by Brian Levitt, Global Market Strategist, Invesco

Key takeaways

|

Seasonal angst I feel it’s my annual responsibility to remind investors that the old adage to “sell in May and go away” may not work. |

Dollar anxieties

While I favour some diversification into non-dollar assets, I believe the current anxieties about the U.S. dollar are overblown. |

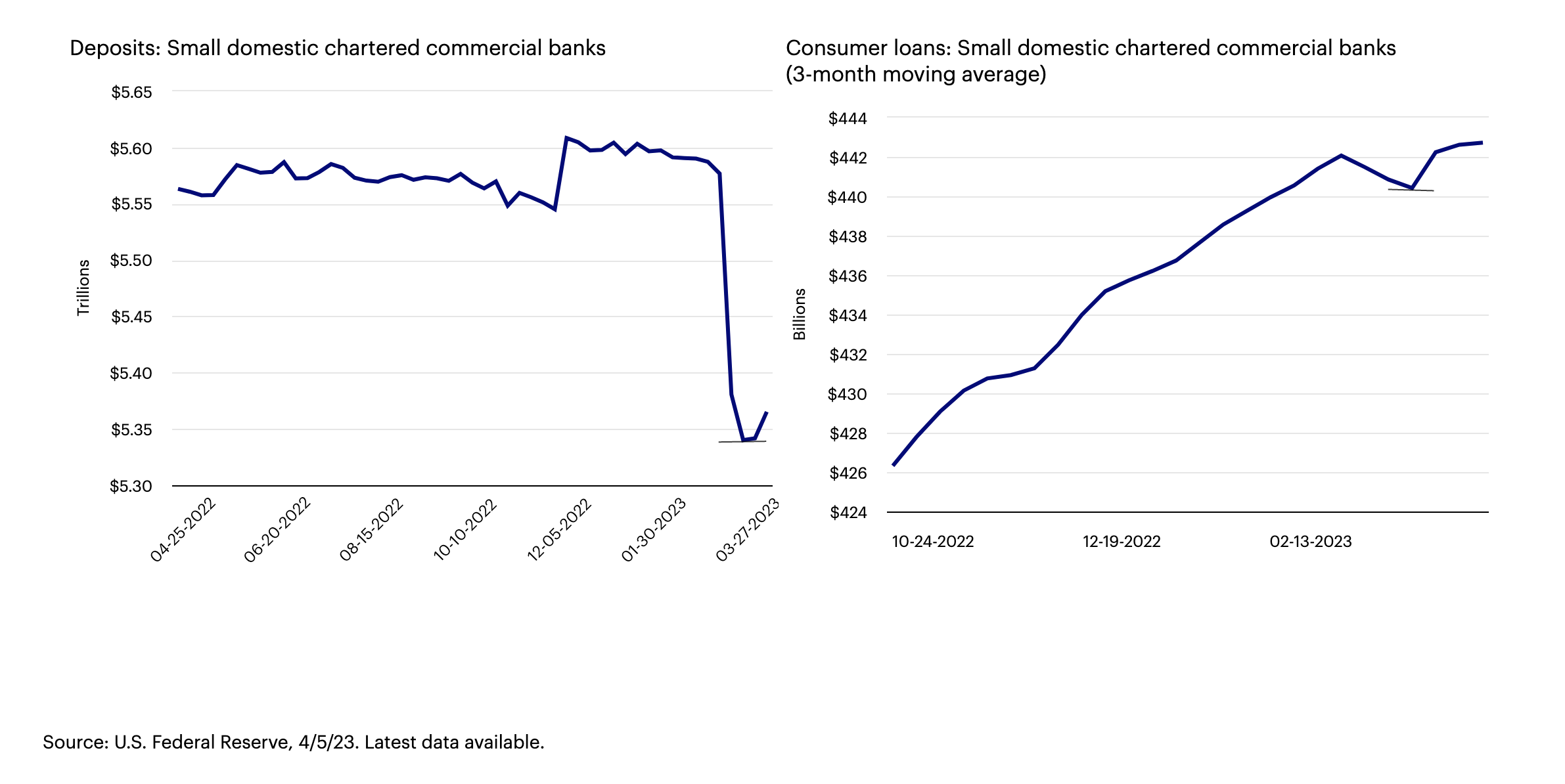

Banking news Policymakers appear to have stabilized the situation with the small banks, as deposit flight has bottomed and loans have moved higher. |

“What, me worry?” The recent passing of Al Jaffee, the legendary cartoonist for the satirical magazine Mad, led me down a Mad Magazine rabbit hole. Nostalgia played a part, but it was the iconic cover photos of an untroubled Alfred E. Neuman with his famous catchphrase that kept me absorbed. The magazine’s pop culture references and political insults changed over time, but Alfred’s happy-go-lucky outlook (and impish grin) remained the same.

Alfred’s relaxed attitude is just like that of investors, only the opposite. Between inflation and policy tightening and bank failures and recession fears and debt ceiling concerns and {insert fear du jour}, the motto of investors is “Yes, I’m worried.” Time passes and crises come and go, but the worry remains the same — and that’s precisely why too many investors miss the market recoveries that precede new business cycles.

Today’s worries (policy tightening, slowing growth, bank failures) are just guideposts on the path to a new cycle. If we’re thinking about what could go wrong, then so too has the market. That’s why even when our biggest fears come true (for example, the bank failures in March), the market reaction may not be as expected. Or as Alfred E. Neuman would say, “In retrospect it becomes clear that hindsight is definitely overrated!”

As always, we attempt to rise above the noise and put all of it in perspective.

A ‘keep it simple’ strategy

We start with three simple questions.

1. Where is the U.S. in the cycle?

It’s late. There’s almost as many economists predicting recession as there are dentists recommending Trident Gum for patients who chew gum.1 Fortunately, the historical probability of markets posting negative returns in a recession is about as good as that of a coin flip.2

2. What’s the market telling us about the direction of the U.S. economy?

The market continues to point to weaker economic growth ahead. Higher quality stocks and bonds have generally been outperforming since the beginning of March.3

3. What will be the U.S. Federal Reserve (Fed) policy response?

Policy tightening is coming to an end. The 6-month percent change in the U.S Consumer Price Index is 1.7%!4

Markets have historically performed well in the 1- and 2-years following peak inflation and the end of Fed tightening.5 Why? That’s how new cycles have tended to emerge.

Seasonal angst

I feel it’s my annual responsibility to remind investors that the old adage to “sell in May and go away” may not work. It’s not entirely clear to me why we are told to sell in May and get back into the markets in November. Some years it works (like 2022).6 And sometimes I hit the fairway on a golf course. More often I don’t. The problem with this seasonal strategy is that it doesn’t work more often that it does, and over a long-term period it would have cost investors dearly.

For example, a hypothetical $1000 investment held in the broad U.S. stock market from January 1928 to December 2022 would have been worth $6.3 million. That same investment by an investor selling May 1 of each year to go into Treasury bills, only to get back into the market on November 1, would be worth $2.4 million, or nearly $4 million less!7

Maybe the adage should have been, “Ignore that it’s May and over time your investments will pay.”

It may be confirmation bias, but …

… policymakers appear to have stabilized the situation with the small banks. Deposit flight has bottomed and loans from small commercial banks have moved higher since the middle of March.8 Tighter lending conditions are still likely to weigh on the economy, but a systemic financial crisis appears to have been averted.

Deposits and loans have started to rebound at small banks

I was informed by an investment professional that worries over the future status of the U.S. dollar caused “more inbound calls than many things I can remember in recent history.” I’m tempted to throw the red-challenge flag on that claim, but I don’t want to risk losing my timeouts so early in the year.

The recent U.S. dollar anxieties stem from A) concerns that China has asked oil producers to accept payments in yuan instead of dollars, and B) a recent comment from Russian President Vladimir Putin stating that Russia, “is in favour of using the Chinese yuan for settlements between Russia and the countries of Asia, Africa, and Latin America.”9

Is the U.S. dollar about to become “toilet paper” as “Rich Dad, Poor Dad” author Robert Kiyosaki recently hyperbolized?

No.

- Given the size of the Chinese economy, one would expect the Chinese yuan to play a larger role in international trade over time.

- Nonetheless, the U.S. dollar likely won’t lose its reserve status any time soon. To paraphrase Nobel Prize winning economist Paul Krugman, “Incumbency matters.” Everyone is already using the dollar. It would take a lot of effort to switch. The U.S. markets are open, meaning that the U.S. doesn’t impose controls on money moving in and out of the country. And the U.S. rule of law is well understood.

- Even if you take it to the extreme and assume the dollar loses its reserve status this century, then what? The same happened to the British pound after the U.S. emerged as the world hegemon following the World Wars. Did the British pound become “toilet paper”? It did not.

All that said, I would favour diversifying a portion of portfolios into non-dollar assets, particularly now given that valuations appear more attractive outside the U.S.10

240 seconds of fame

A new segment designed to share my experiences in the glamorous world of live television.

First, let’s get the always-asked-questions out of the way.

- Do you get nervous? I used to.

- Do you know the questions beforehand? No.

- Do you tell everyone you know when you’ll be on? No. I tell my mom. It seems to make her proud.

- What’s {insert host’s name} like? Very nice to me.

The idea for this segment came as I was desperately trying to argue against a guest’s counterargument to my initial argument, all while the host was throwing to commercial.

Me: The stock market already priced a recession last year.

Other guest: Last year was a valuation adjustment. Now we adjust for earnings.

Me: Can I jump in?

Host: We’ll be right back.

Me (in my thin-skinned head): No! Wait! I just want to say that valuations tend to expand as earnings and interest rates fall. We will have an earnings downturn, but that doesn’t necessarily mean that the market bottom isn’t behind us.

