Pre-opening Comments for Monday July 10th

U.S. equity index futures were mixed this morning. S&P 500 futures were unchanged at 8:30 AM EDT.

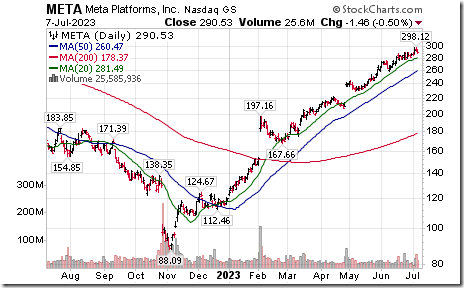

Meta Platform added $2.74 to $293.50 on news that subscriptions to its new product, Threads are nearing 100 million.

Fisker dropped $0.35 to $5.65 after announcing plans to issue convertible notes valued at $340 million.

Northern Trust slipped $0.67 to 473.65 after UBS downgraded the stock from Buy to Neutral.

CAVA Group added $0.77 to $40.35 after Stifel Nicolaus started coverage with a Buy rating.

EquityClock’s Daily Comment

Headline reads “The population in Canada expanded at the fastest rate on record through the first half of the year, placing tremendous pressures on social services at a time when momentum in the labor market is slowing”.

http://www.equityclock.com/2023/07/08/stock-market-outlook-for-july-10-2023/

The Bottom Line

Equity markets on both sides of the border are on central bank watch. In Canada, the Bank of Canada is expected to increase its interest rate for Canadian banks on Wednesday from 4.75% to 5.00%. The BOC is expected to respond to continuing strength in Canada’s employment. The June Employment report reported on Friday included a surprisingly strong increase in employment, another 60,000 positions versus consensus for a 20,000 increase. Upward pressure on wage rates continues, which in turn, puts upward pressure on consumer prices. Another increase in the BOC rate is justified in order to dampen inflation pressures.

In the U.S. the Federal Reserve receives two more “data points” on inflation expectations this week prior to the next FOMC announcement on July 26th, the June CPI report on Wednesday and the June PPI report on Thursday. U.S. inflation rates are coming down, but remain well above the Federal Reserve’s long term target at 2.0%. Consensus currently calls for another 0.50% increase in the Fed Fund Rate on July 26th

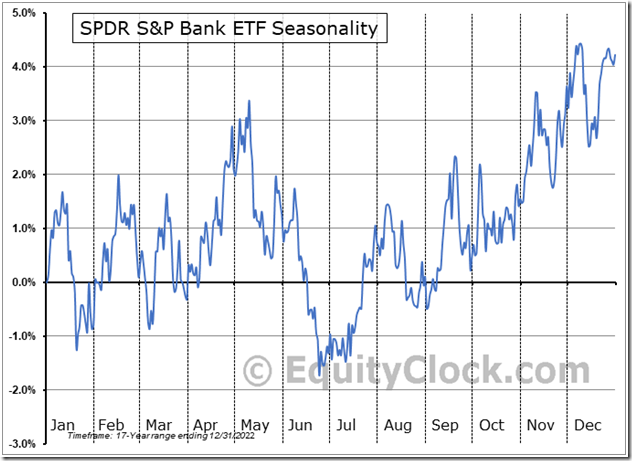

Second quarter earnings reports by major U.S. companies start trickling in this week. Focus is on reports released by money center banks on Friday. Look for increases in their dividends and a renewal of share buyback programs. Money center banks also will benefit from the recent flow of deposits to larger banks following a “shut down” by the Federal Reserve of insolvent smaller banks. Note the chart patterns on Money Center Banks (KBE) and Regional Banks (KRE). Both potentially are developing reverse Head & Shoulders patterns. Note their strength on Friday.

Note seasonal characteristics for the Money Center Bank ETF (Symbol: KBE)

Consensus for Earnings and Revenues for S&P 500 Companies

Source: www.Factset.com

Earnings estimates for the second and third quarters continued to move lower. Earnings momentum turns positive thereafter. Since our last report on June 20th, consensus for the second quarter earnings fell from a drop of 6.4% to a drop of 7.2%. Second quarter revenues are expected to drop 0.3%, up from a drop of 0.4% in revenues predicted on June 20th. Consensus for the third quarter calls for an earnings increase of 0.3% versus a previous estimated gain at 0.8%. Revenues are expected to increase 1.2%. Consensus for the fourth quarter calls for a 12.4% increase in earnings (versus previous estimate at 8.2%). Fourth quarter revenues are expected to increase 4.9% (versus previous estimate at 3.2%). For all of 2023, consensus calls for an earnings increase of 0.8% (versus previous estimated gain at1.2%). Revenues are expected to increase 2.4%.

The recovery in earnings continues into 2024. Consensus for 2024 calls for a 12.4% increase in earnings (versus previous estimate at 12.3%). Consensus for revenue growth remains at 4.9%.

Economic News This Week

U.S. June Consumer Price Index released at 8:30 AM EDT on Wednesday is expected to increase 0.3% versus a gain of 0.1% in May. On a year-over-year basis, June CPI is expected to increase 3.1% versus a gain of 4.0% in May. Excluding food and energy, June Consumer Price Index is expected to increase 0.3% versus 0.4% in May. On a year-over-year basis, Core June CPI is expected to increase 5.0% versus a gain of 5.3% in May.

Bank of Canada updates monetary policy at 10:00 AM EDT on Wednesday. Consensus calls for an increase in the Bank’s rate available for Canada’s major banks from 4.75% to 5.00%.

U.S. June Producer Price Index released at 8:30 AM EDT on Thursday is expected to increase 0.2% versus a drop of-0.3% in May. On a year-over-year basis, June PPI is expected to increase 0.4% versus a gain of 1.1% in May. Excluding food and energy, June Producer Price Index is expected to increase 0.2% versus a gain of 0.2% in in May. On a year-over-year basis, core PPI is expected to increase 2.8% versus a gain of 2.8% in May.

Beige Book is released at 2:00 PM EDT.

July Michigan Consumer Sentiment released at 10:00 AM EDT on Friday is expected to increase to 64.8 from 64.4 in June.

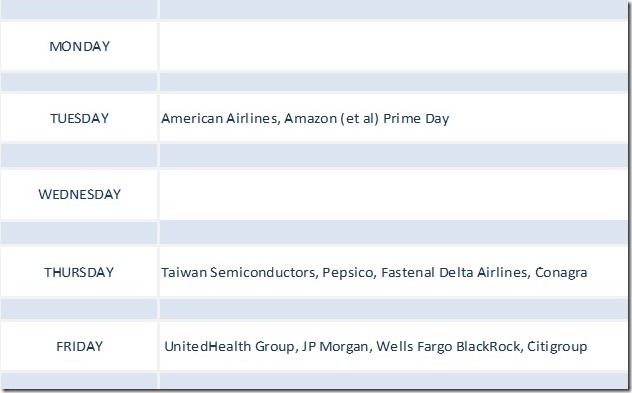

Selected Earnings News This Week

Focus is on reports released by big banks on Friday.

Trader’s Corner

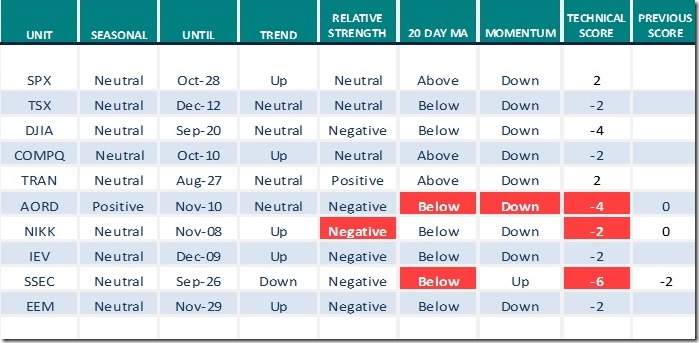

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 7th 2023

Green: Increase from previous day

Red: Decrease from previous day

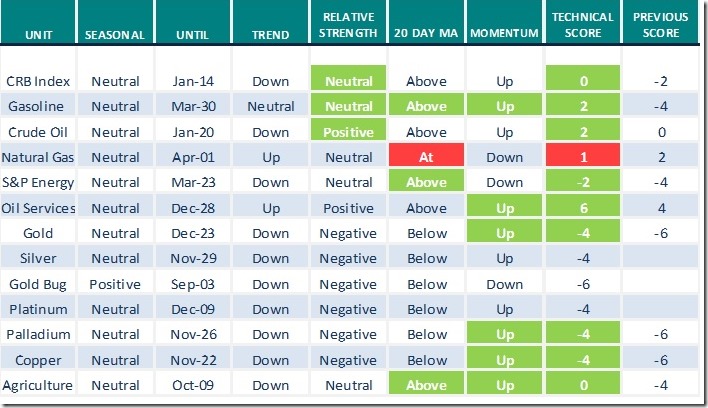

Commodities

Daily Seasonal/Technical Commodities Trends for July 7th 2023

Green: Increase from previous day

Red: Decrease from previous day

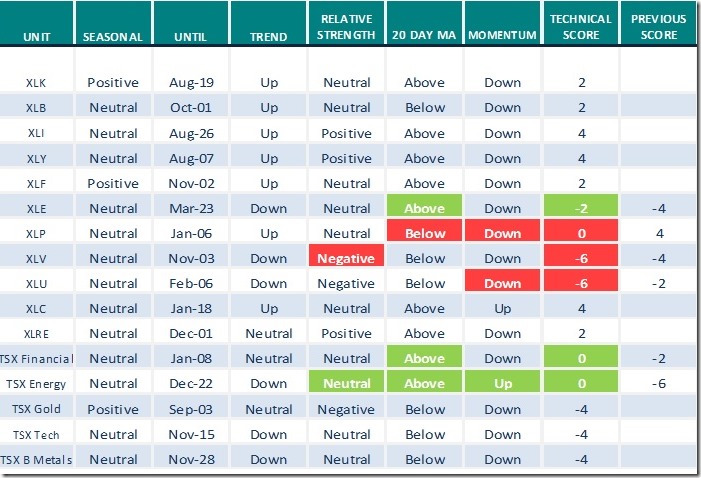

Sectors

Daily Seasonal/Technical Sector Trends for July 7th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

Links offered by Valued Providers

Michael Campbell’s Money Talks for July 8th

July 8th Episode (mikesmoneytalks.ca)

Crypto Names Continue to Soar JULY 07, 2023 Greg Schnell

Crypto Names Continue to Soar | The Canadian Technician | StockCharts.com

Three Key Charts Showing Bearish Divergences JULY 07, 2023 David Keller

Three Key Charts Showing Bearish Divergences | The Mindful Investor | StockCharts.com

Fasten Your Seatbelts: Earnings Season in the Spotlight JULY 07, 2023 Jayanthi Gopalakrishnan

Fasten Your Seatbelts: Earnings Season in the Spotlight | ChartWatchers | StockCharts.com

Interest Rates Are on The Rise–And That’s Bad News for the Nasdaq JULY 07, 2023 Mary Ellen McGonagle

Interest Rates Are on The Rise–And That’s Bad News for the Nasdaq | The MEM Edge | StockCharts.com

Are Gold (GLD) and Silver (SLV) Poised for a Rebound? JULY 07, 2023 Karl Montevirgen

Are Gold (GLD) and Silver (SLV) Poised for a Rebound? | ChartWatchers | StockCharts.com

Bob Hoye: The rich and their money fleeing China.

The Rich and Their Money Fleeing China – HoweStreet

Mark Leibovit: Will Digital Currency Create a Cash Black Market?

Will Digital Currency Create a Cash Black Market? – HoweStreet

Victor Adair: Trading Desk Notes for July 8th

Trading Desk Notes For July 8, 2023 – HoweStreet

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes

20 year + Government Bond iShares $TLT moved below intermediate support at $99.47.

Lower government bond prices triggered sharp weakness in the U.S. Dollar Index and its related ETN: UUP

Crude Oil ETN $USO moved above intermediate resistance at $65.09 and $65.35. Prompted by weakness in the U.S. Dollar Index

Oil Services ETF $OIH moved above intermediate resistance at $298.82. Prompted by higher crude oil prices!

Nutrien $NTR.TO a TSX 60 stock moved above Cdn$80.85 setting an intermediate uptrend.

Mosaic $MOS moved above US$36.60 setting an intermediate uptrend.

Global Agriculture ETF $COW.TO moved above Cdn$61.42 completing a reverse Head & Shoulders pattern. Includes the fertilizer stocks (e.g. Nutrien, Mosaic)! Prompted by weakness in the U.S. Dollar Index.

Open Text $OTEX a TSX 60 stock moved below US$39.63 and US$39.59 completing a Head & Shoulders pattern.

S&P 500 Momentum Barometers

The intermediate term Barometer added 0.60 to 73.00 on Friday, but slipped 1.00 last week to 73.00. It remains Overbought.

The long term Barometer added 0.80 on Friday, but slipped 1.80 last week to 64.40. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 3.95 on Friday, but dropped 3.51 last week to 44.30. It remains Neutral.

The long term Barometer added 2.19 on Friday, but slipped 0.88 last week to 53.51. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed