by Liz Ann Sonders, Chief Investment Strategist, Charles Schwab & Company Ltd.

With unanimity, the Federal Open Market Committee raised the fed funds rate by 25 basis points in May and signaled that further tightening will depend on various economic factors.

Pre-GFC rates…at long last

Disconnect: a pause is not a pivot

Market behavior anything but "typical"

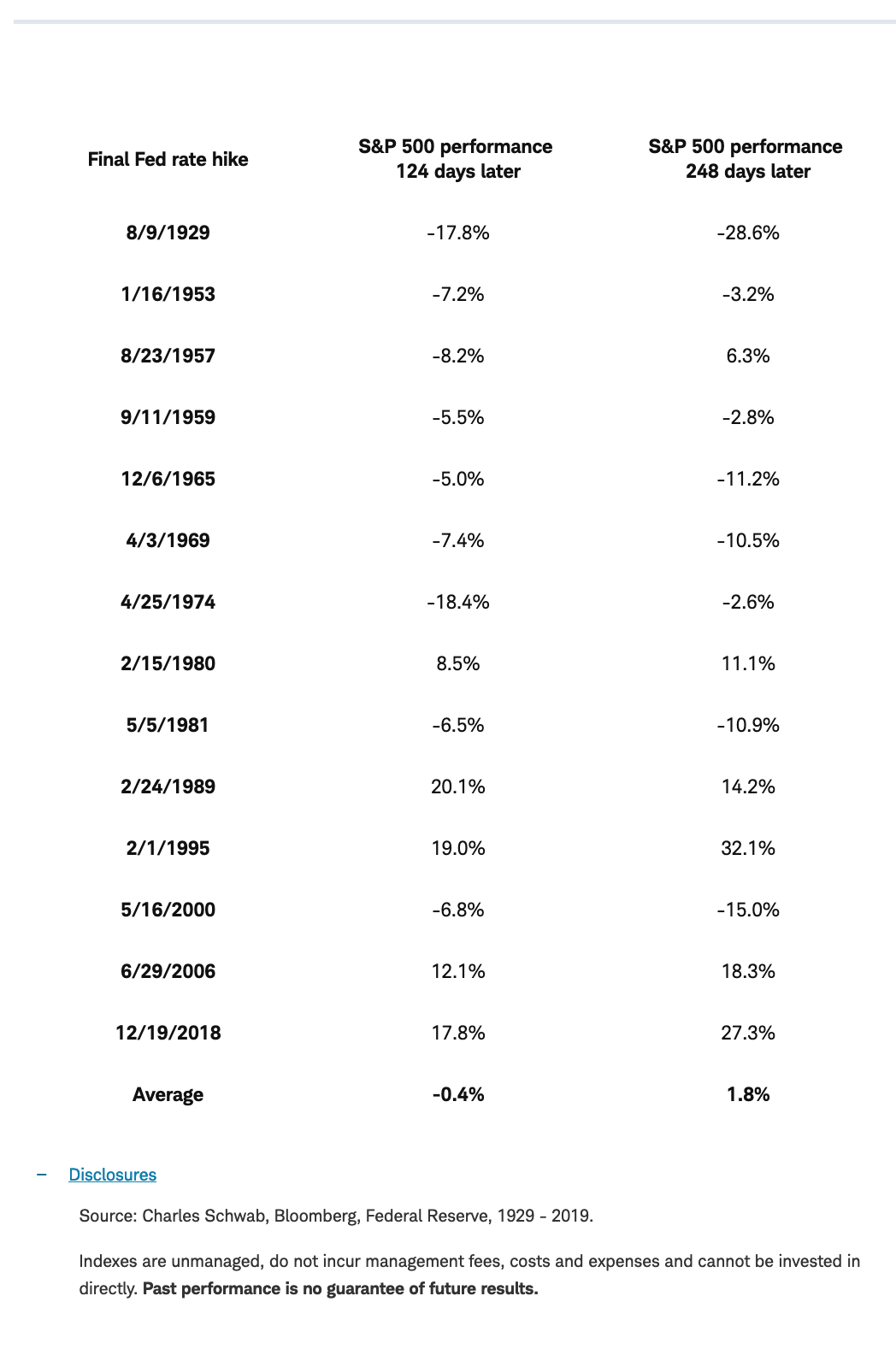

The accompanying table below details each cycle, with the date of the final hike, along with S&P 500 performance at the six-month and one-year points. Pattern? Not so much. This highlights that there are always myriad influences on market behavior—not just monetary policy. But it also reinforces one of my favorite admonitions: "Analysis of an average can lead to average analysis." While penning this commentary, I saw several headlines that flashed something along the lines of "typically, the final rate hike has been a positive for stocks"… there is no "typical" when it comes to this analysis.

What history says about final rate hikes

Source: Charles Schwab, Bloomberg, Federal Reserve, 1929-2019.

Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Source: Charles Schwab, Bloomberg, Federal Reserve, 1929-2019.

Green shading represents best historical performance before and after last Fed rate hike. Red shading represents worst historical performance before and after last Fed rate hike. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance does not guarantee future results.

Presser pressure

- Out of the blocks, although Powell noted the "meaningful change" in the statement's language, he said a "decision on a pause" was not made today.

- The Fed's staff continues to forecast a "mild" recession (note: it is historically rare for the FOMC's members to specifically use the "R" word); but Powell did push back on that forecast a bit.

- Powell reiterated that the debt ceiling should be raised "in a timely way" and that the consequences of default to the U.S. economy would be highly uncertain and could be "quite adverse."

- Past language was repeated that "nobody should assume" the Fed can protect the economy from the effects of a failure to raise the debt limit; but also mentioned that the risk did not impact the Fed's decision today (although they discussed the risks associated with a default).

- On the labor market, noted was the balance between labor supply and demand coming into better balance, with the prime age participation rate increasing and job vacancies falling; but Powell was clear that the "labor market is still very tight."

- When asked about the recent purchase of First Republic by JPMorgan, Powell said it was "actually a good outcome for the banking system" and that the law says the FDIC is bound to take the least-cost bid, and that he "assumes that's what happened."

- Powell said it's difficult to know how significantly tighter credit conditions would translate into the equivalent of rate hikes; and that "how long credit will be tighter is uncertain"…but that policymakers will take that into account in deciding on rates.

- As for whether the fed funds rate is now "sufficiently restrictive," Powell said it's not possible to have confidence that it's there yet and that "before we really declare that" the Fed would need to see data "accumulate."

- "Policy is tight," given it's notably above expectations of the neutral rate; while adding in the impact of quantitative tightening (QT), it suggests rates are "possibly at" a sufficiently restrictive level.

- In response to multiple questions about recession risk, Powell uttered the words that are often characterized as "dangerous": "It's possible that this time is really different."