In a recent article by Alfonso Peccatiello, Founder and Macro-Strategist at The Macro Compass, he discusses the current stress in the banking sector, drawing a parallel with the late Italian judge Giovanni Falcone's method of tackling the mafia:

"Follow the money, find the mafia."

Peccatiello suggests that using a similar approach can help understand the extent of today's banking stress, which is crucial for macro and market analysis moving forward.

In the article, Peccatiello outlines a strategy for tracking banking stress, focusing on specific reports and their analysis.

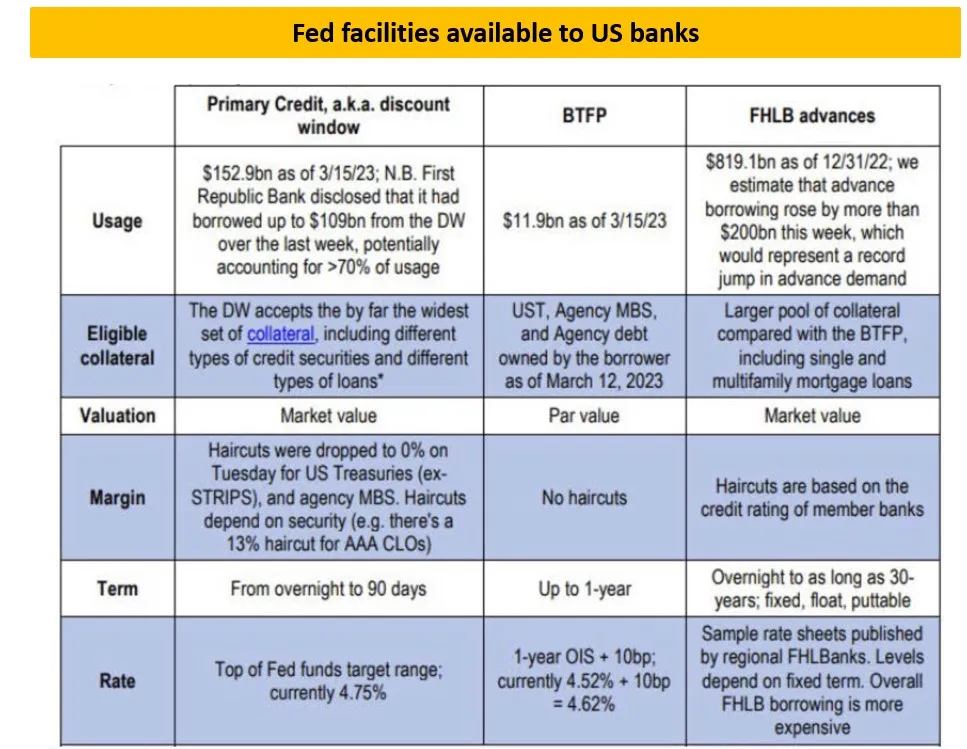

Peccatiello discusses the available liquidity facilities for US banks, which can be a useful indicator of banking stress. He highlights three main facilities: the Discount Window (Fed), the BTFP (Fed), and the FHLB Advances (not Fed). Each facility offers different conditions, eligible collateral, and loan tenors.

The following JP Morgan table nicely summarizes the different facilities available to banks:

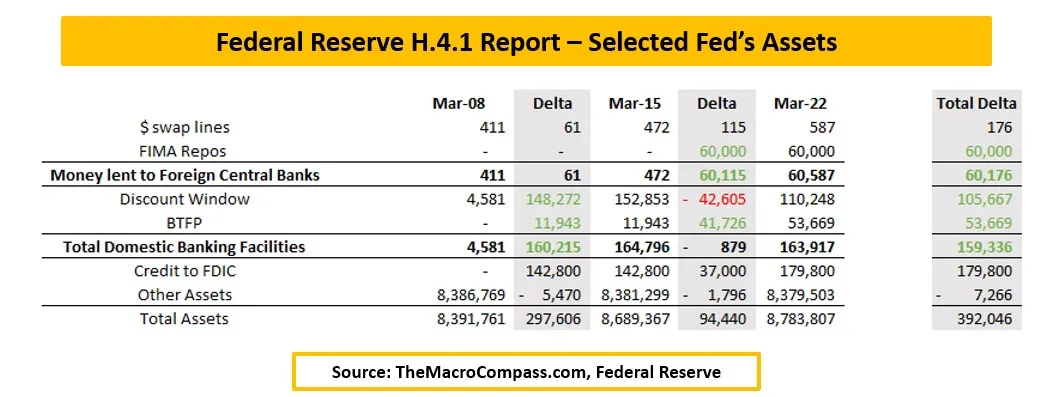

To follow the money, Peccatiello refers to the Fed's H.4.1 report, which provides information on the Discount Window and the BTFP. According to the report, banks drew $160 billion from these facilities during the week of the SVB debacle, and net zero the following week. Notably, First Republic Bank drew about $110 billion from the Discount Window, leaving other US banks with a combined $50 billion draw from Fed facilities two weeks after the stress began.

Peccatiello then examines whether banks might have used the third option, FHLB Advances, more aggressively. Although FHLB disbursed loans to commercial banks are only reported quarterly, it is possible to track the amount of money FHLB raises through bond issuance, which can give an idea of the potential incoming demand FHLB anticipates.

Surprisingly, the FHLB raised as much as $300 billion in just 7-10 days, significantly outpacing its normal issuance pace. This is a substantial figure, indicating that banks might be under considerable stress.

In conclusion, by following the money, Peccatiello presents a compelling case for the presence of banking stress in the US. While the full extent of this stress remains to be seen, his analysis provides valuable insights into the current state of the financial sector. Moving forward, it is essential to continue monitoring these liquidity facilities and other indicators to better understand the implications for markets and the broader economy.

Footnotes:

1 Adapted from source: (Alf), Alfonso Peccatiello. "Follow The Money." The Macro Compass, 28 Mar. 2023, themacrocompass.substack.com/p/follow-the-money?utm_source=substack&utm_medium=email.