by Gershon Distenfeld, CFA, Scott Dimaggio, CFA, AllianceBernstein

Surf’s up! Elevated yields and negative correlations are good news for bond investors. We share strategies for making the most of today’s opportunities.

After a tumultuous two years that included the fastest interest-rate increases in recent memory, cascading bank failures, nail-biting debt-ceiling drama and the worst annual returns in the history of the bond market, we’re not surprised that some investors are reluctant to dip a toe back into bonds.

But in our view, avoiding the asset class could be a costly mistake. Here’s why we think it’s time for investors to get back in the water.

Surf Report: Rates to Stay Higher for Longer

To combat inflation, central banks have raised rates higher and faster than at any time in the past 20 years. Yet the global economy has proved resilient in the face of these aggressive policy measures, as well as Russia’s invasion of Ukraine, China’s prolonged zero-COVID policy and bank failures earlier this year.

With the tug of war between inflation and growth likely to continue as the year progresses, policy rates—and bond yields—are likely to stay higher for longer. Elevated yields are good for bond investors, since over time most of a bond’s return comes from its yield.

Of course, sustained higher interest rates are also likely to lead, eventually, to slower growth and a turn in the credit cycle. Our base-case forecast calls for a protracted period of below-trend global growth through 2024. Rate hikes are already weighing on activity in many sectors and households have begun to deplete savings that accumulated during the pandemic.

But because corporate fundamentals are starting from a position of exceptional strength, we’re not expecting a tsunami of corporate defaults and downgrades. In fact, we believe that both government bonds and credit-sensitive sectors have a role to play in portfolios today, in part because negative correlations between “risk-free” and risky assets are back.

