by Dirk Hofschire, CFA, Managing Director of Research; Jacob Weinstein, CFA, Research Analyst, Asset Allocation Research; Cait Dourney, CFA, Research Analyst, Asset Allocation Research; Fidelity Viewpoints

Taming inflation remains the challenge.

Key takeaways

- In the US, a slowdown in growth may be on the horizon, as suggested by leading indicators in the housing, manufacturing, and credit sectors. Tight labor markets have kept inflation elevated.

- The Chinese economy looks to be recovering from the recession it recently endured. Elsewhere, inflation and tightening monetary policy remain key risks.

- Focus on diversification and disciplined investing strategies to help weather elevated risks of market volatility. Fixed income and non-US stocks look relatively attractive.

United States

- The US is in the late-cycle expansion phase, with a rising likelihood of recession in the second half of 2023.

- While lagging indicators such as the unemployment rate are holding up, leading indicators in the housing, manufacturing, and credit sectors are signaling a growth slowdown.

- On the positive side, the consumer sector is supported by approximately $1 trillion in post-pandemic excess savings, and real wage growth is turning positive.

- The pace of inflation has meaningfully decelerated, helped by falling commodity prices and easing manufacturing supply-related pressures. However, tight labor markets have kept more persistent categories of inflation elevated, suggesting core inflation may remain at higher levels than experienced in recent decades.

- The Fed raised interest rates by 25 basis points in May but is likely close to the end of its rate hiking cycle. The central bank faces a difficult challenge in bringing core inflation back near its target without prompting a significant economic slowdown.

Global

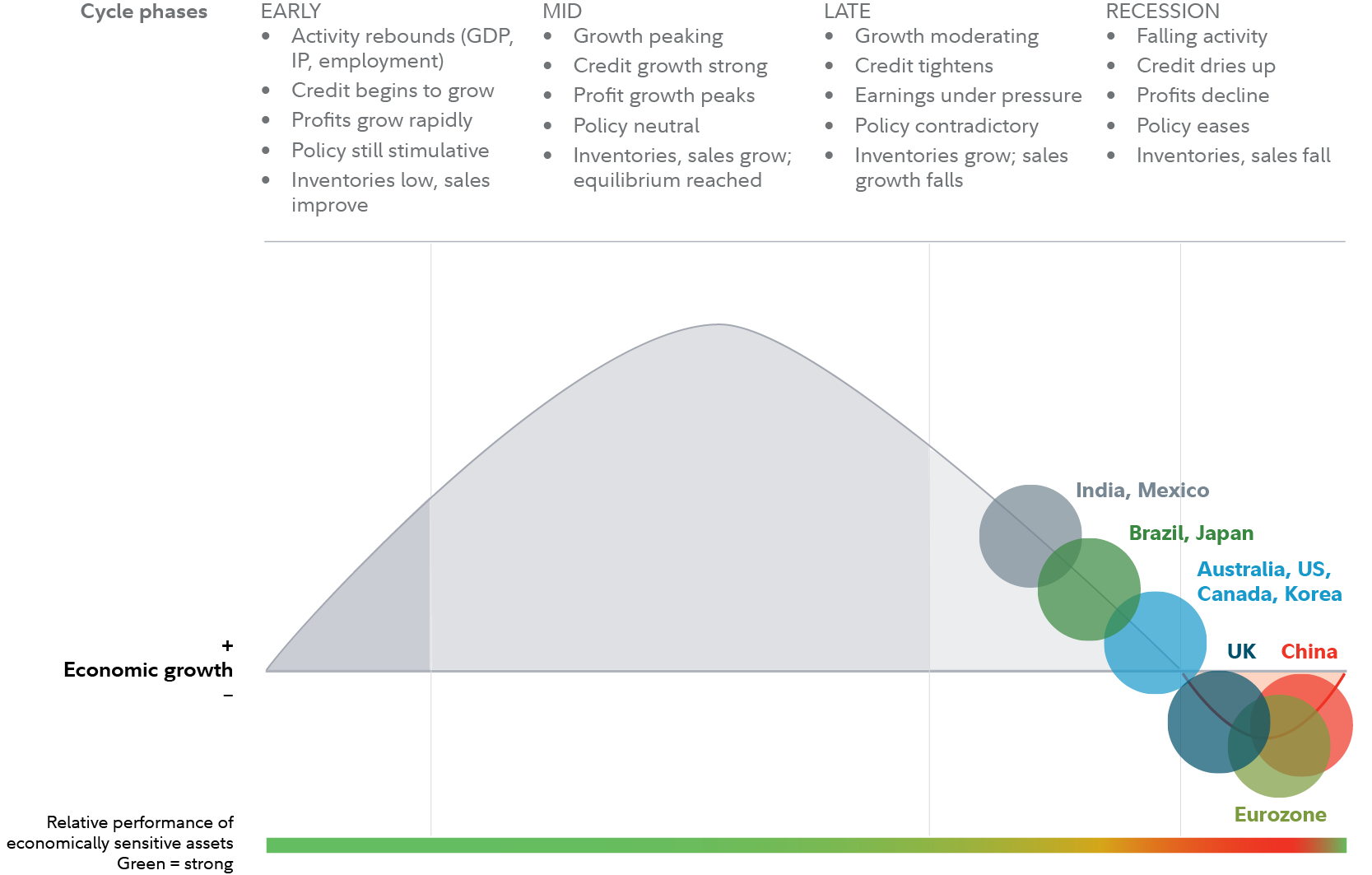

- The global business cycle backdrop is showing signs of desynchronization with economies experiencing both late and early-cycle dynamics

- In China, the ongoing post-COVID reopening and support from policymakers are contributing to an early cycle recovery.

- Europe’s warmer-than-typical weather and lower energy prices have reduced recessionary risk and boosted corporate and consumer confidence. Still, ongoing inflation pressures have kept the European Central Bank in a tightening mode, implying a late-cycle expansion rather than an early-cycle acceleration.

- Central banks in many economies are closer to the end of their hiking cycles than the beginning, but high inflation and continued monetary tightening remain key risks.

Asset allocation outlook

- The US late-cycle phase and rising recessionary risks warrant smaller active allocation positions with a focus on diversified and disciplined investment strategies.

- Slower liquidity growth, persistent inflation and recession risk, and greater monetary policy uncertainty raise the odds that market volatility will remain elevated.

- Some of these challenging dynamics have been priced into markets in the form of more attractive valuations, particularly in fixed income and non-US equities.

- The onset of recession typically implies a challenging time for riskier assets and outperformance of more-defensive categories. Still, recessions can also sow the seeds of greater investment opportunities once they are underway.

Business cycle framework

The business cycle, which is the pattern of cyclical fluctuations in an economy over a few years, can influence asset returns over an intermediate-term horizon. Cyclical allocation tilts are only one investment tool, and any adjustments should be considered within the context of long-term portfolio construction principles and strategic asset allocation positioning.

The diagram above is a hypothetical illustration of the business cycle, the pattern of cyclical fluctuations in an economy over a few years that can influence asset returns over an intermediate-term horizon. There is not always a chronological, linear progression among the phases of the business cycle, and there have been cycles when the economy has skipped a phase or retraced an earlier one. A growth recession is a significant decline in activity relative to a country’s long-term economic potential. Source: Fidelity Investments (AART), as of 05/05/2023.

Copyright © Fidelity Investments