by Invesco Tax & Estate Planning

Personal income tax measures

The Grocery Rebate

Budget 2023 introduces a “Grocery Rebate,” which triples the maximum Goods and Services Tax Credit amount for January 2023 for eligible individuals.

The Goods and Services Tax/Harmonized Sales Tax (GST/HST) Credit is a tax-free quarterly payment made by the Canada Revenue Agency (CRA) that helps low-income individuals and families offset the GST/HST they pay. An eligible individual must be a Canadian resident for income tax purposes at the beginning of the month in which a payment is made and meets one of the following conditions:

- Is 19 years or older

- Has a spouse or common-law partner

- Is a parent who lives/lived with their child(ren)

The amount of credit is indexed to inflation and is based on the family’s net income, marital status, and the number of children under 19 years old who are registered for the GST/HST credit.

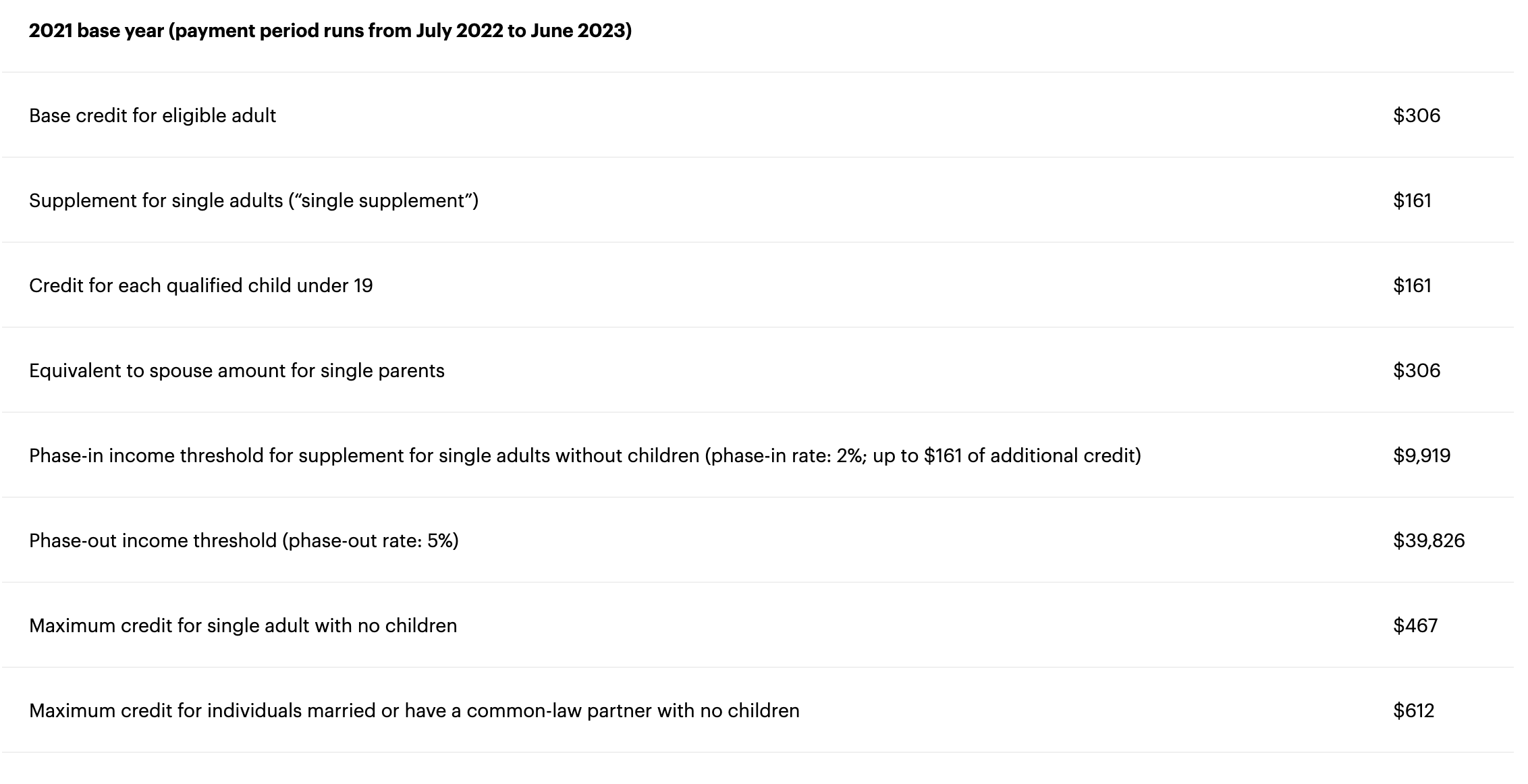

Here’s a summary of the GST/HST credit payment amounts and income thresholds for base year 2021 (payment period July 2022 - June 2023):

- $153 per adult

- $81 per child

- $81 for the single supplement

For more information on the GST/HST credit, please refer to the Government of Canada website.

Employee Ownership Trusts

In brief, an Employee Ownership Trust (EOT) is an employee ownership vehicle using a trust that holds shares of an operating company for the benefit of its employees. It is a structure often used to facilitate the purchase of an active Canadian business by its employees. The funding of the business purchase may be facilitated through the use of a loan from the business that will be acquired by the EOT.

An EOT must be a Canadian resident and have two purposes: To hold shares of qualifying businesses for the benefit of its employee beneficiaries and, secondarily, to allow trust distributions based on a formula that considers an employee’s length of service, remuneration and hours worked. Generally, a qualifying business is one that has all, or substantially all, of its fair market value attributable to assets used in an active business carried on in Canada.

Where the trust qualifies as an EOT, Budget 2023 proposes to introduce the following tax attributes:

- The Capital Gains Reserve (CGR) will be extended from a five-year period to a 10-year period on qualifying business transfers to an EOT. The move will have a minimum capital gain recognition of 10% from the traditional 20% under the current five-year CGR.

- Shareholder loan repayments are generally taxable if unpaid within a year of issuance. The shareholder loan rules will be extended from one year to 15 years to avoid paying taxes on unpaid amounts if related to a qualifying transfer to an EOT.

- An EOT will be exempted from the normal 21-year deem disposition rules that would otherwise apply to trusts.

The changes are effective January 1, 2024.

Registered Education Savings Plans (RESPs) and student support

Budget 2023 contained proposals to modify the rules governing RESPs.

Educational Assistance Payment (EAP) maximums

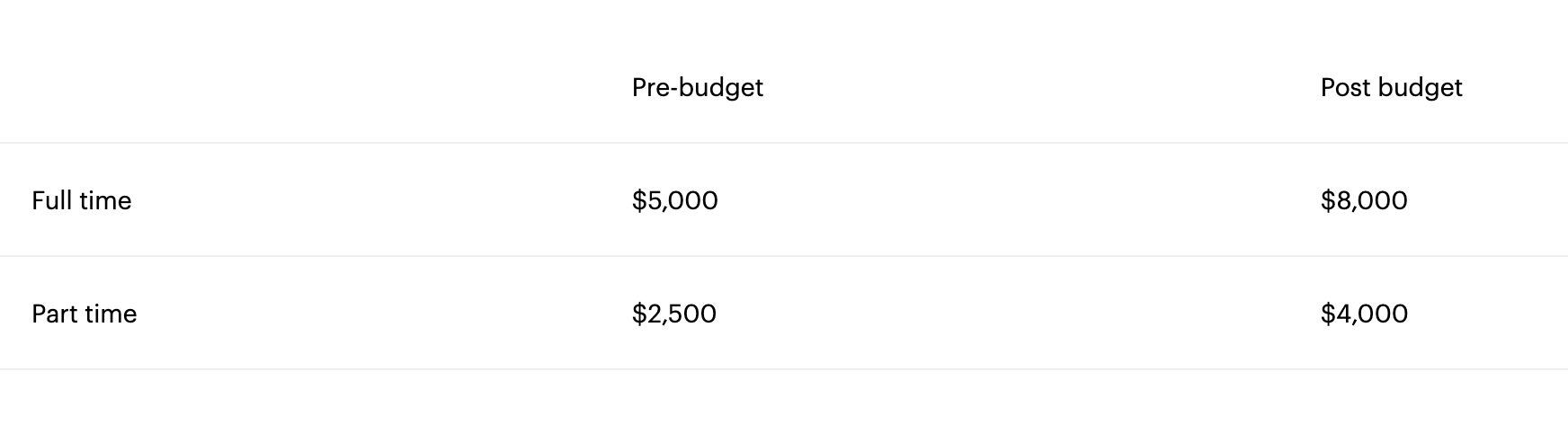

RESP beneficiaries enrolled on a full-time basis in a qualifying post-secondary program are entitled to receive a maximum EAP of $5,000 during the first 13 weeks of enrolment. Part-time students are currently entitled to receive a maximum EAP of $2,500 during each 13-week period of enrolment.

Effective as of Budget Day, the Budget proposes to increase access to EAPs for full-time and part-time students during the 13-week periods, as follows:

Only spouses or common-law partners may open an RESP as joint subscribers. Up until now, if the subscribers divorced or separated after opening a joint RESP, the plan was permitted to remain open, but no new RESPs could be opened jointly by divorced or separated individuals. Budget 2023 proposes to allow divorced or separated individuals to open RESPs, effective as of Budget Day.

Student support

Budget 2023 included proposed enhancements to student loans and grants. Beginning August 1, 2023, the following changes are proposed:

- An increase in Canada Student Grants by 40%, to a maximum of $4,200 for eligible full-time students.

- The Canada Student Loan limit will increase from $210 to $300 per week.

- The existing requirement for mature students over the age of 21 to submit to credit screening when making their first application for federal student grants and loans will be waived.

Retirement Compensation Arrangements (RCAs)

An RCA is a type of employer-sponsored arrangement designed to provide supplementary pension benefits to employees. This arrangement generally permits an employer to make contributions to a custodian, who holds the funds in trust until they are distributed to the employee, or beneficiary, upon retirement, loss of office, loss of employment, or any substantial change in the employee's service. The funds are typically held in an "RCA Investment Account".

Employers can generally deduct 100% of their RCA contributions. While there is no specific limit to the amount of contribution an employer can make to an RCA, the contributions must be considered "reasonable." For example, the benefits provided must not exceed those that are appropriate for the employee's position, salary, and service. Any contributions made, along with any income or realized capital gains within the RCA investment account, are subject to a refundable tax of 50%. The refundable tax levied on contributions made from the employer to the custodian is remitted by the employer to a non-interest-bearing Refundable Tax Account (RTA), which is administered by the Canada Revenue Agency (CRA).

When the custodian distributes the funds from the RCA investment account to the beneficiary, the RTA refunds $1 for every $2 distributed, allowing for the recovery of the entire RTA balance if the RCA is completely paid out. All distributions from an RCA investment account are taxable to the beneficiary, who will receive a T4A-RCA slip from the custodian indicating the amount of distributions and income tax deducted.

"Pre-funding" an RCA generally means that an employer makes contributions to the RCA plan in advance of the employee's retirement. These contributions are tax-deductible for the employer and not taxed as income for the employee until they are distributed out of the RCA at retirement. This allows employers to pre-fund supplemental retirement benefits through contributions to an RCA trust.

Employers who choose not to pre-fund their retirement benefit obligations through contributions to an RCA trust can obtain a letter of credit or a surety bond from a financial institution to settle the employee’s retirement benefit obligations as they become due. This provides security to their employees and guarantees payment of a certain amount of money if the employer is unable to fulfill their obligations under the RCA. To secure or renew the letter of credit or surety bond, the employer pays an annual fee or premium charged by the issuer. These fees or premiums are also subject to the 50% refundable tax, which means that the employer must contribute twice the amount of the fee or premium to the RCA trust to cover both the fee and the refundable tax. For example, if the annual fee for a letter of credit is $50,000, the employer must contribute $100,000 to the RCA trust, as the other $50,000 will be remitted to the CRA for the refundable tax.

Budget 2023 proposes two key measures:

- Fees or premiums paid for securing or renewing a letter of credit or surety bond for an RCA that supplements a registered pension plan would not be subject to the 50% refundable tax. This change would apply to fees or premiums paid on or after Budget Day.

- Allow employers to request a refund of refundable taxes previously paid for letters of credit or surety bonds by RCA trusts. The refund would be granted based on retirement benefits paid out of the employer’s corporate revenues to employees who had RCA benefits secured by letters of credit or surety bonds. Employers would be eligible for a refund of up to 50% of retirement benefits paid, limited to the amount of refundable tax previously paid. This change would apply to retirement benefits paid after 2023.

Registered Disability Savings Plans (RDSPs)

Budget 2023 extends the Qualifying Family Member provision until December 31, 2026. This provision allows a family member such as a parent, a spouse, or a common-law partner to be a plan holder for an adult with mental disabilities who does not have a legal representative. The proposals will also include an adult sibling who is 18 years of age or older to be included in the definition of a Qualifying Family Member. A Qualifying Family Member who becomes a plan holder before year-end 2026 could continue to remain the plan holder after 2026.

Alternative Minimum Tax (AMT) for high-income individuals

The alternative minimum tax (AMT) has been in place since 1986 and was designed to prevent individuals from making disproportionate use of preferential tax treatments and ensuring a certain amount of tax remains payable despite targeted tax benefits claimed. AMT requires a separate tax calculation to be conducted along with an individual’s regular income tax calculations by taking into consideration certain tax preferred treatments or deductions that an individual claimed in the tax year. In other words, the regular taxable income is recalculated based on a different set of assumptions to arrive at an adjusted taxable income for AMT purposes, this re-establishes the “AMT income base” for which the AMT tax can be calculated. This alternative calculation involves the add-back of specific targeted deductions to taxable income otherwise determined under the regular method and excludes certain tax credits otherwise available. Under the current AMT rules, an individual (other than a trust) is entitled to a basic exemption of $40,000 when determining the adjusted taxable income under the AMT calculation. Instead of the progressive tax rates used in regular tax calculations, a flat rate of 15% is used to calculate the minimum tax payable. If the calculated AMT is greater than the regular tax otherwise payable, the individual must pay the AMT. The excess of AMT over the regular tax otherwise payable may be carried forward for up to 7 years and recovered against regular taxes, subject to certain limitations. Technically, an AMT calculation should be done for every individual each year in addition to the regular federal tax calculation. However, in most cases the regular federal tax payable would be greater than the AMT; therefore, in practice the AMT usually only applies to a small number of individuals. Per the 2022 Federal Budget, the review of AMT indicates that thousands of Canadians still pay little to no personal income tax each year and suggested a review of the AMT along with substantive changes.

Budget 2023 proposes several changes (listed below) to the AMT calculation by broadening the base for which income will be subject to the AMT and limiting tax preferences in the forms of deductions, exemptions and credits.

- The capital gain inclusion rate on stock option dispositions will increase from 80% to 100%. Additionally, capital loss carryforwards and allowable business investment losses would apply at a 50% rate. Further, the stock option benefit associated with the exercise of the stock options will be 100% included in income for the AMT base calculation.

- The current 30% inclusion rate for gains that are eligible for the lifetime capital gains exemption will be maintained.

- There will be a 30% inclusion rate on capital gains for publicly listed securities that have been donated. The 20% inclusion rate would also apply to the stock option employment benefit on the exercise of the options to the extent that a donation deduction was available on the underlying securities.

- The following deductions and expenses will be disallowed by applying a 50% cap:

- Employment expenses other than those to earn commission income

- Deductions for CPP, QPP, and Provincial Parental Insurance Plan contributions

- Moving expenses

- Childcare expenses

- Disability supports deduction

- Deduction for workers’ compensation payments

- Deduction for social assistance payments

- Deduction for Guaranteed Income Supplement and Allowance payments

- Canadian armed forces personnel and police deduction

- Interest and carrying charges incurred to earn income from property

- Deduction for limited partnership losses of other years

- Non-capital loss carryovers

- Northern residents’ deductions

- The new rules will expand to limit the application of non-refundable credits to 50% of what would otherwise be available to be claimed. An exemption to this rule will be permitted for the Special Foreign Tax Credit.

- The actual amount of Canadian dividends (both Eligible and Ineligible) will be used to calculate the AMT income base with a full denial of the Canadian dividend tax credit.

The current AMT base income exemption is $40,000, and under Budget 2023, that exemption will increase to the start of the fourth federal tax bracket, approximately $173,000 in 2023, a better income target for high-income earners. As the federal income tax tiers are subject to an annual inflation index, so will the AMT exemption increase with those annual indexation increases. Further, the current flat AMT rate of 15% will increase to 20.50%.

The AMT exemption on its applicability to trust will continue as well as the length of the carryforward be maintained for seven years.

The proposed changes come into force for years that begin after 2023.

Intergenerational transfer measures

Budget 2023 proposes additional conditions to be imposed on a genuine intergenerational share transfer to adult “children” (defined in the Income Tax Act (ITA), more details below). Some background information is provided first.

Section 84.1 – anti-avoidance rule

Section 84.1 of the ITA intends to combat “surplus stripping” (also referred to as “dividend stripping”) transactions used in certain corporate reorganizations where an individual (the “transferor”) converts taxable dividends into capital gains accompanied with a tax-free return of capital. This is usually achieved by transferring existing shares (of the “Transferred Corporation”) to another corporation (the “Purchaser Corporation”) in exchange for Purchaser Corporation’s shares and potentially non-share consideration. The Purchaser Corporation usually does not deal at arm’s length with the transferor (note that “not dealing at arm’s length” is a defined term in the ITA). Since capital gains are treated more favorably than taxable dividends and can potentially be sheltered by the lifetime capital gain exemption (LCGE), these transactions undermine the income tax principle of integration, which aims at providing the same tax treatment for income earned individually or through a corporation.

In simple terms, section 84.1 has two effects: (1) Reduction in paid-up capital (PUC)* – it prevents the transferor from acquiring Purchaser Corporation’s shares with a PUC exceeding the transferred shares’ PUC (or ACB, whichever is greater), and (2) deemed dividend – it deems Purchaser Corporation to have paid the individual a dividend equivalent to the amount by which any non-share considerations received exceeds the transferred shares’ PUC in Transferred Corporation. These effects prevent the individual from converting otherwise taxable dividends into capital gains as well as receiving an increased tax-free return of capital.

However, some genuine intergenerational transfers that do not intend to surplus strip may also be inadvertently caught under section 84.1, resulting in a higher tax rate (on deemed dividends) and loss of LCGE access. As section 84.1 does not apply to arm’s length transfers, some individuals may be better off selling their shares to unrelated parties than to their own children.

*Paid-up capital (PUC) is a tax law concept that measures the contributed capital and capitalized surpluses that a corporation may return to its shareholders on a tax-free basis.

Bill C-208 – introduced exception to section 84.1 rule

Bill C-208 was passed in 2021 to provide an exception to section 84.1 rules and facilitate bona fide intergenerational business transfers. The exception is available to transfers of qualified small business corporation (QSBC) shares or shares of a family farm/fishing corporation to a corporation controlled by one or more of the transferor’s children or grandchildren who are at least 18 years of age, as long as the purchasing corporation does not dispose of the shares within 60 months of purchase (excluding certain situations, such as a sale due to death). The exception provides the transferor a similar tax treatment as if they sell to an arm’s length party.

Since Bill C-208 received Royal Assent, the Department of Finance has expressed concerns about this bill and indicated its intention to introduce amendments to the rules.

Budget 2023 proposal – additional conditions to apply the exception

Budget 2023 proposes to strengthen the safeguarding conditions to apply the exception introduced in Bill C-208 to ensure only genuine intergenerational business transfers can enjoy the treatment.

A genuine intergenerational share transfer is a transfer of shares from the Transferred Corporation by a transferor (a natural person) to the Purchaser Corporation that meets all the following conditions:

- Each share of the Transferred Corporation must be a QSBC or a share of the capital stock of a family farm or fishing corporation (both as defined in the Income Tax Act) at the time of the transfer (existing condition).

- The Purchaser Corporation must be controlled by one or more persons, each of whom is an adult child of the Transferor (the meaning of “child” for these purposes would include grandchildren, stepchildren, children-in-law, nieces and nephews, and grandnieces and grandnephews (existing condition).

- The Transferor who wishes to undertake a genuine intergenerational share transfer may choose one of the two transfer options and meet their respective conditions (Budget 2023 proposed rule).

1) An immediate intergenerational business transfer (3-year test) based on arm’s length sale terms.

2) A gradual intergenerational business transfer (5- to 10-year test) based on traditional estate freeze characteristics.

Regarding number 3 above, both options require hallmarks of a genuine intergenerational business transfer though the specific conditions under each option differ. The proposed conditions focus on the following areas:

- Transfer of (legal and factual) control of the business – legal control must be transferred immediately under both options; factual control doesn’t need to be transferred immediately under the Gradual Business Transfer option.

- Transfer of economic interests in the business – the economic value of the Transferor’s debt and equity interest in the business can be reduced more gradually over 10 years under the Gradual Business Transfer option.

- Transfer of management of the business – both options require a “reasonable” timeframe.

- Child retains control of the business – the receiving child is required to retain legal (not factual) control for a longer period under the Gradual Business Transfer option.

- Child works in the business – the required period of the child’s active involvement in the business is longer under the Gradual Business Transfer option.

Other things to note:

- Relieving rules will be available upon a subsequent arm’s length share transfer or upon death/disability of a child with no limit on the value of shares transferred.

- A joint election must be made by the Transferor and the child(ren) with joint and several liabilities applicable to any tax owing due to application of section 84.1 (where the conditions to the exception are not met).

- CRA’s limitation period to assess the Transferor’s tax liability is proposed to extend by three years for Immediate Business Transfer option and 10 years for Gradual Business Transfer option.

- A 10-year capital gains reserve is proposed for genuine intergenerational business transfers.

The proposed measures will apply to transactions that occur on or after January 1, 2024.

Business Income Tax and International Tax Measures

Tax on repurchases of equity (share buybacks)

Per the 2022 Fall Economic Statement, Budget 2023 proposes to introduce a 2% tax on the net value of all types of share repurchases by public corporations, also known as share buybacks. The tax targets Canadian resident corporations whose shares trade on a designated stock exchange but excludes mutual fund corporations. To level the playing field, the measure will equally apply to other Canadian resident entities whose units are listed on a designated exchange, such as Real Estate Investment Trusts (REITs), Specified Investment Flow-Through (SIFT) trusts and SIFT partnerships.

The tax will be levied through a calculated “net value” of an entity’s repurchase (made during a taxation year) of equity with a minimum exemption of $1 million of equity.

The rules are to apply on or after January 1, 2024.

General Anti-Avoidance Rule (GAAR)

The GAAR is a broad rule in the Income Tax Act that prevents taxpayers from obtaining benefits from strategies deemed to be tax avoidance, even if those strategies themselves have not been expressly prohibited.

Budget 2023 proposes to add a preamble section to the GAAR to clarify the intent of the rule, including a statement that it can apply even where the Department of Finance foresaw or ought to have foreseen the potential for abuse of a tax planning strategy.

There is also a proposed amendment to the “purpose” test under the GAAR. Presently, the GAAR can apply where the primary purpose of a transaction is tax avoidance. Budget 2023 proposes an amendment to apply the GAAR, where tax avoidance was one of the main purposes of the transaction.

An economic substance section will be added to firm up the guidelines for analyzing the economic substance of a transaction. In general, if a transaction is undertaken without having a clear economic benefit (other than an avoidance of tax), the transaction could be deemed to lack economic substance.

A penalty of 25% of tax benefits obtained by transactions caught under the GAAR was proposed, though this tax can be waived in the event the avoidance transaction is either voluntarily or under mandatory disclosure rules.

Lastly, Budget 2023 proposes to extend the normal reassessment period for transactions subject to the GAAR by an additional three years.

The proposals relating to the GAAR amendments will undergo a consultation period until May 31, 2023, after which revisions may be made to the amendments.

Dividend received deduction by financial institutions

A corporation generally claims a deduction in respect of dividends received on shares of other corporations resident in Canada. The policy behind dividend received deduction is to limit the imposition of multiple levels of corporate tax. Budget 2023 proposes to deny the dividend received deduction in respect of dividends received by financial institutions on shares that are mark-to-market property. This measure will apply to dividends received after 2023. Shares are considered mark-to-market property when a financial institution has less than 10% of the votes or value of the corporation that issued the shares. The policy behind the dividend received deduction conflicts with the policy behind the mark-to-market rules. The mark-to-market rules generally classify gains on portfolio shares as business income, and dividends received on such shares are still eligible for the dividend received deduction and are thus excluded from income.