Point Break: Negative Correlations Are Back

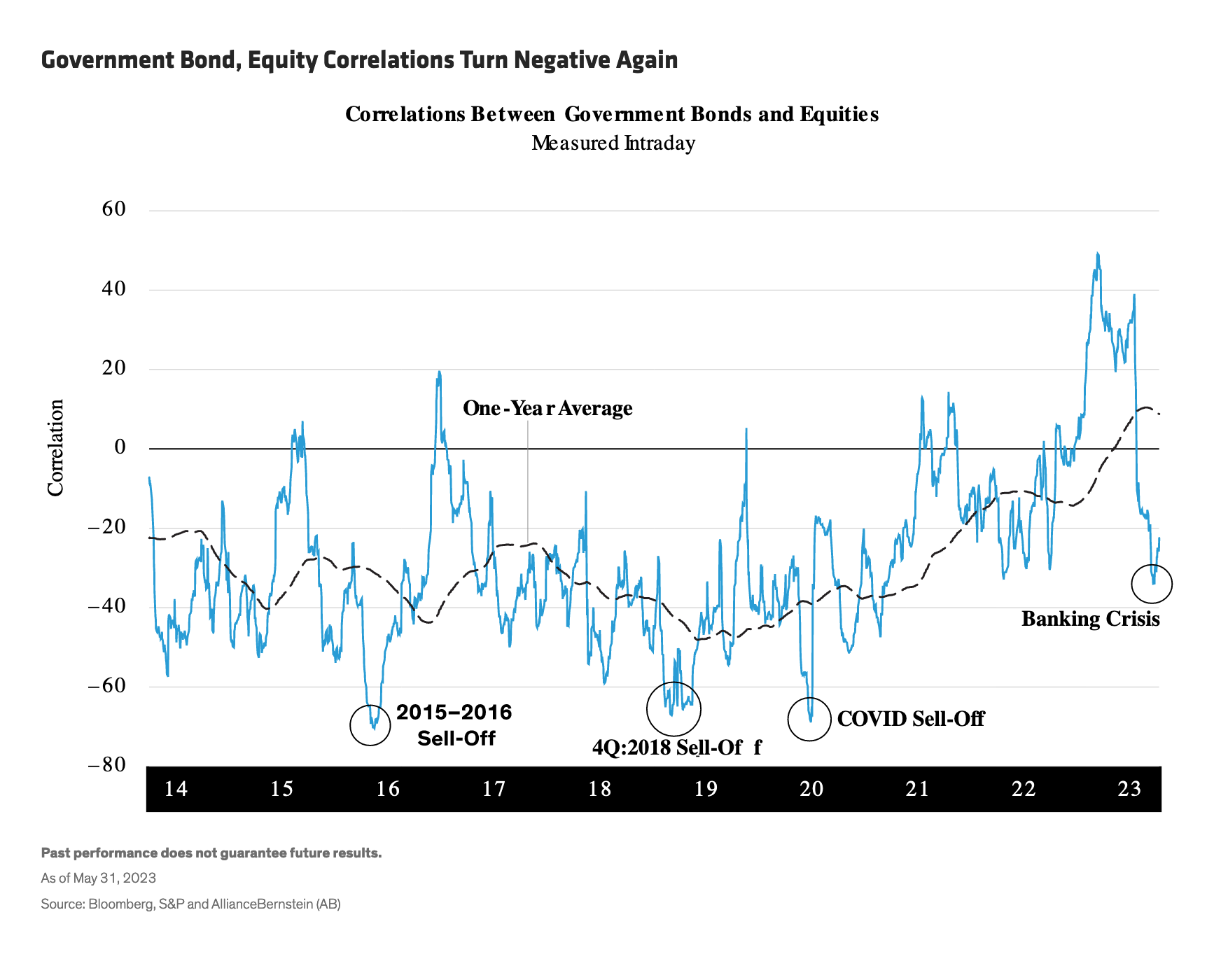

Traditionally, investors have valued government bonds for their role as a “safe haven” when equity markets and high-yield bonds are in crisis. But in 2022, government bonds and risk assets broke with convention and fell in tandem, leaving almost nowhere for investors to hide. The uniformity of terrible returns was so unusual that market observers wondered whether the days of negative correlations between stocks and bonds were behind us.

Recent market events proved that thesis wrong. As risk assets sold off in March, US Treasuries enjoyed a strong rally, reestablishing the negative correlation between government bonds and risk assets in a risk-off environment (Display). We expect this restored relationship to persist.

Shredding: Strategies for Today’s Environment

In our view, bond investors can thrive in today’s environment by adopting a balanced stance and applying these strategies:

1. Get invested. We’ve recently observed that many investors, despite believing that yields will remain flat or fall over the next year, are underweight fixed income, with insufficient duration and credit exposure but meaningful exposure to the volatility of the equities market. We think that’s a dangerous game. The odds of meeting your investment goals over any reasonable horizon are much poorer when you’re not fully invested.

If you’re still parked in cash or cash equivalents in lieu of bonds—the T-bill-and-chill strategy made popular in 2022—you’re losing out on the daily income accrual provided by higher-yielding bonds. For example, as of June 28, the global high-yield market offered yields of 9.2%, on average, compared to one- to three-month T-bills at 5.3%. Remember, fixed-income returns are mainly derived from earning income with the passage of time.

2. Extend duration. If your portfolio’s duration, or sensitivity to interest rates, has veered toward the ultra-short end, consider lengthening your portfolio’s duration. As inflation falls, the economy slows and interest rates decline, duration tends to benefit portfolios. Then get tactical, modestly shortening the portfolio’s average interest-rate exposure when yields drift lower and modestly lengthening when yields rise. Government bonds, the purest source of duration, additionally provide ample liquidity.

3. Own credit. Yields across risk assets are higher today than they’ve been in years, giving income-oriented investors a long-awaited opportunity to fill their tanks. “Spread sectors” such as investment-grade corporates, high-yield corporates and securitized assets—including commercial mortgage-backed securities and credit–risk transfer securities—can also serve as a buffer against inflation by providing a bigger current income stream.

What’s more, an allocation to high-yield debt can complement an equity portfolio. High-yield drawdowns have historically been less severe, helping high yield provide downside mitigation in bear markets. High yield has also recovered faster than equities.

But credit investors should be selective and pay attention to liquidity. CCC-rated corporates (particularly in cyclical industries), lower-rated emerging-market sovereigns and lower-rated securitized debt are most vulnerable in an economic downturn. Careful security selection remains critical.

4. Adopt a balanced stance. Striking the right balance between interest-rate and credit risks can be a good idea in the late stages of a credit cycle. Among the most effective strategies are those that pair government bonds and other interest-rate-sensitive assets with growth-oriented credit assets in a single, dynamically managed portfolio. This approach can help managers get a handle on the interplay between risks and make better decisions about which way to lean at a given moment.

Correlated sell-offs of government bonds and credit assets have been exceedingly rare over the last 30 years. Yet even when the two types of assets do decline in tandem, a barbell strategy may help to minimize the damage. Those who segregate rate-sensitive and credit assets in different portfolios may be tempted in such situations to sell—and lock in losses—in both.

Catching the Wave

Active investors should stay nimble and prepare to take advantage of quickly shifting valuations and fleeting windows of opportunity as the year progresses. Most important, investors should get off the sidelines and fully invest in the bond markets to take advantage of today’s ample yields and potential return opportunities. After all, you can’t catch the coming wave if you don’t get in the water.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.