by Tony DeSpirito, CIO of U.S. Fundamental Equities, Blackrock

Key takeaways

An ounce of optimism, a pound of prudence. It’s still a good time to be measured about taking risk in equities, but we believe the longer-term horizon holds particular promise for active stock pickers. As Q3 begins, we see:

- Investor caution keeping cash on the sidelines

- Greater dispersion in earnings, valuations and returns

- Opportunity to build and deploy shopping lists

Equity market overview and outlook

Stocks arguably defied expectations in the first half of the year, with the S&P 500 notching double-digit returns even as inflation remained elevated and the Fed continued its fastest rate-hiking campaign since the 1980s.

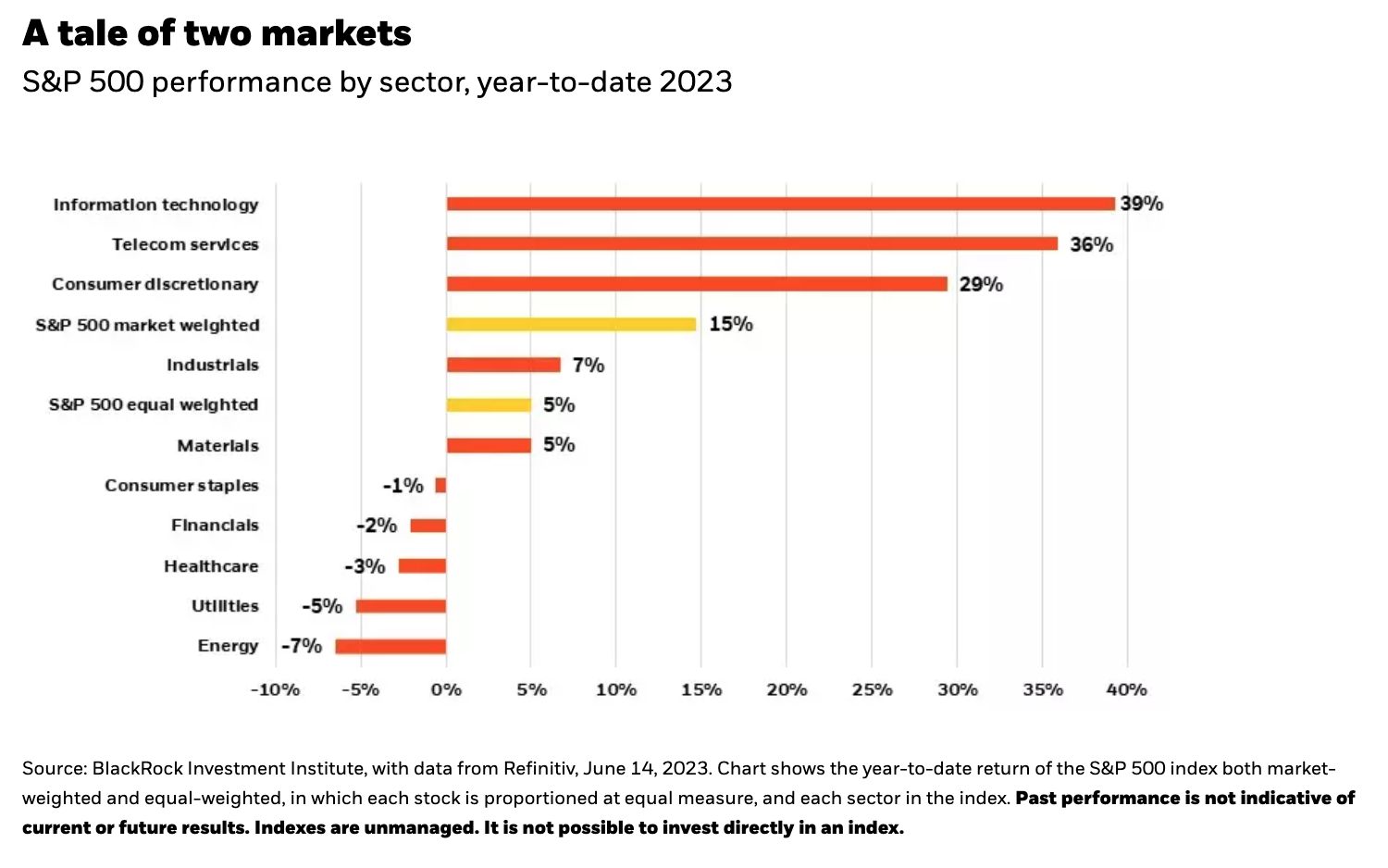

The big picture masks some nuances: Technology shares, after cratering in 2022, have carried index returns. And comparing the index’s market-weighted (15%) and equal-weighted (5%) returns illustrates just how much the mega-cap stocks ― primarily tech-related stocks across IT, telecom services and consumer discretionary ― have driven year-to-date performance. See chart below. We remain selective in taking risk as we prepare our shopping lists for the cycle’s next leg, and we believe stock selection will be rewarded as investors prioritize company fundamentals and market breadth widens beyond the current leaders.

Caution is the consensus

Reasons for caution are many and fund flows suggest investors are aligned in their thinking. Data from Morningstar shows $37 billion has exited U.S. equity funds this year while bonds have gathered $108 billion in assets, even as volatility in the latter asset class has remained higher. An astounding $404 billion flowed into money market funds.*

The spring banking crisis that saw the failure of Silicon Valley Bank and Signature Bank and the takeover of First Republic in the U.S. and Credit Suisse in Europe rattled already fragile investor nerves. The tightening in lending that came as an outgrowth threatens to pressure the corporate real estate market.

All of this comes as the still-inverted yield curve continues to signal recession. Our analysis of the 12 yield curve inversions since 1978 shows the average time from inversion to recession is 18 months. This cycle, the curve between two- and 10-year yields inverted 11 months ago, in July 2022.

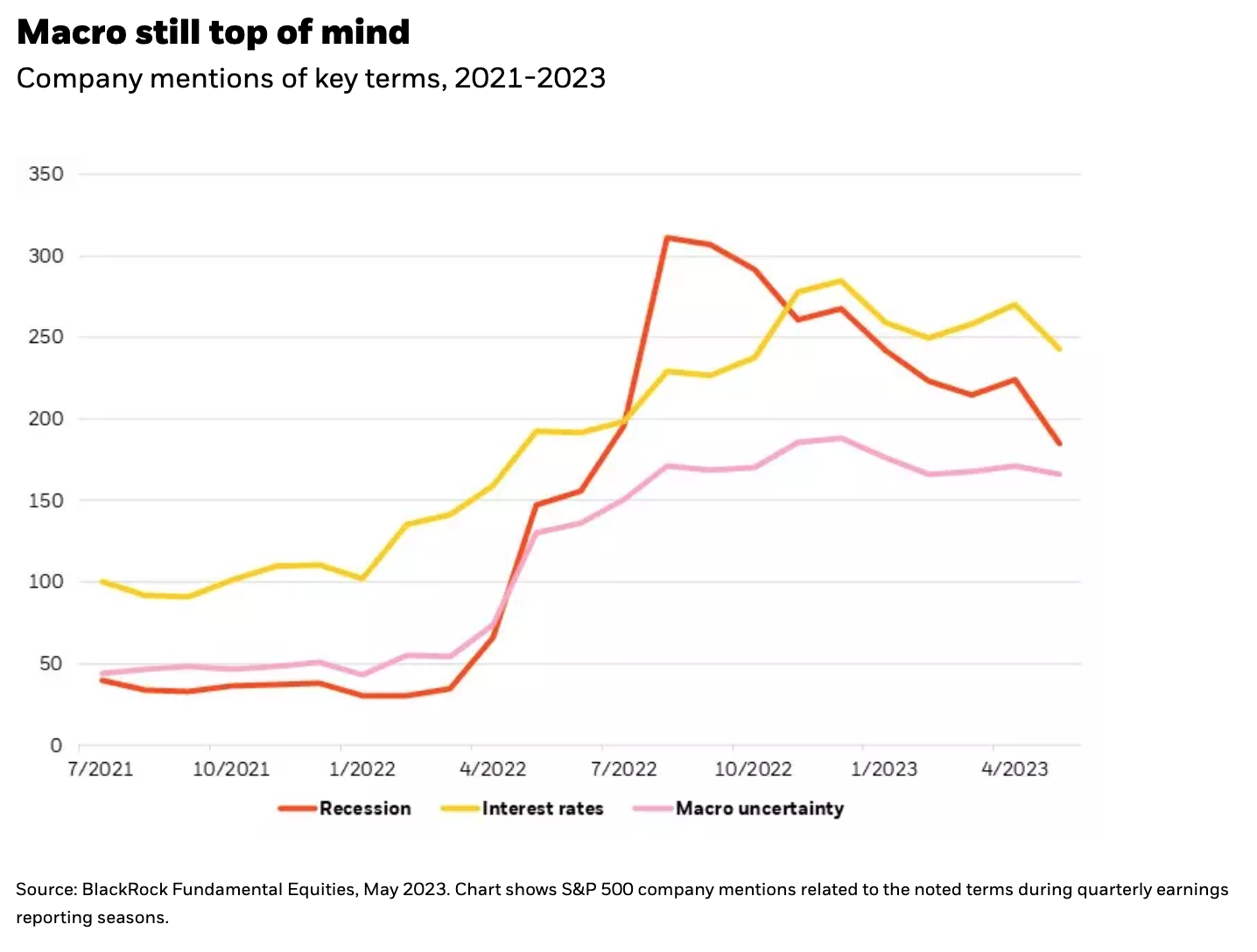

Companies remain focused on recession and interest rates, as indicated by mentions in earnings reports. See chart below. Macroeconomic uncertainty in general remains high on their worry list, if mentions are any indication. And certainly, macro drivers are applying greatest influence on markets while stock fundamentals take a back seat ― for now.

Of course, caution also means ample money waiting to be deployed. While investors have hunkered down in cash, as shown by the extraordinary flows into money market funds, this also suggests record levels of sidelined cash that could eventually make its way into the economy and markets. Past episodes of peak money fund flows historically been followed by strong returns from equities.

Alpha is the opportunity

While caution is prudent in the near term, paralysis can be detrimental to long-term financial goals. Every cycle is different, which makes investing amid uncertainty a challenge but also highlights the importance of an active and selective approach.

As recession risk looms larger, we lean into opportunities in defensive areas of the market, with healthcare still a favored sector. We looked at Russell 1000 sector performance 24 months following prior yield curve inversions and saw typically good performance from healthcare. It is lagging so far in this cycle, which only makes for a more attractive entry point into a well-priced and recession-resilient sector, in our view.

Cyclicals could slump in a recession, but this is where it’s important to have shopping lists ready to capture opportunities amid the rubble. Industrials have so far surprised to the upside versus prior post-inversion episodes, but we expect a wide range of outcomes as advancements in industrial technology and progress or plans for reshoring are already sowing the seeds of opportunity.

A good shopping list should be diversified across sectors and include companies with attractive prospects that could reprice lower should a recession temporarily punish their valuations. In cyclicals, we continue to emphasize business quality and strength of balance sheet since companies with these characteristics should offer greater resiliency.

