by Andrew Ang, PhD, Blackrock

Key takeaways

- Quality investing is not always exciting – but increased volatility and uncertainty in markets makes a compelling case for adding quality today.

- Quality has historically done best during economic slowdowns and contractions. Higher quality firms outperformed their lower quality peers in the largest drawdowns since the turn of the century.1

- While there’s a long-term strategic case to holding quality, today’s macro environment is a good reminder for investors to consider doing some “quality control” in their portfolios.

Fear of missing out, or “FOMO,” seems to be a common trend with investors. Whether it was GameStop, AMC, Bitcoin, or the FAANGs, the last few years has seen some investors exhibit FOMO as they chase the hottest trends in the market. In contrast, investing in the quality factor – investing in profitable companies with strong balance sheets – may seem… boring. But with increased volatility reflecting wavering investor conviction and changing expectations, it may be time for investors to do some “quality control” in their portfolios.

In the current banking crisis, several mid-sized regional banks felt the negative impact of idiosyncratic risk as the Fed raised rates by 475 basis points over a 12-month period.2 With the collapse of Silicon Valley Bank and Signature Bank in the US, and UBS’ acquisition of Credit Suisse in Europe, investor sentiment has shifted as expectations have been lowered and investors re-evaluate where to take risk in their portfolios.

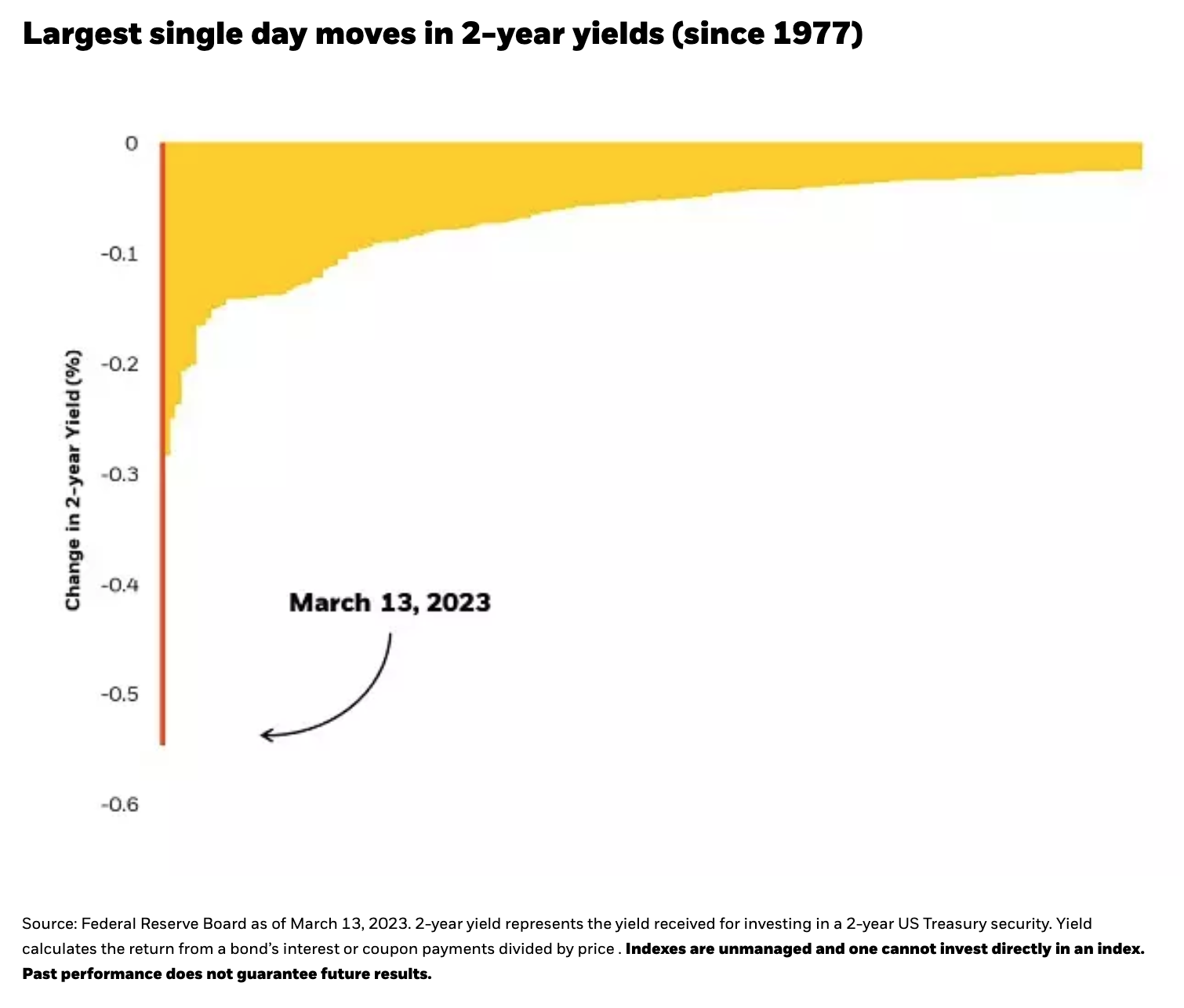

The change in investor sentiment may be most apparent by looking at bond yields. The 2-year US Treasury yield saw its largest one-day decline since 1977 on March 13.

Whether or not we enter a recession, the recent developments in the banking industry, present an opportunity for investors to consider introducing higher-quality companies into their portfolio.

The opportunity for quality

Sometimes overlooked by its flashier factor cousins, momentum and value, quality investing is also supported by a wide body of academic research and empirical data.3 Historically, more profitable firms have outperformed their less profitable peers by 3.5% on average, over rolling 1-year periods.4

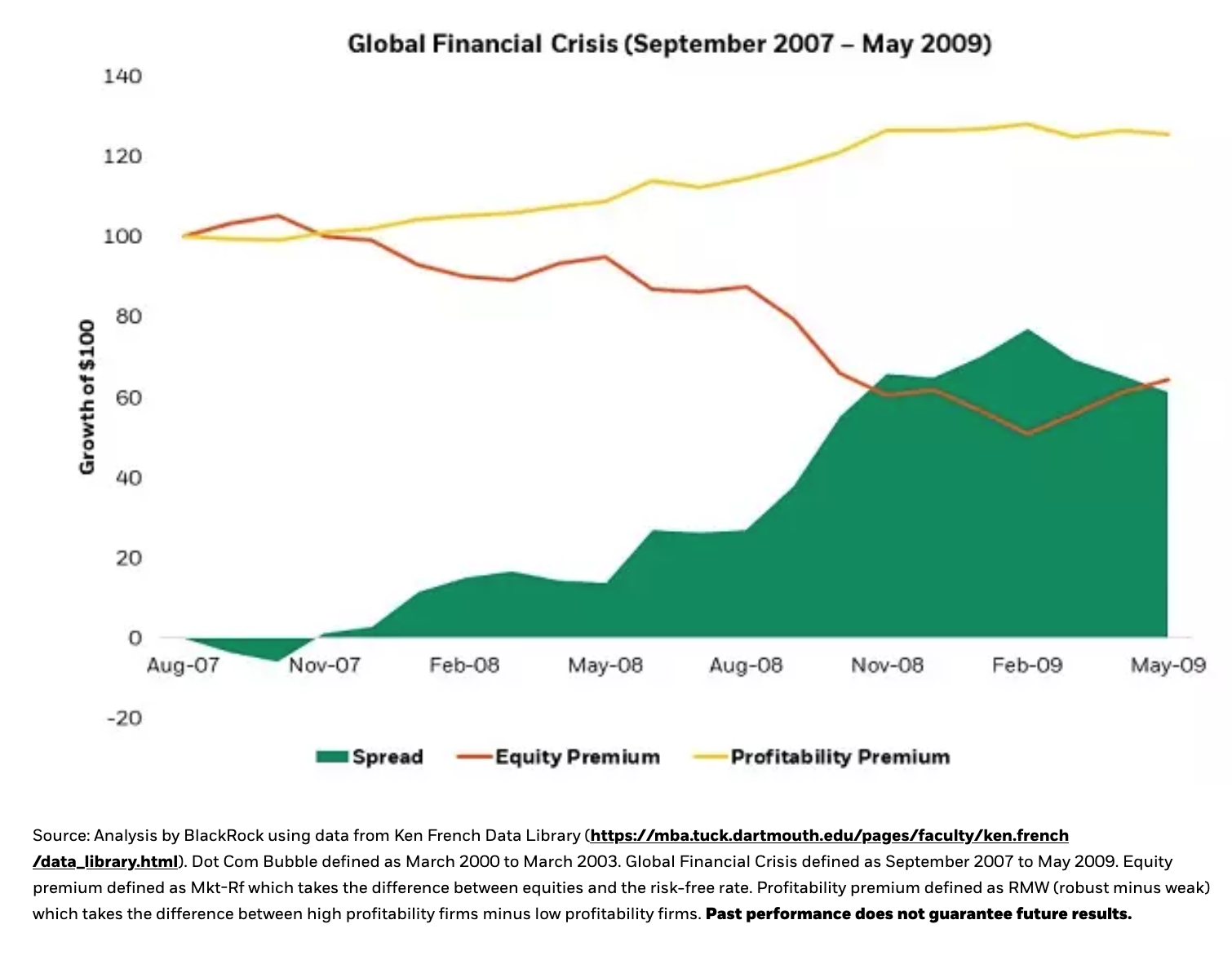

Quality companies are often better positioned to endure worsening economic conditions. In general, quality tends to perform best during economic slowdowns and contractions. When we look at the two largest drawdowns since the turn of the century, higher quality companies not only outperformed their lower quality peers, but also broad equity markets.5