Oh well. As Karl Marx said, “Last words are for fools who haven’t said enough.”

Automate my job?

Each month I pose a question to ChatGPT — the artificial intelligence-driven chatbot — and assess the response.

Q: Will the U.S. Congress raise the debt ceiling without incident?

A: Historically, the debt ceiling has been raised or suspended many times, and it is likely that it will be raised again in the future.”

I agree. Maybe ChatGPT will be taking my job sooner than I thought? Next month I may ask how universal basic income works.

Not to be outdone by a bot, I would also add that it may be easier to raise the debt ceiling in 2023 than it was in 2013. In 2013, the Republicans held a large majority in the House of Representatives, creating a challenge for the Obama administration to find enough House members to vote for an increase without having to make significant compromises.

This time, the Republican majority in the House is meaningfully smaller. If all House Democrats vote to increase the debt limit, only six Republican votes are needed for it to pass.

Market Conversations

Bert Crouch, a portfolio manager with Invesco Real Estate, joined the most recent episode of Market Conversations to put the growing chorus of concerns about the U.S. commercial real estate market into perspective and to identify how current dislocations are creating opportunities.

That episode is currently in production, but keep an eye out for its release in the next week. Subscribe to our Insights emails to find out when it’s available.

Is commercial real estate the proverbial “next shoe to drop” for the global economy?

- There are clear headwinds including higher interest rates and tighter regional bank lending standards.

- Fortunately, leverage, relative to the global financial crisis, is lower while debt service coverage ratios were much higher.

- With challenges come opportunity. We are looking to take advantage of the opportunities that present themselves.

What are the opportunities that are presenting themselves?

- As banks tighten lending standards to commercial real estate entities, Invesco Real Estate is willing to fill the funding gap, originating loans on what are believed to be favourable terms.

- In addition, we are positioning to be a buyer of high-quality real estate assets as the regional banks scale back their exposure to commercial real estate.

Have the long-term structural opportunities changed?

- No. We expect demand for apartment rentals to continue to grow in an environment when new supply remains low. Aging demographics continues to support life sciences, including research and development centres as well as hospitals. We expect omnichannel experiences to continue to transform retail space and e-commerce demand to remain supportive for industrial space.

On the road again

My travels took me to Del Mar, California, for an advisor event. Alas, I did not get a needed reprieve from the winter weather. The temperature in southern California was in the 50s for most of my stay. Making matters worse, the temperature in New York was unseasonably warm. By the time I was to return home, the sun was emerging over San Diego International Airport while the temperature in the northeast had plunged by over 30 degrees.

I couldn’t help but notice the parallels of poorly timing the weather with the futile efforts of investors to time the market. I felt as if I was living in one of those quilt charts!

On to May

Here’s to mild and pleasant times and the blooming of a new cycle.

Happy Mother’s Day to all the moms out there. As Abraham Lincoln said, “All that I am or hope ever to be I get from my mother.” I know it well.

Footnotes

1 Source: National Association for Business Economics, 2/28/23.

2 Source: Bloomberg, 3/23. The S&P 500 Index posted positive returns 45% of the time during the past 10 recessions. Based on recession dates defined by the National Bureau of Economic Research: Aug. 1957 – Apr. 1958, Apr. 1960 – Feb. 1961, Dec. 1969 – Nov. 1970, Nov. 1973 – Mar. 1975, Jan. 1980 – Jul. 1980, Jul. 1981 – Nov. 1982, Jul. 1990 – Mar. 1991, Mar. 2001 – Nov. 2001, Dec. 2007 – Jun. 2009 and Feb. 2020 – Apr. 2020.

3 Source: Bloomberg, 3/23. Stocks based on the performance of the S&P 500 Quality Index (+6.12%) compared to the S&P 500 Index (+5.38%) from 3/1/23, to 4/18/23. Bonds based on the performance of the Bloomberg US Aggregate Bond Index (+2.91%) compared to the Bloomberg US Corporate High Yield Bond Index (+1.78%) from 3/1/2023 to 4/21/2023.

4 Source: U.S. Bureau of Labor Statistics, 3/31/23.

5 U.S. Federal Reserve, 3/23/23. Based on S&P 500 Index performance in the 1- and 2-year periods following peak inflation in February 1970, December 1974, March 1980, December 1990, and July 2008.

6 The S&P 500 Index fell 5.50% from 5/1/22, to 10/31/22. A “sell in May” strategy would have avoided that loss.

7 Source: Factset, as of 12/31/22. As represented by the Dow Jones Industrial Average.

8 Source: U.S. Federal Reserve, 4/5/23. Based on the deposits and loan growth of small domestic chartered commercial banks.

9 Source, Washington Post, 3/24/23

10 Source, Bloomberg, L.P., 3/31/23. Based on the price-to-earnings ratios of the S&P 500 Index, the MSCI Emerging Markets Index, and the MSCI Europe Index.