by William and Cole Smead, Smead Capital Management

To kick off the beginning of 2023, there continues to be a bias we see in equity investor portfolios. These portfolios have many of the traits investors see at the endpoints of the economy like software, consumer products and computer chips. What they often don’t own or under-own are the building blocks of the economies of the world. These tangible products drive construction, power transportation or enhance production. We believe this is particularly true in producers of oil, for the movement of goods, and the production of commodities that create most of the electricity like natural gas and coal. We get excited for the prospects surrounding this phenomenon because there is nothing better than a lack of competition in the ownership of economically-needed products. Our investors are buying unwanted assets.

Charlie Munger explains that ignorance avoidance is one of the easiest ways to have success in life. We agree with Munger and try not to do stupid things. Some investors practice this in reverse. In today’s market, there are some attractive simple risks. Below is the first picture providing information that we care deeply about.

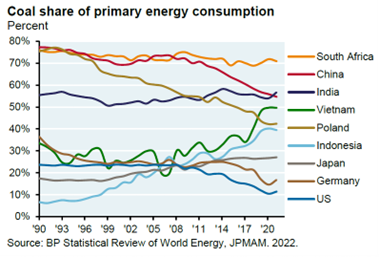

The chart below shows the share of coal as a percentage of energy consumption in the respective countries. This explains something that we all know. The US, Germany and China have reduced their use of coal as a primary consumer. What’s no one saying? India, South Africa, Vietnam, Indonesia and Japan are at the same place or higher than they were 30 years ago. Remember that each of these countries consumes more total energy today than thirty years ago. So, coal demand has grown despite its declining use as a percentage of total energy consumption.

Don’t pay attention to the developed world’s energy consumption. They are rich. They have the means to pick and choose their energy sources, but where the world’s population is likely to grow the most, coal is “el hefe.”

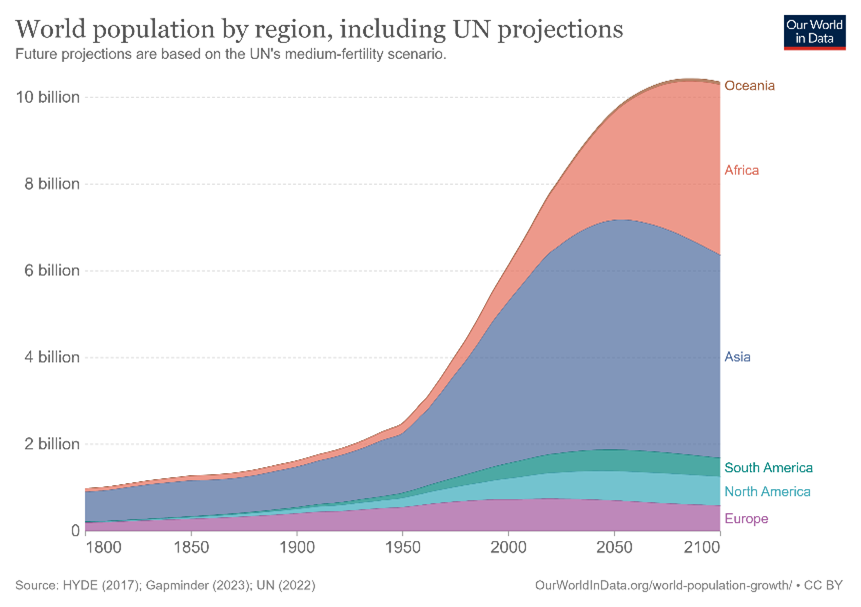

The UN projects that the world population will close the 21st century with roughly 10.9 billion people. Interestingly, 80% of the people in 2100 will live in Asia and Africa. These are not big wind and solar customers. These tend to be economies where a lack of energy impacts economic growth. Again, the West can be picky. These places want economic growth. America didn’t care where its power came from when it was an emerging market. It only cares now when it’s comfortably wealthy and the Bible competes with other religions.

We own a lot of oil and gas assets in OXY (OXY US & OXY/WS US), MEG Energy (MEG CN), Cenovus Energy (CVE CN) and Whitecap Resources (WCP CN). We also own companies that would like to move oil around the oceans of the world in Frontline (FRO NO). Why are we explaining population growth and the dependence on coal? It’s because we know that many worldwide investors have been trained to hate the oil and gas business. This made them unwanted assets. We believe we are seeing signs with other commodities that are hated more than oil and gas and could be attractive for investors.

ESG investment mandates have caused numerous institutional investors and the marketing arms of money management firms to completely avoid oil, gas and coal assets. We don’t believe this causes managers to be investors because it’s rules-based investing. The question is whether the rules are wise.

Investors in the Smead International Value strategy have invested alongside us, but aren’t adding strings to the investment discipline that we use to build wealth. In effect, our investors have become an advantage as they are only seeking to build wealth. They are not trying to build a religion or explain why their view of the world is greater. This puts the strategy at an advantage in pursuit of attractive but unwanted assets.

We believe the smartest people in the commodity markets have been the folks at Glencore. We do not own shares in their London listing but pay attention to what they do because they have deep knowledge of what goes on in energy, metal and mining assets. The King of Oil about Marc Rich is a great resource to understand our view of this.

The unwanted assets today broadly sit in commodity markets. Because of this, there has been a scarcity of new projects started globally. This starving of new investments to find tangible goods like copper, coking coal and iron ore is only worsened by the Western government’s unwillingness to allow new projects to begin inside their domain.