Active equities for a new era

While our medium-term view is for the market to begin shifting its focus from macro factors to the micro, or stock specifics, our longer-term outlook takes that a step further.

We foresee a return to a more normal investing landscape where alpha is at the center. This is based on changes in the underlying dynamics that coalesce to create the opportunity in the stock market.

“We see stock selection driving more return as market dispersion increases and as higher valuations limit beta, or index-level returns.”

The end of easy money

In the 12 years following the 2008 Global Financial Crisis (GFC), there was excess supply as China continued to industrialize, inflation was muted, interest rates were at historic lows and excess money in the system was plentiful. The Fed consistently applied easy monetary policy to help consumers and businesses heal from the crisis, propping up markets in the process.

From an equity market perspective, beta (market return) was abnormally high as valuations went from very low to normal and the differentiation in returns between individual stocks was slim. Investors bought the dips and, as a result, the drawdowns were quite short and shallow. The Fed also was willing to come to the rescue in the case of any wobbles. Beta was king, as well-supported markets provided extreme performance, resulting in an average annual S&P 500 return of 15% over calendar years 2010 to 2021.

In contrast, the era before the GFC featured longer and deeper equity market drawdowns, meaning more volatility as well as greater opportunity for skilled stock picking to deliver above-market returns (or alpha). We see this dynamic returning in the new era.

Back to a period of greater differentiation

In the regime now forming ― the post-COVID era ― stock valuations, inflation and interest rates are all higher. Supply is being constrained by demographic trends (aging populations and fewer workers), decarbonization and deglobalization, all of which are inflationary. Going forward, the Fed is more likely to be in a position of having to fight inflation rather than bolster the economy, a less friendly scenario for financial markets.

Equities historically have been the highest-returning asset class over the long term, and we see nothing to alter that precedent. However, higher stock valuations than at the start of the prior regime plus higher interest rates means less return from markets broadly (beta). We see more dispersion in earnings estimates, valuations and stock returns ― and this suggests greater opportunity for skilled managers to generate more alpha. The result, in our view, is that the years ahead will see active return being a bigger part of investors’ overall return profiles.

Tony DeSpirito, Managing Director, BlackRock Fundamental Equities

Antonio (Tony) DeSpirito, Managing Director, is Chief Investment Officer of U.S. Fundamental Equities. He is also lead portfolio manager of the BlackRock Equity Dividend and value portfolios.

Copyright © BlackRock