by Scott DiMaggio, CFA, Co-Head—Fixed Income; Director—Global Fixed Income, Gershon M. Distenfeld, CFA, Co-Head—Fixed Income; Director—Credit, Matthew Sheridan, CFA, Lead Portfolio Manager—Income Strategies, AllianceBernstein

Striking the right balance between interest-rate and credit risk can be a good idea in the late stages of a credit cycle. We think it’s a particularly good idea in this credit cycle.

Why? Consider that over the last 18 months, investors have grappled with the swiftest tightening of global monetary policy in four decades and a banking crisis that claimed three regional US banks. Yet the American economy has so far managed to avoid contraction. Despite a persistently strong labor market, inflation has eased somewhat from its 40-year peak, though it remains high.

The Federal Reserve, meanwhile, says it is committed to pushing inflation back to the central bank’s long-term 2% target, and the longer that takes, the more likely recession becomes. Indeed, while the Fed held policy rates steady this month, it said it expected to raise them again later in the year.

A Bond Strategy for All Weathers

We suspect this will bring us closer to a turn in the US credit cycle. But pinpointing when this might happen—no easy task in the best of circumstances—is especially fraught in today’s market environment. That’s why we think the time is right for income-oriented investors to consider pairing government bonds and other interest-rate sensitive securities with growth-sensitive credit assets in a single, dynamically managed portfolio.

Both types of bonds are good at generating income—particularly now that inflation and tighter monetary policy have helped to drive yields higher. A diversified “barbell” strategy that balances interest-rate and credit risk allows investors to lean one way or the other at any given moment—an approach that we believe can deliver a high level of income with strong downside mitigation.

We think of it as an all-weather strategy, but now may be the ideal time to lift a barbell, particularly if growth slows enough in the coming months to warrant interest-rate cuts in 2024.

Rates and Risk: Moving in Opposite Directions

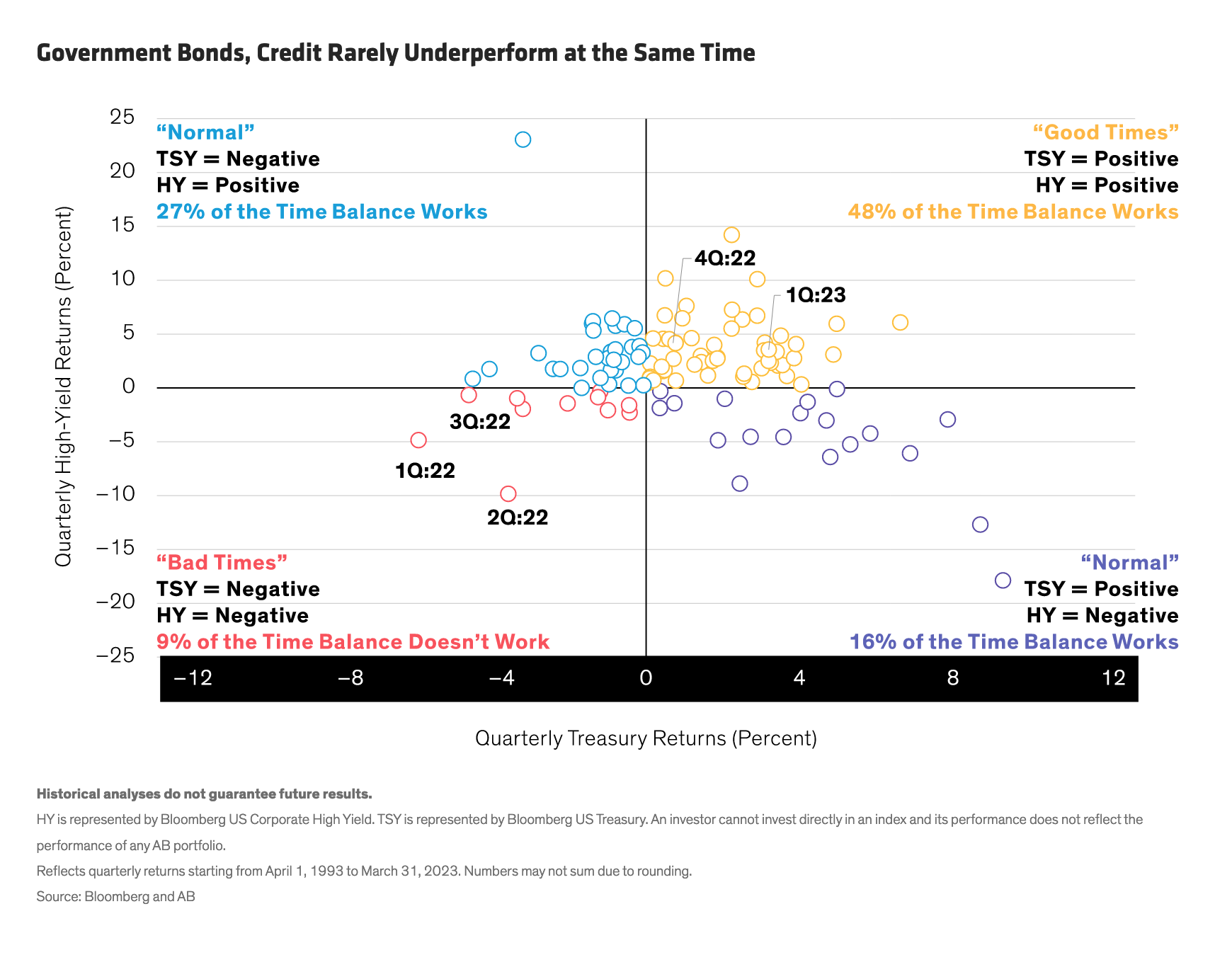

Credit barbells have traditionally worked because the two major types of bond risk tend to be negatively correlated. Government bonds typically do well when growth slows, inflation cools, and markets start bracing for lower interest rates. That has made them reliable diversifiers of higher-yielding corporate and emerging-market bonds, which like equities, shine brightest when growth is strong and rates are rising.

These relationships broke down in 2022 when the two fell in tandem. Some investors began to question whether the days of negative correlations were over. They weren’t. The relationship, as measured by government bonds and equities, was reestablished earlier this year (Display).

Over the longer run, we expect the historical pattern to reassert itself. Correlated selloffs of government bonds and credit assets have been exceedingly rare over the last 30 years. Yet even when the two types of assets do decline in tandem, a barbell strategy may help to minimize the damage. Those who segregate rate-sensitive and credit assets in different portfolios or entrust them to different managers may be tempted in such situations to sell—and lock in losses—in both.

To start with, we believe the credit cycle will begin to turn later this year as tighter monetary policy squeezes growth. If a recession starts to look likely, investors will want to maintain liquidity and a healthy dose of duration—a measure of sensitivity to changes in interest-rate levels. Government bonds do an excellent job of providing both.

At the same time, exposure to “spread sectors” such as high-yield bonds, select emerging-market corporate debt and commercial mortgage-backed securities can bring balance to a portfolio and allows managers to increase income potential. But with credit spreads currently below average, we believe it’s important to be especially cautious when it comes to CCC-rated corporate bonds, which would be particularly vulnerable in an economic downturn.

Today’s market conditions are challenging, particularly when compared to the extended low-volatility, low-rate environment that preceded the pandemic. When uncertainty is high, the best thing investors can do, in our view, is keep their powder dry and be prepared for multiple outcomes. We believe a balanced approach to income generation helps them do just that.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.