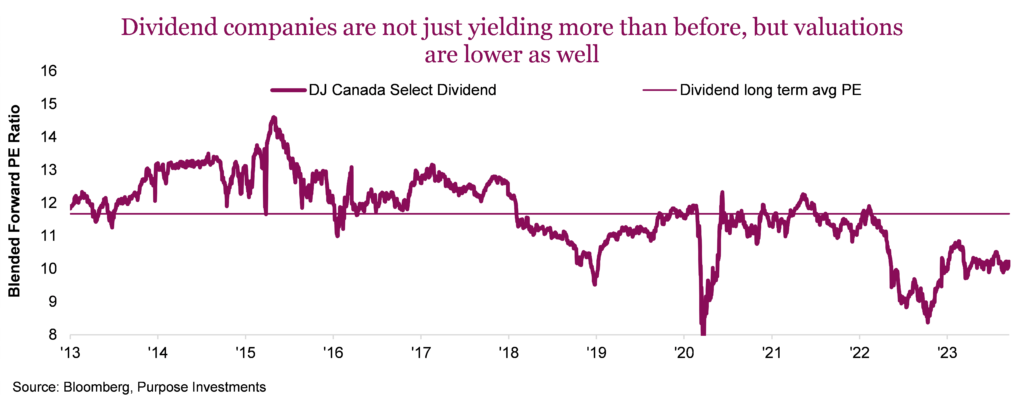

So, dividend-paying companies are now paying more to remain competitive with higher bond yields. There is also an added bonus: valuations among dividend payers are historically low. The dividend space in Canada is currently trading at about 10x forward consensus estimates, about two points lower than the long-term average. One could argue that given the current dividend yield and valuations, this part of the market is certainly pricing in higher yields.

Final thoughts

So, what comes next? If a recession or economic slowdown is looming, well, that is good news for dividends versus the broader market. A recession would likely result in bond yields coming back down, somewhat at least. That would change the recent headwind back to a tailwind. And given the long-term defensiveness of the dividend factor, it’s probably not a bad thing if there is trouble ahead. Of course, yields could remain high or even rise (not our expectations, but possible). While that would be a headwind, the current dividend yields and valuations certainly provide a buffer.

Sign up here to receive the Market Ethos by email.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Richardson Wealth Limited for information purposes only.

*This report is authored by Craig Basinger, Chief Market Strategist at Purpose Investments Inc. Effective September 1, 2021, Craig Basinger has transitioned to Purpose Investments Inc.

Disclaimers

Richardson Wealth Limited

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Richardson Wealth warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Richardson Wealth or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

Richardson Wealth Limited, Member Canadian Investor Protection Fund.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.