by Larry Adam, CIO, Raymond James

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The U.S. earnings recession should be short-lived

- The Fed is unlikely to pivot to an easier policy this year

- The U.S. dollar’s supremacy is not coming to an end

Over the next few weeks, the exciting professional hockey playoffs will determine this year’s Stanley Cup winner! The NHL’s fast-paced playoff games will be sure to keep fans on edge as momentum constantly changes as players skate to a puck that travels up to 100 mph. And with fans celebrating the 24th anniversary of hockey great Wayne Gretzky’s final NHL game this week, we are reminded that the key to his success was to “skate to where the puck is going to be, not where it’s been.” The same can be said about the keys to success in investing. Getting too caught up in the past or present—where the puck has been—often leads to sub-par results. However, focusing on the future—where the puck is going—can provide a competitive edge. That’s what we aim to do in Investment Strategy, sharing insights on where the economy, markets and earnings are headed so our readers can stay one step ahead in the game.

Bottom Line – Tune Out The Noise And Short-Term Distractions | Year-to-date, the financial markets have oscillated around rapidly changing narratives, making it challenging to navigate the investment landscape. While it's easy to get caught up in the daily headlines, particularly when they are negative, it is important to keep perspective, stay focused on your long-term goals, and keep an eye on the big picture (i.e., where the markets will go). Below are some of our thoughts on where the markets are heading:

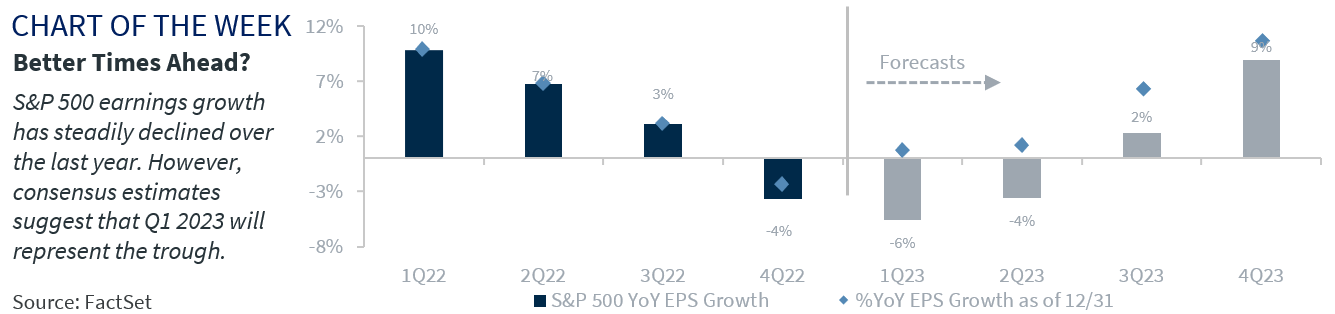

- Earnings Won’t Stay In the Penalty Box For Long | Q1 earnings season is starting to ramp up and so far, the results are better than feared. While it is still early, 78% of the 91 S&P 500 companies reporting earnings have beat their earnings estimates. This is not all that surprising given how low the bar for earnings had been set heading into this earnings season. In fact, last June the estimated year-over-year earnings growth rate for the first-quarter of 2023 was over 10.0%. Today, the earnings growth rate is expected to be down to -6% from a year earlier. This is the biggest decline in earnings we’ve seen since Q3 2020. And while we may be in a shallow earnings recession right now, with two consecutive declines in year-over-year earnings growth, the decline should be short-lived. Consensus estimates suggest that Q1 will be the trough in the earnings cycle, with earnings growth starting to improve as we move through the remainder of the year and into 2024. That’s why we remain confident in our $215 year-end earnings forecast. With many of the headwinds on earnings—an aggressive Federal Reserve (Fed), high inflation, supply chain pressures and the strong dollar—fading and only a mild recession on the horizon, earnings should hold up better than expected. This should be good news for stocks and a key reason why we have a 4,400 year-end price target on the S&P 500.

- The Fed Will Freeze The Puck After Its Next Rate Hike | The Fed’s quick action on the banking crisis appears to have eased stresses in the system, with borrowing at the Fed’s discount window and deposit outflows receding over the last few weeks. Tighter credit is still looming; however, fears of a near-term credit crunch now appear less likely. This has pushed up market expectations for the Fed to raise rates an additional 25 bps in May, which our economist believes will be the Fed’s final rate hike in the tightening cycle. However, market hopes for a quick pivot to rate cuts may not materialize as quickly as the market anticipates, which is currently pricing in ~50 bps of rate cuts by the end of the year. Historically, the Fed has transitioned from rate hikes to rate cuts with an average pause of ~7 months. While cracks in the system are now visible, the macro backdrop does not appear dire enough for policymakers to abruptly change course, particularly with only a mild recession and inflation still well above the 2% target. That’s why our economist expects the Fed to hold rates steady after reaching its peak and for rate cuts not to occur until next year. This should keep the yield curve inverted and exert downward pressure on longer-maturity yields.

- Power Play On US Dollar Dominance Will Pass | The importance of the US dollar on the worldwide stage cannot be understated—it has dominated global trade and capital flows for over 60 years and will likely continue to do so. Concerns about the US dollar have reemerged over the last few weeks as political leaders step up their calls for de-dollarization, casting doubt on the US dollar’s dominant role in international trade. The first ever Chinese yuan settled energy deal between China and France has further unnerved dollar supporters. But while China and Russia have been actively trying to shift the paradigm for years, the US dollar’s status as the world’s reserve currency is not at risk. Yes, the US share of global reserves has steadily declined from above 70% in 2001 to ~58% today, but the US still has 3x the share of reserves than the second most widely used currency, the euro, and around 10x the reserves of the Japanese yen. The US dollar’s share of foreign reserves may continue to diversify in the years ahead; however, the US dollar’s supremacy is set to remain for years to come as there is no real alternative. China’s ambition to dethrone the US dollar is a non-starter as long as the government controls the value of its currency. And while the value of the US dollar may fluctuate based on cyclical factors, confidence in the strength and stability of the US economy and our deep, liquid financial markets underscore the widespread acceptance of the dollar as a store of value.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.