Defining quality

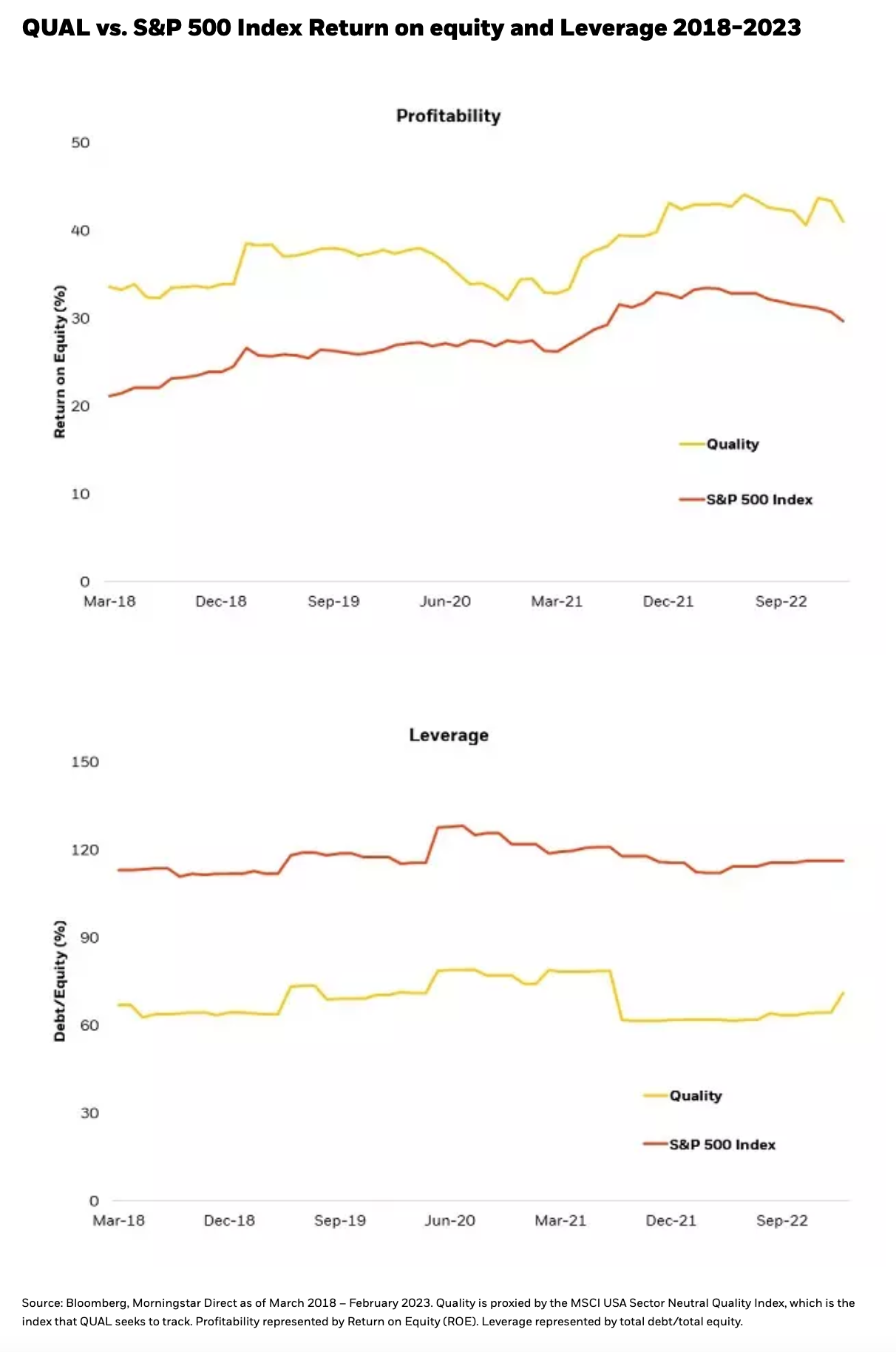

While there are varying definitions of quality, in a time of financial stress, we can define quality companies as those that have less exposure to interest rate risk—or low leverage, and companies that generate consistent, less volatile earnings over time. And as interest rates rise and capital becomes more scarce, we seek companies that are more efficient, which we can measure through Return on Equity (ROE). These are precisely the quality metrics that are used in the iShares MSCI USA Quality Factor ETF, QUAL, which seeks to provide exposure to the quality factor. QUAL’s benchmark index has persistently had higher profitability and lower leverage than the broad market.

The consistent exposure over time to higher quality characteristics makes QUAL a potentially attractive choice for today’s market environment.

Sector constraints

One consideration when building a higher quality portfolio is underlying sector exposure. Certain factors are prone to sector biases. Value strategies tend to have a bias to financials, while unconstrained quality strategies tend to overweight technology due to tech firms generally having higher average profitability.6 By taking a sector neutral approach to quality, QUAL provides exposure to high quality companies in all sectors without taking sector bets.

It’s important to highlight that sector neutrality does not translate to industry neutrality. Intuitively, banks tend to have higher amounts of leverage given their business model. While QUAL’s benchmark index takes a sector neutral approach, it does not have any bank exposure due to the industry’s higher leverage.7

As recent events have shown, higher leverage can be problematic in times of distress. By considering leverage as one signal for quality, QUAL may be better protected when the negative effects of excess leverage are punished.

Quality control

Over the long run, higher quality companies have historically outperformed their counterparts, which makes the case for long-term strategic exposure to the quality factor. But financial tumult, increased volatility, potentially slower growth, and risk-off sentiment, present increased opportunities for exposure to the quality factor today. While not as exciting as fast-moving momentum, or bargain shopping value, rising uncertainty is a good reminder that investors may want to consider adding some “quality control” in their portfolios.

Copyright © Blackrock