Pre-opening Comments for Wednesday June 21st

U.S. equity index futures were lower this morning. S&P 500 futures were down 11 points at 8:35 AM EDT.

Focus today is on Federal Reserve Chairman Powell’s Congressional testimony on U.S. monetary policy starting at 10:00 AM EDT.

The Canadian Dollar added $0.05 to US76.67 cents after release of Canada’s April Retail Sales at 8:30 AM EDT. Consensus was an increase of 0.4%. Actual was an increase of 1.1%.

FedEx dropped $7.40 to $224.25 after reporting less than consensus fiscal fourth quarter results. The company also lowered fiscal first quarter guidance.

La-Z-Boy dropped $1.11 to $26.35 after reporting less than consensus fiscal fourth quarter results. The company also lowered fiscal first quarter guidance.

Patterson Companies advanced $2.44 to $30.68 after reporting higher than consensus fiscal fourth quarter results. The company also offered positive guidance.

Winnebago dropped $2.08 to $62.10 after reporting lower than consensus fiscal third quarter revenues.

EquityClock’s Daily Comment

Headline reads “Emerging market equities presenting a rotation candidate as they start to move higher from bottoming patterns”.

http://www.equityclock.com/2023/06/20/stock-market-outlook-for-june-21-2023/

Technical Notes

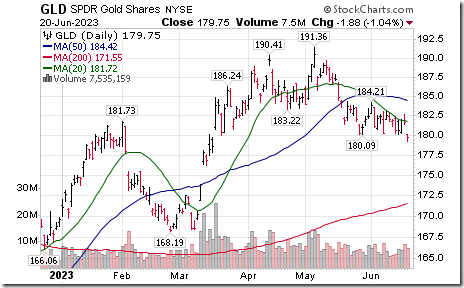

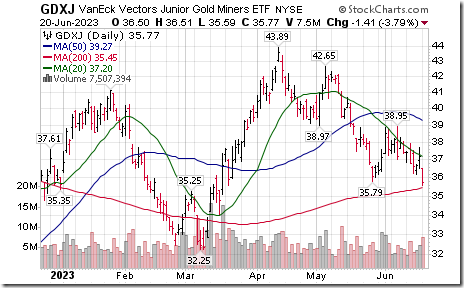

Gold and gold related equities and Exchange Traded Funds dominated the list of securities moving below support extending intermediate downtrends. Among well-known ETFs, GLD moved below $180.09 and GDXJ moved below $35.79.

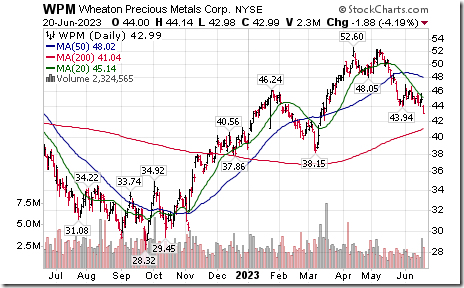

Gold equities in the TSX 60 moving below support and extending intermediate downtrends included ABX.TO, WPM, FNV and AEM.

Canadian Natural Resources $CNQ.TO a TSX 60 stock moved below Cdn$71.92 extending an intermediate downtrend.

CCL Industries $CCL.B.TO a TSX 60 stock moved below Cdn$61.28 extending an intermediate downtrend.

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for June 20th 2023

Green: Increase from previous day

Red: Decrease from previous day

Commodities

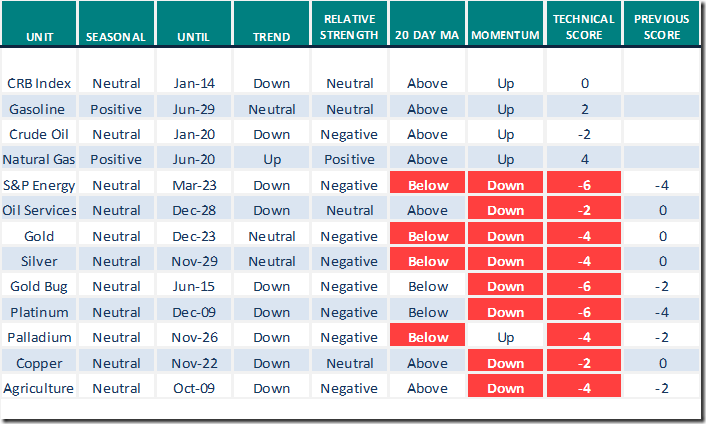

Daily Seasonal/Technical Commodities Trends for June 20th 2023

Green: Increase from previous day

Red: Decrease from previous day

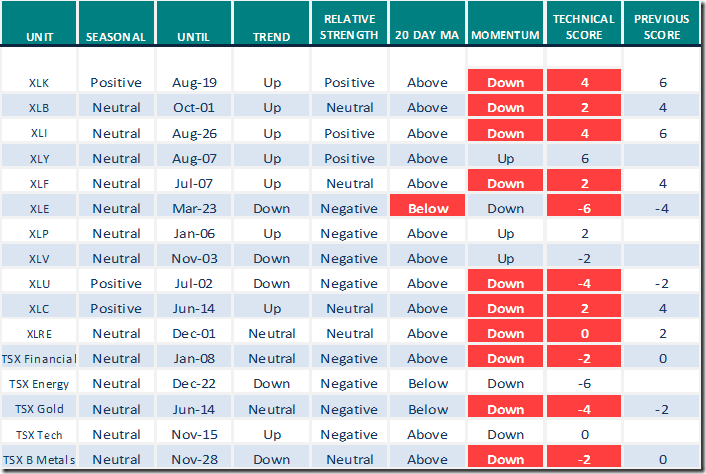

Sectors

Daily Seasonal/Technical Sector Trends for June 20th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

Links offered by valued providers

CAUTION Is This Week’s Word | Tom Bowley | Trading Places (06.20.23)

CAUTION Is This Week’s Word | Tom Bowley | Trading Places (06.20.23) – YouTube

Are Equities Overheated? | Greg Harmon, CMT | Your Daily Five (06.20.23)

Are Equities Overheated? | Greg Harmon, CMT | Your Daily Five (06.20.23) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 5.80 to 64.40. It remains Overbought. Daily trend has started to roll over.

The long term Barometer dropped 4.20 to 61.50. It remains Overbought. Daily trend has started to roll over.

TSX Momentum Barometers

The intermediate term Barometer dropped 5.17 to 32.76. It became oversold on Monday on a move below 40.00.

The long term Barometer dropped 4.74 to 46.55. It remains Neutral. Daily trend is down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed