Pre-opening Comments for Wednesday August 2nd

Equity index futures were lower this morning. S&P 500 futures were down 26 points at 8:30 AM EDT.

Index futures moved lower overnight after Fitch downgraded the U.S. long term credit rating from AAA to AA+

Advanced Micro Devices gained $4.97 to $122.57 after reporting higher than consensus quarterly results.

Mosaic slipped $0.23 to $40.00 after reporting lower quarterly revenues and earnings.

Electronic Arts dropped $4.62 to $131.50 after the company forecast lower than consensus second quarter revenues.

Match advanced $5.01 to $51.16 after second quarter revenues exceeded consensus.

EquityClock’s Daily Comment

Headline reads “Consumer discretionary looking particularly vulnerable in the short-term as the growth trade that has flourished this year takes a pause”.

http://www.equityclock.com/2023/08/01/stock-market-outlook-for-august-2-2023/

Technical Notes

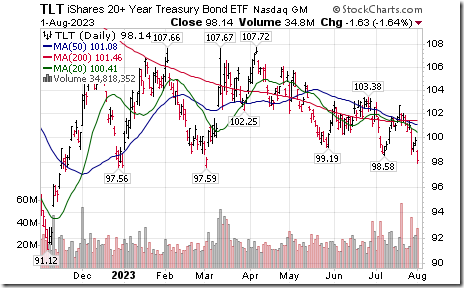

20 year+ Treasury Bond iShares $TLT moved below $98.58 extending an intermediate downtrend. Conversely, 20+ ultrashort Treasury ETF $TBT moved above $32.00 resuming an intermediate uptrend. Units are responding to strength in the U.S. Dollar.

The Canadian Dollar moved lower in response to strength in the U.S. Dollar Index and rising U.S. long term rates.

Telus $T.TO a TSX 60 stock moved below $23.28 extending an intermediate uptrend.

Trader’s Corner

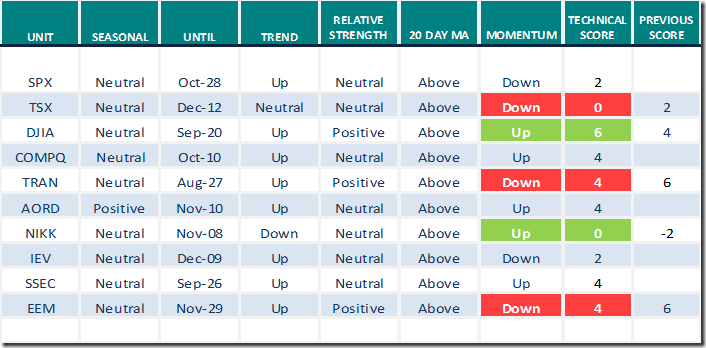

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 1st 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for all positive seasonality ratings: www.EquityClock.com

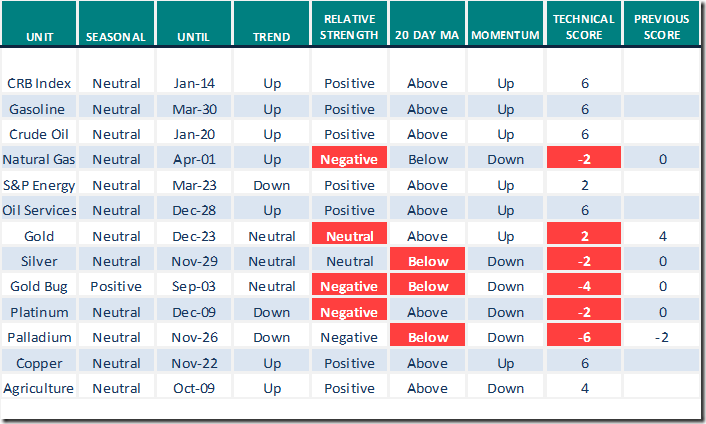

Commodities

Daily Seasonal/Technical Commodities Trends for August 1st 2023

Green: Increase from previous day

Red: Decrease from previous day

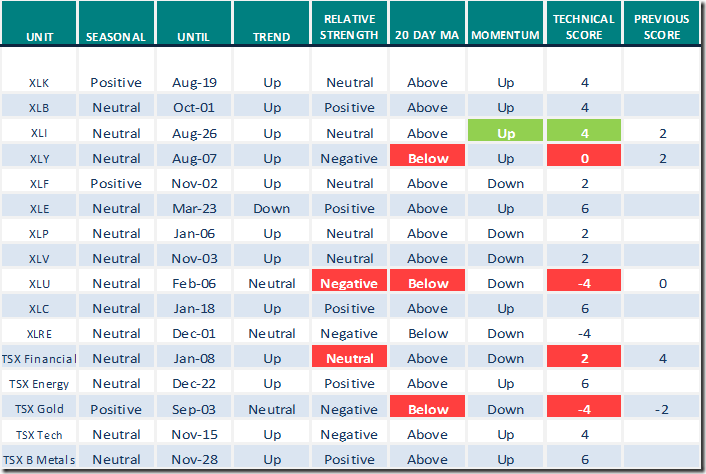

Sectors

Daily Seasonal/Technical Sector Trends for August 1st 2023

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Breaking Down the Heavy Earnings Week | The Final Bar (07.31.23)

https://www.youtube.com/watch?v=zWf5n3wechc

Small Caps Clear Key Resistance | Trading Places (08.01.23)

https://www.youtube.com/watch?v=pOavj_XAVjc

Industrials & Tech Headed to Uncharted Territory | Julius de Kempenaer | Sector Spotlight (08.01.23)

https://www.youtube.com/watch?v=_Ush3Ws1Ebg

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 2.20 to 79.60. It remains Overbought. Daily down trend was extended.

The long term Barometer dropped 2.00 to 72.00. It remains Overbought. Daily down trend was extended.

TSX Momentum Barometers

The intermediate term Barometer dropped 6.14 to 64.91. It remains Overbought.

The long term Barometer dropped 6.14 to 57.98. It changed from Overbought to Neutral on a drop below 60.00. Daily down trend was extended.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed