by Larry Adam, CIO, Raymond James

Choppiness in the equity market continues as investors look to see a debt limit deal approved.

Though the markets remained optimistic about the chance for a bipartisan deal on extending the federal debt limit, May was nonetheless a time of waiting and seeing, extending a streak of equity market choppiness into a second month.

Affirmation came during the Memorial Day weekend with the White House and House leadership announcing a deal to ensure the government continues to pay its debt. Despite a list of legislators pledging to vote No, the deal is expected to pass, averting a jump into the unknown.

Meanwhile, underneath the political drama, the domestic economy remained stronger than expected. As has been the case during this period of inflation, news that appears good at first glance often has an asterisk. Personal consumption expenditures were higher than expected in April – a sign of economic confidence – though real disposable personal income remained flat on account of higher-than-expected inflation, meaning Americans had to dip into savings to spend.

The prevailing view has been that after its last interest rate increase in early May the Federal Reserve (Fed) would hold the line on its inflation-fighting strategy. However, if May’s inflation performance, once tallied, resembles April’s, the Fed could be spurred to take another step on the baseline interest rate. This seems unlikely considering other evidence that the economy is slowing down, but it is a possibility that could drag at the performance of the equity market.

“These conflicting signals have added uncertainty to the Fed’s rate path,” said Raymond James Chief Investment Officer Larry Adam. “With many Fed officials still favoring rate hikes, market expectations for rate cuts in the second half of 2023 have faded.”

Elsewhere in the economy, the number of existing homes sold declined in April. Owners may be seeing their existing homes (with pre-2021, low-rate, fixed-interest notes) with kinder eyes. New home sales increased, though prices declined for the first time in several months – likely reflecting bottom-line math with the current cost of borrowing.

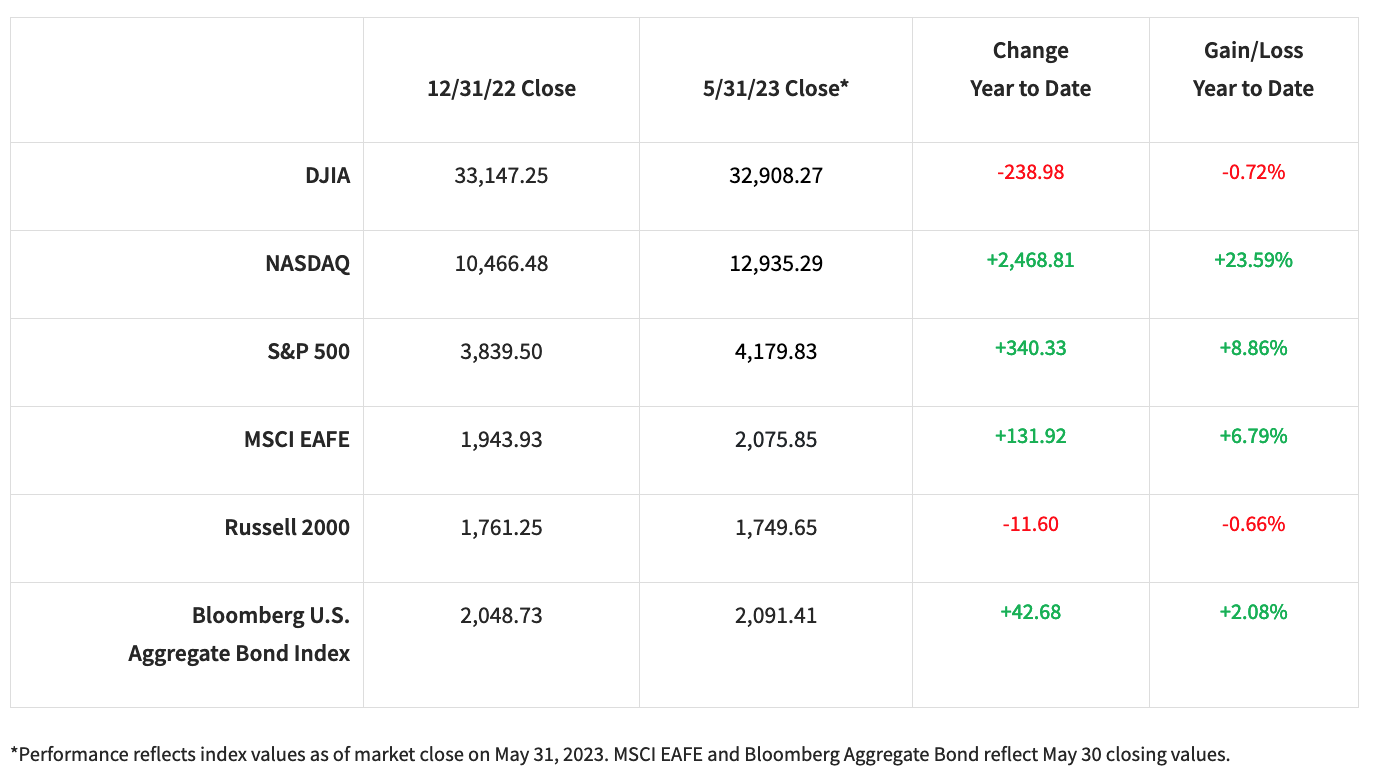

Before we look further into the debt ceiling deal and at other topics of interest, let’s look at the major indices’ year-to-date standings.

Inside the debt limit deal

Key components of the bill to extend the U.S. government’s debt limit is the raising of the debt limit through January 2025, cuts to non-defense discretionary spending, energy permitting reforms, enhanced work requirements, reduced IRS funding and the taking back of unspent COVID funding. Overall, the deal can be seen as a market positive as it avoids default and the energy reforms aid energy independence.

Weaker yen, stronger equities

Amid several strongly performing international equity markets, Japan’s stands out, with the Topix index hitting its highest level since 1990 and the Nikkei 225 recovering its position and surpassing 30,000. Two events have contributed:

- The preliminary estimate of the first quarter’s real gross domestic product was higher than expected.

- The yen has depreciated against the dollar, making exports relatively more attractive to foreign markets and imports less attractive to domestic consumers.

This has boosted expectations for corporate earnings at a time when those same expectations in both the United States and Europe have been under pressure. Despite the stock market’s strength, company valuation metrics confirm that Japanese equities are, in aggregate, still more lowly rated relative to other developed markets.

Eurozone monetary leaders set clear path

European Central Bank President Christine Lagarde made it clear that barring any unforeseen eventuality, the bank would continue to raise key interest rates to fight inflation. This direct messaging strategy has enabled regional financial institutions to price for higher eventual rates, which may avoid creating weakness in the banking sector.

Demand leads oil into pricing lows

Oil prices ended May near their year-to-date lows, following weeks of downbeat headlines about monetary tightening and macroeconomic slowdown around the world. OPEC’s production cut, announced in March, has seemingly been forgotten, as the oil market is laser-focused on demand rather than supply. Still, the industry is entering the season where Alberta wildfires or Gulf hurricanes are more likely to disrupt supply, which could reverse the price downtrend.

Bond market rides the waves

The bond market tone, related to anticipating Fed activity and as measured by the Fed Funds future, uncovered a rolling uncertainty on policy reversal. Treasury rates have rallied and declined in a unified trend, while corporate yields remain desirable in the short to intermediate range, despite insignificant spread change. Municipal bond yields have caught up some relative to other fixed income sectors boosting investor interest and 10-year AAA municipal yields shifted 16 basis points cheaper over the month.

The bottom line

We closed May with an apparent deal to end the latest chapter of political-economic brinkmanship, which is good news, and stronger than expected economic data, which is mixed news. In the continuing churn of a market, we also got a better picture of how a small sliver of ultra-sized technology firms have been responsible for nearly all year-to-date growth reflected in the S&P 500’s value.

As uncertainty fades, we may see those firms’ values drain into more economically sensitive sectors, which presents a risk to treating these mega tech stocks as safe harbors. Long term, the markets seem poised to return to strength, which presents opportunities, but short-term pain could very well precede that return.

Investing involves risk, and investors may incur a profit or a loss. All expressions of opinion reflect the judgment of the authors and are subject to change. There is no assurance the trends mentioned will continue or that the forecasts discussed will be realized. Past performance may not be indicative of future results. Economic and market conditions are subject to change. The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The NASDAQ Composite Index is an unmanaged index of all common stocks listed on the NASDAQ National Stock Market. The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI EAFE (Europe, Australasia and Far East) index is an unmanaged index that is generally considered representative of the international stock market. The Russell 2000 is an unmanaged index of small-cap securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The Nikkei 225 is an unmanaged index of the 225 largest publicly traded Japanese companies listed on the Tokyo Stock Exchange. Topix, the Tokyo Stock Price Index, is an unmanaged index of all domestic companies listed on the Tokyo Stock Exchange under its Prime market division. An investment cannot be made in these indexes. The performance mentioned does not include fees and charges, which would reduce an investor’s returns. Investing in the energy sector involves special risks, including the potential adverse effects of state and federal regulation, and may not be suitable for all investors. Investing in commodities is generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

Material created by Raymond James for use by its advisors.