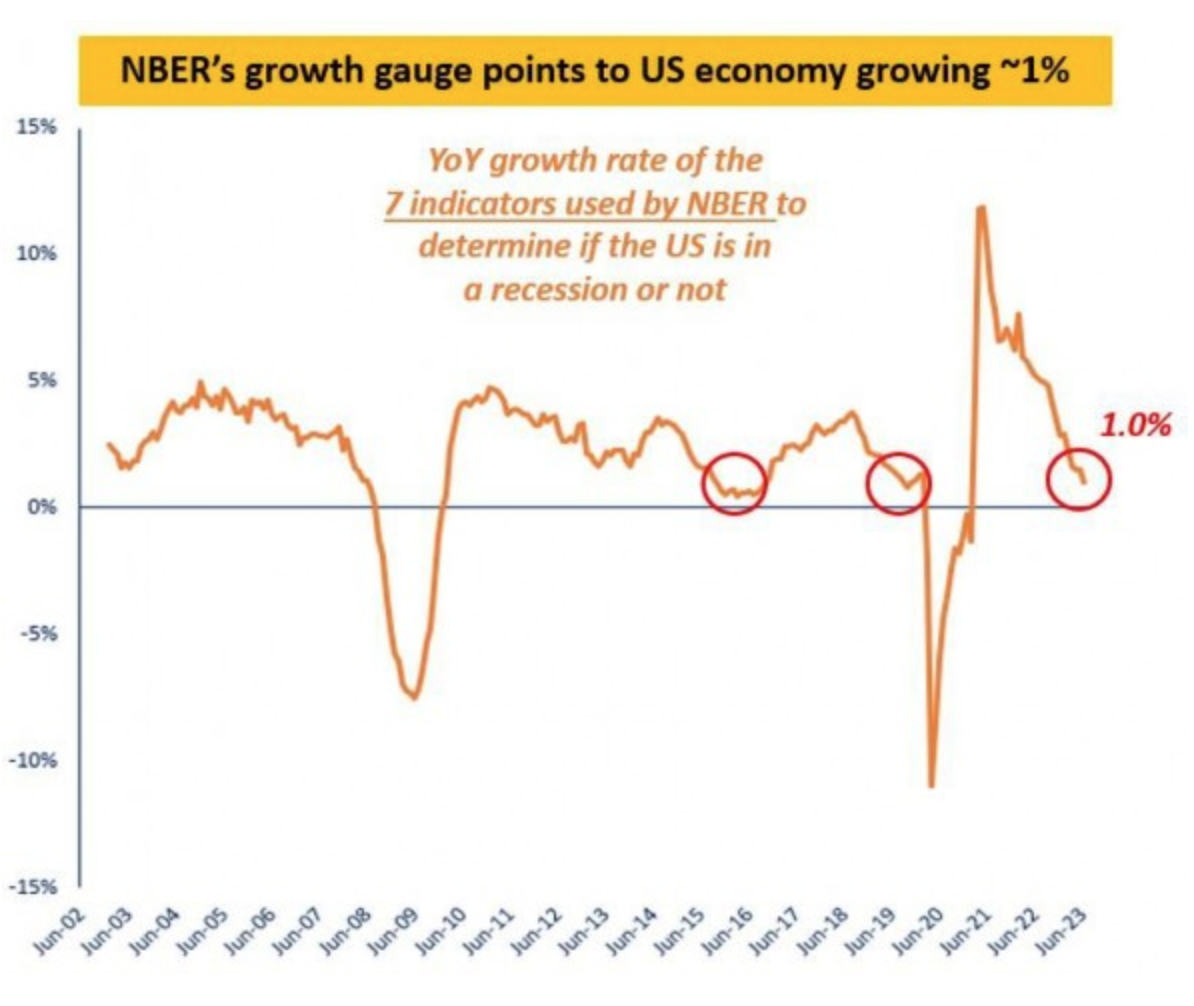

In his latest analysis1, Alfonso Peccatiello, Founder & Chief Strategist of The Macro Compass, examined the prevailing assumption of 'sticky' inflation, challenging its validity in the light of empirical data. Noting the disinflationary trend that is becoming increasingly noticeable, Peccatiello supports his argument with growth figures showing around 1% annualized levels. Consequently, he suggests the reapplication of strategies from 2016 to 2019 in response to the evident disinflation, predictable Federal Reserve (Fed) action, and below-trend yet non-recessionary growth.

Peccatiello emphasizes the importance of understanding the Fed's interpretation of inflation, using Fed Chair Powell's three-category inflation view as an example. These categories include:

1) core goods inflation,

2) housing-related inflation, and

3) core services ex-housing inflation

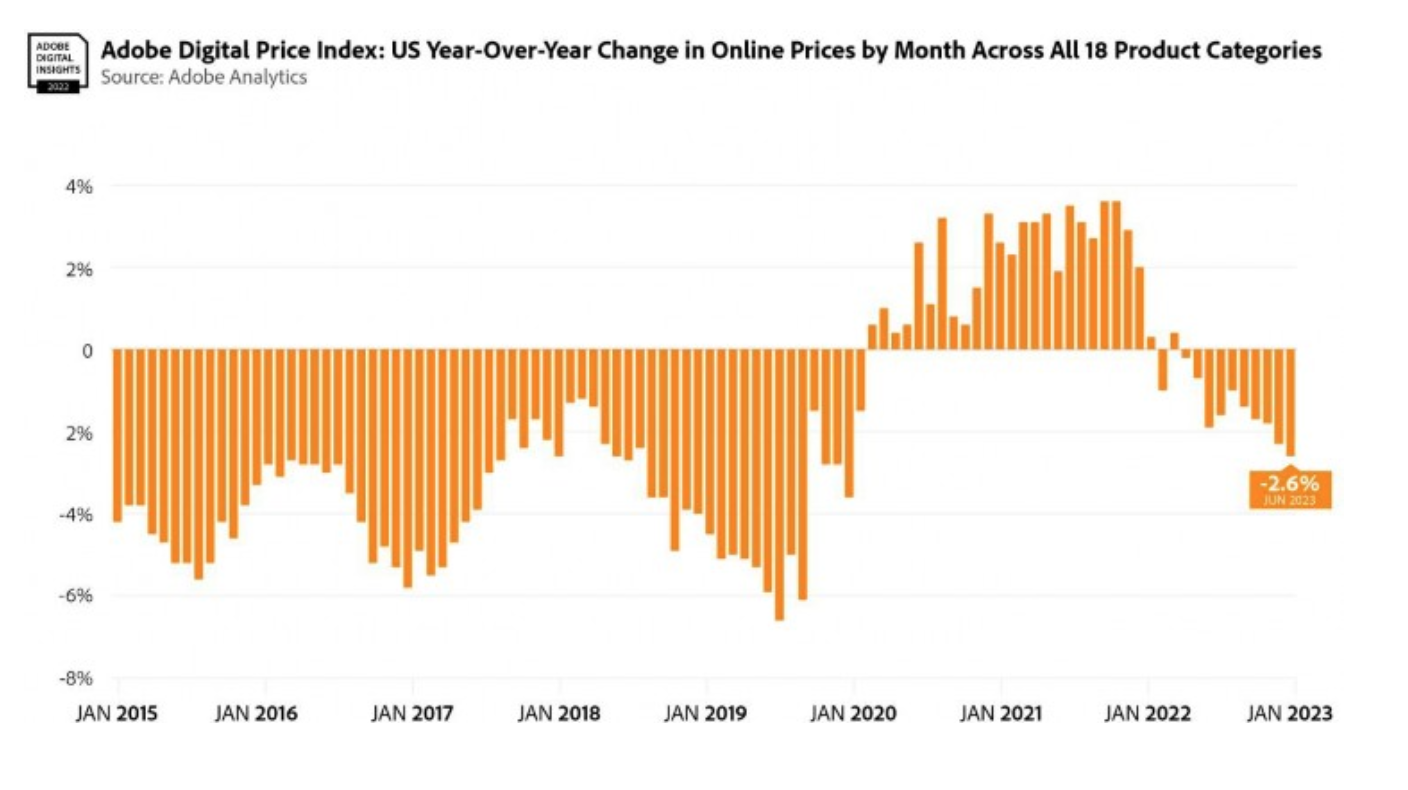

The decline in used car prices and broader goods space, as seen in the Adobe Price Index, signals a return to a disinflationary trend, prompting Peccatiello to question the premise of sticky inflation.

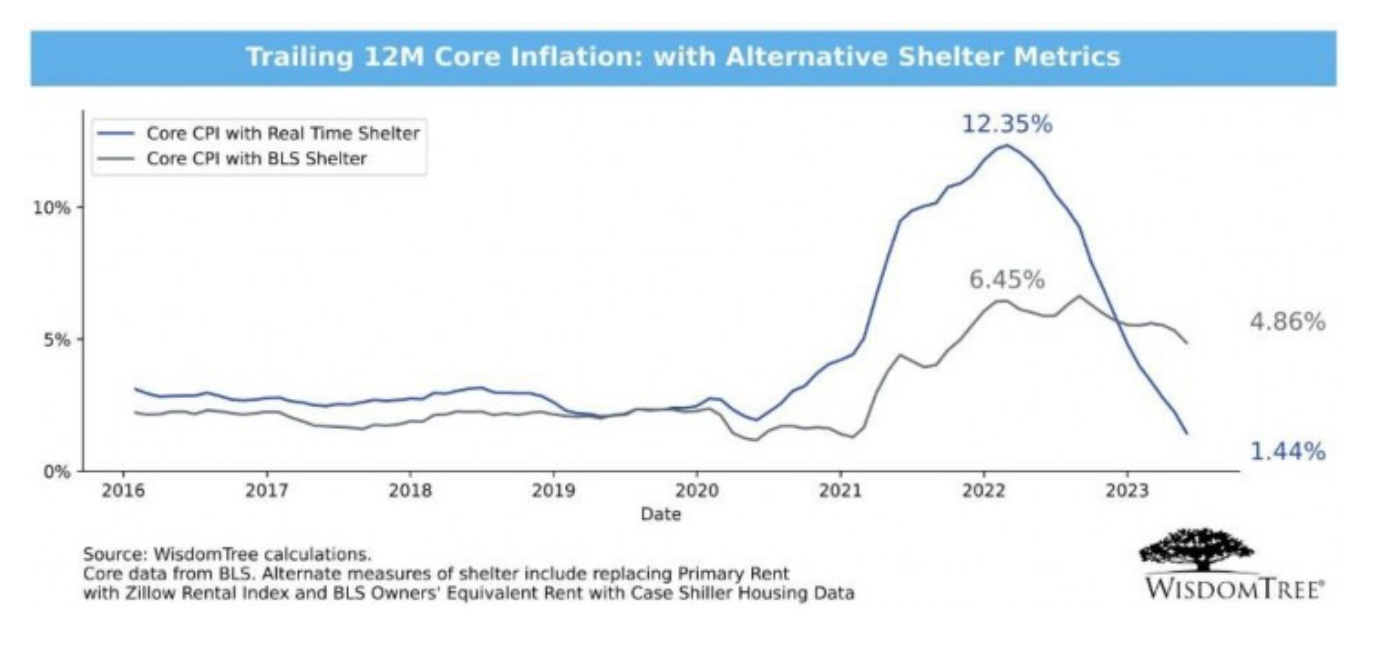

He further asserts that housing-related inflation is underestimated due to measurement lags. By using actual rent of shelter developments, the core Consumer Price Index (CPI) reveals a 1.5% year-on-year core inflation rate, indicating significant underestimation. Peccatiello expects more downward pressure on this front in H2 due to the long lag time.

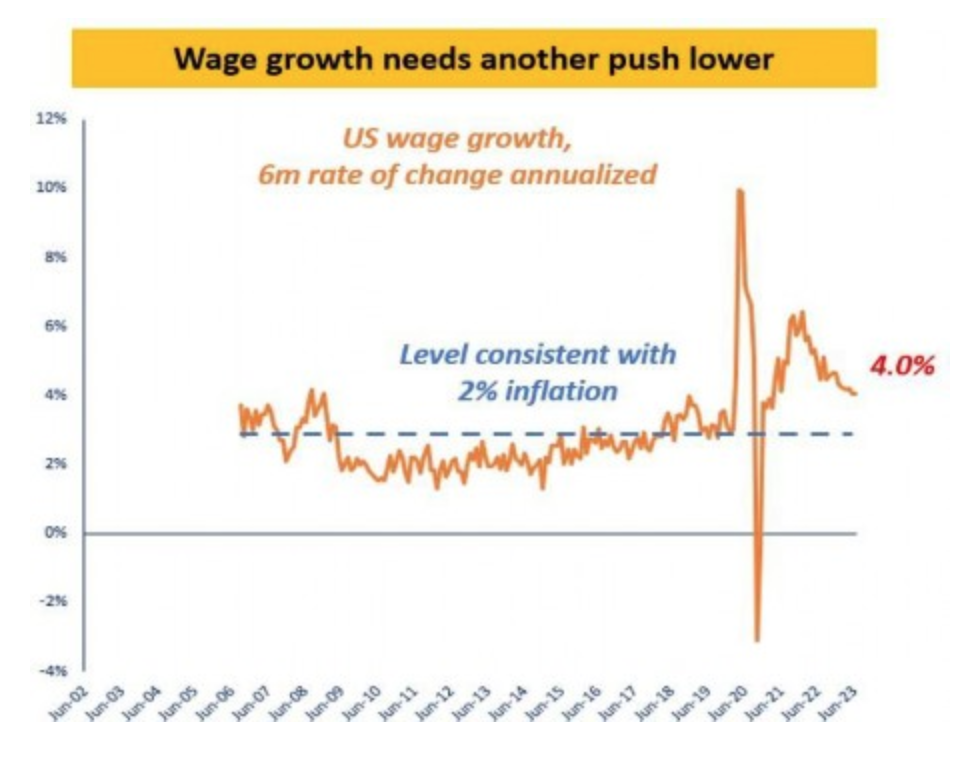

However, Peccatiello argues that the most compelling evidence against the sticky inflation theory lies in the core services ex-housing subcomponent, a significant factor for the Fed, which reflects wage pressures and labor market slack. The three-month annualized rate of change in this subcomponent has consistently decreased from January to June 2023, counterindicating any 'stickiness'.

Examining labor market trends, Peccatiello observes cyclical industries' weak hiring, while labor supply is increasing, suggesting the need for wage growth moderation to align with the Fed's 2% inflation target.

While progress is noticeable, it appears more will be necessary to placate the Fed's concerns.

* * *

The Macro Compass (https://themacrocompass.com) is a paid service, and for this reason, out of respect for Alfonso Peccatiello and The Macro Compass, and its paying subscribers, we have omitted the actionable asset allocation guidance from this note.

Footnote:

1 Adapted from source: "Sticky What?" Alfonso Peccatiello, The Macro Compass, 13 July 2023

All charts sourced from The Macro Compass