Pre-opening Comments for Thursday July 20th

U.S. equity index futures were lower this morning. S&P 500 futures were down 10 points at 8:35 AM EDT.

Index futures were unchanged following release of the July Philly Fed Manufacturing Index at 8:30 AM EDT. Consensus was an improvement to -9.7 from -13.7 in June. Actual was -13.5.

Netflix dropped $39.44 to $438.15 after reporting less than consensus second quarter revenues. The company also offered third quarter guidance that was less than consensus.

Zions Bancorp added $2.60 to $37.06 after reporting higher than consensus second quarter results. The stock completed a reverse Head & Shoulders pattern on a move above $32.56

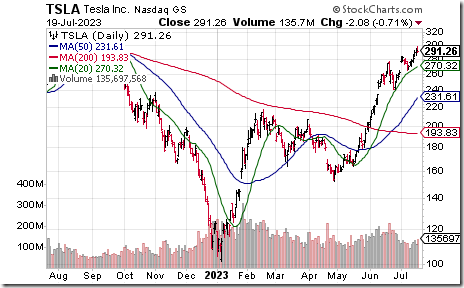

Tesla dropped $12.19 to $279.07 after offering third quarter guidance that was less than consensus.

United Airlines advanced $1.36 to $56.16 after reporting higher than consensus second quarter revenues and earnings.

EquityClock’s Daily Comment

Headline reads “The year-over-year change of Canadian CPI has fallen to the lowest level in over two years, but the favourable backdrop that allowed inflationary pressures to alleviate from last year’s high has come to an end”.

http://www.equityclock.com/2023/07/19/stock-market-outlook-for-july-20-2023/

Technical Notes

U.S. Healthcare Providers iShares $IHF moved above $264.57 completing a double bottom pattern.

Midcap 400 SPDRs $MDY moved above $496.55 extending an intermediate uptrend.

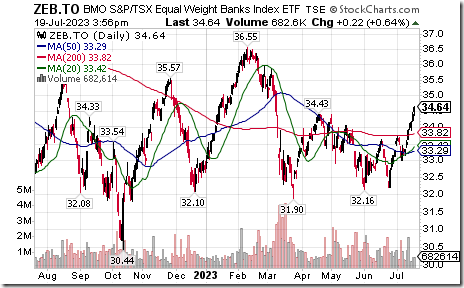

BMO Equal weight Banks ETF $ZEB.TO moved above $34.43 resuming an intermediate uptrend. Units responded partially to Bank of Montreal $BMO.TO a TSX 60 stock completing a double bottom pattern by moving above $123.17.

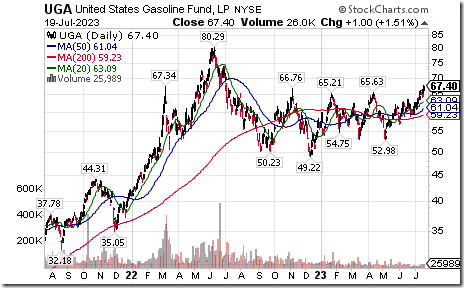

Gasoline ETN $UGA moved above $66.76 extending an intermediate uptrend

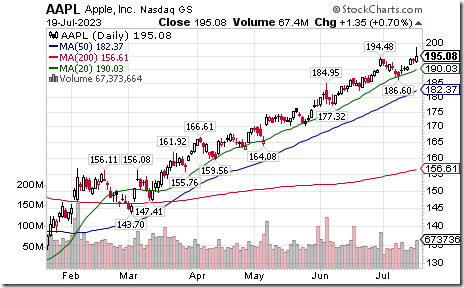

Apple $AAPL a Dow Jones Industrial Average stock moved above $194.48 extending an intermediate uptrend.

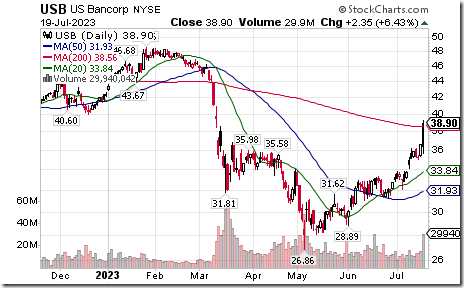

U.S. Bancorp $USB an S&P 100 stock moved above intermediate resistance at $36.79

QualComm $QCOM a NASDAQ 100 stock moved above $125.40 extending an intermediate uptrend.

Cameco $CCJ a TSX 60 stock moved above US$33.00 extending an intermediate uptrend.

SNC Lavalin $SNC.TO a TSX 60 stock moved above Cdn$36.48 extending an intermediate uptrend.

