by William Smead, Smead Capital Management

Dear fellow investors,

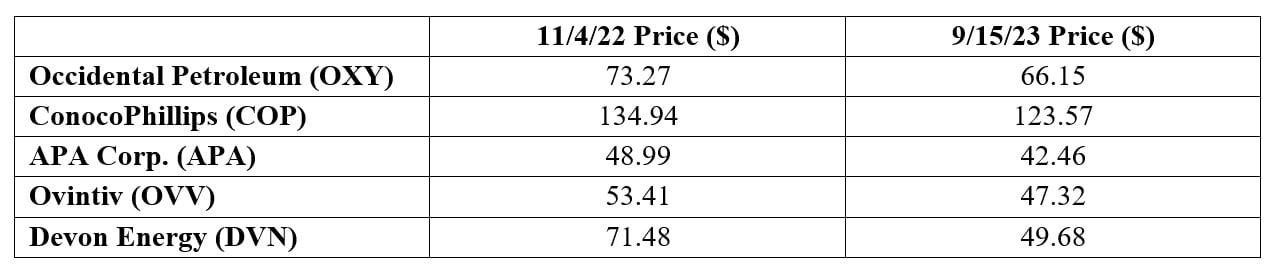

Some very peculiar price action has been occurring in the shares of medium capitalization oil and gas companies. The chart below shows the price of these companies when oil last traded at $91.50/barrel:

Why are the largest oil stocks like Exxon (XOM) and Chevron (CVX) trading at dramatically higher price-to-earnings ratios than their smaller rivals who are more likely to be aggressively growing their oil reserves? Why are these large to medium capitalization shares lagging at the same oil price as before? What does this portend for the future of the shares of what look like very undervalued companies?

The largest oil company shares have done surprisingly well since 2020 even though they have been kowtowing to the environmental moralist crowd. Despite apologizing for what they do and being gun-shy about seizing the maximum advantage of their control over an incredibly valuable resource, these shares have soared in price. Our best explanation is their much larger capitalization at the beginning, their representation in the S&P 500 Index and the size of the investment firms that control the most common stock ownership (Vanguard, State Street, Fidelity, Blackrock, etc.)

The energy sector of the S&P 500 bottomed out in 2020 at 2.01% of the index. The oil and gas companies, as a part of that number, were even less. If you decided to invest in the oil business in late 2020, Exxon and Chevron were the only oil and gas companies that could absorb investments of size without completely jarring the common stock share price. In other words, the liquidity they offered made them the only game in town! Today, they trade for much higher price-to-earnings ratios than companies that are in the middle capitalization range.

The much cheaper oil and gas shares are trading at much lower stock prices at comparable oil prices because they are still too tiny for the larger pools of money to consider. At the same time, very few of the highly thought of larger investment firms believe there is a future in oil and gas (fossil fuel) production. We just returned from meeting with investors in Europe and most stock-picking organizations don’t even want to mention that they own oil and gas shares. Why be an environmental sinner?

Fortunately for us, push eventually comes to shove. Since there is no end in sight in the demand for fossil fuels and there is only criticism for those who are poking holes in the ground to find oil and gas, something has to give. The something that has to give is either a massive increase in oil and gas drilling, or more likely, a consolidation of the industry by the very large-cap companies who were so scared to do this a few years ago at much lower prices. The proverbial “drilling for oil on the New York Stock Exchange (NYSE).”

Investors don’t believe there is a long-term future in oil and gas exploration and production. Therefore, they are more comfortable with huge companies that produce, distribute and sell at the pump like Exxon and Chevron. Stock-picking and financial advisor companies are practicing a very historically strong discipline called “C.Y.A.” Many of them need to own the companies that kowtow to the ESG crowd to have solid representation in an industry that could be in the inflation sweet spot for the next ten years.

In conclusion, we believe there is an unusual opportunity to take advantage of this in the shares of the most undervalued oil and gas companies!

Fear stock market failure,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2023 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com