In a recent article, Alfonso Peccatiello, Macro Strategist at The Macro Compass, raises critical questions about the ability of banks to manage their interest rate risk and deposit outflow risk, particularly in light of recent problems faced by a couple of regional banks. Drawing from his extensive experience managing a large investment portfolio at a European bank and being part of the Treasury department, Peccatiello provides insights on three key aspects:

- How banks approach risk management of large securities portfolios;

- The impact of higher interest rates on banks' balance sheets and the assessment of broader contagion risks; and

- An update on inflation and the likely Federal Reserve's reaction in the current environment.

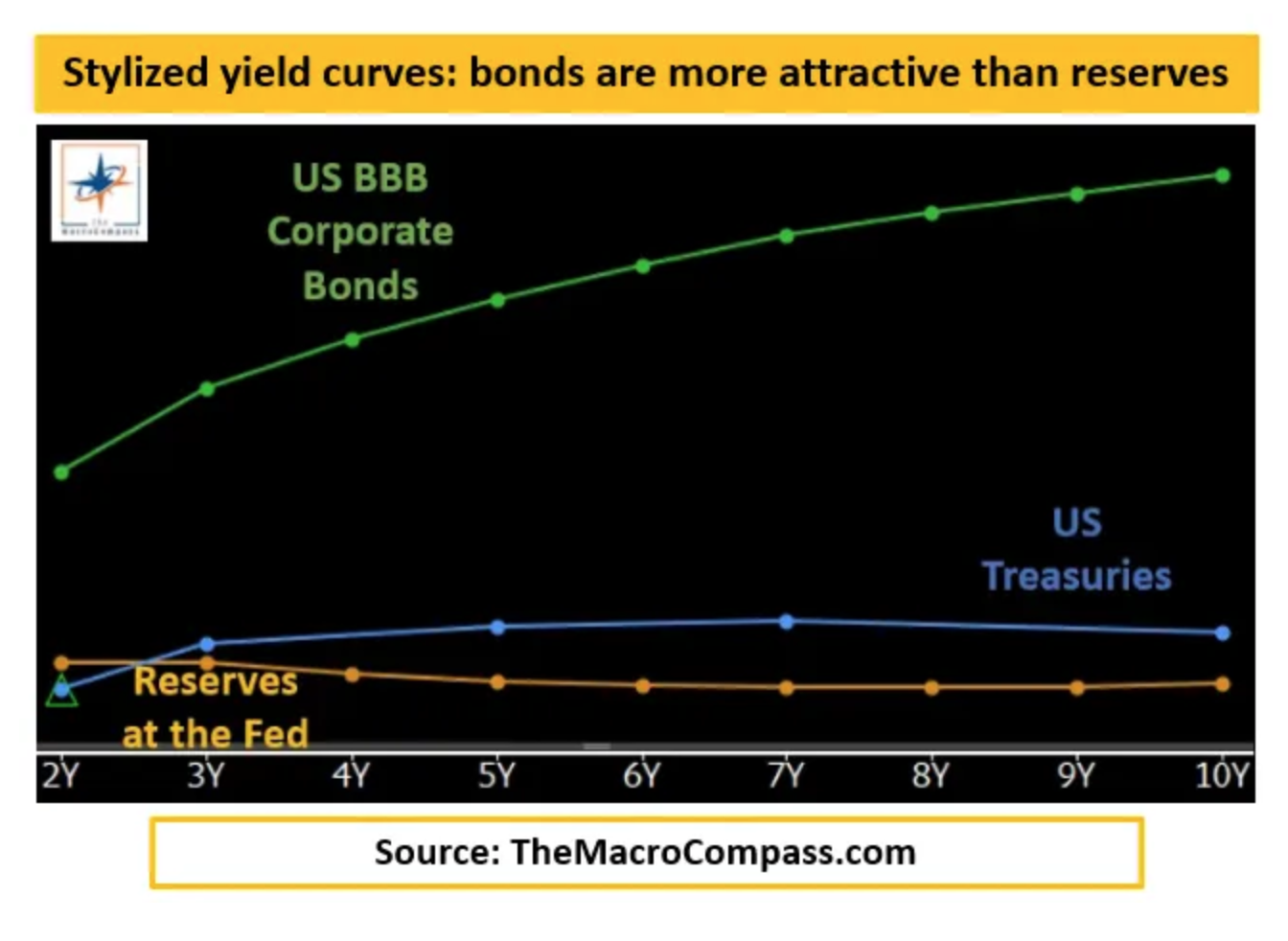

Peccatiello explains that banks primarily buy bonds for two reasons: clipping coupons and adhering to regulation. With regulation (LCR) forcing large banks to own about 20% of their balance sheet in liquid assets (i.e., bonds), banks have substantial investment portfolios to generate income and meet regulatory requirements. To manage the risk associated with these portfolios, prudent banks typically hedge most, if not all, of their interest rate risk using swaps. However, accounting practices can influence the extent to which banks hedge their interest rate risk. For bonds categorized as Available-For-Sale (AFS), using swaps to hedge interest rate risk allows for friendly accounting treatment with little profit and loss (P&L) volatility. Peccatiello points out that "banks don't like" the standard accounting treatment for swaps as derivatives, which directly hit the P&L, causing immediate volatility for the bank's financial results.

To manage the risk associated with these portfolios, prudent banks typically hedge most, if not all, of their interest rate risk using swaps. However, accounting practices can influence the extent to which banks hedge their interest rate risk. For bonds categorized as Available-For-Sale (AFS), using swaps to hedge interest rate risk allows for friendly accounting treatment with little profit and loss (P&L) volatility. Peccatiello points out that "banks don't like" the standard accounting treatment for swaps as derivatives, which directly hit the P&L, causing immediate volatility for the bank's financial results.

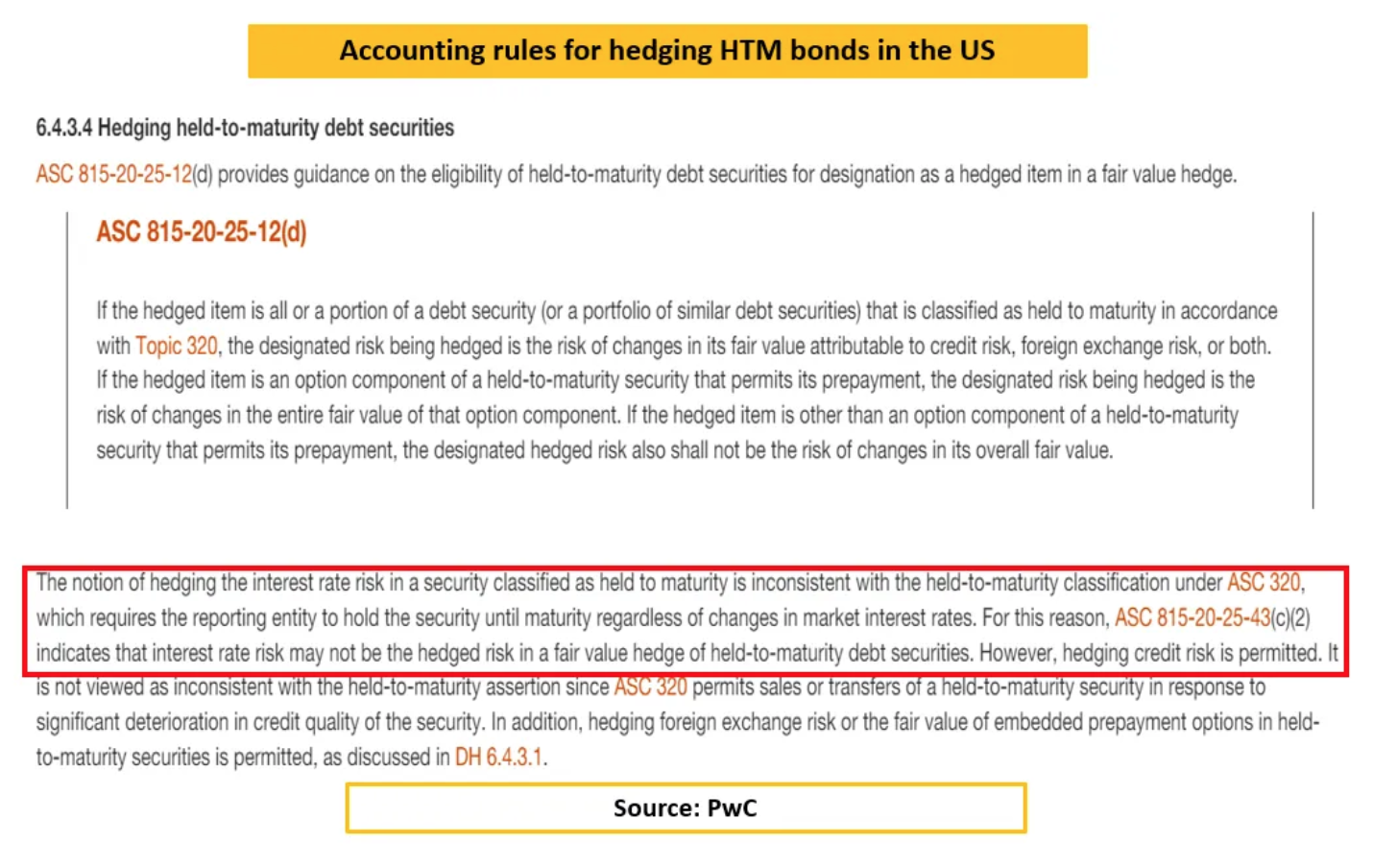

In contrast, the accounting rules for bonds classified as Held-To-Maturity (HTM) in the US discourage banks from hedging the interest rate risk. Swaps used to hedge HTM bonds receive unfavorable accounting treatment, creating a "massively inconvenient asymmetry and P&L vol that banks hate." Consequently, US banks often choose not to hedge the interest risk on HTM bonds, which can lead to significant losses.

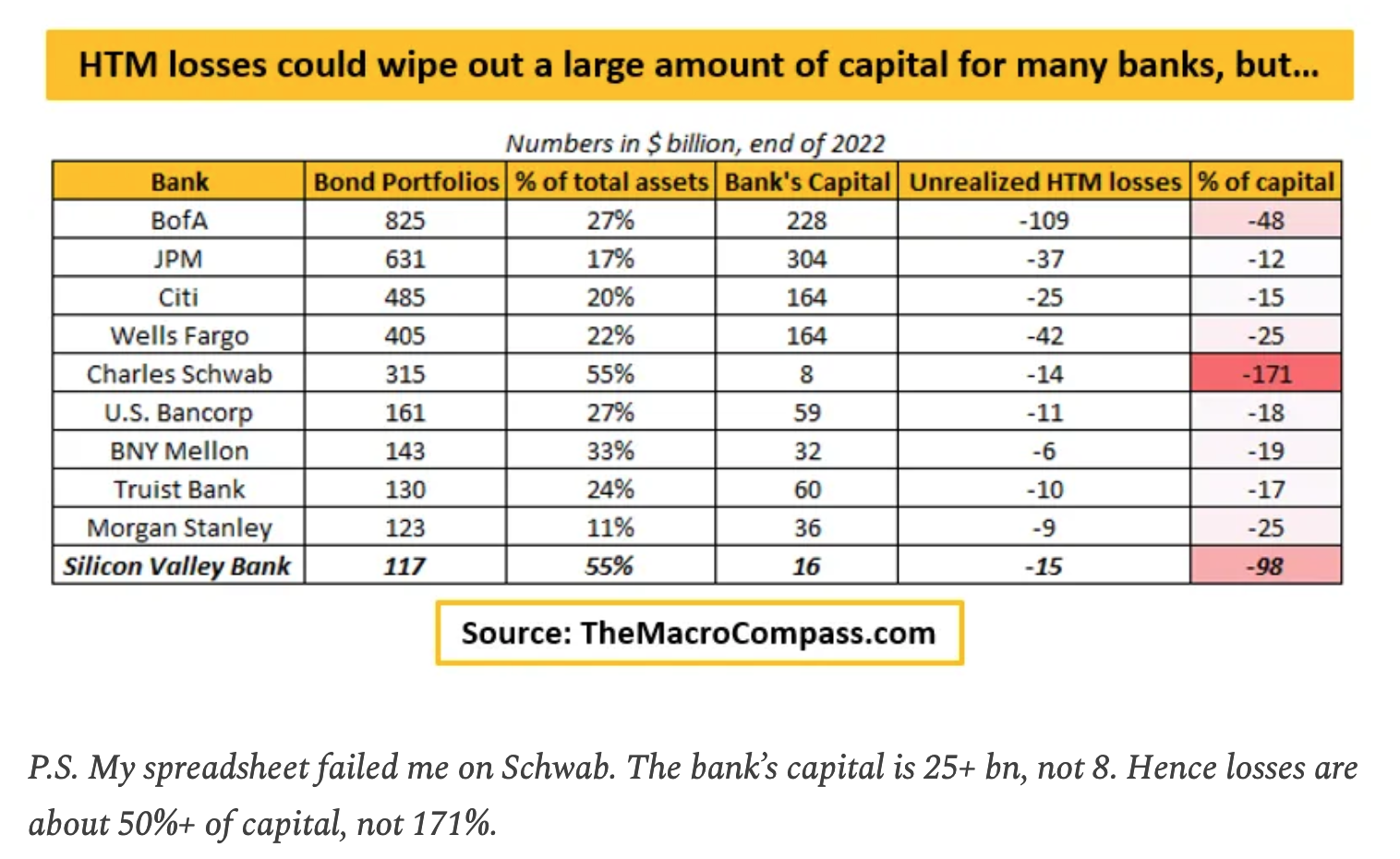

Peccatiello acknowledges an error in his previous assessment of Schwab's capital, clarifying that its capital is $25+ billion, not $8 billion. Consequently, losses would represent more than 50% of the capital rather than 171%. He notes that even for systemically important banks like Bank of America, such losses could wipe out half of their capital.

Considering current inflation rates, Peccatiello ponders the potential actions of the Federal Reserve. While he does not definitively answer whether large US banks are at risk of collapse, he highlights the vulnerability of these institutions due to their exposure to HTM bonds and the challenges in managing interest rate risk.

In summary, Peccatiello's analysis emphasizes the importance of understanding the nuances of bank risk management and accounting practices when assessing the potential impact of higher interest rates on banks' balance sheets. The recent issues faced by a couple of regional banks serve as a reminder of the potential risks and the need for vigilance in monitoring the financial health of banks.

As Peccatiello points out, understanding the intricacies of how banks approach risk management is crucial to accurately gauge their resilience in times of economic stress. The current inflationary environment adds another layer of complexity to the Federal Reserve's likely reactions, and financial institutions will need to remain agile and adaptive to navigate these challenges.

Finally, Peccatiello asks, "So, are large US banks at risk of going belly up too? And given today’s inflation print, what will the Fed do?"

For the full scope, visit The Macro Compass:

Footnotes:

1 Adapted from source: (Alf), Alfonso Peccatiello. "Contagion Risks." The Macro Compass, 14 Mar. 2023, themacrocompass.substack.com/p/contagion-risks.