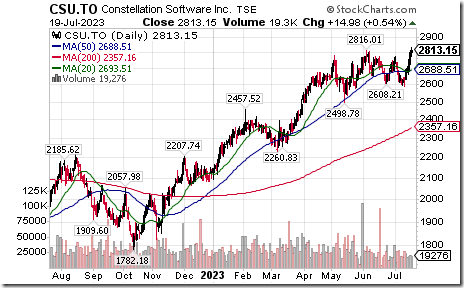

Continental Software $CSU.TO a TSX 60 stock moved above Cdn$2816.01 to an all-time high extending an intermediate uptrend.

Trader’s Corner

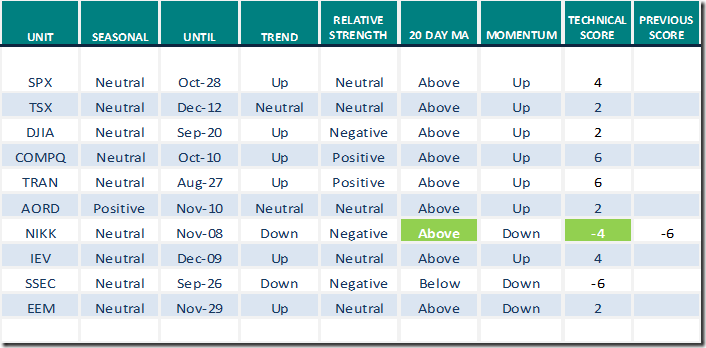

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 19th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for all positive seasonality ratings: www.EquityClock.com

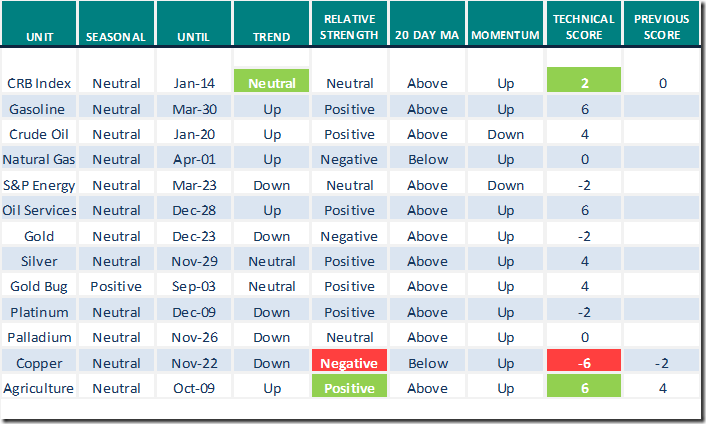

Commodities

Daily Seasonal/Technical Commodities Trends for July 19th 2023

Green: Increase from previous day

Red: Decrease from previous day

Sectors

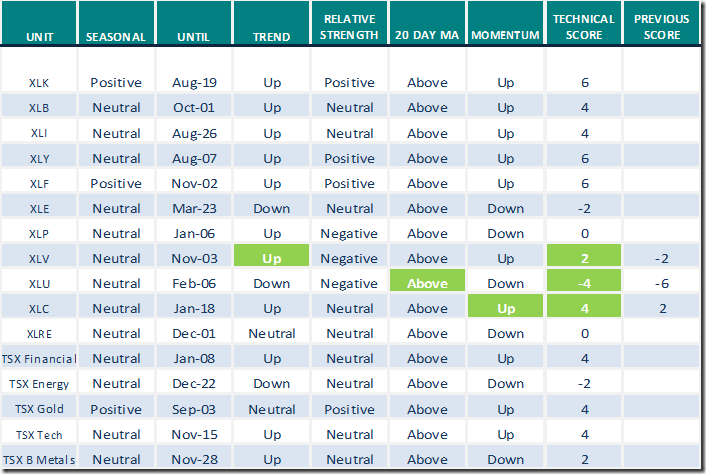

Daily Seasonal/Technical Sector Trends for July 19th 2023

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Sprott Uranium Report: Supply-Demand Gap Ignites Uranium Rally

Sprott Uranium Report: Supply-Demand Gap Ignites Uranium Rally

ANOTHER New High for the Year? | The Final Bar (07.18.23)

https://www.youtube.com/watch?v=72tvV4FMSOQ

Javed Mirza’s top picks on BNN Bloomberg: July 19th

https://www.bnnbloomberg.ca/javed-mirza-s-top-pick-july-19-2023-1.1947874

S&P 500 Momentum Barometers

The intermediate term Barometer added 3.40 to 84.60. It remains Overbought.

The long term Barometer added 3.60 to 73.60. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 2.19 to 69.30. It remains Overbought. Daily trend is up.

The long term Barometer added 1.75 to 64.04. It remains Overbought. Daily trend is up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed