by Wylie Tollette, Ian Westley, Melissa Mayorga, Miles Sampson of Franklin Templeton

Franklin Templeton Investment Solutions explores the shared macro concerns that set the stage for the recent banking crisis, its ripple effects on the broader economy and implications for multi-asset investing.

In this blog, we explore the implications of recent bank turmoil on our multi-asset views. For a more detailed background on what transpired at Silicon Valley Bank (SVB) and the actions that the Federal Reserve (Fed) took to mitigate the fallout, we recommend reading this piece.

Our key takeaways are as follows:

- The recent events at SVB and other global banks occurred due to a mixture of idiosyncratic problems at these institutions as well as macroeconomic forces that are a cause for broader concern.

- Our macroeconomic outlook remains bearish as we expect global growth to further weaken and policy to remain tight.

- We believe that valuations of risk assets are broadly expensive given our bearish macro outlook, which doesn’t appear to be priced in.

What happened? Don’t let the micro details hide the macro story

Idiosyncratic factors certainly played a role in SVB’s failure and the recent turmoil we’re seeing in US regional banks as well as overseas at Credit Suisse (CS). SVB had a glut of corporate customers that were tech startups (that have been drawing down their deposits), as well as a mismanaged asset and liability mix, particularly in an environment of rising interest rates (fixed-rate assets and floating-rate liabilities). CS has been engulfed in scandal over the last few months and has seen outflows and a steady decline in assets under management since this past October. However, we believe that even many of the micro stories of the last two weeks are not fully isolated from one another.

Fiscal and monetary stimulus following the onset of the COVID-19 pandemic in the United States and abroad spurred a hot global economy. With low financing costs, animal spirits were unleashed—booming private markets, unprofitable growth startups, digital assets and Reddit-fueled stocks like AMC and Gamestop saw their valuations soar. Animal spirits help produce strong growth, but they can also produce excesses in the economy that are concealed until policy tightens.

Witnessing a surge in inflation, global central banks embarked on the most rapid tightening cycle in decades. In the United States, Federal Reserve (Fed) policy rates have risen 450 basis points (bps) since the hiking cycle kicked off; 2022 alone saw the most bps of Fed rate hikes ever in a single calendar year. These rate hikes can take time to flow through the economy, and we are seeing the first few dominoes to fall with SVB, Signature Bank, and more recently, volatility at CS.

As a result of central bank liftoff, we saw yield curves around the world invert, which can hurt bank profitability. Banks invest customer deposits, fed funds and short-term instruments into longer-term loans, which under normal circumstances yields them a profit (assuming the loans they make do not default). However, when interest rates rise, the price of longer-dated securities falls in value. Further, when the yield curve inverts, new longer-dated loans are no longer higher yielding than short-term loans. While SVB in particular suffered from underwater carry trades, they’re not alone—banks are currently sitting on around US $620 billion of unrealized losses.1

Economic outlook

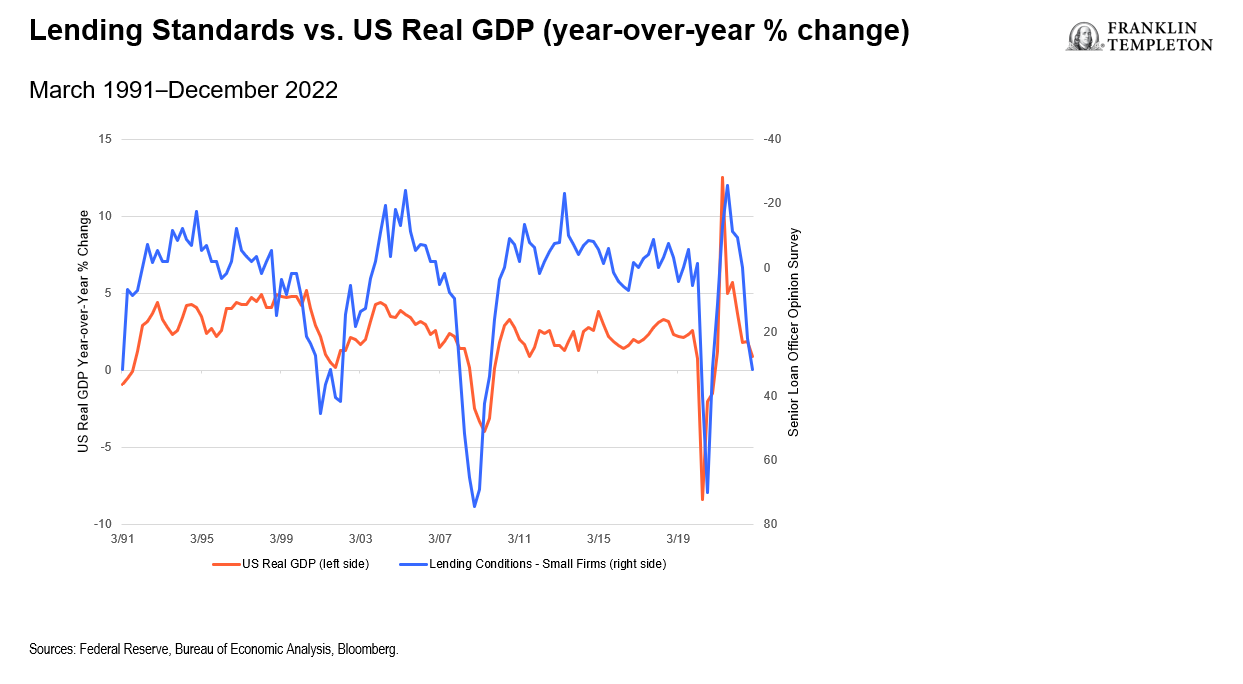

Bank lending standards across the United States and Europe were tightening before SVB’s collapse, and will likely only continue to tighten. These standards are important to watch, as they provide a reliable leading indicator to gross domestic product (GDP) growth and high-yield corporate credit default rates. Additionally, consumers are broadly still concerned about the safety of their deposits and the magnitude of the Fed’s backstop. Blue-chip, “too big to fail” banks like Bank of America and JP Morgan have seen billions of dollars in deposit flows over the last couple of days. The strain on small, regional banks may have a significant impact on economic growth. Loan growth has been shown to be a reliable leading indicator of economic activity, and when it slows, so too does the economy (Exhibit 1).

Exhibit 1: When bank loan growth slows, GDP usually follows

Unfortunately for central banks, a weak growth outlook is likely to take place alongside elevated levels of core inflation. The Fed, European Central Bank (ECB), and other developed market central banks are in a precarious position as there is now tension between their dual objectives of ensuring financial stability and reining in inflation. We wrote a series of papers last year cautioning that the Fed is walking a tightrope between hiking too much, risking recession, and hiking too little, allowing inflation to run too hot. Our concern was that with the Fed behind the curve, they might overdo it, and something would break. It is possible that moment is upon us, and the proverbial tightrope has been cut out from under them.

