by Dan Suzuki, CFA, Deputy CIO

Characteristics of a new bull market

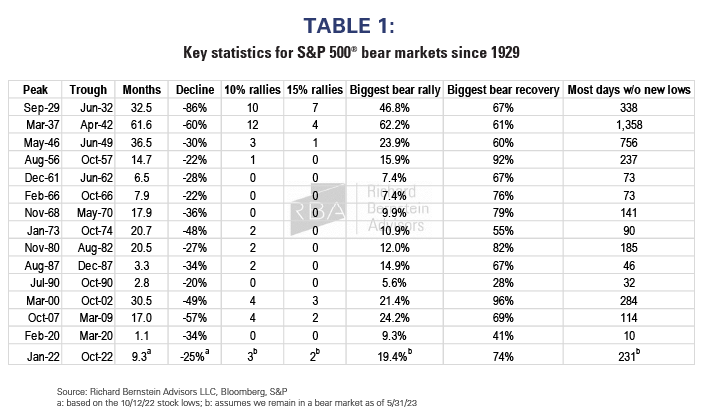

It has been over seven months since the October lows, and during this time, the S&P 500® has rallied over 19%. Naturally, investors are pondering whether this marks the beginning of a new bull market. In this report, we aim to take an objective approach to determine if historical patterns can guide us in assessing the current situation. Spoiler alert: While it is certainly possible for this rally to evolve into a full-fledged bull market, historical precedent suggests it is far from a foregone conclusion. Here are some key takeaways from history:

-

No definitive technical thresholds: There are no specific technical indicators that serve as magical signals for a new bull market. It is not as simple as crossing a specific threshold to confirm the start of a bull market.

-

Breadth indicates strength: A broad-based rally with a wide range of sectors and stocks participating indicates a stronger foundation for a potential bull market.

-

The market leadership of bounces tends to be backward looking: The composition of a market bounce primarily reveals information about the past rather than the future.

-

Fundamentals matter: Rallies cannot transform into bull markets without support from underlying fundamentals.

This would not be an unprecedented start of a bull market or a bear market rally

Bear market rallies are relatively common occurrences. Putting aside the pandemic bear market in 2020 — which only lasted 23 trading days — the 2000 and 2007 bear markets each experienced four bear rallies of 10% or more, including some rallies of over 20% in both periods. In fact, the current 19% rally from the October lows is not much greater than the rally observed just last summer. Although seven months is a considerable duration since the 2022 lows, five of the past 14 bear markets since 1929 had longer periods between new lows being reached. It appears there are no magic levels or stop clocks that ring in the new bull market (Table 1).

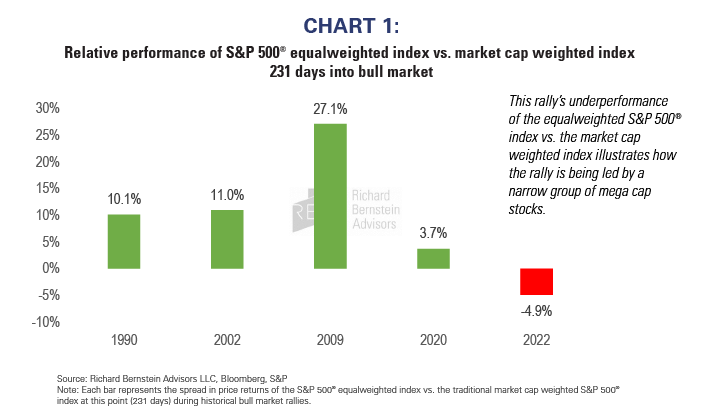

But bad breadth is never a good thing

The narrow breadth of this rally raises technical concerns. Historically, bull markets have often commenced with broad participation across various sectors, but the current rally does not exhibit this characteristic. In fact, this would be the first bull market since at least 1990 to begin with the market cap-weighted S&P 500® index outperforming the equalweighted index (Chart 1).

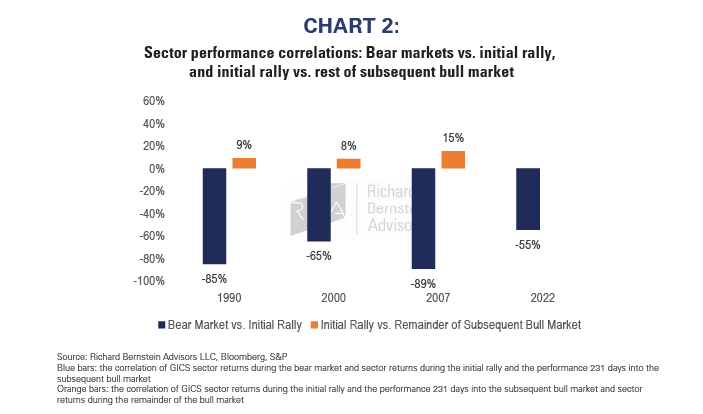

The sector composition of a market bounce says more about the past than the future

Investors would be wise not to read too much into the sector leadership of the initial market bounces. Sector leadership in these rallies tends to merely be a reversal of the preceding drawdown (indicated in the chart below by the large negative correlations in blue) and has historically had no relationship with what worked throughout the remainder of the bull market (small positive correlations in orange). Based on history, it is unsurprising that this year’s big winners (Tech and Comm Services) were last year’s big losers and that this year’s big losers (Energy and Health Care) were last year’s big winners. It would also be quite normal for the sector leadership of the upcoming cycle to look quite different from the rally we have seen thus far.

Chart 2 below shows the correlation between sectors’ performances during bear markets and during the first 231 days of a rebound (blue line). Big negative bars suggest leadership changed significantly during the subsequent rally and was the opposite of the leadership during the preceding bear market. The orange bars show the correlation between sector performance during the initial 231-day rally and the performance for the remainder of the bull market. The small orange bars suggest the leadership of the initial rally had virtually no relationship with the sector performance during the remainder of a bull market.

Ultimately, rallies need fundamentals in order to bloom into bull markets

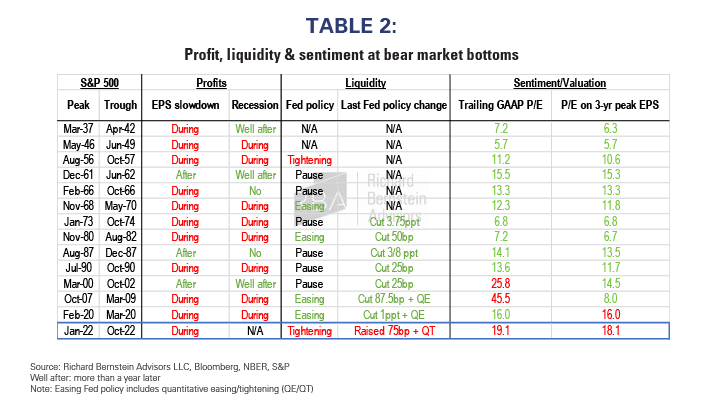

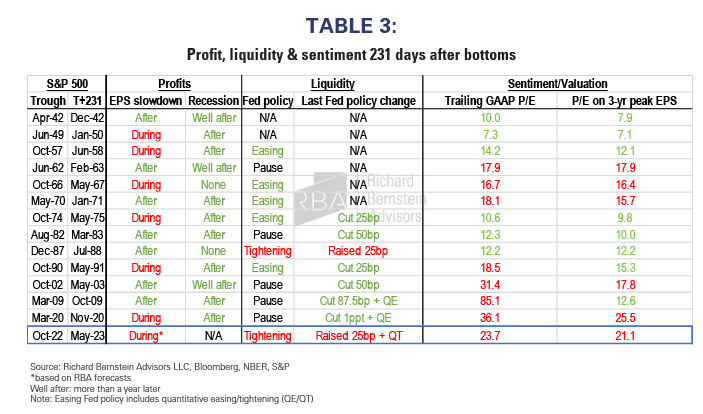

While historical technical statistics are interesting to discuss, at RBA, we believe that fundamentals ultimately drive market performance. Corporate profits, liquidity, and sentiment/valuation are the primary factors influencing market trends over time. A sustained market rally requires support from at least one, if not a combination, of these factors. The table below provides an overview of the prevailing macroeconomic conditions at bear market bottoms (Table 2) and 231 days into a new bull market (Table 3). It is important to note that this table is not exhaustive and does not include factors such as fiscal policy (e.g. TARP or PPP), bank lending standards or investor positioning, but still offers a general understanding of the circumstances surrounding historical market bottoms.

Investors always try to anticipate troughs in fundamentals, and the times they get it wrong turn out to be the bear market rallies discussed earlier in this piece. But investors also get it right sometimes, and thus it’s not surprising that the market has historically tended to bottom before earnings growth reaches its trough. Nevertheless, when the markets have bottomed in the absence of earnings support, there has always been significant support from either liquidity or sentiment/valuation (typically both) to pick up the slack:

-

Fed policy was more difficult to characterize before the Fed began targeting the Fed funds rate in the 1970s, but since then every bull market has begun with easing Fed policy.

-

Prior to the Internet Bubble, every bull market began with a trailing GAAP P/E multiple below the historical median of 16.6x.

-

Up until the pandemic, every bull market started with a P/E ratio on the prior peak EPS below the historical median of 15.4x.

The current rally may indeed be the early stages of a bull market, but this would truly be an unprecedented beginning without some signs of improving profit fundamentals, increasing liquidity or much cheaper valuations.