Pre-opening Comments for Tuesday March 28th

U.S. equity index futures were lower this morning. S&P 500 futures were down 5 points at 8:30 AM EDT.

Occidental Petroleum added $0.80 to $60.45 after Berkshire Hathaway confirmed an increased ownership to 23.5% of outstanding shares.

Wallgreens Boots gained $0.85 to$33.79 after reporting higher than consensus fiscal second quarter revenues and earnings.

Ciena advanced $1.57 to $50.18 after Raymond James upgraded the stock from Outperform to Strong Buy.

McCormick added $2.51 to $76.57 after reporting higher than consensus first quarter earnings.

EquityClock’s Daily Comment

Headline reads “Market is in risk-off mode”.

http://www.equityclock.com/2023/03/27/stock-market-outlook-for-march-28-2023/

Technical Notes

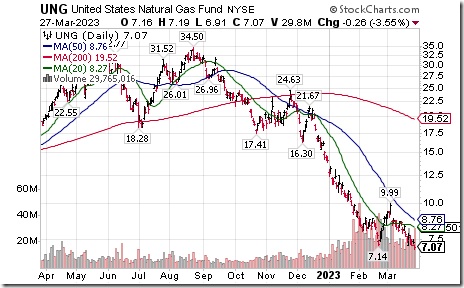

Natural gas ETN $UNG moved below $7.14 extending an intermediate downtrend.

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 27th 2023

Green: Increase from previous day

Red: Decrease from previous day

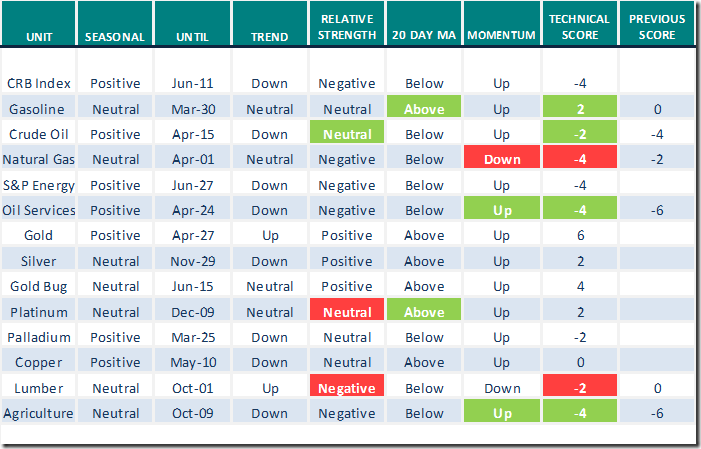

Commodities

Daily Seasonal/Technical Commodities Trends for March 27th 2023

Green: Increase from previous day

Red: Decrease from previous day

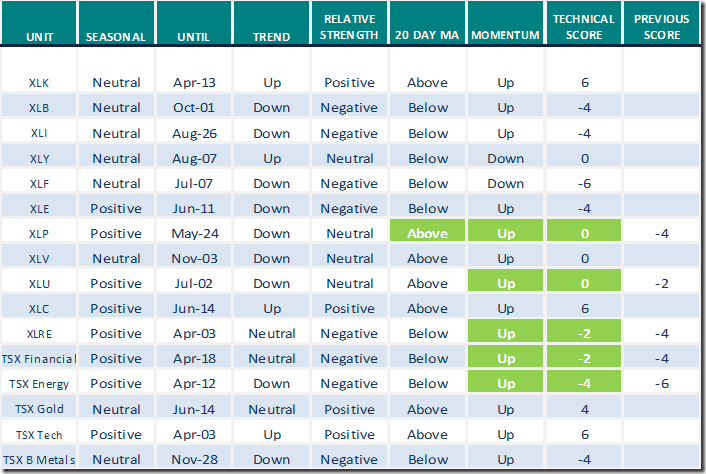

Sectors

Daily Seasonal/Technical Sector Trends for March 24th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive Seasonal ratings: www.equityclock.com

Links offered by valued sources

Morgan Stanley’s Mike Wilson on Stocks, Earnings, Fed, Bond Markets, Banking Sector

Morgan Stanley’s Mike Wilson on Stocks, Earnings, Fed, Bond Markets, Banking Sector – YouTube

Market Poised For A Big Decline | Jeffrey Huge, CMT | Your Daily Five (03.27.23)

Market Poised For A Big Decline | Jeffrey Huge, CMT | Your Daily Five (03.27.23) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer added 1.60 to 24.60. It remains Oversold. More evidence of a bottom at 17.60 has appeared.

The long term Barometer added 2.80 to 45.60. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer added 3.42 to 34.19. It remains Oversold. More evidence of a bottom at 26.81 has appeared.

The long term Barometer added 3.42 to 55.56. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed