Pre-opening Comments for Wednesday June 28th

U.S. equity index futures were lower this morning. S&P 500 futures were down 7 points at 8:30 AM EDT.

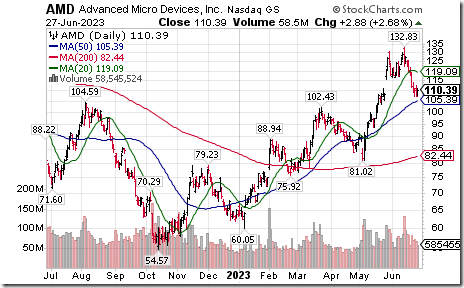

After the close yesterday Nvidia dropped $12.96 to $405.80 and Advanced Micro Devices plunged $3.08 to $107.31 on news that the Biden administration is considering a new ban on sales of Artificial Intelligence chips to China.

Jefferies Financial slipped $0.30 to $31.64 after the company lowered second quarter revenue guidance.

General Mills dropped $4.10 to $76.80 after reporting lower than consensus fiscal fourth quarter revenues.

EquityClock’s Daily Comment

Headline reads “A slate of upbeat economic data points has kicked off the summer rally period as stocks bounce from levels of short-term support”.

http://www.equityclock.com/2023/06/27/stock-market-outlook-for-june-28-2023/

Technical Notes

Materials SPDRs $XLB moved above intermediate resistance at $81.61.

Transportation iShares $IYT moved above $246.21 extending an intermediate uptrend. Responding to lower crude oil (fuel) prices!

Lowes Companies $LOW an S&P 100 stock moved above $222.20 extending an intermediate uptrend.

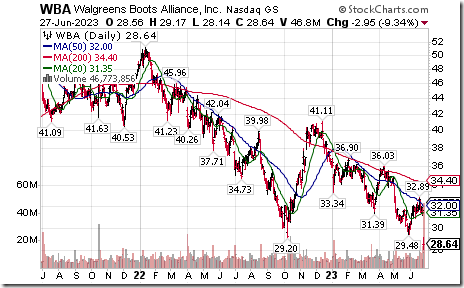

Walgreens Boots $WBA a Dow Jones Industrial Average stock moved below $29.48 and $29.20 extending an intermediate downtrend. The company reported less than consensus fiscal third quarter results.

Sirius XM $SIRI formerly a NASDAQ 100 stock moved above intermediate resistance at $4.11.

Copart $CPRT a NASDAQ 100 stock moved above $89.79 to an all-time high extending an intermediate uptrend.

Lam Research $LRCX a NASDAQ 100 stock moved above $642.83 extending an intermediate uptrend.

Trader’s Corner

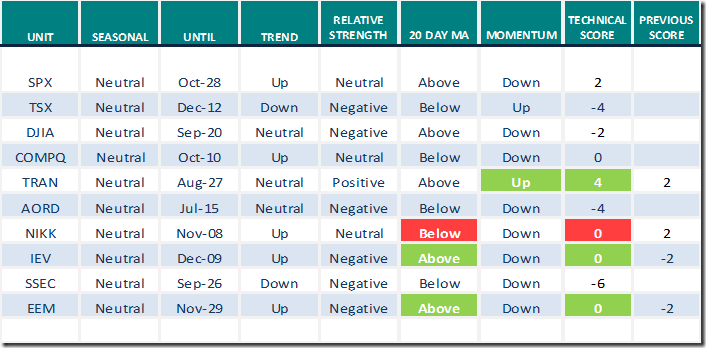

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for June 27th 2023

Green: Increase from previous day

Red: Decrease from previous day

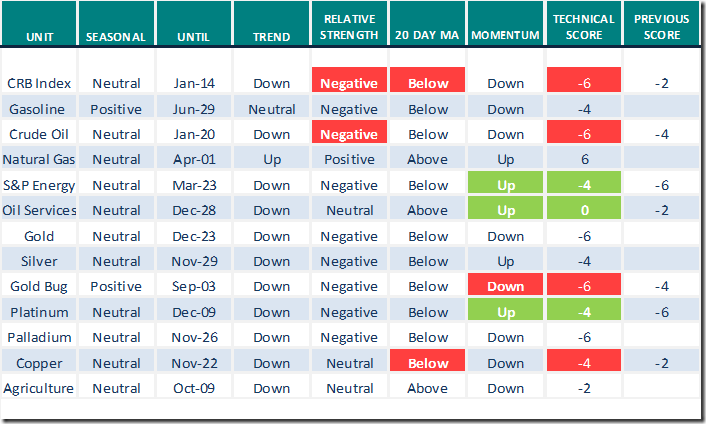

Commodities

Daily Seasonal/Technical Commodities Trends for June 27th 2023

Green: Increase from previous day

Red: Decrease from previous day

Sectors

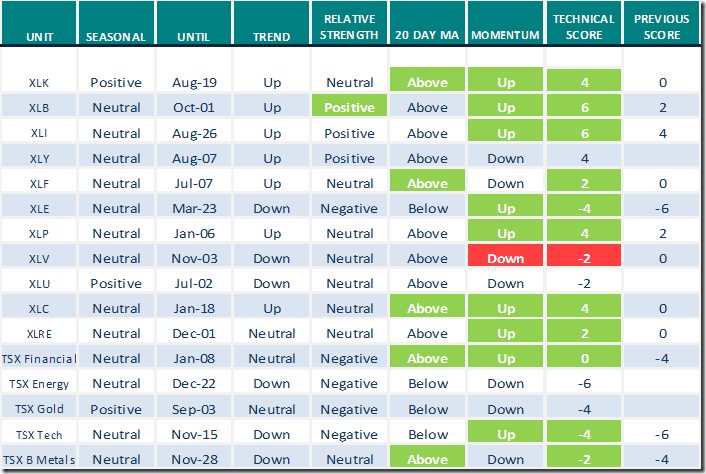

Daily Seasonal/Technical Sector Trends for June 27th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

Links offered by valued providers

Is There A New Gold Rush? | Leslie Jouflas, CMT | Your Daily Five (06.27.23)

A focus on the “build to rent” sector!

Is There A New Gold Rush? | Leslie Jouflas, CMT | Your Daily Five (06.27.23) – YouTube

Stocks Lining Up for a Strong July | Julius de Kempenaer | Sector Spotlight (06.26.23)

Note comments on seasonality.

Stocks Lining Up for a Strong July | Julius de Kempenaer | Sector Spotlight (06.26.23) – YouTube

Power Up Your Analysis With CandleGlance | Tom Bowley | Trading Places (06.27.23)

Power Up Your Analysis With CandleGlance | Tom Bowley | Trading Places (06.27.23) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer jumped 7.00 to 65.40. It changed from Neutral to Overbought on a move above 60.00.

The long term Barometer gained 3.40 to 61.40. It changed from Neutral to Overbought on a move above 60.00.

TSX Momentum Barometers

The intermediate term Barometer jumped 7.42 to 32.31. It remains Oversold.

The long term Barometer added 2.62 to 46.29. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed