by Drew O'Neil, Fixed Income, Raymond James

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

Short-term Treasury yields skyrocketed throughout 2022 reaching levels not seen in almost 15 years. In early October, the yield of the 6-month T-bill topped 4% for the first time since 2007 and by the end of the month had topped 4.5%. This understandably got many investors interested and brought a lot of money into short-term fixed income investments. While yields north of 4% are attractive for a short-term investment, these investments are just that: short-term. For the investors that purchased 6-month T-bills last October, those investments are now maturing. As yields are quoted on an annualized basis, these investors earned holding period returns on these investments in the low 2% range. Now what?

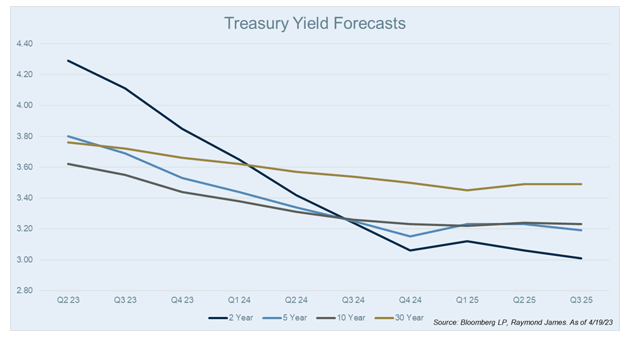

Short-term yields are still attractive but taking a longer-term view often makes sense when it comes to investing in fixed income. Purchasing short maturity fixed income investments currently provides attractive yield levels but also comes with near-term reinvestment risk. Staying with the 6-month T-bill as an example, an investor will have to reinvest every 6 months at current market rates. If rates move higher you get to reinvest into a higher yielding investment but conversely, if rates move lower, you reinvest into a lower yielding investment. As most market participants are calling for lower yields by the end of the year, it is worthwhile to consider if you want to expose yourself to reinvestment risk 6 months from now. The chart below shows the forecasts for 2, 5, 10, and 30 year Treasury yields over the next few years, according to Bloomberg data.

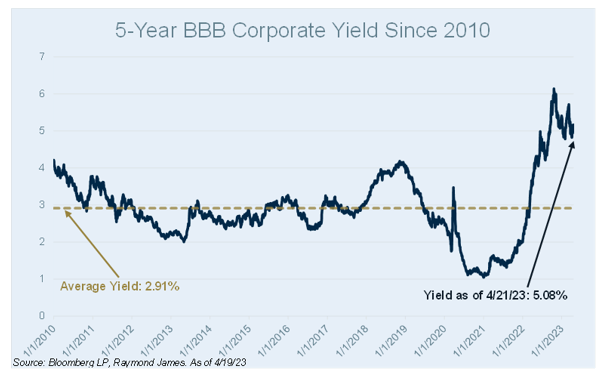

Determining the purpose of your investment allocation can help you decide if short-term securities make the most sense. For long-term fixed income allocations, a primary benefit, barring default, is the known aspects that a portfolio of individual bonds can provide (known cash flow, known income, known principal return amount and date). The longer the maturity of the bond, the longer the cash flow and income are locked in. Yields across the intermediate and long parts of the curve are at some of the most attractive levels we have seen in the past 10+ years. For longer term fixed income allocations, locking in these yields now rather than keeping money in short term investments (their corresponding reinvestment risk) might optimize long term earnings.

As an example, the chart above shows the 5-year BBB rated corporate yield since 2010. While we might not be at the absolute peak in yields, there have only been a handful of months over this timeframe when investors were able to lock in yields higher than we see today. Over this highlighted historic range, yields were well below what is currently available. The average 5-year BBB corporate yield since 2010 is 2.91% compared to a 5.08% yield as of 4/21/23. Purchasing a longer-term bond locks in your yield for a longer period of time. As your short-term fixed income investments begin maturing, consider what type of investment (short-term or long-term) is likely to best serve your long-term financial plan.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.