Pre-opening Comments for Tuesday May 2nd

U.S. equity index futures were lower this morning. S&P 500 futures were down 11 points at 8:30 AM EDT.

President Biden has called for a meeting on May 9th with Congressional leaders to discuss the Federal government debt limit. Treasury secretary Janet Yellen noted that the debt limit could be breached as early as June 1st.

Blackberry gained $0.24 to US$4.22 after weighing plans to separate some of its business divisions into new entities.

Chegg plunged $6.28 to $11.32 after lowering guidance for second quarter revenues. JP Morgan lowered its target price from $19 to $14.

MGM Resorts added $0.33 to $46.37 after announcing higher than consensus first quarter results.

Stryker dropped $14.89 to $285.00 after reporting less than consensus first quarter earnings.

EquityClock’s Daily Comment

Headline reads “US Dollar Index showing a double bottom at the February low, a technical event that should concern equity investors”.

http://www.equityclock.com/2023/05/01/stock-market-outlook-for-may-2-2023/

Technical Notes

S&P 500 SPDRs $SPY briefly moved above $416.72 extending an intermediate uptrend.

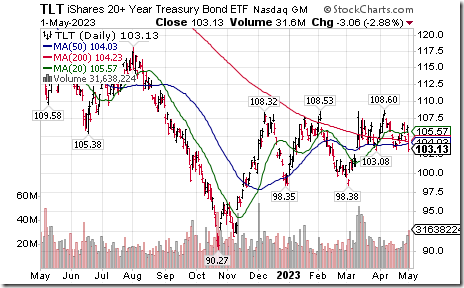

20+ Treasury iShares moved below intermediate support at $103.08. Possible anticipation of FOMC action on interest rates on Wednesday!

Check Point $CHKP a NASDAQ 100 stock moved below $123.05 completing a double top pattern.

Rogers Communications $RCI a TSX 60 stock moved above US$49.76 extending an intermediate uptrend.

Trader’s Corner

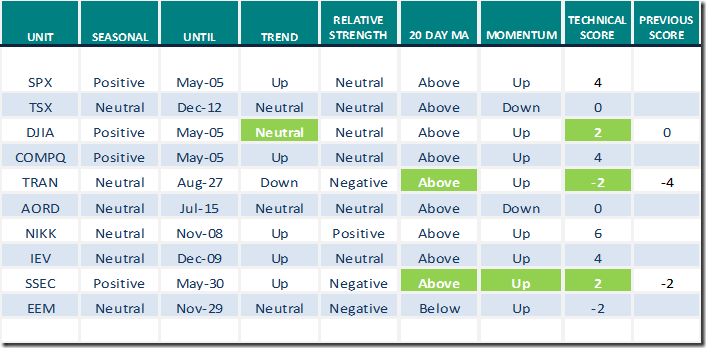

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for May 1st 2023

Green: Increase from previous day

Red: Decrease from previous day

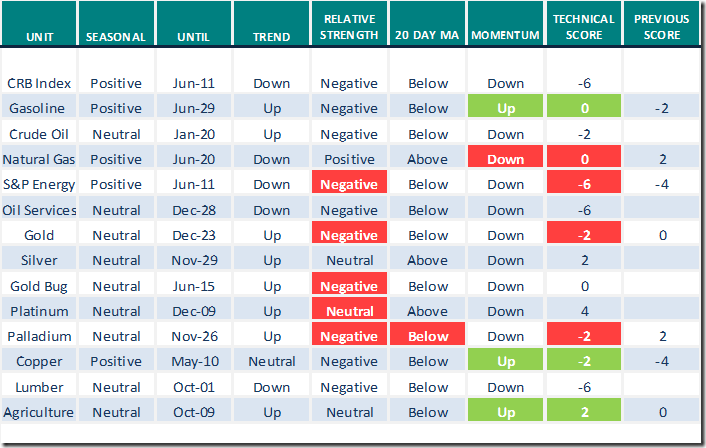

Commodities

Daily Seasonal/Technical Commodities Trends for May 1st 2023

Green: Increase from previous day

Red: Decrease from previous day

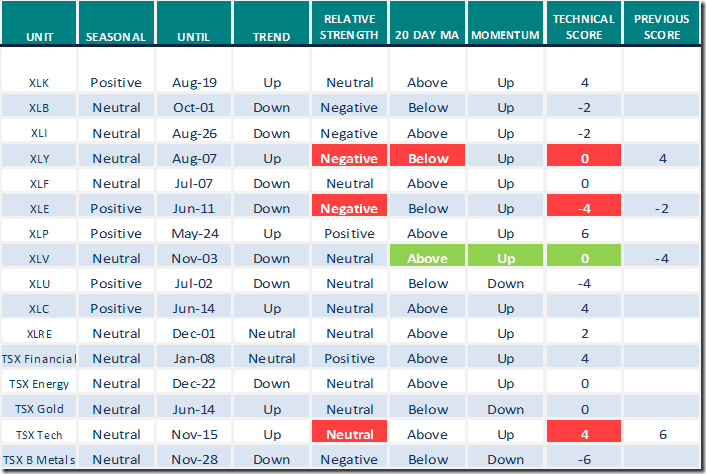

Sectors

Daily Seasonal/Technical Sector Trends for May 1st 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

Links offered by valued providers

Market Holds Its Breath | Carl Swenlin & Erin Swenlin | The DecisionPoint Trading Room (05.01.23)

Market Holds Its Breath | Carl Swenlin & Erin Swenlin | The DecisionPoint Trading

Room (05.01.23) – YouTube

The Fed’s next move: Pause, pivot or hike? Comments by CNBC’s Steve Leisman

The Fed’s next move: Pause, pivot or hike? – YouTube

Technical Chart of the Day

Technical score for Consumer Discretionary SPDRS (Symbol: XLY) changed from 4 to 0

· Intermediate trend remains up: Score: 2

· Strength relative to the S&P 500 changed from Neutral to Negative:

Score: 0 to -2

· Price moved below its 20 day moving average: Score: +1 to -1

· Daily momentum indicators remain positive: Score: +1

· Total score: 2-2-1+1= 0

S&P 500 Momentum Barometers

The intermediate term Barometer added 1.80 to 60.00. It changed from Neutral to Overbought on a return to 60.00.

The long term Barometer dropped 2.60 to 56.00. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer was unchanged at 64.22. It remains Overbought.

The long term Barometer slipped 0.43 to 61.64. It remains Overbought.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed