by Frank Holmes, CEO, CIO, U.S. Global Investors

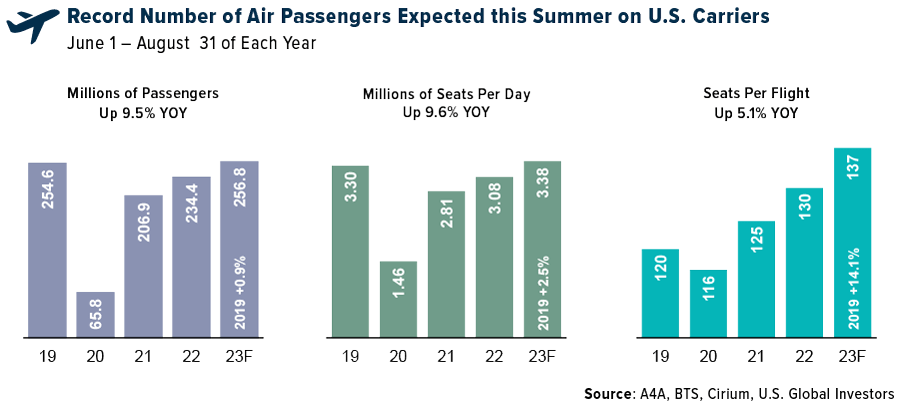

If current forecasts are accurate, this summer could mark a historic high in airline passenger volumes. The industry group Airlines for America (A4A) predicts that approximately 257 million people will travel on U.S. commercial airlines from June 1 to August 31, representing a 9.5% increase from the previous summer. That would also set a new record, as volumes are projected to surpass summer 2019 levels by around 2 million passengers.

To meet demand, airlines will employ larger aircraft and increase capacity by adding approximately 297,000 seats per day. Airlines for America (A4A) expects the daily average of seats this summer will reach nearly 3.4 million, an increase from 3.3 million per day during the summer of 2019. This translates to an estimated 137 seats per flight, representing a 14% rise compared to four years ago.

Memorial Day weekend is typically viewed as the informal launch of the busy summer travel season, and this year was no different. According to data from the Transportation Security Administration (TSA), some 9.8 million people flew on commercial airlines in the U.S. from Friday to Monday of the previous week. This figure is slightly higher than the 9.7 million who traveled during the same holiday weekend in 2019.

Rise in Leisure Travel Offsets Slow Recovery of Business Travel

I should point out that we’re seeing these new record volumes despite the fact that business travel has yet to recover to pre-pandemic levels.

Leisure travel, though, is hot right now, even with recession storm clouds gathering over the horizon. A survey conducted in late April and early May by luxury retailer Saks found that more than three quarters (77%) of American adults had plans to book or had already booked a trip in the next three months. Of those, 74% said they would buy luxury items during their trip.

American Airlines Raises Q2 Guidance Amid Strong Demand and Lower Fuel Costs

American Airlines, the world’s largest airline by passengers carried, upgraded its guidance for the second quarter based on what it sees as “continued strength in the demand environment.” In a regulatory filing this week, American said it now forecasts quarterly earnings per share to fall within the $1.45 to $1.65 range, an increase from its previous estimate of $1.20 to $1.40 per share.

The revision is based on not only stronger-than-expected demand but also lower fuel costs. The carrier estimates it paid between $2.55 and $2.65 per gallon on average during the quarter, or $0.10 less per gallon than its initial forecast. Fuel consumption is also down compared to years past since American is flying larger aircraft that can accommodate more passengers per flight; this approach is more efficient than operating smaller jets with fewer passengers.

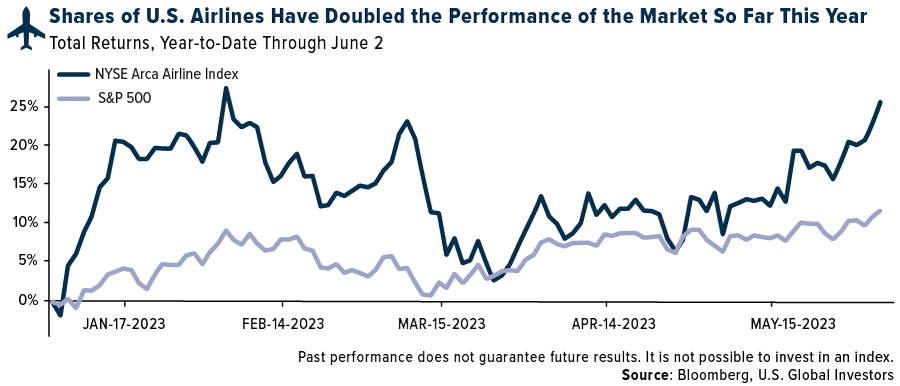

Investors appear to have recognized airlines’ versatility and ability to raise capacity to meet demand. Shares of U.S. airlines have soared more than 27% so far this year, more than double what the S&P 500 has returned. Standout performers include United Airlines, up 27% for the year, and American, up 17%. Among the Big Four carriers, Southwest Airlines is the only one to trade in the red, as it continues to face challenges after its network meltdown during Christmas 2022.

Depressed PMIs, Falling Commodity Prices and Election-Year Investment Prospects

A possible headwind to continued economic growth could be the depressed purchasing manager’s indexes (PMIs). In May, the Eurozone Manufacturing PMI fell to 44.8 from 45.8 in April, the steepest contraction in three years. The U.S. Manufacturing PMI also shrank in May, sliding to 48.4 from a neutral 50.2 in April. The JPMorgan Global Manufacturing PMI recorded 49.6, just below the threshold and little changed from March to April.

China was the only major economy to report month-on-month expansion in its manufacturing sector. The Caixin PMI of private Chinese firms was 50.9 in May, marking the first positive reading in three months. (China’s official state-run PMI, however, fell to 48.8 in May.)

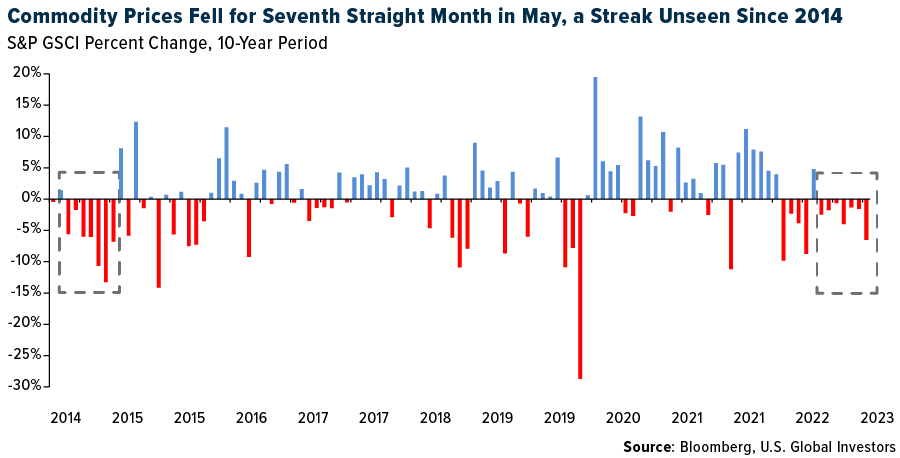

Widespread manufacturing weakness helps explain why commodity prices have plunged this year. The energy-heavy S&P GSCI lost ground for the seventh straight month in May, a streak we haven’t seen since 2014 when oil collapsed. Year-to-date, the index of raw materials is down nearly 12%.

The drop in commodity prices is obviously good for consumers as well as companies, particularly those involved in shipping and transportation.

I believe it could also be good for investors. The 2024 elections occur in 17 months. President Joe Biden’s approval rating currently stands in the high 30s and low 40s, and Congress’s is even lower at around 16%, according to the latest Gallup poll. To appeal to voters, elected officials may be more inclined to pass and enact legislation that would ignite growth and drive demand, which in turn would support asset prices.

Reflecting on Meritocracy: The U.S. Commitment to Rewarding Excellence

On a final note, I want to reflect on my admiration of the country and culture I’m privileged to call home. I don’t know how many of you tuned into the Scripps Spelling Bee, but it got me thinking about the United States and, more specifically, meritocracy.

Although many other countries have their own national spelling bees, I’m not sure if they’re broadcast or generate as much attention as the contest in the U.S. does. A lot of this has to do, I assume, with how notoriously difficult English words are to spell compared to other languages. But beyond that, America—more so than any country that I know of—rewards and recognizes merit, from superhuman athletes to skilled money managers to phenomenal spellers.

When a society is based on merit and persistence, as it is in the U.S., it creates an environment where competition and innovation can flourish. It’s no accident that, of the top 20 largest public companies by market cap, 15 are American.

Let’s hope that future generations remain committed to the principles of merit that have made the U.S. the greatest nation in history.