In Q1 2023, macro and market dynamics created confusion for investors. Alfonso Peccatiello, Macro Strategist at The Macro Compass, seeks to provide clarity for Q2 by analyzing volatility-adjusted market performance, examining key variables in their quantitative TMC Asset Allocation Model, and reflecting on asset class valuations.

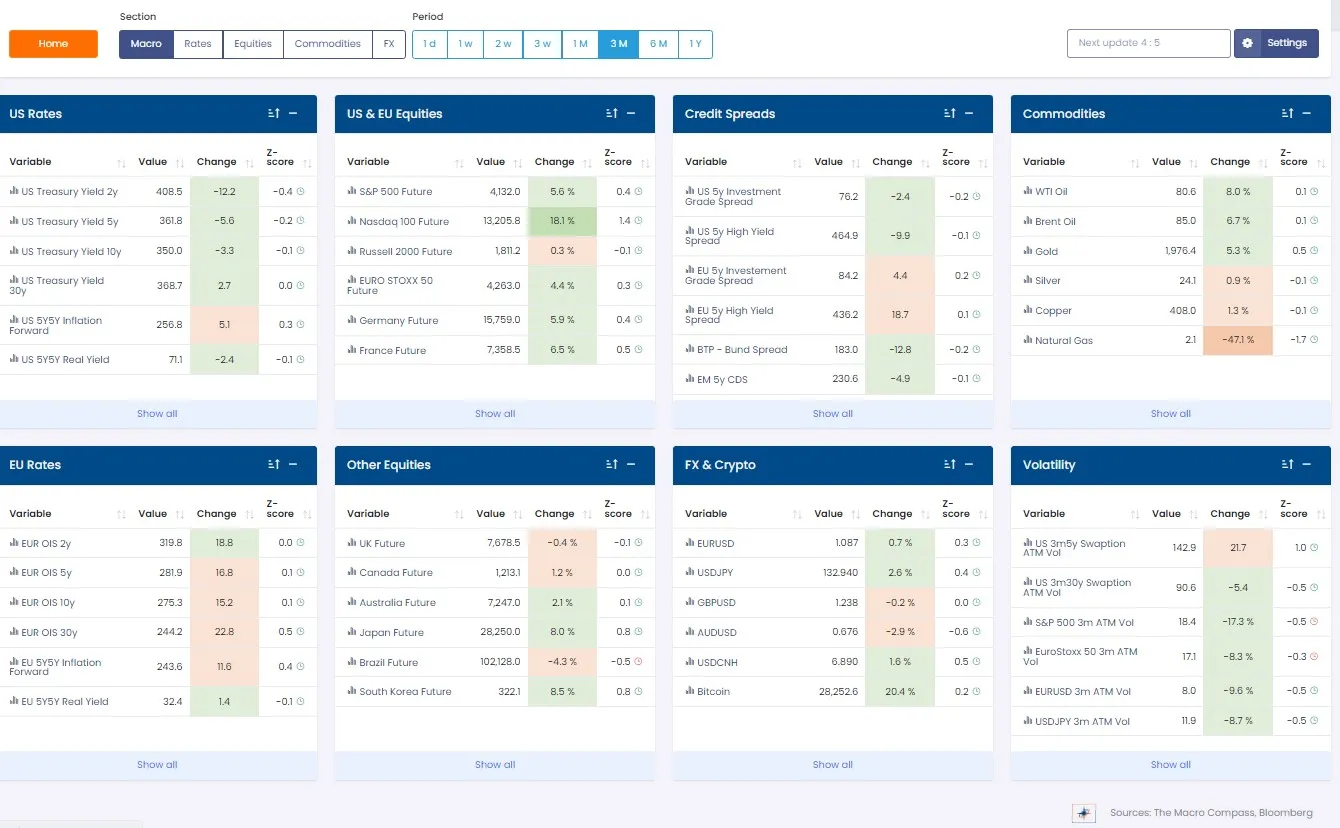

Q1 brought mildly positive returns for long-term macro investors, but with substantial volatility. The Volatility-Adjusted Market Dashboard (VAMD) reveals that most assets had a 3-month Z-Score of less than 1, indicating no significant vol-adjusted action.

A major Q1 macro trend was the rotation in US equity sectors, with Tech and Consumer Discretionary outperforming defensive sectors like Healthcare and Utilities. Peccatiello cites mechanical re-leveraging flows, not fundamentals, as the reason for this shift.

