Pre-opening Comments for Wednesday March 22nd 2023

U.S. equity index futures were lower this morning. S&P 500 futures were down 4 points at 8:30 AM EDT.

Focus today is on the FOMC announcement on monetary policy released at 2:00 PM EDT. Consensus is calling for another 0.25% increase in the Fed Fund Rate for a target range of 4.75%-5.00%. Federal Reserve Chairman Powell will offer additional guidance at a press conference at 3:00 PM EDT.

Nike dropped $2.11 to $123.50 following release of fiscal third quarter results. The company offered guidance for fiscal 2023 below consensus estimates.

GameStop jumped $9.37 to $27.00 after reporting higher than consensus fourth quarter revenues and earnings.

Petco dropped $0.76 to $9.41 after reporting less than consensus fourth quarter earnings. The company also lowered guidance for 2023

Winnebago gained $2.26 to $60.51 after reporting higher than consensus fiscal second quarter earnings.

EquityClock’s Daily Comment

Headline reads “Looking for setups that are prone to mean-reversion into the end of the quarter”.

http://www.equityclock.com/2023/03/21/stock-market-outlook-for-march-22-2023/

Technical Notes

Technology SPDRs XLK moved above $144.27 extending an intermediate uptrend.

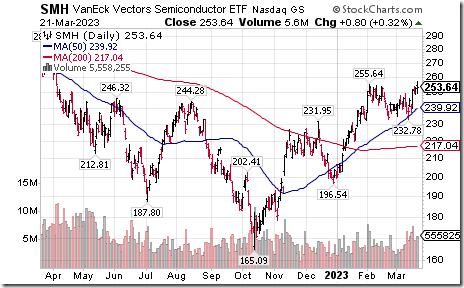

Semiconductor ETF $SMH moved above $255.64 extending an intermediate uptrend.

AbbVie $ABBV an S&P 100 stock moved above $156.46 extending an intermediate uptrend.

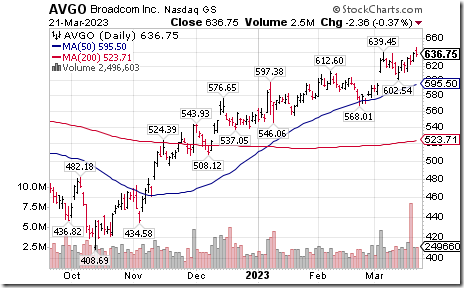

Broadcom $AVGO a NASDAQ 100 stock moved above $639.45 extending an intermediate uptrend.

Trader’s Corner

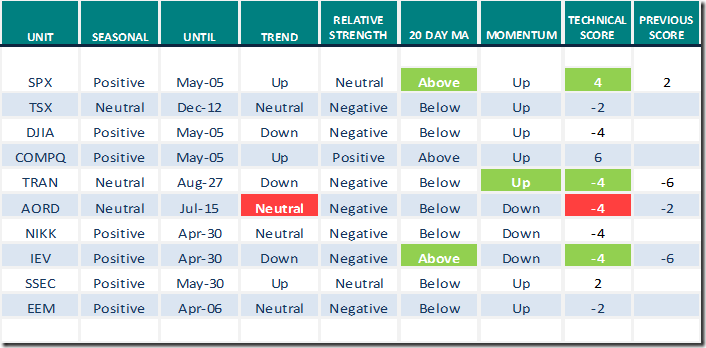

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 21st 2023

Green: Increase from previous day

Red: Decrease from previous day

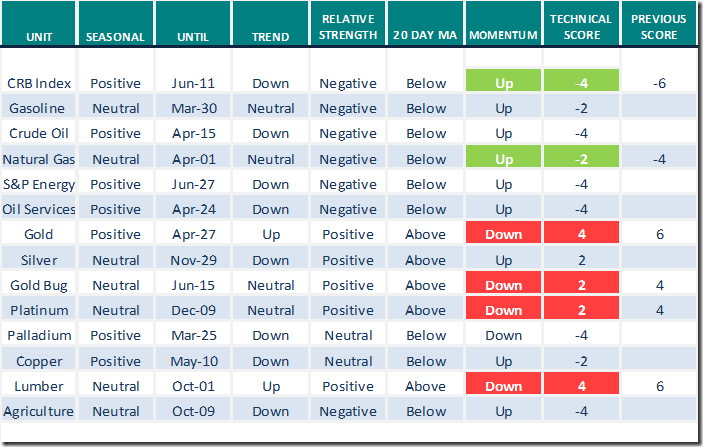

Commodities

Daily Seasonal/Technical Commodities Trends for March 21st 2023

Green: Increase from previous day

Red: Decrease from previous day

Sectors

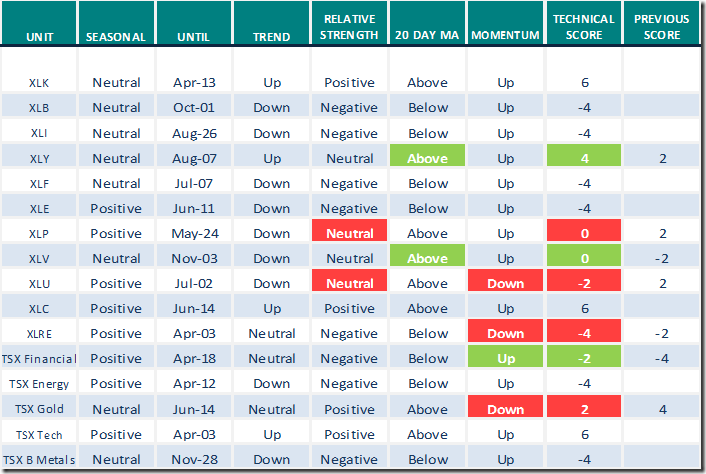

Daily Seasonal/Technical Sector Trends for March 21st 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for Seasonal ratings: www.equityclock.com

Links offered by valued providers

Understanding The Bullish MACD Crossover | Tom Bowley | Trading Places (03.21.23)

Understanding The Bullish MACD Crossover | Tom Bowley | Trading Places

(03.21.23) – YouTube

Trade Setups In Semiconductors | Joe Rabil | Your Daily Five (03.21.23)

https://www.youtube.com/watch?v=fTz7-0Jd4iE

S&P 500 Momentum Barometers

The intermediate term Barometer added 0.20 to 26.40. It remains Oversold. Daily trend is up.

The long term Barometer added 3.20 to 49.60. It remains Neutral. Daily trend is up.

TSX Momentum Barometers

The intermediate term Barometer slipped 0.85 to 34.04. It remains Oversold.

The long term Barometer advanced 2.98 to 54.89. It remains Neutral. Daily trend is up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed