Pre-opening Comments for Wednesday April 5th

U.S. equity index futures were lower this morning. S&P 500 futures were down 5 points at 8:30 AM EDT.

Johnson & Johnson added $4.75 to $165.25 after announcing an $8.9 billion settlement on talc claims.

UnitedHealth Group gained $4.55 to $497.80 after Raymond James upgraded the stock from Outperform to Strong Buy.

Cigna advanced $2.46 to $259.00 after Raymond James upgraded the stock from Outperform to Strong Buy.

Meta Platforms added $0.67 to $215.39 after Jefferies raised its target price from $225 to $250.

Technical Notes

Eurozone iShares $EZU moved above $45.38 extending an intermediate uptrend.

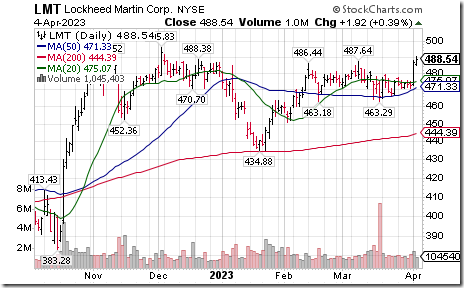

Lockheed Martin $LMTan S&P 100 stock moved above $487.64 extending an intermediate uptrend.

Gold $GLD and Silver bullion $SLV ETFs moved above resistance extending an intermediate uptrend

Related gold equity ETFs quickly responded to higher precious metals prices. Gold equity ETFs breaking resistance and extending an intermediate uptrend included GDX, GDXJ and XGD.TO

Loblaws $L.TO and George Weston $WN moved above intermediate resistance to an all-time high.

Trader’s Corner

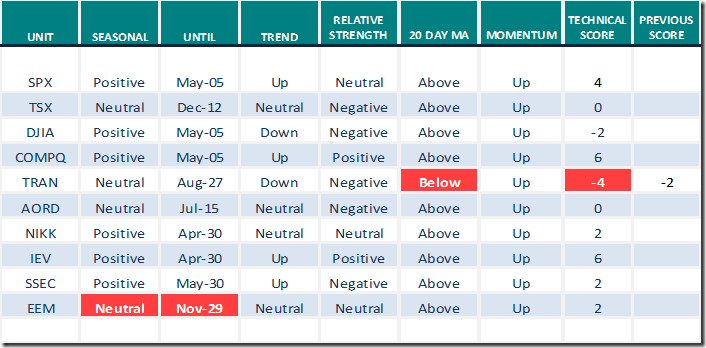

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 4th 2023

Green: Increase from previous day

Red: Decrease from previous day

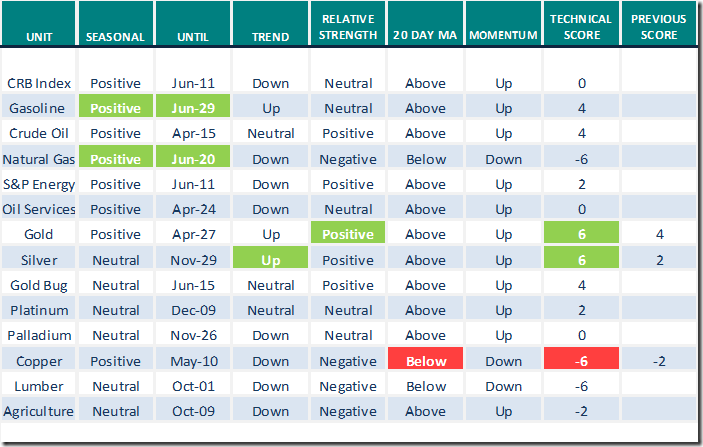

Commodities

Daily Seasonal/Technical Commodities Trends for April 4th 2023

Green: Increase from previous day

Red: Decrease from previous day

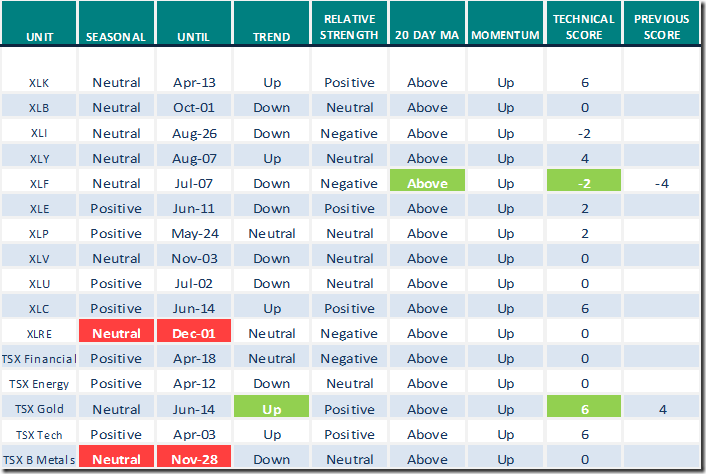

Sectors

Daily Seasonal/Technical Sector Trends for April 4th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 8.80 to 44.40. It remains Neutral.

The long term Barometer dropped 2.80 to 57.60. It changed from Overbought to Neutral on a move below 60.00.

TSX Momentum Barometers

The intermediate term Barometer slipped 2.99 to 50.00. It remains Neutral.

The long term Barometer slipped 0.85 to 64.10. It remains Overbought.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed