Pre-opening Comments for Tuesday June 13th

U.S. equity index futures were higher this morning. S&P 500 futures were up 9 points at 8:35 AM EDT.

Index futures moved higher following release of the May U.S. Consumer Price Index at 8:30 AM EDT Consensus was an increase 0.1% versus a gain of 0.4% in April. Actual was an increase of 0.1%. On a year-over year basis, consensus was an increase of 4.0% versus a gain of 4.9% in April. Actual was an increase of 4.0%. Excluding food and energy, consensus was an increase 0.4% versus a gain of 0.4% in April. Actual was an increase of 0.4%. On a year-over-year basis, consensus was an increase of 5.3% versus a gain of 5.6% in April. Actual was an increase of 5.3%.

Oracle advanced $3.94 to $120.47 after reporting higher than consensus fiscal fourth quarter revenues and earnings. Stifel Nicolaus raised its target price from $84 to $120. Mizuho raised its target price from $116 to $150.

Accenture added $0.70 to $312.18 after announcing plans to spend $3 billion during the next three years on development of Artificial Intelligence.

Bunge slipped $1.79 to $92.00 following purchase of Viterra in a cash and share deal valued at US$6.3 billion.

EquityClock’s Daily Comment

Headline reads “Metal prices are in focus as we prepare for the period of seasonal strength that runs through the month of July”.

http://www.equityclock.com/2023/06/12/stock-market-outlook-for-june-13-2023/

Technical Notes

S&P 500 Index moved above 4,325.28 reaching a 14 month high.

Israel iShares $EIS moved above $55.67 completing a double bottom pattern.

Boeing $BA a Dow Jones Industrial Average stock moved above $221.33 extending an intermediate uptrend. A good example of an industrial stock with an improving technical profile! Other aerospace & defense equities and ETFs (PPA, ITA) also are starting to show an improving technical profile

DexCom $DXCM a NASDAQ 100 stock moved above $126.44 extending an intermediate uptrend.

Biogen $BIIB a NASDAQ 100 stock moved above $$319.74 extending an intermediate uptrend. Strength in Biogen was a major reason for strength in related ETFs including IBB, BBH and XBI.

Trader’s Corner

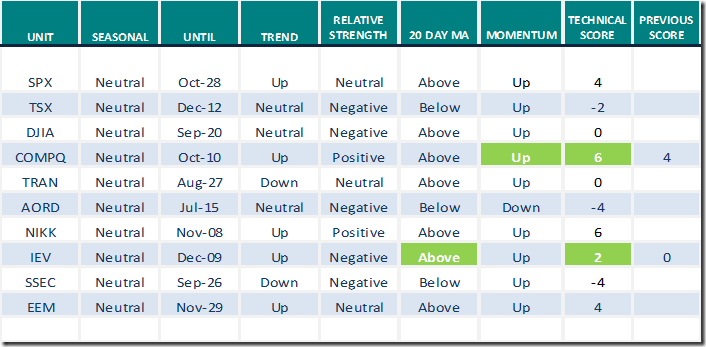

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for June 12th 2023

Green: Increase from previous day

Red: Decrease from previous day

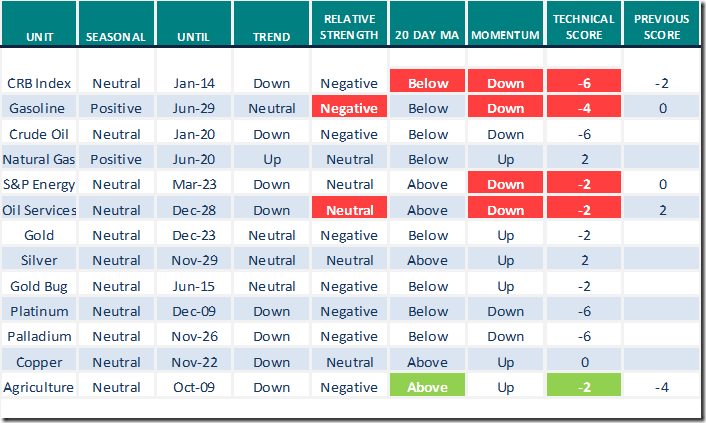

Commodities

Daily Seasonal/Technical Commodities Trends for June 12th 2023

Green: Increase from previous day

Red: Decrease from previous day

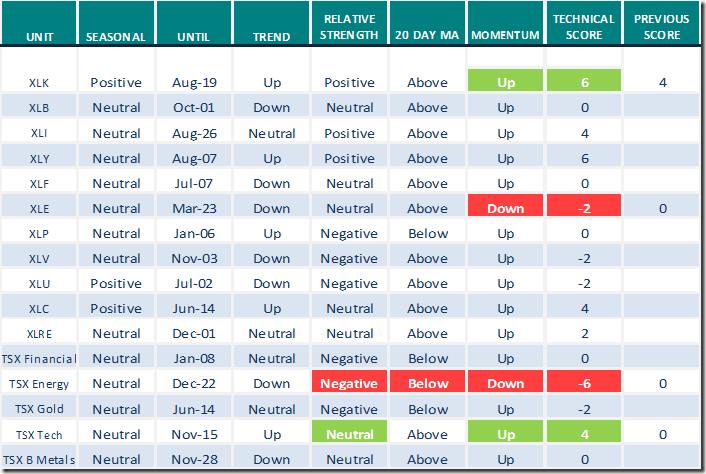

Sectors

Daily Seasonal/Technical Sector Trends for June 12th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

S&P 500 Momentum Barometers

The intermediate term Barometer added 1.20 to 58.40. It remains Neutral.

The long term Barometer added 0.60 to 58.00. It remains Neutral. Daily trend remains up.

TSX Momentum Barometers

The intermediate term Barometer was unchanged at 36.21. It remains Oversold.

The long term Barometer slipped 0.43 to 50.43. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed