by Tony Davidow, CIMA®, Senior Alternatives Investment Strategist, Franklin Templeton Institute

The collapse of Silicon Valley Bank will likely lead to tighter credit conditions as banks pull back from lending. Private credit managers are poised to fill the void that banks have left, and can negotiate favorable terms, according to Franklin Templeton Institute’s Tony Davidow.

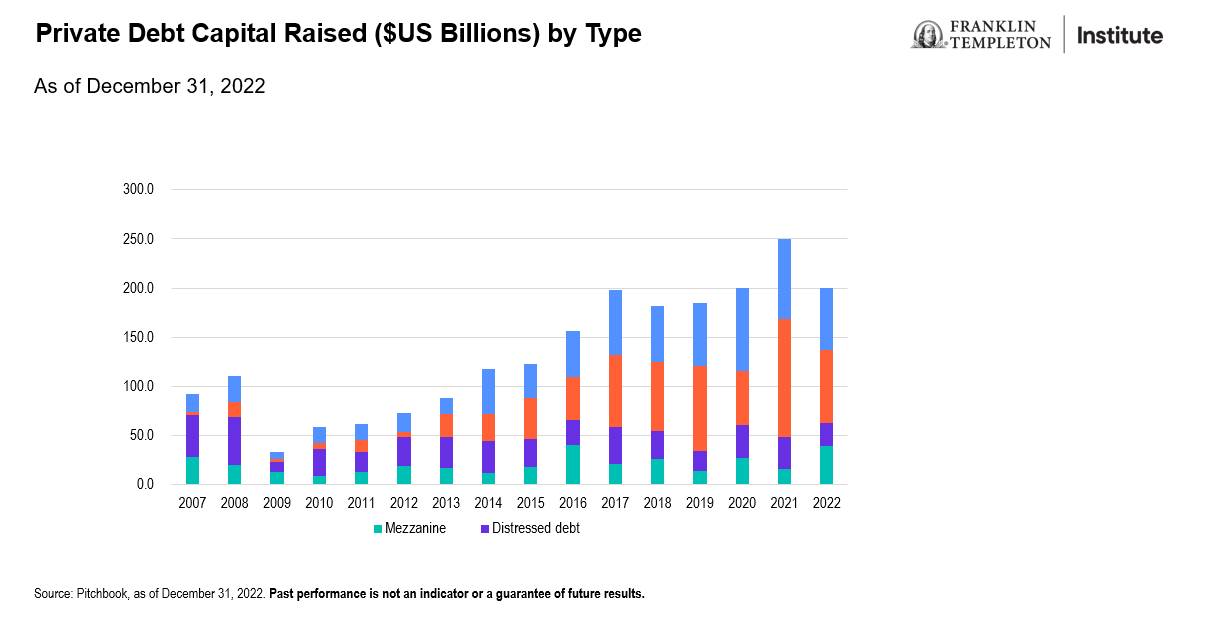

After the 2008 global financial crisis (GFC), where banks retrenched from lending to small-middle market opportunities, private credit managers stepped in to fill the void, leading to the extraordinary growth of the asset class. As the data below illustrates, private credit (debt) grew dramatically from 2009 through 2022, with diversified growth across direct lending, mezzanine and distressed.

Private credit has been a growing allocation for institutions and family offices due to its attractive risk-adjusted returns, high income potential and inflation hedging.1 And, recently through product innovation, private credit is now available to a broader group of investors, at lower minimums, and with more flexible features. It is estimated that most private credit is floating rate, and the asset class delivered positive returns in 2022, as the coupon rate adjusted as rates rose throughout the year.2

We see parallels to the post-GFC market environment, where private credit managers stepped in to fill the void traditional banks had left. In a post-Silicon Valley Bank market environment, private credit managers will have the upper hand in negotiating favorable pricing, terms and covenants. During the last several years, with growing competition for deal flow, there was an increasing amount of “covenant-lite” deals. Now, private credit managers have the leverage to negotiate favorable terms and covenants.

Looking ahead, we anticipate seeing a larger dispersion of return between experienced managers who can navigate the challenging environment, and those whose only experience is investing capital during an easy money environment, with low default rates. Even if default rates rise, we believe seasoned managers, with experienced workout teams, should be able to renegotiate terms.

In today’s market environment, private credit managers can be more selective in deploying capital. Like the post-GFC environment, the pendulum has switched to favor lenders in these tight credit conditions. Experienced private credit managers should be able to effectively navigate these challenging conditions in an effort to generate favorable outcomes.

Copyright © Franklin Templeton Investments