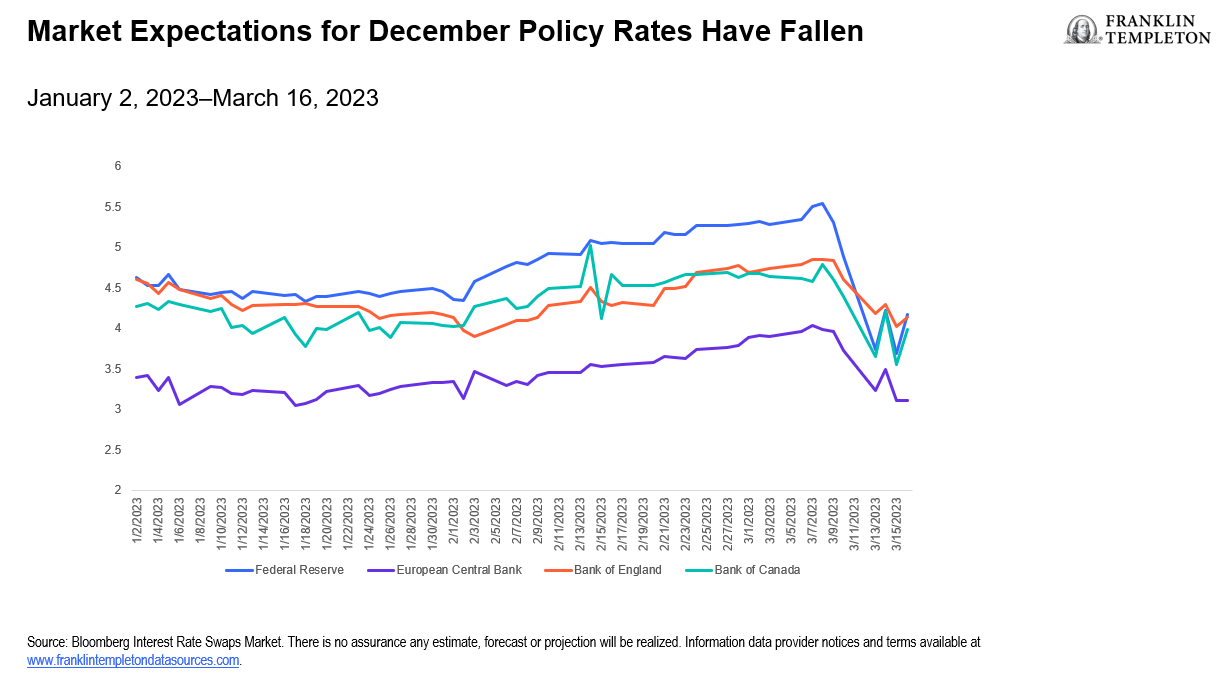

Market pricing for central banks’ policy rates have fluctuated dramatically over the first couple weeks of March. On March 8, market participants were expecting the Fed to hike rates to 5.70% before pausing. As of March 16, the market is pricing in rates at just 4.93%. What this tells us is that investors believe that the Fed may have been too aggressive, recession risk has crept up, and the central bank may need to reverse course sooner than expected. While these expectations may end up coming true, the repricing is noteworthy; this highlights the tension between inflation and financial stability.

We continue to expect the Fed to hike rates by 25 bps at its upcoming March 21-22 policy meeting, although this is a highly fluid situation. Likewise, we are not surprised that the ECB increased policy rates by 50 bps as it focuses its interest rate policy on inflation.

Exhibit 2: Have central banks been too aggressive?

The mixture of a weak growth outlook, challenging inflation and tightening policy keeps our recession risk high, particularly in the United States and Europe where financial conditions have tightened. It also supports our regional preference for Asia, where inflation is a lesser issue and some economies are geared to China’s reopening.

Tail risk

CS is a much larger and more economically critical bank than SVB, with significant liquid assets and access to Swiss National Bank (SNB) credit lines to call upon in the event of rapid deposit withdrawals. The SNB backstop is a crucial development. While we continue to have some concerns, a full-scale SVB-like collapse in Europe, Japan, and other developed markets is unlikely given stricter liquidity and capital requirements than seen in the United States. We are monitoring these developments closely.