The investor’s saying never and the government’s doing this likely means a squeeze coming in the price of these goods. The folks at Glencore showed their hand with a proposal to buy Teck Resources in Canada at a 20% premium to what they traded for. Teck quickly rejected them. Glencore followed by adding cash to sweeten their prior stock deal on April 11th. Why is a large commodity trading firm stalking a Canadian copper/metallurgical coal business? There are few out there.

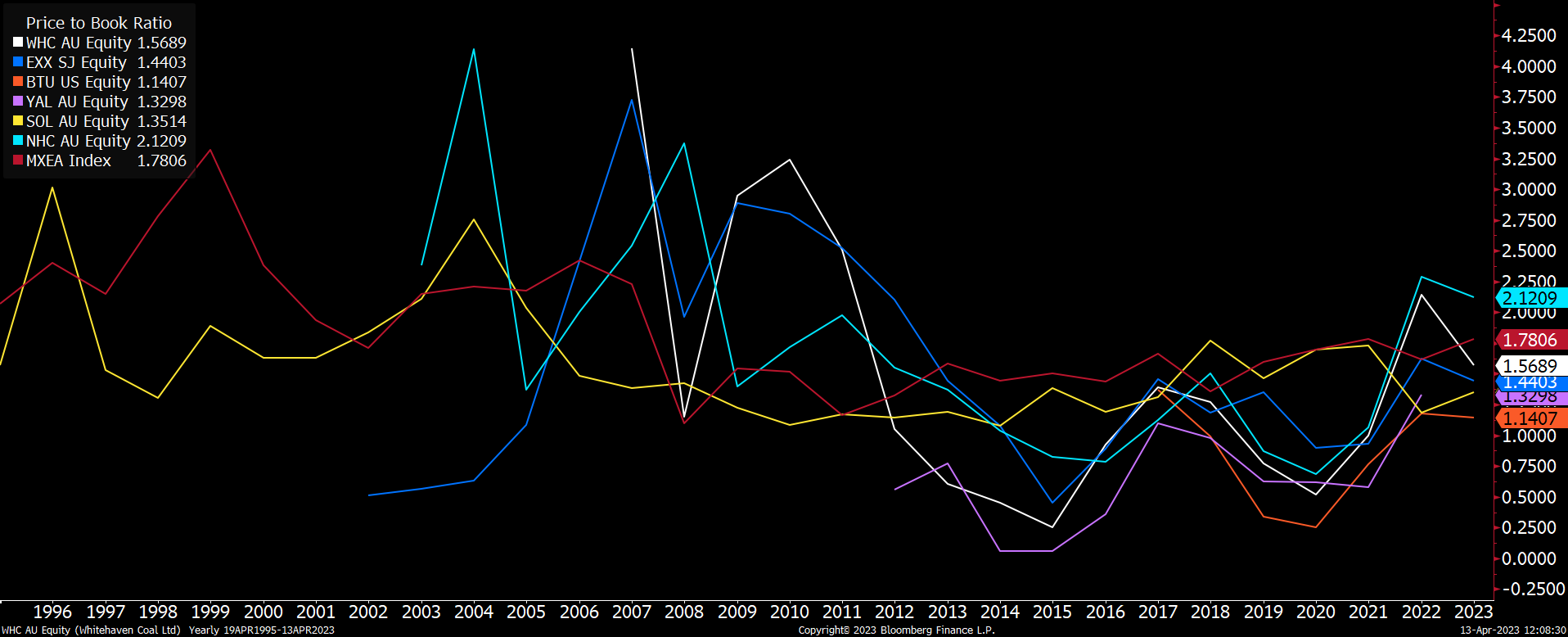

Lastly, let’s look at some pricing on these businesses. Below is a chart of the price-to-book (P/B) ratio of the coal mining businesses greater than $3 billion of market capitalization in North America, Europe, Africa and Developed Asia versus the MSCI EAFE’s price-to-book ratio in red.

You can buy them at a nice discount to many stocks abroad. What is interesting is that five of these six companies have more cash than debt. It’s hard to go bankrupt with more cash than debt.

It is our suspicion that many investors are looking for some spectacular company to own. We believe the marvel is found in the unspectacular businesses that give investors good pricing and good capital structures with growing consumer markets as their allies. Canadian billionaire Jim Pattison has been asked why he has bought various companies that have made him very wealthy over time. He says, “I buy things that no one else wants.” We seek to compound our money in harmony with what Jim has done, while practicing the ignorance avoidance that Munger advocates. This leads us to buy unwanted assets in various energy markets around the world; products that come from the ground, not the cloud. By being excited about this boring approach, we fear stock market failure.

Fear stock market failure,

_______________________________________________

The information contained herein represents the opinion of Smead Capital Management and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Smead Capital Management, Inc.(“SCM”) is an SEC registered investment adviser with its principal place of business in the State of Arizona. SCM and its representatives are in compliance with the current registration and notice filing requirements imposed upon registered investment advisers by those states in which SCM maintains clients. SCM may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Registered investment adviser does not imply a certain level of skill or training.

This newsletter contains general information that is not suitable for everyone. Any information contained in this newsletter represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. SCM cannot assess, verify or guarantee the suitability of any particular investment to any particular situation and the reader of this newsletter bears complete responsibility for its own investment research and should seek the advice of a qualified investment professional that provides individualized advice prior to making any investment decisions. All opinions expressed and information and data provided therein are subject to change without notice. SCM, its officers, directors, employees and/or affiliates, may have positions in, and may, from time-to-time make purchases or sales of the securities discussed or mentioned in the publications.

This Newsletter and others are available at smeadcap.com