Approaching Q2, Peccatiello turns to the TMC Quadrant Asset Allocation Model (QAAM) to assess macro fundamentals. The model combines monetary policy and economic growth indicators to determine the prevailing Macro Quadrant and corresponding asset allocation tilt. It also evaluates valuations, correlations, and portfolio volatility to finalize allocations in the Long-Term Macro ETF Portfolio.

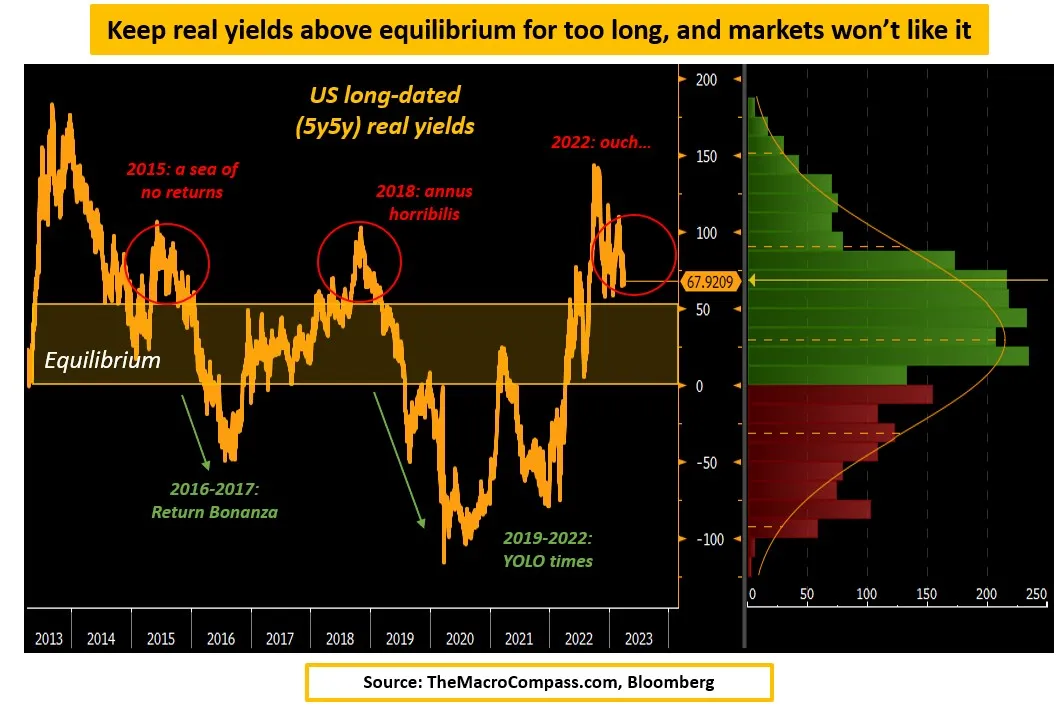

The QAAM reveals that global monetary policy remains tight due to elevated and sticky real yields, which are expected to tighten further as the flow of financial money turns more negative. Long-dated real yields are now positive and above equilibrium in many jurisdictions, negatively impacting growth and markets as the debt-based system struggles to roll over cheap leverage. In the US, sustained periods of above-equilibrium real yields historically lead to poor market performance, as seen in 2015 and 2018.

In 2022, the rate of change in real yields alarmed markets, shifting from -0.75% in March to +1.50% in October within six months. Although real yields have since stabilized, they have averaged a tight +0.93% for the past six months. In Q2, real yields are likely to remain tight, which markets typically dislike, especially when sustained over a long period.

Peccatiello questions whether central banks are conducting quantitative tightening (QT) or printing money, and how that impacts macro and markets in Q2. He emphasizes the importance of considering the global monetary policy stance, the effect of real yields on growth and markets, and the role of mechanical re-leveraging flows in driving market trends.

In conclusion, investors should approach Q2 with caution, given the ongoing tight global monetary policy and its potential impact on markets. By analyzing volatility-adjusted market performance, using the QAAM to assess macro fundamentals, and reflecting on asset class valuations, investors can better position their portfolios for the uncertainties ahead.

Footnote:

1 Adapted from source (Alf), Alfonso Peccatiello. "How To Invest In Q2." The Macro Compass, 3 Apr. 2023, themacrocompass.substack.com/p/how-to-invest-in-q2.