Multi-asset implications

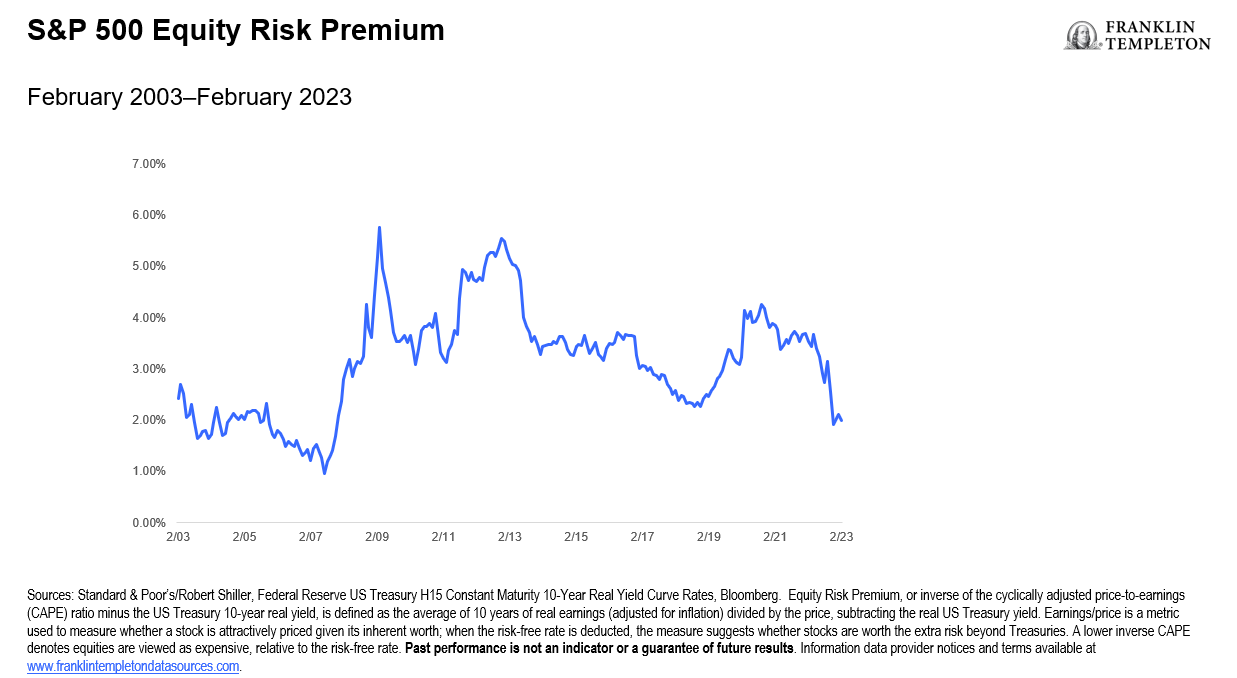

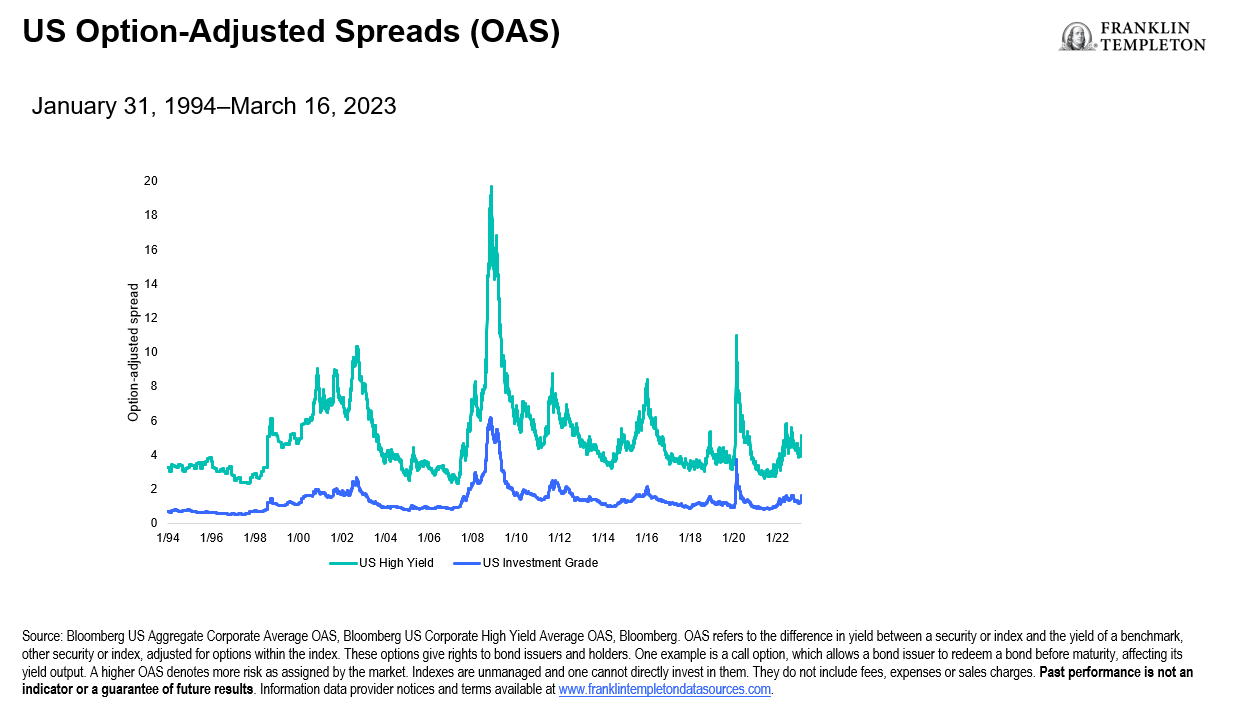

Asset valuations are not reflecting our weak macro outlook. Equity risk premia and credit spreads are a far cry from levels we’ve seen in prior recessions (see Exhibits 3A and 3B). Similarly, corporate earnings expectations still appear too high, especially as profit margin pressures continue. To us, risky assets are not appropriately pricing in current macro fundamentals or recession possibility. Furthermore, if the Fed stays its hawkish course—against investor expectations—risk assets could suffer.

Exhibit 3A: Stocks valuations are not reflecting imminent recession

Exhibit 3B: Yields are not mimicking past crises

At this point, we remain defensively positioned. We favor fixed income over equity, with a preference for government bonds over credit. Even with the strong repricing in government bond yields, elevated concerns around a recession still support duration at these levels as they can provide material downside protection.

Finally, as mentioned above, we are tilting away from developed markets, where inflation remains highest and bank concerns are having the most material impact on confidence. These issues are less apparent in Asia, which is also buoyed by the growth impetus stemming from China’s reopening. This supports our preferencing for Chinese equities and Asia Pacific emerging market local debt.

*****

WHAT ARE THE RISKS?

All investments involve risks, including the possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. The positioning of a specific portfolio may differ from the information presented herein due to various factors, including, but not limited to, allocations from the core portfolio and specific investment objectives, guidelines, strategy and restrictions of a portfolio.

Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions.

Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Investments in lower-rated bonds include higher risk of default and loss of principal. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. In general, an investor is paid a higher yield to assume a greater degree of credit risk. The risks associated with higher-yielding, lower-rated debt securities include higher risk of default and loss of principal. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments.

Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

_________________________

1. Source: “Remarks by FDIC Chairman Martin Gruenberg on the Fourth Quarter 2022 Quarterly Banking Profile.” Last updated: February 28, 2023. FDIC Speeches and Testimony.