Income tax and GHT/HST treatment of credit unions

Subsection 137(6) of the Income Tax Act contains a definition of “credit union,” which is used for both income tax and GST/HST purposes. Broadly speaking, the Income Tax Act defines a credit union as a corporation, association, or federation that is incorporated or organized as a credit union or cooperative credit society, which derives all or substantially all of its revenues from various sources. These sources include loans made to members, debt obligations or securities of the Canadian government or public bodies, fees charged to members, or loans made to other credit unions. The ITA also includes specific criteria that a credit union must meet, such as having members with full voting rights who are corporations, associations, or federations incorporated as credit unions or cooperative credit societies.

Credit unions that meet the definition are subject to unique income tax and GST/HST rules that apply to them. For instance, a credit union that meets the definition may reap the advantages of a GST/HST rule that enables it to acquire otherwise taxable supplies of goods and services from credit union centrals and other credit unions on an exempt basis. The existing legislation imposes a revenue test on credit unions, which means that if a credit union earns more than 10% of its revenue from sources other than certain specified sources (such as interest income from lending activities), it would no longer be considered a "credit union" and would lose the income tax and GST/HST benefits. As the majority of credit unions function as full-service financial establishments providing a broad range of financial goods and services, exceeding the 10% revenue threshold could yield unexpected tax consequences. In response, Budget 2023 proposes to amend the Income Tax Act by eliminating the revenue test from the definition of “credit union” and implementing further amendments to ensure the definition accommodates how credit unions currently operate. The proposed amendments would take effect with respect to the taxation years of a credit union after 2016.

Other Notable Measures

inCracking down on “junk” fees

Budget 2023 will take steps to reduce “junk fees,” such as telecom roaming fees, event and concert fees, excess baggage fees, and shipping and freight fees, to name a few.

Cracking down on predatory lending

Budget 2023 will take steps to reduce the maximum allowable chargeable interest rate on high-interest loans. Changes will include amendments to the Criminal Code to lower the rate of interest from the current equivalent of 47% to 35%.

Lowering credit card transaction fees for small businesses

Budget 2023 has secured a commitment from Visa and Mastercard to lower interchange fees to credit card issuers on transactions for small businesses. The measures will also protect reward points for Canadians offered by Canada’s large banks.

Doubling the tradespeople’s tool deduction

Budget 2023 proposes to increase the deduction available to tradespersons for the purchase of eligible new tools (required as a condition for employment) from $500 to $1,000, effective in 2023 and in future years. The claim is made for eligible costs that exceed the Canada Employment Credit ($1,368 in 2023), with the deduction limited to the total of the employment income earned as a tradesperson and any grants received to acquire the tools.

The new measure will also apply to apprentice vehicle mechanics for eligible costs exceeding the Canada Employment Credit or 5% of the taxpayer’s income earned as an apprentice mechanic, whichever is greater.

The new Canadian Dental Care Plan

To be in a position to help deliver on the new Canadian Dental Care Plan, Budget 2023 will permit the sharing of taxpayer information with Health Canada and Employment and Social Development Canada. Benefits under the Dental Care Plan are income tested and dependent on the number of children under 12 years of age with no access to a private dental insurance plan.

International tax reforms

Canada has joined the framework on Base Erosion and Profit Shifting (BEPS) as a member of the Organization for Economic Co-operation and Development (OECD). As part of that framework, Canada has agreed to the two-pillar plan for international tax reform and has already taken steps to introduce measures related to Pillar One. Pillar One aims at reallocating taxing rights over the profits of large corporations to countries where their customers are located. Pillar Two aims at ensuring the profits of these large corporations are subject to a tax rate of at least 15%, irrespective of where those profits are earned.

As part of Canada’s efforts in implementing and enforcing Pillar Two, Budget 2023 will introduce tax reforms that will be effective on or after December 31, 2023.

Expanding automatic tax filing systems

First introduced in 2018, the automatic tax filing program offered through the Canada Revenue Agency will expand the service that will increase the number of Canadians eligible for the “File My Return” feature to 2 million by 2025, an estimated increase of 300%. The service will also expand a pilot program that will automate tax filing for the most vulnerable Canadians who currently do not file their taxes and receive benefits they may otherwise be entitled.

Creating a new leave for pregnancy loss + improving access to leave related to the death or disappearance of a child

Budget 2023 proposes to make the necessary amendments to the Canada Labour Code to create new stand-alone leave for workers in federally regulated sectors who experience a pregnancy loss or experience the death or disappearance of a child.