by Vinod Chathlani, Lead Portfolio Manager—Multi-Asset Solutions, Salima Lamdouar, Senior Research Analyst—2050 CleanTech Solutions, AllianceBernstein

The global pursuit to limit rising temperatures has bolstered carbon allowances markets. As these instruments flourish, they’ve become a distinct asset class that offers hedging and other benefits in a portfolio.

Carbon Allowances Link the Price of Carbon to Markets

Climate change poses many risks to society and industries, whether it’s elevated weather uncertainty and physical damage from global warming or business-model disruptions in the transition to a lower-carbon economy. While both can impact asset prices over longer horizons, the risk of markets pricing in a faster-than-expected transition is more likely to impact portfolios in the near term. Carbon allowances can be an important tool in protecting portfolios from such transition risks. Based on our research, they’ll likely become a key asset-allocation building block in the years ahead.

A carbon allowance is a permit for a company or other organization to emit one metric ton of CO2 within a specified timeframe—usually one year. They’re issued by local jurisdictions from governments and authorities to supranational entities and are usually auctioned to companies to align with mandatory emissions caps. Companies that emit more greenhouse gases (GHG) than they’re allowed risk hefty fines but those that don’t use all their allowances can sell them back into the market.

Allowances differ from carbon offsets, which businesses buy to support green initiatives outside their operations, hoping to reduce their overall carbon footprint. Another key difference is that carbon offsets are usually “retired” from the market once the buyer claims them.

Carbon allowances, on the other hand, are usually traded among companies and financial intermediaries in the markets they serve. Some of these markets can be accessible through futures and swap contracts, and their prices change with market dynamics. Carbon allowances are the most liquid carbon-related asset class and are often exchanged at high volumes. The most heavily traded market is the European Union’s ETS, with an average of EUR €2.5 billion in contracts changing hands daily.

Carbon Markets Are Still Evolving but Rife with Opportunity

Carbon allowances trade in the compliance markets, one of two primary types of carbon markets. The other is voluntary. While both are important, we think compliance markets, which involve some regulatory oversight, are more imminently investable given their greater scale, liquidity, stronger integrity and transparency.

Voluntary markets tend to be more freewheeling, with no shortage of controversies. They’ve grown only to USD $2 billion over decades and need fundamental reexamining before they can be an effective tool in the low-carbon transition. In contrast, compliance markets add up to USD $850 billion and rising, offering investors much more choice today.

Commonly referred to as “cap-and-trade” or “emissions trading systems (ETS),” compliance markets can range in scope from individual US states to multi-country zones. With nearly 200 countries committed to the Paris Agreement’s goals, the floodgates have swung wide open for carbon allowance issuance across compliance markets worldwide, with secondary investor demand regularly outpacing supply. And as imports increasingly are factored into countries’ decarbonization goals, new Carbon Border Allowance Mechanisms in Europe and elsewhere should only boost compliance market growth through the end of the decade.

What Carbon Allowances Can Do for Investors

In weighing climate-specific risks to investment outcomes, we see three roles for carbon allowances:

- They can enhance return potential, since they participate directly in a secular theme of a transition to a decarbonized world that’s already gaining momentum. Issuance will continue to shrink as caps are lowered and fewer allowances are distributed. Moreover, some markets are likely to converge further over a longer time horizon, as we saw with California’s ETS 2014 linkage with Quebec’s, allowing the two systems—now known as the Western Climate Initiative—to share carbon instruments to reach their goals. This trend should provide select arbitrage opportunities over time.

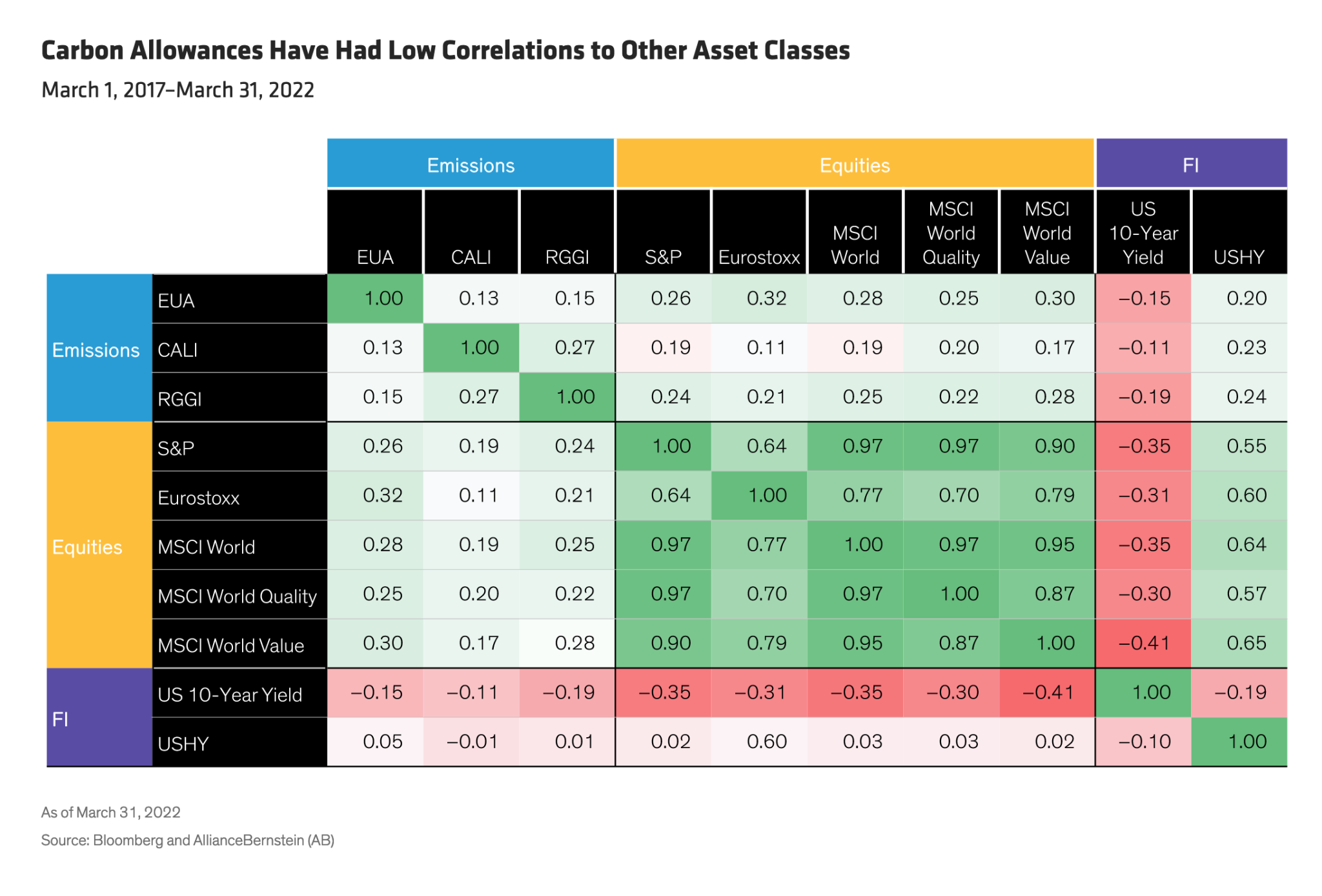

- Allowances are an effective diversifier, with consistently low correlation to traditional assets such as stocks and bonds (Display). For example, based on a five-year period ending March 31, 2022, the US 10-Year Treasury had a -0.19 correlation with the Regional Greenhouse Gas Initiative (RGGI). Just as important, carbon pricing is regional, with varying degrees of emission coverage, market mechanisms and policies in place. Therefore, correlations across carbon markets have also been historically low, such as the 0.13 correlation between the California ETS and the European Carbon Emission Allowance (EUA) for the same period. This makes a strong case for active allocation—not just among carbon allowances but throughout the carbon-related asset class.

- They’re an effective hedge against some of the tail risk of investment losses related to the climate transition. In fact, we found that carefully selected allocations to carbon allowances have historically reduced transition risk in diversified investment strategies.

Risk Considerations When Allocating to Carbon Allowances

When sizing carbon allowance allocation weightings, three considerations are important: which climate transition path is most likely to occur, the portfolio’s exposure to that scenario and the investor’s tolerance to this risk. That is, there are several ways climate transition could progress, so investors need to weigh the ones they think are most likely to occur.

Moreover, for a given transition scenario, different portfolios may have varying exposure to its risk. For instance, a strategy with a higher allocation to companies whose business models are likely to be disrupted by a faster transition, such as commodity producers, will be more exposed to this risk than one that invests in utilities that produce renewable power.

Our analysis compared multiple climate transition scenarios based on the Network for Greening the Financial System’s (NGFS) REMIND model, a widely accepted baseline.

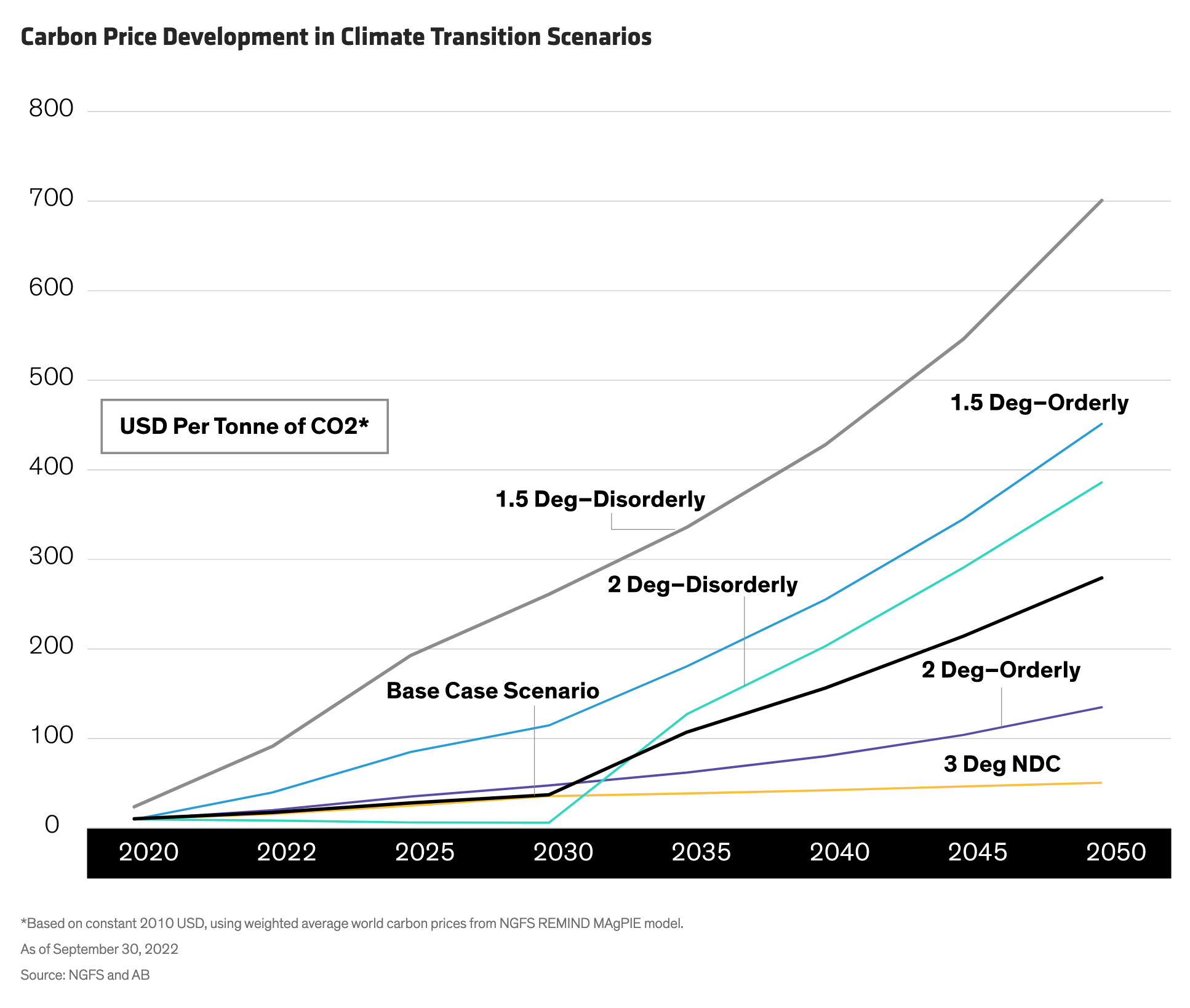

Looking to 2050, temperature scenarios examined ranged from conservative and methodical to random and disorderly. An orderly path, such as 2 degrees warming orderly scenario, assumes that the early introduction of policies made the transition gradual and with more subdued risks. The disorderly scenarios feature delayed or divergent policies, with carbon costs rapidly increasing later to make up for lost time. Much of the risk comes down to each scenario’s cost of carbon over time—carbon prices will likely rise faster in more rapid transition scenarios (Display).

The climate risks for economies, financial systems and businesses vary widely with each scenario, which has important—and potentially significant—implications for investment strategies. Using common indices as proxies for global equities and stocks of commodities producers, we applied the distinct carbon pricing risks for each scenario to all three assets against the Paris Agreement’s 2030 deadline to cut GHG emissions in half (Display).

As expected, the modest scenario made the smallest impact. The projected loss from transition risk and cost of carbon for global stocks in a 3 degree nationally determined contribution (NDC) scenario was minimal (the gold bar). But transition risks are higher depending on portfolio context. For instance, global stocks saw up to a 3% loss among the more aggressive scenarios. However, commodity producers—companies involved in the carbon-intensive business of providing fossil fuels and related materials—have materially greater transition-risk exposure. That’s why the size of the allocations come down to which scenarios are more likely and the exposure of the portfolio under consideration.

Allocating to Allowances: How Much is Enough?

Based on our assessment of the likelihood of each NGFS transition scenario, we assume a base case scenario for the expected path of climate transition.

Global stocks are exposed to less relative transition risk. So, we think a nearly 2% allocation to carbon allowances is sufficient to protect the strategy in our base-case scenario. For commodity producers, risk exposure is higher, which would need a much higher allocation to achieve a similar level of protection in the base case (Display). Of course, climate change is a moving target. What’s important isn’t the specific numbers, which may evolve with climate change data and models, but rather finding the right framework to think about putting carbon markets to work in investor portfolios.

Diversification has long been the calling card of an effective long-term strategy. But with climate change a growing factor in portfolio risk, global leaders contend that traditional asset mixes may need rethinking and expanding. We see carbon allowances as the next logical step in that direction.

*****About the Authors

Vinod Chathlani is Lead Portfolio Manager on the Multi-Asset Solutions team, with a focus on real assets, energy transition and climate change. He joined AB in 2013 as a quantitative researcher and assistant portfolio manager on the Dynamic Asset Allocation team, where he helped research and develop quantitative tools and systematic strategies. Prior to that, Chathlani held roles in investment risk and corporate strategy, focusing on mergers and acquisitions. He holds a BTech from the University of Madras, India; an MFE in quantitative finance from the University of California, Los Angeles; and a PGDM (MBA) from the Indian School of Business, India. Location: New York

Salima Lamdouar is a Senior Research Analyst for 2050 CleanTech Solutions. Before joining the team, she was the lead portfolio manager for sustainable and climate-focused fixed-income strategies at AB, spanning investment grade, high-yield income and emerging-market debt. In her role, Lamdouar was responsible for day-to-day performance of the funds as well as for defining the sustainability approaches across corporate, sovereign and securitized asset classes for the strategies. She has also been leading a firmwide working group on carbon markets. Before joining the firm in 2015, Lamdouar was a generalist portfolio manager at fixed-income manager Rogge Global Partners. She holds a BSc (Hons) in banking and finance from from Cass Business School. Location: London