Technical Notes

Wal-Mart $WMT a Dow Jones Industrial Average stock moved below $138.17 extending an intermediate downtrend.

MetLife $MET an S&P 100 stock moved below $68.18 extending an intermediate downtrend.

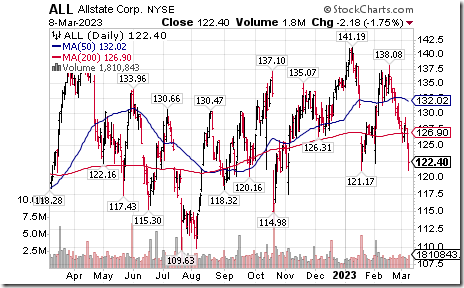

Allstate $ALL an S&P 100 stock moved below $121.17 setting an intermediate downtrend.

Match $MTCH a NASDAQ 100 stock moved below $38.64 extending an intermediate downtrend.

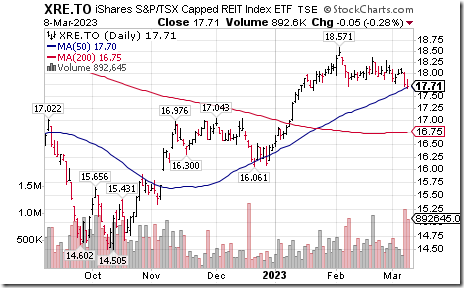

TSX Real Estate iShares $XRE.TO moved below $17.72 completing a double top pattern.

SNC Lavalin $SNV.TO a TSX 60 stock moved above $30.68 extending an intermediate uptrend

Trader’s Corner

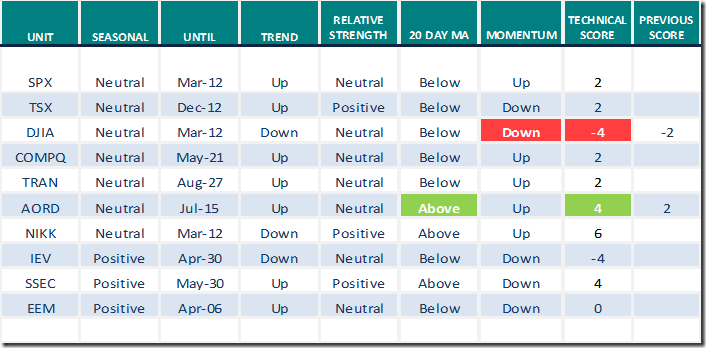

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 8th 2023

Green: Increase from previous day

Red: Decrease from previous day

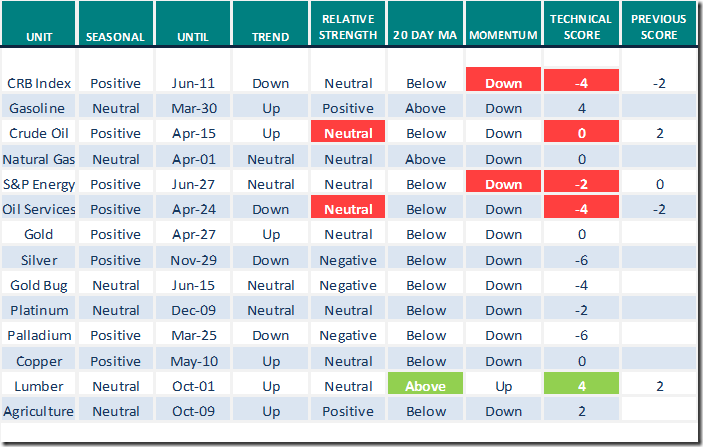

Commodities

Daily Seasonal/Technical Commodities Trends for March 8th 2023

Green: Increase from previous day

Red: Decrease from previous day

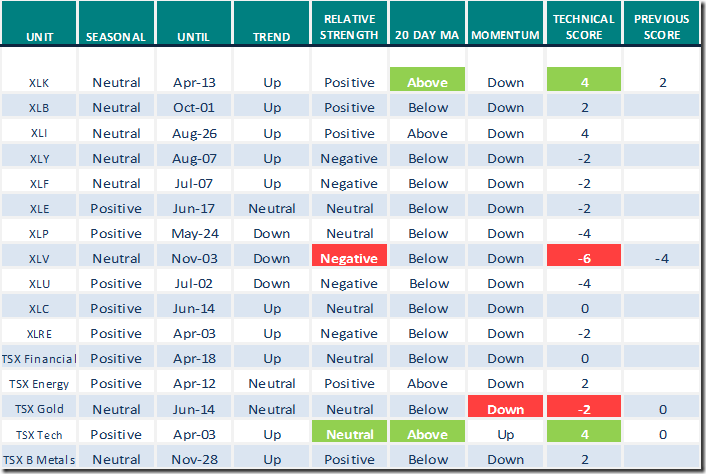

Sectors

Daily Seasonal/Technical Sector Trends for March 8th 2023

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Mish Schneider, Mary Ellen McGonagle, Erin Swenlin with David Keller, CMT (03.08.23

https://www.youtube.com/watch?v=G8zggI5DJr0

S&P 500 Momentum Barometers

The intermediate term Barometer added 0.20 to 38.00. It remains Oversold.

The long term Barometer added 0.20 to 57.60. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer added 1.70 to 48.09. It remains Neutral.

The long term Barometer added 0.43 to 62.55. It remains Overbought.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed